March, 12 2012, 12:37pm EDT

Statement: Challenging the World Water Forum to Protect Water from Corporate Control

Statement by Shayda Naficy, Senior Organizer, Challenge Corporate Control of our Water

BOSTON

This week, the World Water Forum (WWF) will convene representatives of the water industry, other major corporations and government officials in Marseilles to shape international water policy such that it to prioritizes for-profit models of water delivery, and profit-oriented allocation of the world's most essential resource. While water for domestic purposes is a recognized human right, today nearly 900 million people lack consistent, safe access. Corporate control and management has proven a failure in addressing this tragic shortfall, instead diverting the investment dollars and political will required to reverse this global crisis.

20 years of water privatization has demonstrated time and again that water corporations do not serve those unable to afford water nor invest in the infrastructure maintenance and expansion critical for sustainable delivery of water. Corporate control of water has resulted in labor force downsizing, higher prices and shutoffs for poor and marginalized communities, reduced government capacity and oversight, decreased ability of water users to participate in and influence decision making, diluted legal recourse and information, neglect of long-term infrastructure and system expansion, as well as the shifting of the political and cultural values around water so as to grant access to users according to their ability to pay not their basic human right to the resource. Extracting corporate profits drains the resources required for reinvestment, with damaging consequences for communities, the environment and democracy itself.

As the largest external source of financing for water in developing countries, the World Bank has served as a critical ally for the water industry in the push to privatize. With mounting evidence of the flaws of the private model, governments and civil society alike have grown increasingly resistant to turn water systems over to corporate control. The Bank's response has been to bypass governments altogether: today, about a quarter of the Bank's funding goes directly to the private sector, including equity (stock ownership) investments in transnational water corporations. Investing directly in corporate water providers precludes public accountability and democratic oversight; it also gives the Bank itself a direct financial stake in the ability of corporations like Veolia to profit off of water delivery.

That's why Corporate Accountability International, working with a broad range of allies and experts, is renewing and strengthening the call for the World Bank to divest from private water as a critical means of returning governance to legitimate and transparent institutions from the United Nations down to local and municipal governments.

In a forthcoming report slated for release at the World Bank meetings in April, Corporate Accountability International documents how the Bank's investment in private water not only fails to deliver accessible safe water to populations in need, but is financially unsound for the Bank itself. The report reviews the many forms of support the Bank provides in promoting an agenda of water privatization, ranging from untenable funding packages and profit guarantees to the extra-financial research, advocacy and public relations which are used to market these policies to borrower governments and their populations. It then focuses on the Bank's direct relationships with global water corporations, honing in on the Bank's private sector International Finance Corporation (IFC), raising particular concerns around the inherent conflict of interest created by the IFC's ownership stakes, and hence profit interests, in major water corporations. The controversy surrounding water privatization is irrefutable: while the water sector comprises a small portion of IFC's portfolio of investments, 40 percent of the complaints received by its Ombudsman are water-related.

The World Bank and its corporate clients have sought for decades to remove water policy-making from transparent governmental spaces to business-oriented forums like the World Water Forum, as well as the Bank itself. The forthcoming report also exposes the newest face of Bank-supported corporate water governance in a recently-launched corporation housed at the IFC that uses the Bank's access to and leverage over borrower governments to insert corporate water lobbyists directly into the national and local policy processes surrounding water. The 2030 Water Resources Group (2030WRG) convenes a consortium of water profiteers and water-intensive corporations ranging from bottlers Coca-Cola and Pepsi to beverage corporations SAB Miller and Diageo, to the world's largest private water utility corporation, Veolia, in a powerful lobby group housed at the IFC and headed by the Chairman of Nestle, Peter Brabeck-Letmathe. The stated aim of the group is to "transform the water sector" by introducing "new normative models of water governance," one country at a time.

The World Water Forum is another tool in the corporate move to shift policy debates to opaque, elite forums insulated from broad democratic participation, asserting market assumptions as a starting-point for water policy. Since its 1997 inception, the WWF has been a lightning-rod for international protest, as a prime example of corporate interference with water governance. Organized by the private trade association, the World Water Council, in conjunction with host governments, this year's Forum will be held in France, the home of the two largest water corporations, Suez and Veolia. While the movement to reclaim public control of water has made major strides in France in recent years, most notably with the 2010 transition of the Paris water utility back to public control, the Forum location of Marseille remains a stronghold for the private water industry, and the home turf of the World Water Council.

With the controversy surrounding the Forum and the privatization agenda more broadly, attendance at the official forum is in marked decline. This year more than a thousand representatives from global civil society are converging on Marseille to protest the forum and organize the alternative Peoples Water Forum. The stakes for public and planetary health are profound, and a growing international movement recognizes water as a public good and a common resource that must be managed for the broadest benefit. The public health implications alone are staggering: the WHO reports that one tenth of the global disease burden could be alleviated through concerted investment in the water systems required to realize universal access to safe water. The solution to this human crisis is well-understood; what is required is the financial and political commitment to achieve universal fulfillment of this human right. Public commitment to this task has been undermined, and the necessary resources diverted, by the profiteering aspirations of global water corporations and allied institutions led by the World Bank.

This week Corporate Accountability International is exposing the illegitimacy of the WWF, challenging the corporate agenda and engaging directly with policy makers and other opinion leaders. In addition, Corporate Accountability International is a sponsor of the People's Water Forum, and will be previewing the report with water justice allies and interested media. Specifically, the organization will conduct two panels on corporate interference in water governance and on the role of the World Bank in the promotion of water privatization. We will also be presenting key mechanisms for protecting public policymaking from corporate interference, based on precedents from the global tobacco treaty, which enacted in 2005, is the world's first corporate accountability and public health treaty.

With its resources, connections and influence, the World Bank could play a critical role in reversing the global water crisis, alleviating human suffering and promoting sustainable, equitable development. Instead, by taking a profit stake in the fortunes of the private water industry, the Bank has allowed its mission of poverty alleviation to take a second seat to facilitating the profits of client corporations. The call for the World Bank's divestment from private water recognizes that removing this institutional support for privatization would clear space for public, democratic oversight, and redirecting the Bank's support toward the resulting public agenda and solutions would be a profound contribution to mobilize the momentum required to fulfill the human right to water on a global scale.

As Corporate Accountability International's report (available on April 20, 2012 at www.stopcorporateabuse.org or by contacting Shayda Naficy at 617-695-2525) finds, privatization has neither extended water access, nor proven economically viable. The preponderance of evidence provided in this report suggests the time has come for the Bank to divest from private water and redirect support to public and democratically accountable institutions.

Corporate Accountability stops transnational corporations from devastating democracy, trampling human rights, and destroying our planet.

(617) 695-2525LATEST NEWS

Hegseth 'Responsible' for 'Murder': Family Files Formal Complaint Over Killing of Colombian Fisherman

According to the official filing, Trump's Defense Secretary "has admitted that he gave such orders despite the fact that he did not know the identity of those being targeted for these bombings and extra-judicial killings."

Dec 03, 2025

The family of Colombian fisherman Alejandro Carranza Medina, believed killed by the US military in a boat bombing in the Caribbean Sea on Sept. 15, has filed a formal complaint with the Inter-American Commission on Human Rights accusing US Secretary of Defense Pete Hegseth of murder over the unlawful attack.

"From numerous news reports, we know that [Hegseth] was responsible for ordering the bombing of boats like those of Alejandro Carranza and the murder of all those on such boats," reads the petition, filed Tuesday on behalf of Carranza's family by Dan Kovalik, a human rights attorney based in Pittsburgh.

"Secretary Hegseth," the petition continues, "has admitted that he gave such orders despite the fact that he did not know the identity of those being targeted for these bombings and extra-judicial killings."

The complaint also notes that President Donald Trump, the commander in chief of the US military, "ratified the conduct of Secretary Hegseth described herein.”

First reported on by The Guardian, the filing of the petition with the IACHR—an autonomous body under the charter of Organization of American States (OAS) designed to uphold human rights in the Western Hemisphere—could result in the initiation of an investigation and the release of findings about the bombing that took the life of Carranza and two other individuals believed to be aboard the vessel.

The petition, the outlet noted, "marks the first formal complaint over the airstrikes by the Trump administration against suspected drug boats, attacks that the White House says are justified under a novel interpretation of law." Experts in international human rights law have stated from the outset that the administration's justifications lack legal basis and that the attacks constitute unlawful criminal acts.

According to The Guardian:

Carranza, 42, appears to have been killed in the second strike of the Trump administration’s bombing campaign, on 15 September. The administration has publicly disclosed 21 strikes on alleged drug boats. Carranza’s family says he was a fisher who would often set out in search of marlin and tuna.

On the day of the strike, Trump announced on his Truth Social platform that “This morning, on my Orders, US Military Forces conducted a SECOND Kinetic Strike against positively identified, extraordinarily violent drug trafficking cartels and narcoterrorists in the SOUTHCOM area of responsibility”. Trump attached video marked “unclassified” of a small boat floating in the water before it was struck.

Both Hegseth, the highest-ranked civilian at the Pentagon, and Trump have been under growing scrutiny for the series of boat bombings that have resulted in the extrajudicial killing of over 80 people since September. Experts have said the killings should be seen as "murder, plain and simple."

New revelations about a strike on Sept. 2, in which two survivors of an initial bombing were later killed as they clung to the exploded boat on which they were traveling, has evelated that concern in Washington, DC this week with lawmakers seeking answers about the attack which, even if one accepted the legality of the initial strike under the construct the Trump administration has tried to claim, would constitute a clear human rights violation amounting to a war crime.

In an interview with Agence France-Presse in October, Katerine Hernandez, Carranza's wife in Colombia, said her husband was "a good man" devoted to fishing and providing for his family. "Why did they just take his life like that?" she asked.

Hernandez denies that Carranza was involved in drug trafficking, as Trump and Hegseth have alleged without providing evidence, but also suggested that even if drug trafficking was taking place, it would not justify his murder. "The fishermen have the right to live," she said. "Why didn't they just detain them?"

In a Tuesday statement, the IACHR urged the US government to "ensure respect for human rights" during any and all extraterritorial military operations in the region, noting the deaths of a high number of persons both in the Caribbean and in the Pacific, where other strikes have taken place.

"While acknowledging the seriousness of organized crime and its impact on the enjoyment of human rights, the Commission recalls that States are obliged to respect and ensure the right to life of all persons under their jurisdiction," the statement reads.

"According to the Inter-American jurisprudence, this duty extends to situations when State agents exercise authority or effective control, including extraterritorial actions at sea," it continues. "When lethal force is used by security or military personnel outside national territory, States have the obligation to demonstrate that such actions were strictly lawful, necessary, and proportionate, and to investigate, ex officio, any resulting loss of life. These obligations persist irrespective of where the operations occur, or the status attributed to the individuals affected. Likewise, persons under State control must always enjoy full respect for due process and humane treatment."

The commission called on the US to "refrain from employing lethal military force in the context of public security operations, ensuring that any counter-crime or security operation fully complies with international human rights standards; conduct prompt, impartial, and independent investigations into all deaths and detentions resulting from these actions; and adopt effective measures to prevent recurrence."

Keep ReadingShow Less

'Flashing Warning Sign' for GOP as Republican Squeaks Out Win in Deep-Red Tennessee District

"The fact that Republicans spent millions to protect this Trump +22 district and still lost so much ground should have the GOP shaking in their boots," said the chair of the Democratic National Committee.

Dec 03, 2025

Republican Matt Van Epps narrowly prevailed Tuesday in a special election for a Tennessee district that President Donald Trump carried by 22 points last year, a result that has the GOP increasingly worried about the party's prospects in the 2026 midterms as voters take out their anger over high living costs.

Van Epps defeated Democratic candidate Aftyn Behn in the US House race by roughly nine points, a strikingly narrow margin for a district that Republican Mark Green—who resigned from Congress over the summer—won by 21 points last year.

Behn placed affordability, which Trump has called a Democratic "scam," at the center of her bid to represent Tennessee's 7th Congressional District, replicating the playbooks of recently successful Democratic campaigns across the country.

"I don’t care what political party you belong to, but if you are upset about the cost of living and the chaos of Washington, then I’m your candidate, and I welcome you with open arms," Behn said during the race, which drew national attention and millions of dollars in spending.

The Planned Parenthood Action Fund (PPAF), which backed Behn—a supporter of abortion rights—said late Tuesday that "the lesson from Aftyn’s campaign is clear: Voters are looking for leaders who will put healthcare affordability over billionaire special interests."

"Every day that President Trump and his backers are in power, people suffer," said Alexis McGill Johnson, PPAF's president and CEO. "They’re seeing healthcare costs rise, abortion bans in 20 states, and health center closures leading to longer wait times and distances to get care—all worsening the healthcare crisis the Trump administration created."

Notably, while Van Epps embraced Trump, much of the Republican messaging in the race focused on attacking Behn as a "radical" rather than championing the president's economic agenda, which voters across the country blame for driving up costs. Behn, who received over 115% of the 2022 Democrat nominee's vote total, said that Republicans were attacking her because "they don't have a plan to make healthcare more affordable."

The GOP scramble to defend a deep-red seat was seen by both Republicans and Democrats as a possible signal of what's to come in next year's midterms. One House Republican, speaking anonymously, told Politico that "tonight is a sign that 2026 is going to be a bitch of an election cycle."

Ken Martin, chair of the Democratic National Committee, said in a statement that "what happened tonight in Tennessee makes it clear: Democrats are on offense and Republicans are on the ropes."

"Aftyn Behn’s overperformance in this Trump +22 district is historic and a flashing warning sign for Republicans heading into the midterms. Aftyn centered her campaign on lowering grocery, housing, and healthcare costs for Tennessee families," said Martin. "The fact that Republicans spent millions to protect this Trump +22 district and still lost so much ground should have the GOP shaking in their boots."

Keep ReadingShow Less

'Time Is Ticking': GOP Lawmakers Urged to Back Healthcare Tax Credit Extension

"Anything less is a choice to raise healthcare costs, strip millions of people of their coverage, and deepen America’s ongoing healthcare crisis," said one campaigner.

Dec 02, 2025

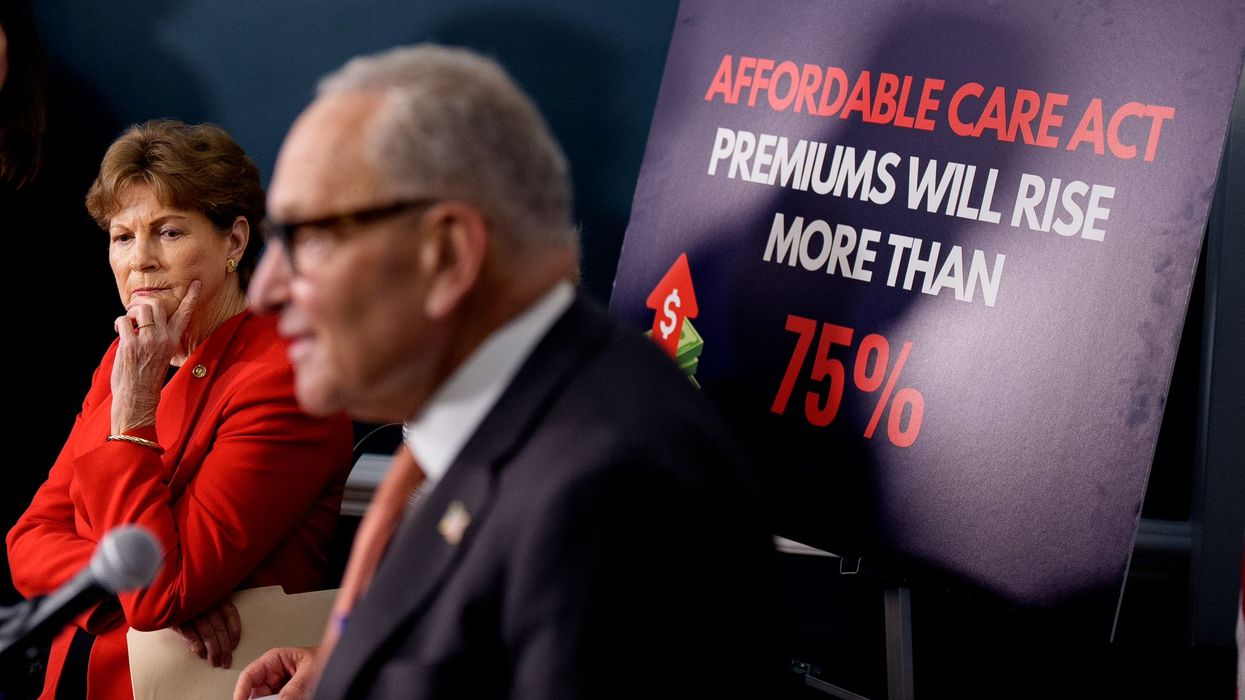

With less than a month remaining before Affordable Care Act healthcare tax credits are set to expire—which would cause monthly premiums to soar for an estimated 20 million Americans and potentially leave millions without coverage—Democratic lawmakers and progressive advocacy groups on Tuesday implored congressional Republicans to back a three-year extension on the vital subsidies.

While President Donald Trump and Republican legislators have promised lower healthcare costs, prices are soaring and millions of families are facing major premium hikes if the Affordable Care Act (ACA) subsidies end as scheduled on December 31. That leaves lawmakers with just 12 legislative days to act.

Trump has expressed openness to extending the ACA subsidies, even teasing a policy framework featuring a two-year extension with income caps and minimum premium payments for enrollees in the program also known as Obamacare.

However, the president has put the brakes on his proposal under pressure from House Speaker Mike Johnson (R-La.) and other congressional Republicans, many of whom are seeking a guarantee that the Hyde Amendment—which prohibits federal Medicaid funding for most abortion services—will be expanded to further restrict reproductive healthcare.

Calling Republicans "a total mess" who "don’t know what to do," Senate Minority Leader Chuck Schumer (D-NY) said Tuesday: "One day, Trump floats a so-called 'healthcare plan.' The next day, Speaker Johnson forces him to shoot it down. Some Republicans say they want to dismantle the ACA, probably a majority of them in the House and a large number in the Senate want to just dismantle it altogether."

"Other Republicans seem to be more focused on eradicating reproductive care in every state than helping people afford healthcare," Schumer continued. "The bottom line is that Republicans are in total disarray on healthcare."

"And while Republicans continue the infighting, who is paying the price? The American people," he added. "The people whose premiums are going up by $500 to $1,000 a month. These people know that Trump and Republicans are to blame."

Democratic lawmakers are pushing more lawmakers to sign a discharge petition, which would require Johnson to hold a vote on legislation to extend the ACA subsidies for three years. Such a bill is backed by numerous healthcare and economic advocacy groups.

"If Republicans in Congress truly cared about lowering costs for their constituents, they would swallow their pride and sign on to the discharge petition to force a vote on extending healthcare tax credits,” Unrig Our Economy campaign director Leor Tal said in a statement Tuesday.

“Republicans in Congress have spent months attacking Americans' access to healthcare while giving tax breaks to billionaires," Tal added. "Now, it is time that they finally put their constituents first, sign on to the discharge petition to extend these healthcare tax credits, and stop voting to undermine access to healthcare for millions of Americans.”

Michelle Sternthal, director of government affairs at Community Catalyst, a national health justice organization, said Tuesday that "Congress should pass a clean extension of the tax credits, repeal the dangerous healthcare provisions of the ‘Big Beautiful Bill,’ and protect the communities who rely on them the most."

"Because affordable, accessible care isn’t just good policy—it’s the foundation of a stronger, more resilient nation," she added.

Reproductive rights defenders sounded the alarm over Republican efforts to further restrict abortion care—which has been eviscerated by Trump-appointed Supreme Court justices and GOP-led state legislatures with sometimes deadly results—in any ACA tax credit extension.

Noting previous GOP efforts to strip abortion care from the ACA, Planned Parenthood Action Fund and Reproductive Freedom for All said in a joint statement on Monday:

Anti-abortion members of Congress want to create an additional abortion coverage ban on the ACA marketplace by making plans that include abortion coverage prohibitively expensive and unworkable. They want to restrict coverage for more than 20 million enrollees and prohibit people using tax credits from buying plans that cover abortion. This restriction conflicts with decisions some states have made to require coverage of abortion. In states that allow plans to cover abortion, since plans would be significantly more expensive without the availability of tax credits, insurers would likely drop abortion coverage because these plans would be unattractive and onerous to consumers.

The ACA already prohibits federal funding from being used to pay for abortion coverage under marketplace plans except in the very limited circumstances of rape, incest, and life-endangerment. What anti-abortion politicians are calling for would be an expansion of abortion restrictions into the private insurance market. This would only cause more chaos and confusion for those seeking their health insurance through the marketplace. The ACA was passed with the intent of providing affordable coverage, but anti-abortion politicians want to place new and expanded barriers to abortion coverage and push healthcare out of reach for people who rely on the marketplace.

Congressional Democrats echoed the advocacy groups' calls for their Republican colleagues to support the discharge petition.

"Democrats have an active discharge petition, and all we need are a handful of House Republicans to join us and we can trigger an up-or-down vote on a three-year extension of the Affordable Care Act tax credits to save the healthcare of the American people in every single state in this country, and protect the healthcare of people who these so-called Republican members allegedly represent, but who have failed to do a single thing to make their life better," House Minority Leader Hakeem Jeffries (D-NY) said Monday.

Congresswoman Nikki Budzkinski (D-Ill.) wrote on the social media platform Bluesky, "At the end of this month, the ACA tax credits will expire—plunging millions of Americans even deeper into the affordability crisis as their healthcare costs skyrocket."

"It’s time for President Trump and Republicans in Congress to get serious about saving healthcare," she added.

The healthcare crisis continues to loom and it’s time we extend the healthcare tax credits NOW to ensure folks are able to afford quality healthcare.TIME IS TICKING AND WE CANNOT WAIT ANY LONGER!

— Rep. Frederica Wilson (@repwilson.bsky.social) December 1, 2025 at 7:04 AM

Noting that the GOP spending bill signed by Trump in July "made the biggest Medicaid cuts in history to fund trillions in tax breaks for billionaires," Congresswoman Summer Lee (D-Pa.) warned Tuesday that "when these cuts go into effect, over 17,000 people in my district will lose healthcare."

Other lawmakers argued that Congress should go even further and pass Medicare for All legislation led by Sen. Bernie Sanders (I-Vt.) and Rep. Pramila Jayapal (D-Wash.).

"We must stop tinkering around the edges of a broken healthcare system," Sen. Chris Van Hollen (D-Md.), a cosponsor of the bill, said Monday. "Yes, let's extend the ACA tax credits to prevent a huge spike in healthcare costs for millions. Then, let's finally create a system that puts your health over corporate profits. We need Medicare for All."

Keep ReadingShow Less

Most Popular