SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

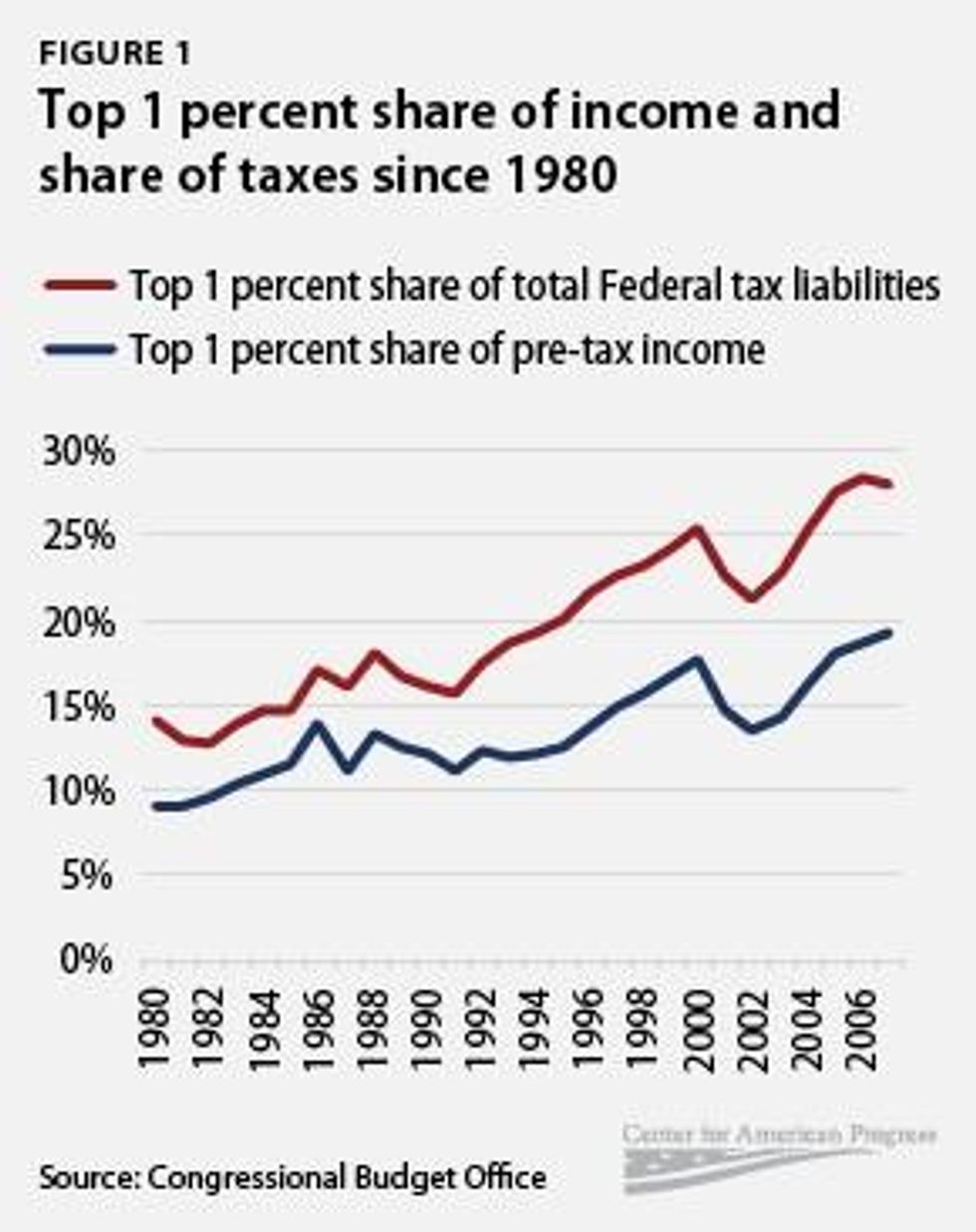

Today a new analysis by the Center for American Progress debunks the conservative talking point that the richest 1 percent of Americans are overtaxed because they pay a higher share of taxes.

Conservatives often point out that the top 1 percent of income earners pay about 40 percent of all the taxes. While that statistic might sound unfair at first blush, CAP's Sarah Ayres and Michael Linden explain that the share of taxes paid is a misleading and fundamentally unreliable statistic that reveals little about the fairness or relative burden of the tax system.

The paper outlines three reasons why the conservative argument that the rich already pay more than their fair share is false:

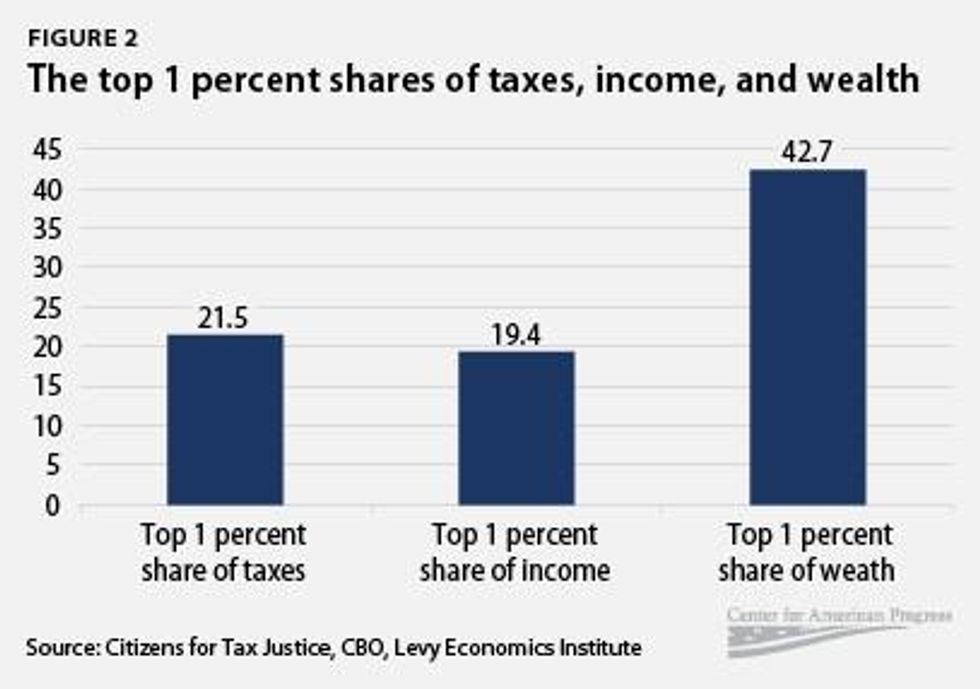

The amount of taxes an individual pays as a share of his or her own income matters. The amount of taxes someone pays as a share of total revenues is less important. (see Figure 2)

Read the analysis:

See also:

The Center for American Progress is a think tank dedicated to improving the lives of Americans through ideas and action. We combine bold policy ideas with a modern communications platform to help shape the national debate, expose the hollowness of conservative governing philosophy and challenge the media to cover the issues that truly matter.

"Senate Democrats will not help pass the SAVE Act under any circumstances," vowed the Senate Minority Leader.

The extremes to which the Republican Party will go to sway the 2026 elections in their favor was highlighted again on Sunday after US President Donald Trump said he will sign no other legislation into law this year until the SAVE Act—a bill that would deeply erode voting rights and threatens ballot access for tens of millions of Americans—is passed by Congress.

"It must be done immediately," Trump declared in a characteristically unhinged social media post on Sunday, referring to the SAVE Act, versions of which have passed the Republican-controlled House but so far stalled in the Senate.

"It supersedes everything else. MUST GO TO THE FRONT OF THE LINE," Trump continued in an all-caps tantrum. "I, as President, will not sign other Bills until this is passed, AND NOT THE WATERED DOWN VERSION - GO FOR THE GOLD: MUST SHOW VOTER I.D. & PROOF OF CITIZENSHIP: NO MAIL-IN BALLOTS EXCEPT FOR MILITARY - ILLNESS, DISABILITY, TRAVEL: NO MEN IN WOMEN’S SPORTS: NO TRANSGENDER MUTILIZATION FOR CHILDREN! DO NOT FAIL!!!"

Voting rights experts and Democratic lawmakers have denounced the SAVE Act as a dangerous threat to millions of eligible voters, calling it a clear effort by the GOP to tip the scales in their favor by depressing voter turnout in 2026 and beyond.

"In every form, the SAVE Act would require American citizens to show documents like a passport or birth certificate to register to vote. Our research shows that more than 21 million Americans lack ready access to those documents," warned Eliza Sweren-Becker and Owen Bacskai of the Brennan Center for Justice, which advocates for robust voting rights, in a blog post last week.

"Roughly half of Americans don’t even have a passport," Sweren-Becker and Bacskai continued. "Millions lack access to a paper copy of their birth certificate. The SAVE Act would disenfranchise Americans of all ages and races, but younger voters and voters of color would suffer disproportionately. Likewise, millions of women whose married names aren’t on their birth certificates or passports would face extra steps just to make their voices heard."

In response to Trump's threat on Sunday, Senate Minority Leader Chuck Schumer (D-N.Y.) characterized the SAVE Act as "Jim Crow 2.0" as he condemned the president and his GOP allies.

"If Trump is saying he won’t sign any bills until the SAVE Act is passed, then so be it: there will be total gridlock in the Senate," said Schumer. "Senate Democrats will not help pass the SAVE Act under any circumstances."

Melanie D'Arrigo, executive director of the Campaign for New York Health, said Sunday that the SAVE Act—which Trump said last week must be passed "at the expense of everything else"—is not a voter ID bill, but rather "voter suppression" legislation bill masquerading as a solution to a problem that doesn't exist.

"If it was a voter ID bill, it would provide people with the proper IDs to vote, with no barriers — but it doesn’t," noted D'Arrigo. "The voter fraud rate is .0001%, and this bill would potentially prevent up to 69 million women, 40 million who don’t have access to their birth certificate, and 140 million without a passport, from voting."

"The American people don't want this war," said Sen. Chris Murphy of Connecticut. "Virtually nothing good happened from sending thousands of Americans to die in Iraq in the 2000s and if we don't learn that lesson then shame on every single one of us."

Sen. Chris Murphy of Connecticut offered immediate push back on Sunday when CNN anchorJake Tapper said a vote against an expected $50 billion request by President Donald Trump to fund his attack on Iran would be seen as "voting against the troops."

"Oh come on," said Murphy, incredulous. "I mean, the American people don't want this war. They don't want this war—they have seen what happens when American troops go into places like Iraq, places like Afghanistan. Ultimately we get a lot of people killed, we waste a lot of dollars. The one thing the people of the American people have been clear about is that they don't want the United States dragged into another long-term war in the Middle East."

Polling has shown that Murphy is correct, with only one out of four people—a mere 25%—in a Reuters/Ipsos poll released last week showing any kind of support for Trump's war of choice against Iran.

"If you support the troops," said Murphy, "then you should vote against this war so that we get our troops out of harm's way. Virtually nothing good happened from sending thousands of Americans to die in Iraq in the 2000s and if we don't learn that lesson then shame on every single one of us."

TAPPER: "You have said you're a 'hell no' on funding the war. We have seen this movie before. We know that vote will be cast as - especially if you run for higher office - you voting against the troops."

MURPHY: "Oh come on I mean, the American people don't want this war." pic.twitter.com/lTB5isM8I7

— State of the Union (@CNNSOTU) March 8, 2026

Trump has yet to make the formal request for the $50 billion in funding, but estimates for just one week of fighting have put the cost of the military operations thus far at something close to $1billion per day.

Murphy has said he is a "hell no" on any additional funding and other members of the Democratic caucus have echoed that message.

"Trump is already spending $1 BILLION PER DAY on his illegal regime change war of choice in Iran," said Sen. Chris Van Hollen (D-Md.) on Thursday. "Now, he's going to ask Congress to give him up to $50 BILLION MORE. My vote: hell NO."

"We could be lowering the cost of health care, but instead Trump is spending BILLIONS on his reckless war with Iran," said Sen. Patty Murray (D-Wash.) on Thursday. "Trump is blowing YOUR taxpayer dollars on war and causing gas prices to spike while he's at it."

Senator Susan Collins, said Platner outside the Republican senator's office in Portland, Maine, is more interested in the profits of weapons contractors "than the shame that we bring upon ourselves when we kill children."

Graham Platner, the Democratic hopeful running for the US Senate in Maine to unseat Republican Sen. Susan Collins, delivered a sharp rebuke Saturday to the war of choice launched against Iran last week by President Donald Trump—the kind of messaging, say anti-war progressives, that every lawmaker or politician seeking office should be giving in the face of a military campaign that a majority of Americans, across the political spectrum, adamantly oppose.

"We can all see what is happening right now," said Platner outside Collins' offices in downtown Portland, Maine on Saturday. "At least with the war in Iraq, they had the decency to try to trick us for months. At least they made Colin Powell go sully his name in front of the UN to try to trick us into thinking WMDs were real. At least then they tried to convince us that it was necessary. This time around, they're just doing it."

And the Trump administration is doing it, he continued, "because we have a system that does not hold people accountable. We have a Congress that for decades has abdicate its constitutional role in war making. It never should have been an option that a president can just start a huge regional conflict because he's afraid we're going to find out he might be a pedophile."

In a vote in the Senate on Wednesday, Collins sided against a War Powers Resolution that would have curbed Trump's ability to wage the war that has already killed more than 1,300 civilians, a large portion of them children. While the joint US-Israeli operation has unleashed chaos across the Middle East and been denounced as a criminal war of aggression by experts, Collins argued that passing the resolution "would send the wrong message to Iran and our troops."

"At least with the war in Iraq, they had the decency to try to trick us for months... This time around, they're just doing it."

Platner, who served multiple tours of combat duty in Afghanistan and Iraq as both a Marine and Army infantry soldier, expressed outrage at how willing politicians like Collins are to send young Americans off to kill and die for wars that bring such horror and carnage abroad while costing US taxpayers billions at home.

"Susan Collins is more interested in protecting the wealthy and the powerful. She is more interested in protecting the profits of the defense industry. She's more interested in protecting the interests of her AIPAC donors," Platner told the crowd, ripping Collins for her vote against the resolution. "She is more interested in all of that, than in protecting the sacred resource that is the lives of young American men and women who are willing to put their lives on the line for this country. She is more interested in their profits than the shame that we bring upon ourselves when we kill children."

On the first day of US bombing last week, a school in the southeastern town of Minab was struck, killing an estimated 165 civilians, most of them young students.

"She [Susan Collins] is more interested in their profits [AIPAC donors and the defense industry] than the shame that we bring upon ourselves when we kill children."

Watch Maine Democratic U.S. Senate candidate @grahamformaine confront Republican Senator Susan Collins. pic.twitter.com/9uaKqBcKix

— Zeteo (@zeteo_news) March 7, 2026

Norman Solomon, national director of the progressive advocacy group RootsAction, said "the content and location" of Platner’s remarks made them "doubly vital" and that other lawmakers and politicians would be wise to follow his lead and that others in the US should replicate such rallies where they live.

Across the country, Solomon told Common Dreams, "members of Congress who’ve voted for more high-tech slaughter in Iran are smugly going on with routine business in their offices, insulated from the murderous effects of their political positions. They do not deserve insulation, they deserve nonviolent and militant confrontation."

Showing up at local district offices of their members of Congress, "to protest with clear moral messaging" like those in Maine over the weekend, said added Solomon, "is long overdue and should become widespread. Most of us don’t live far from such offices. Why should politicians who enable mass murder from the skies be able to run their offices every day as though nothing is amiss?"

"Antiwar speeches and picket lines with moral clarity should become standard aspects of the political environment at the decentralized congressional offices," he said, "that for far too long have been aloof from the carnage and human anguish that craven elected officials continue to inflict."

Platner has emerged as potent anti-war voice in the week since Trump launched the US assault on Iran, repeatedly invoking the trauma he suffered and the horrors of war he witnessed as a soldier as a way to condemn repeating history, especially by lawmaker like Collins who appeared to have learned no lessons from the experience of the disasters in Afghanistan and Iraq.

Talking to reporters after Saturday's rally, Platner referred to both Trump and US Secretary of Defense Pete Hegseth as "morons" with no plan to get out of the mess they've created.

"I don't think these people have any idea what they're doing," Planter said. "And the problem with that is that that incompetent leadership is going to result in dead Americans—and it already has—and it's going to result in a region thrust into chaos and bloodshed."

If lawmakers won't stand up to stop Trump's war, Platner told News Center Maine in an interview that it will ultimately be up to the American people to organize and force an end to the conflict.

"The people who are going to send their sons and daughters off to fight, the people who are going to see their friends and families maimed and killed in combat, the people who are going to have to pay for all of this instead of getting health care," said Platner, "we need to stand together and show the political class in this country that we are not going to stand another foreign war."

In a separate post on Saturday, Platner reached out to Trump voters who may be disappointed or disillusioned after the warmongering of a president who told voters he would act to end wars in his second term, not start them.

"To all of those who voted for Trump," said Platner, "hoping for an end to stupid foreign wars: We may not agree on everything, but I promise to never waste your hard-earned money on a pointless quagmire in the Middle East."