SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Lacy MacAuley, IPS,

(202) 445-4692, lacy@ips-dc.org

Of last year's 100 highest-paid U.S. corporate chief executives, 25 took home more in CEO pay than their company paid in 2010 federal corporate income taxes, according to a new report from the Institute for Policy Studies.

Of last year's 100 highest-paid U.S. corporate chief executives, 25 took home more in CEO pay than their company paid in 2010 federal corporate income taxes, according to a new report from the Institute for Policy Studies.

Executive Excess 2011: The Massive CEO Rewards for Tax Dodging, the Institute's18th annual compensation report, details "the pernicious impact of hundreds of millions of dollars spent lobbying for corporate tax loopholes and shifting profits to offshore tax havens," says report co-author Chuck Collins.

"Instead of sharing responsibility for addressing our nation's fiscal challenges," notes Collins, a senior scholar at IPS. "Corporations are rewarding CEOs for aggressive tax avoidance."

The 25 tax-dodging CEOs the IPS report spotlights averaged $16.7 million in pay last year, well above the $10.8 million S&P 500 CEO average. Most of their companies registered substantial profits. Yet these same companies actually came out ahead at tax time. They collected, on average, $304 million in refunds from the IRS.

Access the report:

Report link: https://www.ips-dc.org/reports/executive_excess_2011_the_massive_ceo_rewards_for_tax_dodging

To request a hard copy, please contact: lacy@ips-dc.org

PRESS CONFERENCE CALL: 11:00 AM ET; Wednesday, August 31, 2011 Dial-in: 712-432-0075; Passcode: 385784. On the press conference call, report co-authors Chuck Collins and Scott Klinger will discuss their report findings and answer reporters' questions about the report.

Key Findings:

Low Taxes, Despite High Profits: The 25 firms that paid their CEOs more than Uncle Sam last year reported average global profits of $1.9 billion. Only one reported negative global returns. Only seven of the 25 companies reported losses in U.S. pre-tax income.

Extensive Use of Tax Havens for Tax Avoidance: Eighteen of the 25 firms operate subsidiaries in offshore tax havens, for a combined total of 556 tax haven subsidiaries. Of the seven companies that reported losses in U.S. pre-tax income, five have a combined total of 267 tax haven subsidiaries and a sixth, Nabors Industries, is headquartered in Bermuda.

Bigger Checks for Influence-Peddling than to the IRS: Of the 25 companies that paid their CEO more than Uncle Sam, 20 also spent more on lobbying lawmakers than they paid in corporate taxes. Eighteen gave more to the political campaigns of their favorite candidates than they paid to the IRS in taxes.

Gap Between CEO and Worker Pay Jumps: S&P 500 CEOs last year collected $10.8 million in average compensation, a 27.8 percent increase over 2009. The gap between CEO and average U.S. worker pay rose from 263-to-1 in 2009 to 325-to-1 last year.

"These 25 companies are extreme examples of how large corporations can get away with picking Uncle Sam's pocket," says IPS Associate Fellow and report co-author Scott Klinger. "And while the CEOs clearly benefit, working and middle class families and small businesses are left to pick up the tab."

EXECUTIVE PAY REFORM SCORECARD

This year's Executive Excess report includes an updated scorecard which rates pay reforms that have been recently enacted, as well as those that are pending in Congress and a few that are not yet on the table.

Report co-authors include veteran compensation analysts Sarah Anderson, Chuck Collins, Scott Klinger, and Sam Pizzigati. Their explosive 2010 report on CEO pay among layoff leaders is available at: https://www.ips-dc.org/reports/executive_excess_2010

Institute for Policy Studies (IPS-DC.org) is a community of public scholars and organizers linking peace, justice, and the environment in the U.S. and globally. We work with social movements to promote true democracy and challenge concentrated wealth, corporate influence, and military power.

Institute for Policy Studies turns Ideas into Action for Peace, Justice and the Environment. We strengthen social movements with independent research, visionary thinking, and links to the grassroots, scholars and elected officials. I.F. Stone once called IPS "the think tank for the rest of us." Since 1963, we have empowered people to build healthy and democratic societies in communities, the US, and the world. Click here to learn more, or read the latest below.

"Sami never should have spent a single night in an ICE cell," said one advocate. "His only real ‘offense’ was speaking clearly about Israel’s genocidal war crimes against Palestinians."

A leading Muslim civil rights group in the US applauded Monday as the Trump administration's agreement to release British pro-Palestinian commentator Sami Hamdi acknowledged that he is not "a danger to the community or to national security," after he was held in Immigration and Customs Enforcement detention for more than two weeks.

Hamdi's family and the California chapter of the Council on American-Islamic Relations (CAIR), which has been representing the journalist, expressed relief at the news that he had accepted an offer to leave the US voluntarily.

Hamdi was detained at San Francisco International Airport on October 26, mid-way through a US speaking tour during which he spoke about Palestinian rights and Israel's US-backed war in Gaza, which has killed more than 68,000 Palestinians.

The journalist, who is Muslim and of Tunisian and Algerian descent, had just spoken at an event in Sacramento, where he called on US leaders to take an "America First" rather than "Israel First" approach to its policy in the Middle East.

As Prem Thakker reported at Zeteo News, two "unelected, far-right, Islamophobic figures," Laura Loomer and Amy Mekelburg, took credit for "investigating" Hamdi. Mekelburg published a report that called on the US to deport Hamdi and prohibit him from entering the country, claiming he was “training US Muslims in digital agitation, electoral sabotage, and political warfare in alignment with Muslim Brotherhood doctrine.”

Loomer, a far-right conspiracy theorist, has become known during President Donald Trump's second term as someone with a considerable influence over the White House. Two days after Mekelburg's report was published, the US State Department revoked Hamdi's visa, and a day later ICE arrested him.

"His forthcoming release is welcome, but it does not erase the message this sends to every activist and journalist watching—and every authoritarian dictatorship worldwide who can now claim they are following America’s example.”

The Trump administration said at the time that it had "no obligation to host foreigners who support terrorism and actively undermine the safety of Americans," and appeared to reference comments Hamdi made after the October 7, 2023 Hamas-led attack on Israel. The Department of Homeland Security shared a video clip released by the pro-Israel group Memri, which showed Hamdi saying Palestinians should “celebrate their victory."

As The Guardian reported, Hamdi later clarified those remarks, saying, "We don’t celebrate blood lust, we don’t celebrate death and we don’t celebrate war... What Muslims are celebrating is not war, they’re celebrating the revival of a cause—a just cause—that everybody thought was dead, this is an important distinction."

Hamdi's wife, Soumaya Hamdi, told The Guardian after his arrest that the Memri video had been “edited in a way to frame Sami in a horrible light and produced by an organization that is very well known to be anti-Muslim, anti-Arab, Islamophobic, and out there to target people who are speaking up against the genocide against Palestinians."

CAIR-CA emphasized Monday that in Hamdi's immigration charging documents, the US government alleged only a visa overstay "and never identified any criminal conduct or security grounds."

“It is this simple: Sami never should have spent a single night in an ICE cell. His only real ‘offense’ was speaking clearly about Israel’s genocidal war crimes against Palestinians," said Hussam Ayloush, CEO of CAIR-CA.

“Sami’s case shows how quickly our government officials are willing to sacrifice our First Amendment and free press when a journalist uses his platform to dare put America first before Israel," said Ayloush. "His forthcoming release is welcome, but it does not erase the message this sends to every activist and journalist watching—and every authoritarian dictatorship worldwide who can now claim they are following America’s example.”

"The Democratic Party at the leadership level has really just become entirely feckless," said the progressive US Senate candidate running to unseat Republican Sen. Susan Collins.

Progressive US Senate candidate Graham Platner said late Monday that the leadership of the national Democratic Party must be replaced as eight Democratic senators—with the tacit approval of Chuck Schumer—voted with Republicans to end the government shutdown without a deal to avert a disastrous surge in health insurance premiums.

"The Democratic Party, at the leadership level, has really just become entirely feckless," Platner, who is running to unseat Sen. Susan Collins (R-Maine), said on a call hosted by Our Revolution, a progressive advocacy group that is also calling on Schumer (D-NY) to step down as leader of the Senate Democratic caucus.

"It is his job to make sure that his caucus is voting along the lines that are going to be good for the people," Platner said on Monday's call. "He is just completely unable to rise to this moment in American history."

"We gotta get rid of them," Platner said of Democratic leaders. "They have to go."

🚨 Tonight, U.S. Senate candidate Graham Platner didn’t hold back:

“The Democratic Party at the leadership level has really just become entirely feckless. There’s an inability to wield power — and people are fed up," he said live on Our Revolution’s 2026 Kickoff Call.

"What… pic.twitter.com/OjiwOMTcaW

— Our Revolution (@OurRevolution) November 11, 2025

On Monday night, eight Democratic caucus members—Sens. Jeanne Shaheen of New Hampshire, Dick Durbin of Illinois, Tim Kaine of Virginia, Maggie Hassan of New Hampshire, Angus King of Maine, Jacky Rosen and Catherine Cortez Masto of Nevada, and John Fetterman of Pennsylvania—broke ranks and voted with Republicans to send a government funding deal to the House, effectively ending a standoff over Affordable Care Act (ACA) subsidies that are set to lapse at the end of the year.

In addition to doing nothing to extend the enhanced ACA tax credits, the bill lacks language "saying that Trump has to spend the money," The American Prospect's David Dayen lamented.

"He can keep withholding funds, and even rescind them with a party-line vote," Dayen added. "None of the problems that inspired the shutdown are resolved."

Schumer personally voted against the legislation, which progressives dismissed as a face-saving maneuver.

Durbin, who is not running for reelection next year, told reporters that Schumer was "not happy" when informed of the Illinois senator's decision to vote with Republicans to end the shutdown.

"But he accepted it," Durbin added. "I think our friendship is still intact."

The Democratic capitulation after what became the longest shutdown in US history sparked an eruption of anger within the Democratic Party and from outside advocates who backed Democrats' effort to extend the ACA tax credits as premiums skyrocket, viewing the fight as both good policy and good politics.

The progressive organization MoveOn said late Monday that, in the wake of Democrats' surrender, 80% of its members voiced support for Schumer resigning as leader of the Senate Democratic caucus, a position that was also expressed by progressives in the House of Representatives.

“With Donald Trump and the Republican Party doubling healthcare premiums, weaponizing our military against us, and ripping food away from children, MoveOn members cannot accept weak leadership at the helm of the Democratic Party," said Katie Bethell, executive director of MoveOn Political Action. "Inexplicably, some Senate Democrats, under Leader Schumer’s watch, decided to surrender. It is time for Senator Schumer to step aside as minority leader to make room for those who are willing to fight fire with fire when the basic needs of working people are on the line."

Schumer is not up for reelection until 2028; progressive Rep. Alexandria Ocasio-Cortez (D-NY) has been floated as a possible primary challenger. Prior to the 2028 contest, it's far from clear that enough Senate Democratic caucus would support removing Schumer from the position he's held since 2017.

House Minority Leader Hakeem Jeffries (D-NY) voiced support for Schumer on Monday, indicating that he views the Senate Democratic leader as "effective" even as he folded, yet again, to President Donald Trump and the Republican Party.

"His campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for."

Amid calls for ousting Democratic congressional leadership because the party caved in the government shutdown fight over healthcare, a YouGov poll released Monday shows the nationwide popularity of New York City Mayor-elect Zohran Mamdani's economic agenda.

Mamdani beat former New York Gov. Andrew Cuomo in both the June Democratic primary and last week's general election by campaigning unapologetically as a democratic socialist dedicated to making the nation's largest city more affordable for working people.

Multiple polls have suggested that Mamdani's progressive platform offers Democrats across the United States a roadmap for candidates in next year's midterms and beyond. As NYC's next mayor began assembling his team and the movement that worked to elect him created a group to keep fighting for his ambitious agenda, YouGov surveyed 1,133 US adults after his victory.

While just 31% of those surveyed said they would have voted for Mamdani—more than any other candidate—and the same share said they would vote for a candidate who identified as a "democratic socialist," the policies he ran on garnered far more support.

YouGov found:

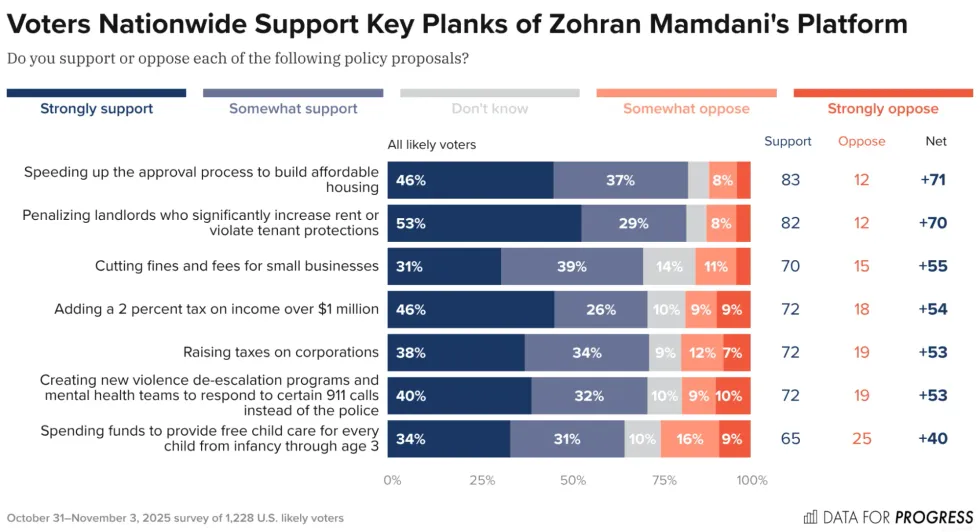

Data for Progress similarly surveyed 1,228 likely voters from across the United States about key pieces of Mamdani's platform before his win. The think tank found that large majorities of Americans support efforts to build more affordable housing, higher taxes for corporations as well as millionaires and billionaires, and free childcare, among other policies.

"There's a common refrain from some pundits to dismiss Mamdani's victory as a quirk of New York City politics rather than a sign of something bigger," Data for Progress executive director Ryan O'Donnell wrote last week. "But his campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for. The lesson isn't that every candidate should mimic his style—you can't fake authenticity—but that voters everywhere respond when a candidate connects economic populism to clear, actionable goals."

"Candidates closer to the center are running on an affordability message as well," he noted, pointing to Democrat Mikie Sherrill's gubernatorial victory in New Jersey. "When a center-left figure like Sherill is running on taking on corporate power, it underscores how central economic populism has become across the political spectrum. Her message may have been less fiery than Mamdani's, but she drew from a similar well of voter frustration over rising costs and corporate influence. In doing so, Sherrill demonstrated to voters that her administration would play an active role in lowering costs—something that voters nationwide overwhelmingly believe the government should be doing."