SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

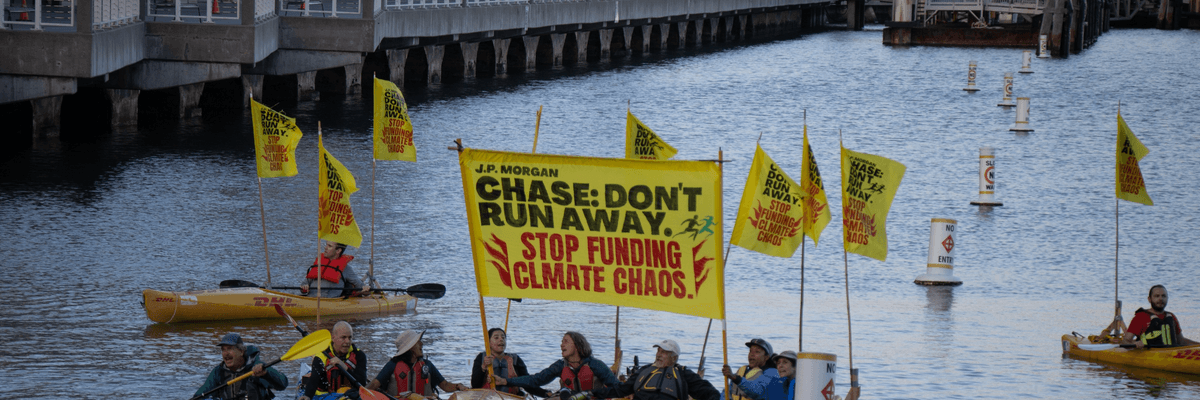

Stop the Money Pipeline coalition "kayaktavists" protest in McCovey Cove in San Francisco Bay during the JPMorgan Chase Corporate Challenge running race on September 20, 2022. (Photo: Stop the Money Pipeline/Twitter)

Members of the Stop the Money Pipeline coalition on Thursday welcomed a U.S. Federal Reserve pilot program to study banks' exposure to climate risks while warning that more robust action from the Fed and the nation's banking system is needed to rein in Wall Street's fossil fuel funding.

"Big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process."

According to the Fed, the "pilot climate scenario analysis exercise," which will begin early next year, is "designed to enhance the ability of supervisors and firms to measure and manage climate-related financial risks" amid a worsening planetary emergency fueled, in part, by the policies and activities of central and commercial banks.

Six of the biggest U.S. banks--Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo--will participate in the program, which "is exploratory in nature and does not have capital consequences."

Akiksha Chatterji, lead campaigner at the advocacy group Positive Money U.S., said in a statement that "the new climate scenario exercise is a welcome first step and indicates that the Fed is finally beginning to take climate risks seriously, after lagging behind international counterparts."

"Climate scenario analysis is a useful exercise to assess some of the serious risks that climate change poses to financial institutions, but we need the Fed to move from exploring to acting," Chatterji added. "We have enough information about the dangers of climate change to justify regulatory and supervisory action now, such as penalizing banks' excessive and reckless fossil fuel lending. To truly safeguard financial stability, the Fed must further introduce policies that reflect the high risk of fossil fuel investments."

The pilot program comes as the world's 100 largest banks are on pace to set new commodity trading profit records this year amid soaring food and energy prices--even as many millions of people face starvation--and as financial institutions keep pouring billions of dollars into fossil fuel investments, despite deceptive net-zero pledges.

Earlier this month, the Stop the Money Pipeline coalition--which includes more than 200 advocacy groups--launched a new "Blame Wall Street" campaign aimed at holding banks that have invested more than $1 trillion in oil and gas projects in recent years.

Related Content

Responding to the new Fed program, Adele Shraiman, campaign representative for the Sierra Club's Fossil-Free Finance campaign, said that "the climate crisis already affects financial institutions and the broader economy, but banks are seriously unprepared to respond and adapt."

"In fact, big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process," she continued.

"As the country's most powerful financial regulator, the Federal Reserve is finally sending a strong signal to banks to start taking climate risk seriously and prepare for the clean energy transition," Shraiman added. "This is a promising first step in the urgent effort to rein in Wall Street's dangerous and reckless behavior and protect our financial system from a climate-driven economic crash."

Emily Park, senior organizer at the climate action group 350.org's Fossil-Free Fed campaign, said her group was "excited to learn about the pilot climate scenario risk analysis exercise with the Fed and six of the U.S.' largest banks."

"While we applaud this first step, it's not enough," Park stressed. "Hurricane Ian is showing us that the American economy and the American people can't wait any longer for stronger action from the Fed and the U.S. banking system. We need the Federal Reserve to do more. Now."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Members of the Stop the Money Pipeline coalition on Thursday welcomed a U.S. Federal Reserve pilot program to study banks' exposure to climate risks while warning that more robust action from the Fed and the nation's banking system is needed to rein in Wall Street's fossil fuel funding.

"Big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process."

According to the Fed, the "pilot climate scenario analysis exercise," which will begin early next year, is "designed to enhance the ability of supervisors and firms to measure and manage climate-related financial risks" amid a worsening planetary emergency fueled, in part, by the policies and activities of central and commercial banks.

Six of the biggest U.S. banks--Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo--will participate in the program, which "is exploratory in nature and does not have capital consequences."

Akiksha Chatterji, lead campaigner at the advocacy group Positive Money U.S., said in a statement that "the new climate scenario exercise is a welcome first step and indicates that the Fed is finally beginning to take climate risks seriously, after lagging behind international counterparts."

"Climate scenario analysis is a useful exercise to assess some of the serious risks that climate change poses to financial institutions, but we need the Fed to move from exploring to acting," Chatterji added. "We have enough information about the dangers of climate change to justify regulatory and supervisory action now, such as penalizing banks' excessive and reckless fossil fuel lending. To truly safeguard financial stability, the Fed must further introduce policies that reflect the high risk of fossil fuel investments."

The pilot program comes as the world's 100 largest banks are on pace to set new commodity trading profit records this year amid soaring food and energy prices--even as many millions of people face starvation--and as financial institutions keep pouring billions of dollars into fossil fuel investments, despite deceptive net-zero pledges.

Earlier this month, the Stop the Money Pipeline coalition--which includes more than 200 advocacy groups--launched a new "Blame Wall Street" campaign aimed at holding banks that have invested more than $1 trillion in oil and gas projects in recent years.

Related Content

Responding to the new Fed program, Adele Shraiman, campaign representative for the Sierra Club's Fossil-Free Finance campaign, said that "the climate crisis already affects financial institutions and the broader economy, but banks are seriously unprepared to respond and adapt."

"In fact, big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process," she continued.

"As the country's most powerful financial regulator, the Federal Reserve is finally sending a strong signal to banks to start taking climate risk seriously and prepare for the clean energy transition," Shraiman added. "This is a promising first step in the urgent effort to rein in Wall Street's dangerous and reckless behavior and protect our financial system from a climate-driven economic crash."

Emily Park, senior organizer at the climate action group 350.org's Fossil-Free Fed campaign, said her group was "excited to learn about the pilot climate scenario risk analysis exercise with the Fed and six of the U.S.' largest banks."

"While we applaud this first step, it's not enough," Park stressed. "Hurricane Ian is showing us that the American economy and the American people can't wait any longer for stronger action from the Fed and the U.S. banking system. We need the Federal Reserve to do more. Now."

Members of the Stop the Money Pipeline coalition on Thursday welcomed a U.S. Federal Reserve pilot program to study banks' exposure to climate risks while warning that more robust action from the Fed and the nation's banking system is needed to rein in Wall Street's fossil fuel funding.

"Big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process."

According to the Fed, the "pilot climate scenario analysis exercise," which will begin early next year, is "designed to enhance the ability of supervisors and firms to measure and manage climate-related financial risks" amid a worsening planetary emergency fueled, in part, by the policies and activities of central and commercial banks.

Six of the biggest U.S. banks--Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo--will participate in the program, which "is exploratory in nature and does not have capital consequences."

Akiksha Chatterji, lead campaigner at the advocacy group Positive Money U.S., said in a statement that "the new climate scenario exercise is a welcome first step and indicates that the Fed is finally beginning to take climate risks seriously, after lagging behind international counterparts."

"Climate scenario analysis is a useful exercise to assess some of the serious risks that climate change poses to financial institutions, but we need the Fed to move from exploring to acting," Chatterji added. "We have enough information about the dangers of climate change to justify regulatory and supervisory action now, such as penalizing banks' excessive and reckless fossil fuel lending. To truly safeguard financial stability, the Fed must further introduce policies that reflect the high risk of fossil fuel investments."

The pilot program comes as the world's 100 largest banks are on pace to set new commodity trading profit records this year amid soaring food and energy prices--even as many millions of people face starvation--and as financial institutions keep pouring billions of dollars into fossil fuel investments, despite deceptive net-zero pledges.

Earlier this month, the Stop the Money Pipeline coalition--which includes more than 200 advocacy groups--launched a new "Blame Wall Street" campaign aimed at holding banks that have invested more than $1 trillion in oil and gas projects in recent years.

Related Content

Responding to the new Fed program, Adele Shraiman, campaign representative for the Sierra Club's Fossil-Free Finance campaign, said that "the climate crisis already affects financial institutions and the broader economy, but banks are seriously unprepared to respond and adapt."

"In fact, big banks still pour billions into fossil fuels, ignoring the serious risks posed by climate change and threatening the savings of everyday Americans in the process," she continued.

"As the country's most powerful financial regulator, the Federal Reserve is finally sending a strong signal to banks to start taking climate risk seriously and prepare for the clean energy transition," Shraiman added. "This is a promising first step in the urgent effort to rein in Wall Street's dangerous and reckless behavior and protect our financial system from a climate-driven economic crash."

Emily Park, senior organizer at the climate action group 350.org's Fossil-Free Fed campaign, said her group was "excited to learn about the pilot climate scenario risk analysis exercise with the Fed and six of the U.S.' largest banks."

"While we applaud this first step, it's not enough," Park stressed. "Hurricane Ian is showing us that the American economy and the American people can't wait any longer for stronger action from the Fed and the U.S. banking system. We need the Federal Reserve to do more. Now."