SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

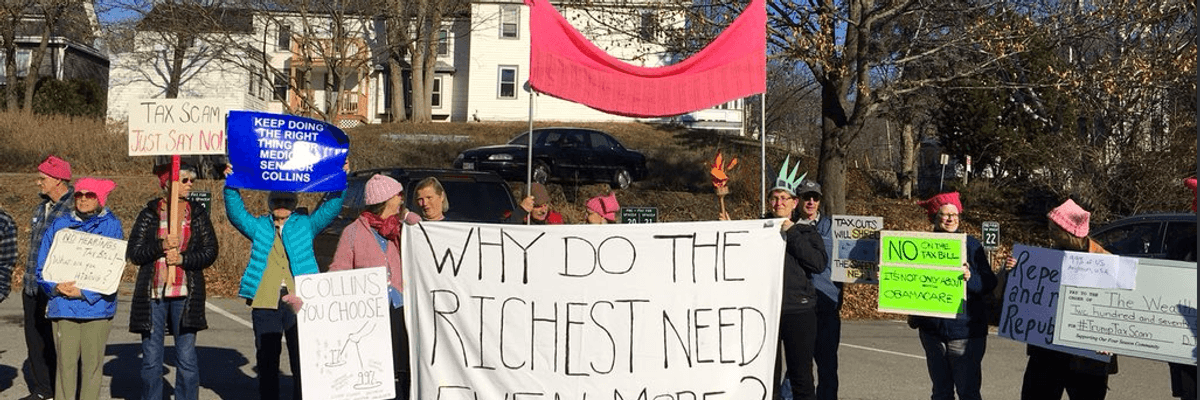

The Trump resistance has argued since the first Republican tax proposals were released that corporations and wealthy Americans would see most of the benefits of tax reform. (Photo: @gail_leiser/Twitter)

Confirming the suspicions of Trump critics and the analyses of the Republican tax plan that have been released by numerous economists, large corporations have admitted that the money they'll save if the plan passes will go towards enriching their wealthy shareholders--not towards strengthening the middle class through job creation.

At Bloomberg on Wednesday, Toluse Olorunnipa reported that executives at Coca-Cola, Pfizer, Amgen, and Cisco have all said in recent weeks that their companies will prioritize increasing dividends or buying back shares from shareholders, before investing their savings in the company by hiring more workers or giving employees raises.

The admission by the country's most powerful corporations runs counter to the narrative the Trump administration and congressional Republicans have pushed, according to Bloomberg:

At a Nov. 14 speech to the Wall Street Journal CEO Council by Trump's top economic adviser, Gary Cohn, the moderator asked business leaders in the audience for a show of hands if they planned to reinvest tax cut proceeds. Few people responded.

"Why aren't the other hands up?" Cohn asked.

Cohn's speech was followed by an appearance by Vice President Mike Pence, who reportedly told the business leaders, "We need all of you to tell this story" of corporate tax cuts leading to higher wages and more jobs for working Americans.

Groups including Americans for Tax Fairness, the Tax Policy Center, and the Center on Budget and Policy Priorities, have all found that the notion of long-term, meaningful benefits for the middle- and lower-classes is indeed just a story.

While corporations' taxes are immediately and permanently cut from 35 percent to 20 percent under the GOP plan, middle-class Americans will owe more in taxes by 2027, even if they see some relief in 2018.

According to the Congressional Budget Office analysis of the Senate plan, taxpayers making up to $30,000 will see their tax burden increase by 2019. By 2021, that extends to those making $40,000 and under.

Not all of corporate America is supportive of the tax plan. The investor John Bogle has called the proposal "a moral abomination," while Warren Buffett and the CEOs of Starbucks, BlackRock Financial Management, and Goldman Sachs have all publicly criticized the Republican plan.

On social media, Sen. Elizabeth Warren (D-Mass.) wrote on Wednesday that "Republicans are handing corporations the tax plan of their dreams. And the rest of us will be paying for their joy ride." Other critics also denounced the new revelations that corporations are already planning to use the tax cuts to their own advantage.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Confirming the suspicions of Trump critics and the analyses of the Republican tax plan that have been released by numerous economists, large corporations have admitted that the money they'll save if the plan passes will go towards enriching their wealthy shareholders--not towards strengthening the middle class through job creation.

At Bloomberg on Wednesday, Toluse Olorunnipa reported that executives at Coca-Cola, Pfizer, Amgen, and Cisco have all said in recent weeks that their companies will prioritize increasing dividends or buying back shares from shareholders, before investing their savings in the company by hiring more workers or giving employees raises.

The admission by the country's most powerful corporations runs counter to the narrative the Trump administration and congressional Republicans have pushed, according to Bloomberg:

At a Nov. 14 speech to the Wall Street Journal CEO Council by Trump's top economic adviser, Gary Cohn, the moderator asked business leaders in the audience for a show of hands if they planned to reinvest tax cut proceeds. Few people responded.

"Why aren't the other hands up?" Cohn asked.

Cohn's speech was followed by an appearance by Vice President Mike Pence, who reportedly told the business leaders, "We need all of you to tell this story" of corporate tax cuts leading to higher wages and more jobs for working Americans.

Groups including Americans for Tax Fairness, the Tax Policy Center, and the Center on Budget and Policy Priorities, have all found that the notion of long-term, meaningful benefits for the middle- and lower-classes is indeed just a story.

While corporations' taxes are immediately and permanently cut from 35 percent to 20 percent under the GOP plan, middle-class Americans will owe more in taxes by 2027, even if they see some relief in 2018.

According to the Congressional Budget Office analysis of the Senate plan, taxpayers making up to $30,000 will see their tax burden increase by 2019. By 2021, that extends to those making $40,000 and under.

Not all of corporate America is supportive of the tax plan. The investor John Bogle has called the proposal "a moral abomination," while Warren Buffett and the CEOs of Starbucks, BlackRock Financial Management, and Goldman Sachs have all publicly criticized the Republican plan.

On social media, Sen. Elizabeth Warren (D-Mass.) wrote on Wednesday that "Republicans are handing corporations the tax plan of their dreams. And the rest of us will be paying for their joy ride." Other critics also denounced the new revelations that corporations are already planning to use the tax cuts to their own advantage.

Confirming the suspicions of Trump critics and the analyses of the Republican tax plan that have been released by numerous economists, large corporations have admitted that the money they'll save if the plan passes will go towards enriching their wealthy shareholders--not towards strengthening the middle class through job creation.

At Bloomberg on Wednesday, Toluse Olorunnipa reported that executives at Coca-Cola, Pfizer, Amgen, and Cisco have all said in recent weeks that their companies will prioritize increasing dividends or buying back shares from shareholders, before investing their savings in the company by hiring more workers or giving employees raises.

The admission by the country's most powerful corporations runs counter to the narrative the Trump administration and congressional Republicans have pushed, according to Bloomberg:

At a Nov. 14 speech to the Wall Street Journal CEO Council by Trump's top economic adviser, Gary Cohn, the moderator asked business leaders in the audience for a show of hands if they planned to reinvest tax cut proceeds. Few people responded.

"Why aren't the other hands up?" Cohn asked.

Cohn's speech was followed by an appearance by Vice President Mike Pence, who reportedly told the business leaders, "We need all of you to tell this story" of corporate tax cuts leading to higher wages and more jobs for working Americans.

Groups including Americans for Tax Fairness, the Tax Policy Center, and the Center on Budget and Policy Priorities, have all found that the notion of long-term, meaningful benefits for the middle- and lower-classes is indeed just a story.

While corporations' taxes are immediately and permanently cut from 35 percent to 20 percent under the GOP plan, middle-class Americans will owe more in taxes by 2027, even if they see some relief in 2018.

According to the Congressional Budget Office analysis of the Senate plan, taxpayers making up to $30,000 will see their tax burden increase by 2019. By 2021, that extends to those making $40,000 and under.

Not all of corporate America is supportive of the tax plan. The investor John Bogle has called the proposal "a moral abomination," while Warren Buffett and the CEOs of Starbucks, BlackRock Financial Management, and Goldman Sachs have all publicly criticized the Republican plan.

On social media, Sen. Elizabeth Warren (D-Mass.) wrote on Wednesday that "Republicans are handing corporations the tax plan of their dreams. And the rest of us will be paying for their joy ride." Other critics also denounced the new revelations that corporations are already planning to use the tax cuts to their own advantage.