Critics of the Republican tax plan say it offers a crystal-clear view of which Americans matter to the Trump administration and the Party in control of Congress--and which don't. Despite an aggressive push to portray the proposal as a tax cut for middle-class Americans, according to a New York Times analysis, millions of middle-income families would pay more in taxes immediately--and many more would see their tax bills rise over time.

"The GOP tax plan is a simple political statement about who matters more in American democracy: the heirs to hedge fund fortunes or everyone else in the country," wrote Zach Carter in the Huffington Post on Monday. "Trump and the Republicans have chosen the dynasts."

The analysis by the Times, similar to one shown by the Institute of Taxation and Economic Policy (ITEP), finds that 45 percent of middle-class Americans would be paying more in taxes within a decade, even if they see some modest relief initially. As theTimes notes, it's "a striking finding for a bill promoted as a middle-class tax cut."

Due to the elimination of personal exemptions, which allows many taxpayers to deduct $4,000 per household member, the tax plan would immediately be costly for many families with children. According to the Times, "Fewer than 40 percent of middle-class families with at least three children would receive a tax cut under the plan, compared with nearly 80 percent of families without children."

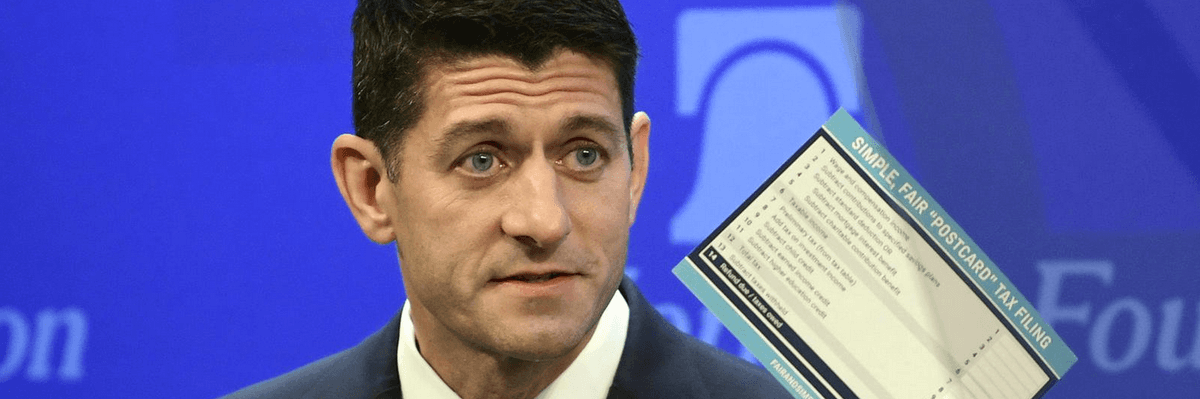

Households with large medical bills would be hit hard in 2018 as well, following the proposal's elimination of medical expenses deductions. Overall, about a third of middle-class families would pay more in 2018 than they do now--far from the rescue package House Speaker Paul Ryan (R-Wisc.) portrayed the tax plan as last week.

"These are matters of justice, social prestige, and political power," Carter wrote in the Huffington Post, regarding the GOP's insistence on . "There is no economic law that governs how the $19 trillion [in national wealth] we produce each year must be distributed. Figuring out who should get how much of that $19 trillion is a political choice--and the Republicans' choice is to give much of that money to a few hundred financial dynasties."