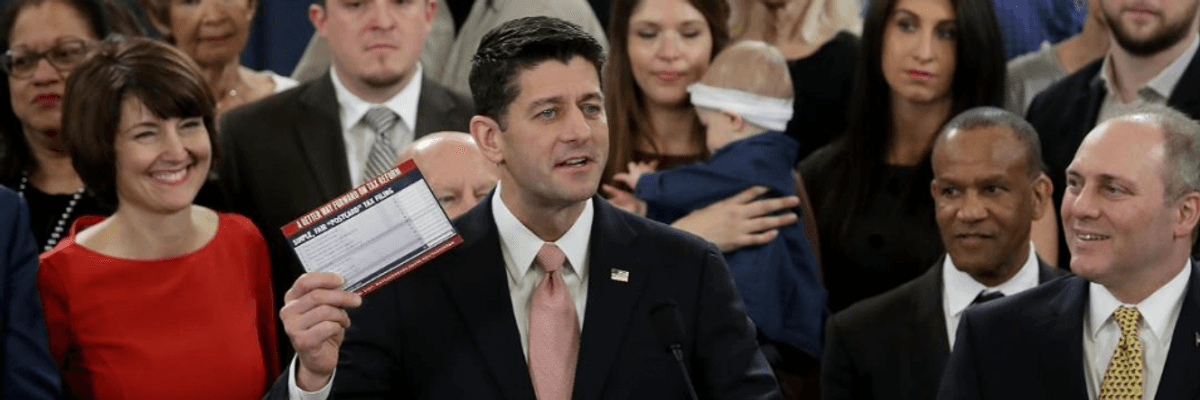

House Speaker Paul Ryan (R-Wis.) heralded the Republican tax plan as a win for the middle class, but spoke little about benefits for lower income Americans and the rich. (Photo: @srbija_eu/Twitter)

Instead of $2 Trillion Corporate Tax Cut, GOP Could Give Average American Families $17,000 Each

Sen. Elizabeth Warren scoffs at GOP's offer of $1,182 per year for families under tax plan

Appearing on CNN Thursday, Sen. Elizabeth Warren (D-Mass.) argued that the $1,182 that Republicans spent the day touting as the money average American families will save under their tax plan, is far from what the government could afford to give them--if they weren't spending that money on massive tax cuts for the rich.

As House Leader Paul Ryan (R-Wis.) and his colleagues said in a press conference unveiling some of the proposal's details, "the typical family of four will save $1,182 a year on their taxes."

Most American families would happily accept an extra $1200 per year to help with bills, college funds, and savings--but the estimated sum of $1,182 will only apply to families of four earning $59,000 per year, not lower income households.

Critics were also concerned about the GOP's plans for the Child Tax Credit. As the CBPP explained in September after the Republicans unveiled the framework for their plan, the Party "proposed to make their Child Tax Credit increase non-refundable, meaning that working families with incomes too low to have federal income tax liability would not benefit." A single parent raising two children making minimum wage would be left out of receiving the credit.

Sister Simone Campbell of NETWORK Lobby for Catholic Social Justice also noted that immigrant families would lose out under the plan. The so-called Tax Cuts & Jobs Act "rips the credits away from 5.1 million children whose parents are immigrant taxpayers with an average annual income of $21,000, which is a loss of 8.5% of their annual income. This will directly jeopardize the economic, educational, and developmental outcomes of children living in the U.S."

On social media, Americans expressed doubts that the GOP's tax plan would benefit them in a meaningful way--even if they're in the segment of the population that could receive $1,182 more per year in tax savings--especially compared to the huge tax cut given to corporations under the plan.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Appearing on CNN Thursday, Sen. Elizabeth Warren (D-Mass.) argued that the $1,182 that Republicans spent the day touting as the money average American families will save under their tax plan, is far from what the government could afford to give them--if they weren't spending that money on massive tax cuts for the rich.

As House Leader Paul Ryan (R-Wis.) and his colleagues said in a press conference unveiling some of the proposal's details, "the typical family of four will save $1,182 a year on their taxes."

Most American families would happily accept an extra $1200 per year to help with bills, college funds, and savings--but the estimated sum of $1,182 will only apply to families of four earning $59,000 per year, not lower income households.

Critics were also concerned about the GOP's plans for the Child Tax Credit. As the CBPP explained in September after the Republicans unveiled the framework for their plan, the Party "proposed to make their Child Tax Credit increase non-refundable, meaning that working families with incomes too low to have federal income tax liability would not benefit." A single parent raising two children making minimum wage would be left out of receiving the credit.

Sister Simone Campbell of NETWORK Lobby for Catholic Social Justice also noted that immigrant families would lose out under the plan. The so-called Tax Cuts & Jobs Act "rips the credits away from 5.1 million children whose parents are immigrant taxpayers with an average annual income of $21,000, which is a loss of 8.5% of their annual income. This will directly jeopardize the economic, educational, and developmental outcomes of children living in the U.S."

On social media, Americans expressed doubts that the GOP's tax plan would benefit them in a meaningful way--even if they're in the segment of the population that could receive $1,182 more per year in tax savings--especially compared to the huge tax cut given to corporations under the plan.

Appearing on CNN Thursday, Sen. Elizabeth Warren (D-Mass.) argued that the $1,182 that Republicans spent the day touting as the money average American families will save under their tax plan, is far from what the government could afford to give them--if they weren't spending that money on massive tax cuts for the rich.

As House Leader Paul Ryan (R-Wis.) and his colleagues said in a press conference unveiling some of the proposal's details, "the typical family of four will save $1,182 a year on their taxes."

Most American families would happily accept an extra $1200 per year to help with bills, college funds, and savings--but the estimated sum of $1,182 will only apply to families of four earning $59,000 per year, not lower income households.

Critics were also concerned about the GOP's plans for the Child Tax Credit. As the CBPP explained in September after the Republicans unveiled the framework for their plan, the Party "proposed to make their Child Tax Credit increase non-refundable, meaning that working families with incomes too low to have federal income tax liability would not benefit." A single parent raising two children making minimum wage would be left out of receiving the credit.

Sister Simone Campbell of NETWORK Lobby for Catholic Social Justice also noted that immigrant families would lose out under the plan. The so-called Tax Cuts & Jobs Act "rips the credits away from 5.1 million children whose parents are immigrant taxpayers with an average annual income of $21,000, which is a loss of 8.5% of their annual income. This will directly jeopardize the economic, educational, and developmental outcomes of children living in the U.S."

On social media, Americans expressed doubts that the GOP's tax plan would benefit them in a meaningful way--even if they're in the segment of the population that could receive $1,182 more per year in tax savings--especially compared to the huge tax cut given to corporations under the plan.