Multinational corporations are taking advantage of global tax treaties to avoid paying their fair share, thereby fueling poverty around the world, according to a groundbreaking report released this week.

The analysis by Johannesburg-headquartered ActionAid International shows how "rip-off tax treaties cost developing countries billions every year, tying the hands of governments, hurting some of the poorest people in the world, and deepening global inequality," said campaigner Savior Mwambwa.

These treaties--which dictate how much, and even if, countries can tax multinational companies--"have no place in the 21st century," ActionAid declares in its report.

As the Mistreated (pdf) report explains, "Tax revenue is one of the most important, sustainable and predictable sources of public finance there is. It is a crucial part of the journey towards a world free from poverty--funding lasting improvements in public services such as health and education." In particular, the group points out, many poor countries are asking for public funds to be put toward "the realization of women and girls' human rights."

Yet thanks to what Mwambwa calls the "broken tax treaty system," global corporations "pay little or no tax in poor countries."

In turn, he said, "Women and children in poverty pay the price when crumbling public services like schools and hospitals are starved of possible funding."

Indeed, after examining more than 500 binding tax treaties that low- and lower-middle-income countries in sub-Saharan Africa and eastern and southern Asia signed with other countries from 1970 until 2014, the international development organization concluded that many such pacts "are ensuring that money flows untaxed from poor to rich countries, making the world more unequal and exacerbating poverty."

ActionAid identifies the UK and Italy as the countries that have entered into the highest number of "very restrictive" tax treaties with African and Asian countries since the 1970s, followed by Germany. China, Tunisia, and Mauritius also have a rapidly growing number of similar treaties with some of the world's poorest countries, the organization notes.

Generally speaking, tax treaties that lower income countries have signed with members of what ActionAid calls "the [Organization for Economic Cooperation and Development, or OECD] club of rich countries" take away more taxing rights than those with other countries. "Worryingly, the deals struck with OECD countries are getting worse," the group says.

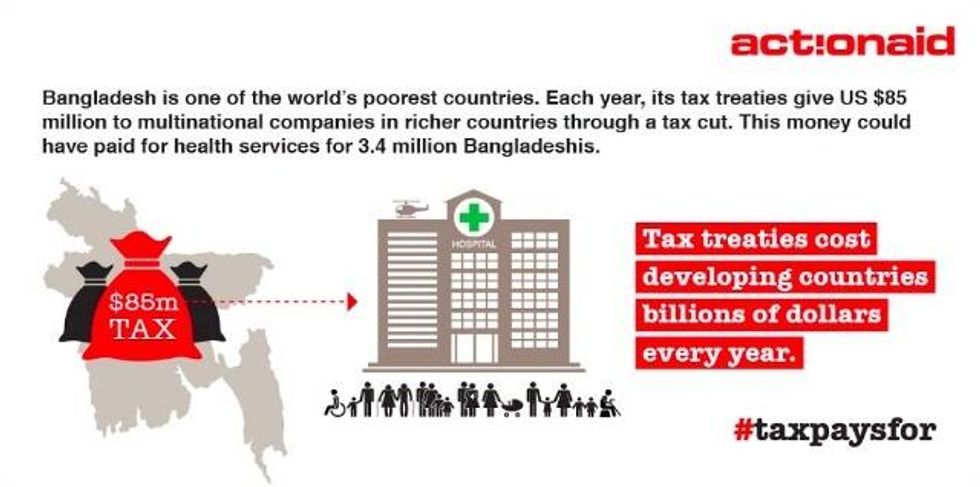

Meanwhile, Bangladesh is the country that has given up the most power to tax multinational companies. According to ActionAid, a single clause that restricts the country's ability to tax dividends--money paid by companies to overseas shareholders--is costing Bangladesh around US$85 million every year.

"This is a country where 66 million people live in extreme poverty--less than US$1.90 a day," the group points out.

The report comes as nations grapple individually and as a bloc with how to close corporate tax loopholes.

In January, Googleagreed to a deal with British tax authorities to pay PS130 million (US$143.5 million) in back taxes and bear a greater tax burden in future, after coming under fire for its tax avoidance practices. The UK Parliament's public spending watchdog on Wednesday criticized the settlement as "disproportionately small."

Indeed, as ActionAid policy advisor Anders Dahlbeck told the Independent last month, "The row over tax dodging by big companies like Google shows how strongly the British public feels that multinationals aren't paying their fair share." But as Mistreated clearly illustrates, "this is just part of a far larger global problem."

Late last month, the 31 OECD members signed an agreement to share information about multinationals' profits and taxation, a move "aimed at stopping firms from using complicated loopholes or moving money across borders to minimize or avoid paying corporate tax," Agence France-Pressereported at the time.

And just this week, it was reported that developing nations will join that effort, under a proposal that would open up the OECD's Committee on Fiscal Affairs to new, associate members that agree to implement certain tax reforms.

The news brought mixed reaction from development groups who said it was too little, too late. "Inclusion after the fact is a poor substitute for a voice in how the standards are designed," said Oriana Suarez of the Latin American Network on Debt, Development, and Rights. "Developing countries now being invited...did not have a say while the rules were being set."

"The OECD is certainly one part of the global fight against tax evasion and tax avoidance, but it's not well-positioned to be the sole standard bearer for the globe," added Porter McConnell of the Washington, D.C.-based Financial Transparency Coalition. "Having its members speak on behalf of the rest of the world's countries is patronizing and it's ultimately ineffective."