SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

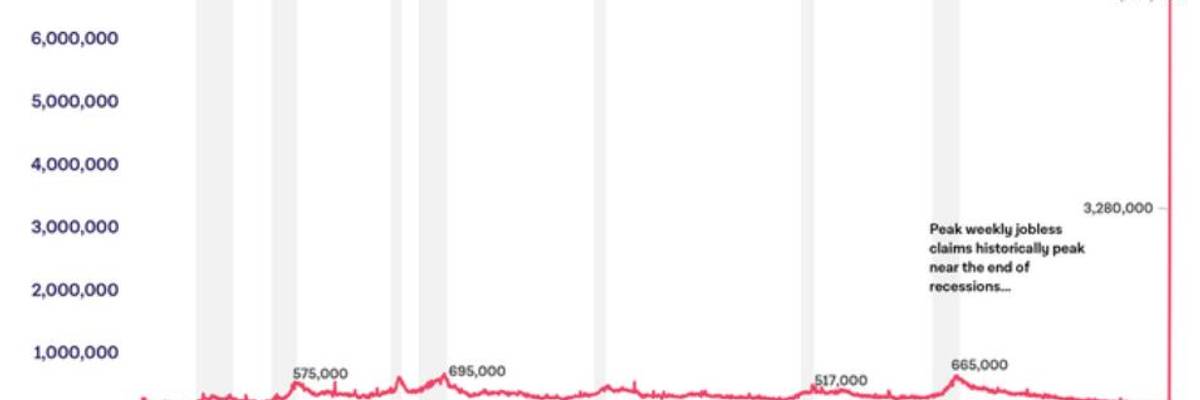

The chart shows that 9.9 million initial unemployment insurance claims have been made over the last two-week period, creating a graphic described as "difficult to stomach" by economic analysts. (Source: The Block/FRED)

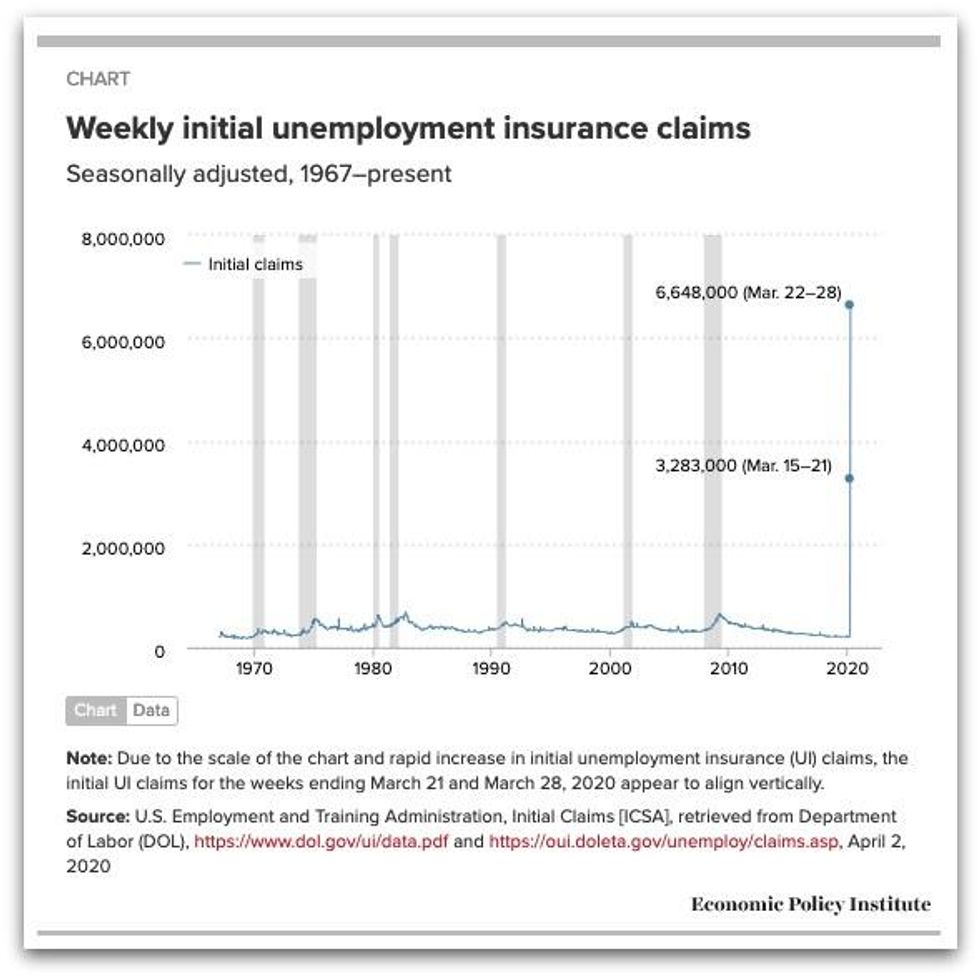

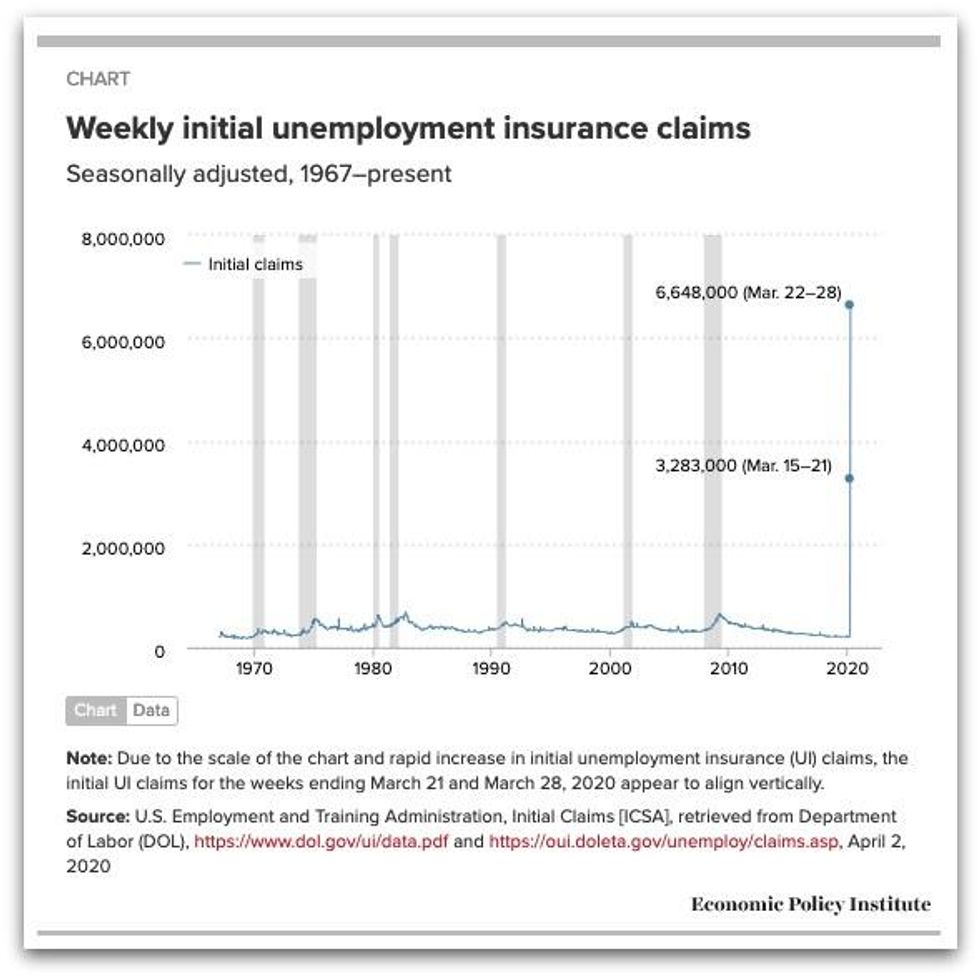

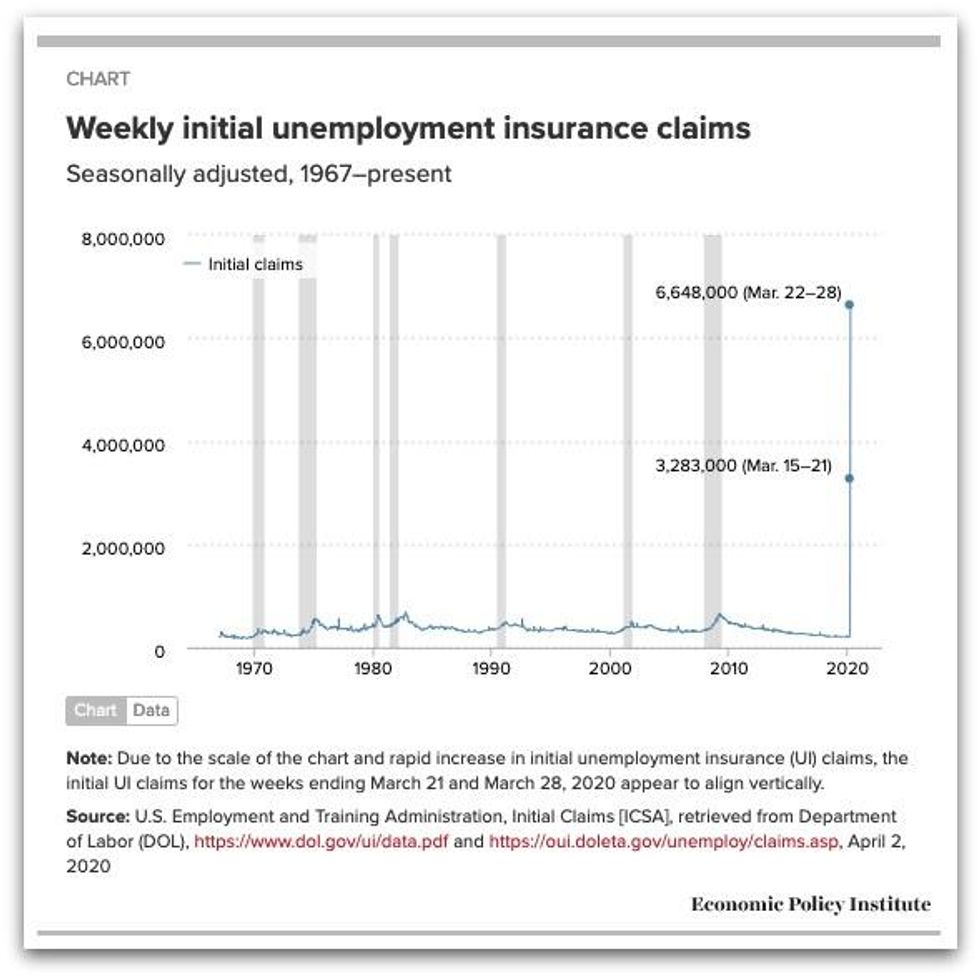

This morning, the Department of Labor (DOL) released data on initial unemployment insurance (UI) claims, showing that UI claims jumped from 211,000 in the week ending March 7th to 6.6 million in the week ending March 28th. This is more than a 3,000% increase in three weeks. This kind of upending of the labor market in such a short time is unheard of.

The figure shows initial UI claims over time. The spike at the end shows the unprecedented territory we are in right now. (Note: Because the x-axis covers more than 50 years and the increase in the last two weeks is so drastic, the last two observations appear to be in a vertical line.) What the labor market is currently experiencing is far more extreme than anything we've ever seen, including the worst weeks of the Great Recession.

It's worth noting that UI claims do not include many workers who are out of work due to the virus, including independent contractors, those who don't have long enough work histories, those who had to quit work to care for a child whose school closed, and more, so the actually number of people out of work is higher than today's' data show us. One of the most effective parts of the CARES ACT, the relief and recovery act that Congress passed last week, is a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness, which is regrettable because the job loss we have seen so far is just the tip of the iceberg. Based on new GDP forecasts, we project that nearly 20 million workers will be laid off or furloughed by July, with losses in every state. And importantly, the GDP forecasts these projections are based on include the impact of the CARES Act and they assume that Congress will pass another relief package focused on aid to states. That implies that far more than 20 million workers will be laid off or furloughed if there is not another meaningful relief and recovery bill.

It's important to step back from today's UI numbers and remember that this labor market crisis didn't have to happen. Due to failed leadership, we twice missed the chance to avert widespread job loss. Now policymakers must act to avoid greater damage. Given the incredible deterioration of the labor market in a matter of weeks, federal policymakers will absolutely need to come back and provide more desperately needed relief, and more support for the recovery once the lockdown is over.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

This morning, the Department of Labor (DOL) released data on initial unemployment insurance (UI) claims, showing that UI claims jumped from 211,000 in the week ending March 7th to 6.6 million in the week ending March 28th. This is more than a 3,000% increase in three weeks. This kind of upending of the labor market in such a short time is unheard of.

The figure shows initial UI claims over time. The spike at the end shows the unprecedented territory we are in right now. (Note: Because the x-axis covers more than 50 years and the increase in the last two weeks is so drastic, the last two observations appear to be in a vertical line.) What the labor market is currently experiencing is far more extreme than anything we've ever seen, including the worst weeks of the Great Recession.

It's worth noting that UI claims do not include many workers who are out of work due to the virus, including independent contractors, those who don't have long enough work histories, those who had to quit work to care for a child whose school closed, and more, so the actually number of people out of work is higher than today's' data show us. One of the most effective parts of the CARES ACT, the relief and recovery act that Congress passed last week, is a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness, which is regrettable because the job loss we have seen so far is just the tip of the iceberg. Based on new GDP forecasts, we project that nearly 20 million workers will be laid off or furloughed by July, with losses in every state. And importantly, the GDP forecasts these projections are based on include the impact of the CARES Act and they assume that Congress will pass another relief package focused on aid to states. That implies that far more than 20 million workers will be laid off or furloughed if there is not another meaningful relief and recovery bill.

It's important to step back from today's UI numbers and remember that this labor market crisis didn't have to happen. Due to failed leadership, we twice missed the chance to avert widespread job loss. Now policymakers must act to avoid greater damage. Given the incredible deterioration of the labor market in a matter of weeks, federal policymakers will absolutely need to come back and provide more desperately needed relief, and more support for the recovery once the lockdown is over.

This morning, the Department of Labor (DOL) released data on initial unemployment insurance (UI) claims, showing that UI claims jumped from 211,000 in the week ending March 7th to 6.6 million in the week ending March 28th. This is more than a 3,000% increase in three weeks. This kind of upending of the labor market in such a short time is unheard of.

The figure shows initial UI claims over time. The spike at the end shows the unprecedented territory we are in right now. (Note: Because the x-axis covers more than 50 years and the increase in the last two weeks is so drastic, the last two observations appear to be in a vertical line.) What the labor market is currently experiencing is far more extreme than anything we've ever seen, including the worst weeks of the Great Recession.

It's worth noting that UI claims do not include many workers who are out of work due to the virus, including independent contractors, those who don't have long enough work histories, those who had to quit work to care for a child whose school closed, and more, so the actually number of people out of work is higher than today's' data show us. One of the most effective parts of the CARES ACT, the relief and recovery act that Congress passed last week, is a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness, which is regrettable because the job loss we have seen so far is just the tip of the iceberg. Based on new GDP forecasts, we project that nearly 20 million workers will be laid off or furloughed by July, with losses in every state. And importantly, the GDP forecasts these projections are based on include the impact of the CARES Act and they assume that Congress will pass another relief package focused on aid to states. That implies that far more than 20 million workers will be laid off or furloughed if there is not another meaningful relief and recovery bill.

It's important to step back from today's UI numbers and remember that this labor market crisis didn't have to happen. Due to failed leadership, we twice missed the chance to avert widespread job loss. Now policymakers must act to avoid greater damage. Given the incredible deterioration of the labor market in a matter of weeks, federal policymakers will absolutely need to come back and provide more desperately needed relief, and more support for the recovery once the lockdown is over.