SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A patient is treated for the flu in Louisiana. Healthcare costs in the U.S. were found to be twice as high as those in ten other developed countries because of high prices across the healthcare industry--from doctor's salaries to prescription drugs. (Photo: Mario Villafuerte/Getty Images)

Pundits and politicians repeatedly warn us that the country cannot afford costly social services. They caution about the perils of a rising national debt, the supposed near bankruptcy of Medicare and Social Security, and the need to sell public services to the highest bidder in order to save them. We must tighten our belts sooner or later, they tell us, rather than spend on social goods like universal health care, free higher education and badly needed infrastructure.

To many Americans this sounds all too true because they are having an incredibly tough time making ends meet. According to the Federal Reserve, "Four in 10 adults in 2017 would either borrow, sell something, or not be able pay if faced with a $400 emergency expense." To those who are so highly stressed financially, the idea of paying for a costly program like Medicare for All sounds impossible.

"The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums."

We are the richest country in the history of the world, however, and certainly could afford vastly expanded and improved vital public services if we had the will. What stands in the way is runaway inequality. Our nation's wealth has been hijacked by the super-rich, with plenty of aid from their paid-for politicians.

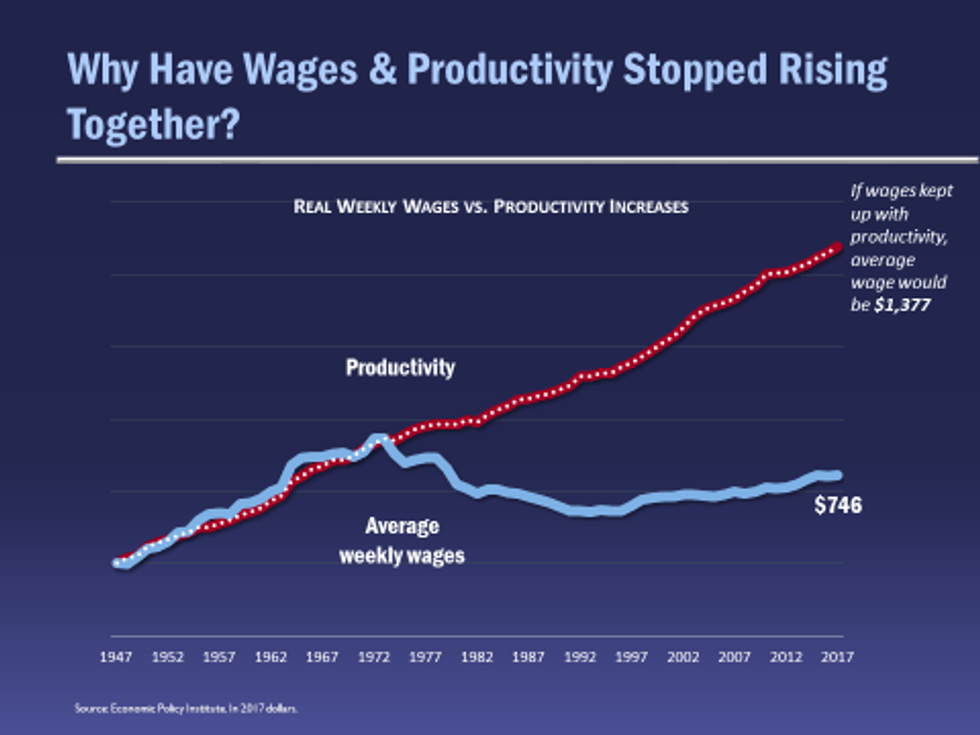

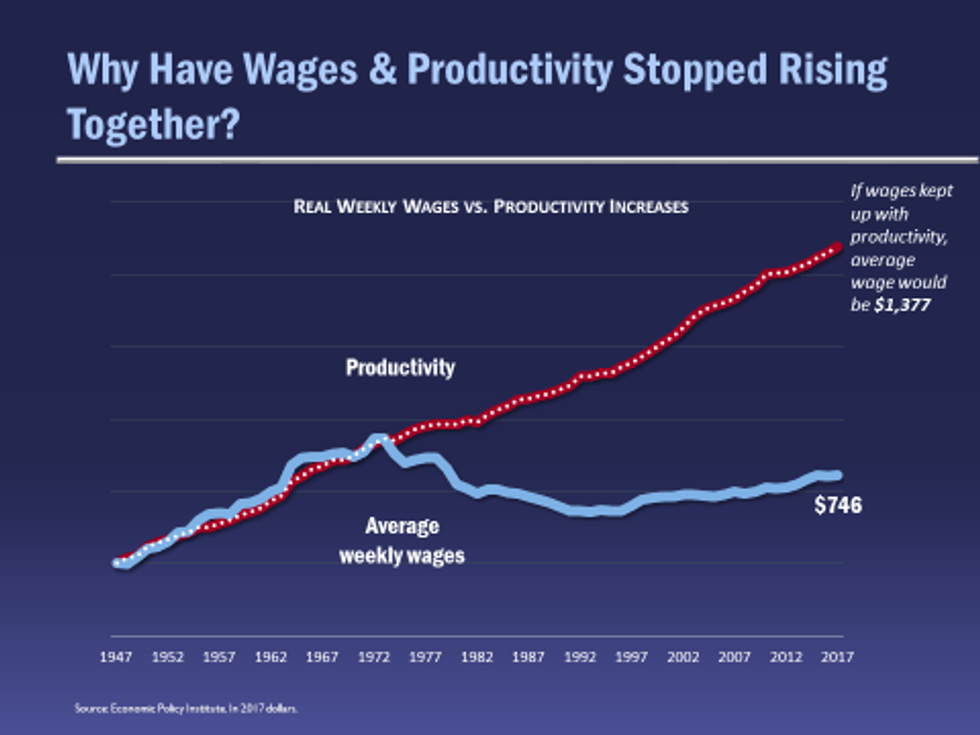

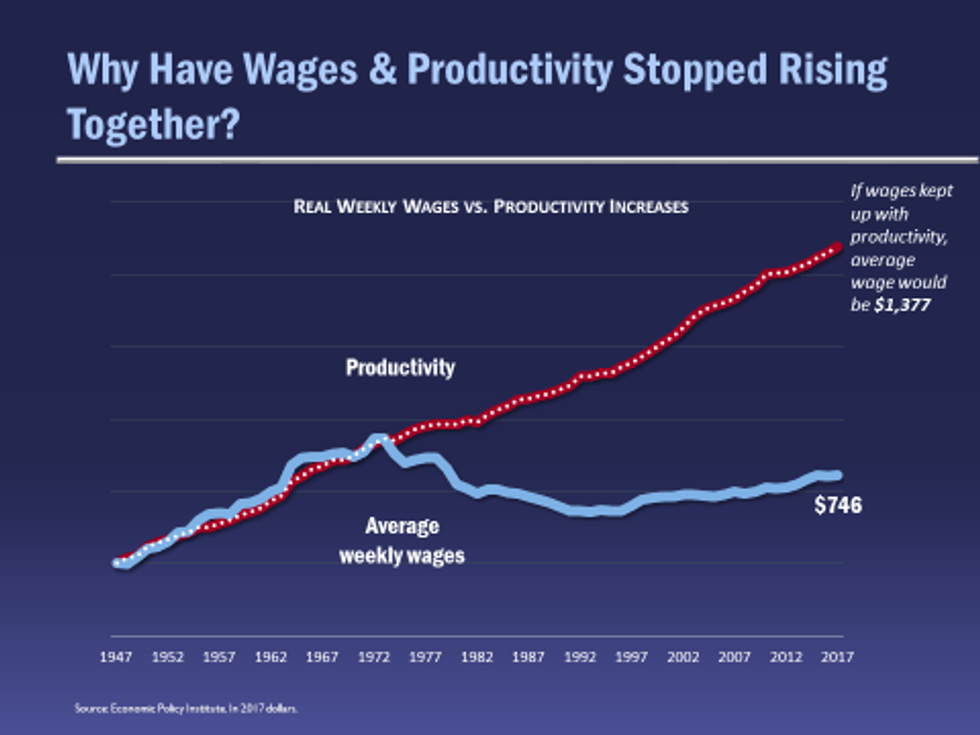

Over the past 40 years the top fraction of the top one percent have systematically denied working people the fruits of their enormous productivity. The results of this wage theft can be seen clearly in the chart below which tracks productivity (output per hour of labor) and average weekly wages (after accounting for inflation) of non-supervisory and production workers (about 85 percent of the workforce).

The red line shows the rise of American productivity since WWII. While not a perfect measurement of the power of our economy, it does capture our overall level of knowledge, technical skills, worker effort, management systems, and technology. Ever-rising productivity is the key to the wealth of nations.

As we can see clearly, the productivity trend has been ever upward. Today the average worker is nearly three times as productive per hour of labor as he or she was at the end of WWII. And the workforce is more than three times as large. That means we are a colossal economic powerhouse. But unless you are an economic elite, it doesn't feel that way.

To understand why we need to look at the blue line - average real worker wages. From WWII to the late 1970s or so, as productivity rose so did the average real wage of nearly all American workers. Year by year most working people saw their standard of living rise. For every one percent increase in productivity, about two-thirds went to labor, and the remaining one-third went to capital investment and profits.

After the late 1970s, however, the story changes dramatically. Real wages stall for more than 40 years, while productivity continues to climb. Had wages and productivity continued to rise in tandem, the average weekly earnings of the American worker would be almost double what it is today, rising from today's average of $746 per week to $1,377 per week.

What happened? Where did all the money go that once went to working people?

The fatalistic story sold to us by elite-funded think tanks is that the rise of international competition and the introduction of advanced technology crushed the wages of those without the highest skill levels. The typical worker, it is claimed, is now competing with cheap labor from around the world and hence sees his or her wages stall and even decline. And since there really isn't much anyone can do about globalization or automation, there's nothing we can do about the stalling wages. Such a convenient story to justify runaway inequality!

"So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top."

The real story is far more complex and troubling. Yes, globalization and automation contribute to stagnant wages. But as the International Labor Organization shows in their remarkable 2012 study, only about 30 percent of this wage stagnation can be attributed to technology and globalization. The main cause is the neo-liberal policy agenda of deregulation of finance, cuts in social spending and attacks on labor unions. And within that mix the biggest driver of wage stagnation can be attributed to financialization - the deregulation of Wall Street which permitted -- for the first time since the Great Depression -- the rapacious financial strip-mining of workers, students, families and communities. Put simply, the neo-liberal model ushered in by Thatcher and Reagan, and then intensified by Clinton and Blair, moved the wealth that once flowed to working people to financial and corporate elites. (For a more thorough account see Professor William Lazonick's "Profits without Prosperity." )

How much money are we losing?

More than we can imagine. Here's a back-of-the-envelope estimate for just the most recent year on the chart, 2017: The gap between the productivity wage and the current average wage is $631 per week. That is, if the average weekly wage continued to rise with productivity, it would be $631 higher than the current average wage. In 2017, there are 103 million of these workers. So the total amount of "lost" wages that flowed to economic elites is a whopping $3.4 trillion! (103 million x $631 x 52 weeks) And that's just for one year.

Here's how to pay for Medicare for All

Current estimates for a single payer system come in at about $3 trillion per year. Americans already are paying $1.9 trillion in payroll and income taxes that go to Medicare, Medicaid and other government health programs. So, we would need to raise another $1.1 trillion to provide universal healthcare and prescription drugs with no co-pays, no deductibles and no premiums.

In the name of fairness, that additional $1.1 trillion to pay for Medicare for All should be raised by taxing back a portion of the $3.4 trillion in wealth that has flowed to the super rich instead of to working people. After all, working people have not had a real wage increase in more than forty years as economic elites have siphoned away tens of trillions of dollars of income that once went to working people, (the gap between the two lines). Wouldn't it be more than fair to ask the superrich to pay the $1.1 trillion needed for Medicare for All?

There are numerous ways for these economic elites pay their fair share:

The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums.

Think about how much your income would go up if you didn't have to pay for healthcare at all. That would begin to close the gap between productivity and wages for the first time in a generation.

Wait! Shouldn't working people pay something for health care coverage?

We already are. We pay payroll taxes for Medicare and a portion of our regular taxes go to fund Medicaid and other public health programs for veterans, Native Americans and public health-related research and regulation.

So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top. Think about that big fat gap between productivity and real wages. Think about how runaway inequality has allowed the wealth of the richest nation in history to be hijacked by the super-rich.

It's time the American people got a real wage increase and Medicare for All would deliver just that.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

Pundits and politicians repeatedly warn us that the country cannot afford costly social services. They caution about the perils of a rising national debt, the supposed near bankruptcy of Medicare and Social Security, and the need to sell public services to the highest bidder in order to save them. We must tighten our belts sooner or later, they tell us, rather than spend on social goods like universal health care, free higher education and badly needed infrastructure.

To many Americans this sounds all too true because they are having an incredibly tough time making ends meet. According to the Federal Reserve, "Four in 10 adults in 2017 would either borrow, sell something, or not be able pay if faced with a $400 emergency expense." To those who are so highly stressed financially, the idea of paying for a costly program like Medicare for All sounds impossible.

"The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums."

We are the richest country in the history of the world, however, and certainly could afford vastly expanded and improved vital public services if we had the will. What stands in the way is runaway inequality. Our nation's wealth has been hijacked by the super-rich, with plenty of aid from their paid-for politicians.

Over the past 40 years the top fraction of the top one percent have systematically denied working people the fruits of their enormous productivity. The results of this wage theft can be seen clearly in the chart below which tracks productivity (output per hour of labor) and average weekly wages (after accounting for inflation) of non-supervisory and production workers (about 85 percent of the workforce).

The red line shows the rise of American productivity since WWII. While not a perfect measurement of the power of our economy, it does capture our overall level of knowledge, technical skills, worker effort, management systems, and technology. Ever-rising productivity is the key to the wealth of nations.

As we can see clearly, the productivity trend has been ever upward. Today the average worker is nearly three times as productive per hour of labor as he or she was at the end of WWII. And the workforce is more than three times as large. That means we are a colossal economic powerhouse. But unless you are an economic elite, it doesn't feel that way.

To understand why we need to look at the blue line - average real worker wages. From WWII to the late 1970s or so, as productivity rose so did the average real wage of nearly all American workers. Year by year most working people saw their standard of living rise. For every one percent increase in productivity, about two-thirds went to labor, and the remaining one-third went to capital investment and profits.

After the late 1970s, however, the story changes dramatically. Real wages stall for more than 40 years, while productivity continues to climb. Had wages and productivity continued to rise in tandem, the average weekly earnings of the American worker would be almost double what it is today, rising from today's average of $746 per week to $1,377 per week.

What happened? Where did all the money go that once went to working people?

The fatalistic story sold to us by elite-funded think tanks is that the rise of international competition and the introduction of advanced technology crushed the wages of those without the highest skill levels. The typical worker, it is claimed, is now competing with cheap labor from around the world and hence sees his or her wages stall and even decline. And since there really isn't much anyone can do about globalization or automation, there's nothing we can do about the stalling wages. Such a convenient story to justify runaway inequality!

"So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top."

The real story is far more complex and troubling. Yes, globalization and automation contribute to stagnant wages. But as the International Labor Organization shows in their remarkable 2012 study, only about 30 percent of this wage stagnation can be attributed to technology and globalization. The main cause is the neo-liberal policy agenda of deregulation of finance, cuts in social spending and attacks on labor unions. And within that mix the biggest driver of wage stagnation can be attributed to financialization - the deregulation of Wall Street which permitted -- for the first time since the Great Depression -- the rapacious financial strip-mining of workers, students, families and communities. Put simply, the neo-liberal model ushered in by Thatcher and Reagan, and then intensified by Clinton and Blair, moved the wealth that once flowed to working people to financial and corporate elites. (For a more thorough account see Professor William Lazonick's "Profits without Prosperity." )

How much money are we losing?

More than we can imagine. Here's a back-of-the-envelope estimate for just the most recent year on the chart, 2017: The gap between the productivity wage and the current average wage is $631 per week. That is, if the average weekly wage continued to rise with productivity, it would be $631 higher than the current average wage. In 2017, there are 103 million of these workers. So the total amount of "lost" wages that flowed to economic elites is a whopping $3.4 trillion! (103 million x $631 x 52 weeks) And that's just for one year.

Here's how to pay for Medicare for All

Current estimates for a single payer system come in at about $3 trillion per year. Americans already are paying $1.9 trillion in payroll and income taxes that go to Medicare, Medicaid and other government health programs. So, we would need to raise another $1.1 trillion to provide universal healthcare and prescription drugs with no co-pays, no deductibles and no premiums.

In the name of fairness, that additional $1.1 trillion to pay for Medicare for All should be raised by taxing back a portion of the $3.4 trillion in wealth that has flowed to the super rich instead of to working people. After all, working people have not had a real wage increase in more than forty years as economic elites have siphoned away tens of trillions of dollars of income that once went to working people, (the gap between the two lines). Wouldn't it be more than fair to ask the superrich to pay the $1.1 trillion needed for Medicare for All?

There are numerous ways for these economic elites pay their fair share:

The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums.

Think about how much your income would go up if you didn't have to pay for healthcare at all. That would begin to close the gap between productivity and wages for the first time in a generation.

Wait! Shouldn't working people pay something for health care coverage?

We already are. We pay payroll taxes for Medicare and a portion of our regular taxes go to fund Medicaid and other public health programs for veterans, Native Americans and public health-related research and regulation.

So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top. Think about that big fat gap between productivity and real wages. Think about how runaway inequality has allowed the wealth of the richest nation in history to be hijacked by the super-rich.

It's time the American people got a real wage increase and Medicare for All would deliver just that.

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

Pundits and politicians repeatedly warn us that the country cannot afford costly social services. They caution about the perils of a rising national debt, the supposed near bankruptcy of Medicare and Social Security, and the need to sell public services to the highest bidder in order to save them. We must tighten our belts sooner or later, they tell us, rather than spend on social goods like universal health care, free higher education and badly needed infrastructure.

To many Americans this sounds all too true because they are having an incredibly tough time making ends meet. According to the Federal Reserve, "Four in 10 adults in 2017 would either borrow, sell something, or not be able pay if faced with a $400 emergency expense." To those who are so highly stressed financially, the idea of paying for a costly program like Medicare for All sounds impossible.

"The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums."

We are the richest country in the history of the world, however, and certainly could afford vastly expanded and improved vital public services if we had the will. What stands in the way is runaway inequality. Our nation's wealth has been hijacked by the super-rich, with plenty of aid from their paid-for politicians.

Over the past 40 years the top fraction of the top one percent have systematically denied working people the fruits of their enormous productivity. The results of this wage theft can be seen clearly in the chart below which tracks productivity (output per hour of labor) and average weekly wages (after accounting for inflation) of non-supervisory and production workers (about 85 percent of the workforce).

The red line shows the rise of American productivity since WWII. While not a perfect measurement of the power of our economy, it does capture our overall level of knowledge, technical skills, worker effort, management systems, and technology. Ever-rising productivity is the key to the wealth of nations.

As we can see clearly, the productivity trend has been ever upward. Today the average worker is nearly three times as productive per hour of labor as he or she was at the end of WWII. And the workforce is more than three times as large. That means we are a colossal economic powerhouse. But unless you are an economic elite, it doesn't feel that way.

To understand why we need to look at the blue line - average real worker wages. From WWII to the late 1970s or so, as productivity rose so did the average real wage of nearly all American workers. Year by year most working people saw their standard of living rise. For every one percent increase in productivity, about two-thirds went to labor, and the remaining one-third went to capital investment and profits.

After the late 1970s, however, the story changes dramatically. Real wages stall for more than 40 years, while productivity continues to climb. Had wages and productivity continued to rise in tandem, the average weekly earnings of the American worker would be almost double what it is today, rising from today's average of $746 per week to $1,377 per week.

What happened? Where did all the money go that once went to working people?

The fatalistic story sold to us by elite-funded think tanks is that the rise of international competition and the introduction of advanced technology crushed the wages of those without the highest skill levels. The typical worker, it is claimed, is now competing with cheap labor from around the world and hence sees his or her wages stall and even decline. And since there really isn't much anyone can do about globalization or automation, there's nothing we can do about the stalling wages. Such a convenient story to justify runaway inequality!

"So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top."

The real story is far more complex and troubling. Yes, globalization and automation contribute to stagnant wages. But as the International Labor Organization shows in their remarkable 2012 study, only about 30 percent of this wage stagnation can be attributed to technology and globalization. The main cause is the neo-liberal policy agenda of deregulation of finance, cuts in social spending and attacks on labor unions. And within that mix the biggest driver of wage stagnation can be attributed to financialization - the deregulation of Wall Street which permitted -- for the first time since the Great Depression -- the rapacious financial strip-mining of workers, students, families and communities. Put simply, the neo-liberal model ushered in by Thatcher and Reagan, and then intensified by Clinton and Blair, moved the wealth that once flowed to working people to financial and corporate elites. (For a more thorough account see Professor William Lazonick's "Profits without Prosperity." )

How much money are we losing?

More than we can imagine. Here's a back-of-the-envelope estimate for just the most recent year on the chart, 2017: The gap between the productivity wage and the current average wage is $631 per week. That is, if the average weekly wage continued to rise with productivity, it would be $631 higher than the current average wage. In 2017, there are 103 million of these workers. So the total amount of "lost" wages that flowed to economic elites is a whopping $3.4 trillion! (103 million x $631 x 52 weeks) And that's just for one year.

Here's how to pay for Medicare for All

Current estimates for a single payer system come in at about $3 trillion per year. Americans already are paying $1.9 trillion in payroll and income taxes that go to Medicare, Medicaid and other government health programs. So, we would need to raise another $1.1 trillion to provide universal healthcare and prescription drugs with no co-pays, no deductibles and no premiums.

In the name of fairness, that additional $1.1 trillion to pay for Medicare for All should be raised by taxing back a portion of the $3.4 trillion in wealth that has flowed to the super rich instead of to working people. After all, working people have not had a real wage increase in more than forty years as economic elites have siphoned away tens of trillions of dollars of income that once went to working people, (the gap between the two lines). Wouldn't it be more than fair to ask the superrich to pay the $1.1 trillion needed for Medicare for All?

There are numerous ways for these economic elites pay their fair share:

The point is to give Americans what they have been long denied - high quality universal healthcare AND a real wage increase by providing Medicare for All with no co-pays, no deductibles and no premiums.

Think about how much your income would go up if you didn't have to pay for healthcare at all. That would begin to close the gap between productivity and wages for the first time in a generation.

Wait! Shouldn't working people pay something for health care coverage?

We already are. We pay payroll taxes for Medicare and a portion of our regular taxes go to fund Medicaid and other public health programs for veterans, Native Americans and public health-related research and regulation.

So next time you hear someone say we can't afford a public good, that we need to tighten our belts and get used to austerity, think about all that wealth that has flowed to the very top. Think about that big fat gap between productivity and real wages. Think about how runaway inequality has allowed the wealth of the richest nation in history to be hijacked by the super-rich.

It's time the American people got a real wage increase and Medicare for All would deliver just that.