SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

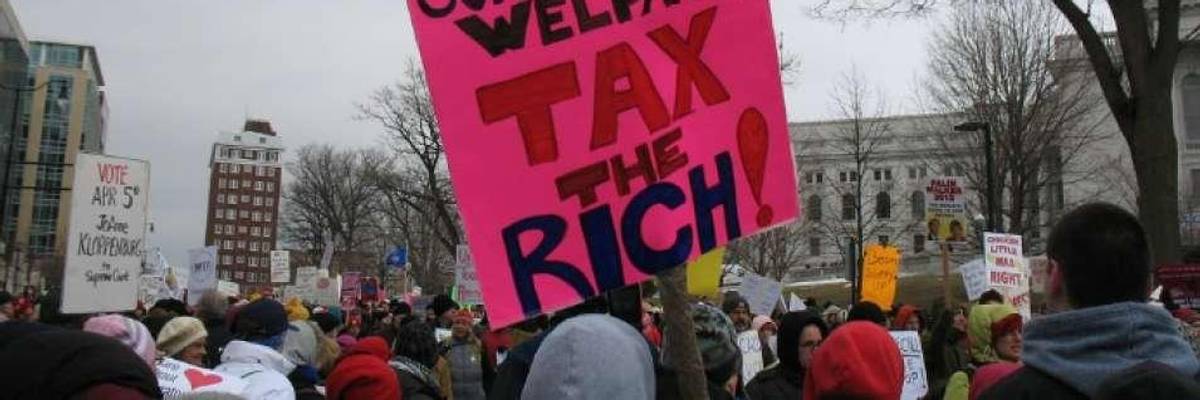

When looking at this enormous disparity in the U.S., it's clear that the ultra-wealthy are the beneficiaries of this system. (Photo: Yuri Keegstra/flickr/cc)

For all that some might grumble about paying our taxes when this time of year rolls around, we do it. And most of us do it not just because it's the law, but because we understand and agree with the one of the basic underlying concept behind taxes: We all pay some portion of what we have into a shared pool of resources. And that money goes to fund the services we all need, collectively, like water infrastructure, schools, and transportation.

For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

But this system, like much of our current democracy, is very broken right now. For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

As this tax season comes to a close, and as evidence grows of how the 2017 tax cuts passed by Congress were yet another step toward making the ultra-wealthy and corporations wealthier and more powerful, the call to fix the system is growing louder. But as politicians begin to heed this call, we must make sure they hold all entities responsible: the ultra wealthy and transnational corporations.

Abandoning the common good

It's becoming more and more clear how our current economic and political system is failing to provide, take care of, and manage the resources and services we all need. Our aging water infrastructure is in dire need of public reinvestment. Public schools struggle mightily around the country. And in most places in the U.S. public transportation is not equitable, in need of major reinvestment, or doesn't even exist.

Who bears the brunt of these failures? Well, certainly not super wealthy corporate and mostly white CEOs being driven in limos stocked with bottled water. Or celebrities and hedge fund managers bribing college coaches to get their children into Ivy League and other prestige-bestowing schools.

It's the mostly Black folks in Flint and Detroit whose water is poisoned or shut off who are experiencing these systemic failures to the greatest degree. It's people who rely on public transportation to get them to their hourly wage jobs--and who get docked pay or fired if they come in late because of a broken-down subway. It's low-income families who do the best they can by their kids in resource-starved public K-12 schools.

The source of the wealth divide

When looking at this enormous disparity in the U.S., it's clear that the ultra-wealthy are the beneficiaries of this system. But it's also important to follow this wealth disparity to the source: transnational corporations.

U.S.-based transnational corporations are generating--and protecting--enormous profits that are adding to the fortunes of the wealthy. One way they do so is by avoiding paying taxes. Less money paid into our common pool of resources means more money going into already wealthy shareholders' pockets.

From offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

So, from offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

And the 2017 tax cuts made that even easier.

Corporations, flush with cash from the new tax cuts, bought back stock--which often raises stock prices and enriches shareholders. Goldman Sachs analysts estimated corporations spent $1.3 trillion in buybacks in 2018, to the alarm of politicians across the political spectrum. The research group Just Capital estimated that for the 1000 corporations it tracks, 56 percent of their tax-cut related spending went to shareholders.

(As a point of comparison: the same corporations spent just 6 percent of their tax savings onworkers in the form of raises or one-time bonuses--mostly one-time bonuses--at an average of $225 per worker.)

Unleash the dams

Even though economists call the U.S. economy "healthy," only a tiny percentage of people are prospering. There is no rising tide lifting all boats. It's more like a river dammed up to create a small, deep, exclusive reservoir--while the rest of us are making do with a tiny trickle in a dried out riverbed.

That's why, as politicians like Rep. Alexandria Ocasio-Cortez and Sen. Elizabeth Warren are driving forward a call to tax the ultra-wealthy, they are seeing great interest in and support of their plans. Even a Fox News poll shows that 70 percent of voters in the U.S. favor taxing the wealthy.

But taxing the ultra-wealthy is only addressing half the solution. We must also apply the same scrutiny to corporations and enact policies that ensure corporations pay what they owe in taxes (not to mention what they owe in externalized costs). Sen. Warren's new proposal is a welcome policy proposal in that direction.

The argument against doing so is that the U.S. already has too high of a corporate tax rate, and if we actually make corporations pay their fair share, more of them will move their headquarters somewhere else with lenient tax laws, offshore their profits, and/or take jobs elsewhere.

But the truth is, without effective regulation and enforcement, transnational corporations will keep gaming the system, no matter what. Today, few corporations pay the actual tax rate, which is now at 21 percent, down from 35 thanks to the 2017 law.

In fact, this year, Amazon (the corporation owned by the richest man in the world today) filed for a $129 million refund.

That's why we need to take the system back. We need transformative, deep-seated changes where corporations do not get to write the rules and where people and our government hold them accountable.

This is the right time for this vision and demand for change. People across the political spectrum are outraged at our rigged system that is leaving them behind. To unrig the system we need to not only tax the ultra-wealthy. We also need to tax and hold accountable the driving force behind their wealth and our nation's overall income inequality: transnational corporations.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

For all that some might grumble about paying our taxes when this time of year rolls around, we do it. And most of us do it not just because it's the law, but because we understand and agree with the one of the basic underlying concept behind taxes: We all pay some portion of what we have into a shared pool of resources. And that money goes to fund the services we all need, collectively, like water infrastructure, schools, and transportation.

For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

But this system, like much of our current democracy, is very broken right now. For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

As this tax season comes to a close, and as evidence grows of how the 2017 tax cuts passed by Congress were yet another step toward making the ultra-wealthy and corporations wealthier and more powerful, the call to fix the system is growing louder. But as politicians begin to heed this call, we must make sure they hold all entities responsible: the ultra wealthy and transnational corporations.

Abandoning the common good

It's becoming more and more clear how our current economic and political system is failing to provide, take care of, and manage the resources and services we all need. Our aging water infrastructure is in dire need of public reinvestment. Public schools struggle mightily around the country. And in most places in the U.S. public transportation is not equitable, in need of major reinvestment, or doesn't even exist.

Who bears the brunt of these failures? Well, certainly not super wealthy corporate and mostly white CEOs being driven in limos stocked with bottled water. Or celebrities and hedge fund managers bribing college coaches to get their children into Ivy League and other prestige-bestowing schools.

It's the mostly Black folks in Flint and Detroit whose water is poisoned or shut off who are experiencing these systemic failures to the greatest degree. It's people who rely on public transportation to get them to their hourly wage jobs--and who get docked pay or fired if they come in late because of a broken-down subway. It's low-income families who do the best they can by their kids in resource-starved public K-12 schools.

The source of the wealth divide

When looking at this enormous disparity in the U.S., it's clear that the ultra-wealthy are the beneficiaries of this system. But it's also important to follow this wealth disparity to the source: transnational corporations.

U.S.-based transnational corporations are generating--and protecting--enormous profits that are adding to the fortunes of the wealthy. One way they do so is by avoiding paying taxes. Less money paid into our common pool of resources means more money going into already wealthy shareholders' pockets.

From offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

So, from offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

And the 2017 tax cuts made that even easier.

Corporations, flush with cash from the new tax cuts, bought back stock--which often raises stock prices and enriches shareholders. Goldman Sachs analysts estimated corporations spent $1.3 trillion in buybacks in 2018, to the alarm of politicians across the political spectrum. The research group Just Capital estimated that for the 1000 corporations it tracks, 56 percent of their tax-cut related spending went to shareholders.

(As a point of comparison: the same corporations spent just 6 percent of their tax savings onworkers in the form of raises or one-time bonuses--mostly one-time bonuses--at an average of $225 per worker.)

Unleash the dams

Even though economists call the U.S. economy "healthy," only a tiny percentage of people are prospering. There is no rising tide lifting all boats. It's more like a river dammed up to create a small, deep, exclusive reservoir--while the rest of us are making do with a tiny trickle in a dried out riverbed.

That's why, as politicians like Rep. Alexandria Ocasio-Cortez and Sen. Elizabeth Warren are driving forward a call to tax the ultra-wealthy, they are seeing great interest in and support of their plans. Even a Fox News poll shows that 70 percent of voters in the U.S. favor taxing the wealthy.

But taxing the ultra-wealthy is only addressing half the solution. We must also apply the same scrutiny to corporations and enact policies that ensure corporations pay what they owe in taxes (not to mention what they owe in externalized costs). Sen. Warren's new proposal is a welcome policy proposal in that direction.

The argument against doing so is that the U.S. already has too high of a corporate tax rate, and if we actually make corporations pay their fair share, more of them will move their headquarters somewhere else with lenient tax laws, offshore their profits, and/or take jobs elsewhere.

But the truth is, without effective regulation and enforcement, transnational corporations will keep gaming the system, no matter what. Today, few corporations pay the actual tax rate, which is now at 21 percent, down from 35 thanks to the 2017 law.

In fact, this year, Amazon (the corporation owned by the richest man in the world today) filed for a $129 million refund.

That's why we need to take the system back. We need transformative, deep-seated changes where corporations do not get to write the rules and where people and our government hold them accountable.

This is the right time for this vision and demand for change. People across the political spectrum are outraged at our rigged system that is leaving them behind. To unrig the system we need to not only tax the ultra-wealthy. We also need to tax and hold accountable the driving force behind their wealth and our nation's overall income inequality: transnational corporations.

For all that some might grumble about paying our taxes when this time of year rolls around, we do it. And most of us do it not just because it's the law, but because we understand and agree with the one of the basic underlying concept behind taxes: We all pay some portion of what we have into a shared pool of resources. And that money goes to fund the services we all need, collectively, like water infrastructure, schools, and transportation.

For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

But this system, like much of our current democracy, is very broken right now. For decades, corporations and the ultra-wealthy have been rigging it in their favor--creating vast income inequality and widening the economic racial divide.

As this tax season comes to a close, and as evidence grows of how the 2017 tax cuts passed by Congress were yet another step toward making the ultra-wealthy and corporations wealthier and more powerful, the call to fix the system is growing louder. But as politicians begin to heed this call, we must make sure they hold all entities responsible: the ultra wealthy and transnational corporations.

Abandoning the common good

It's becoming more and more clear how our current economic and political system is failing to provide, take care of, and manage the resources and services we all need. Our aging water infrastructure is in dire need of public reinvestment. Public schools struggle mightily around the country. And in most places in the U.S. public transportation is not equitable, in need of major reinvestment, or doesn't even exist.

Who bears the brunt of these failures? Well, certainly not super wealthy corporate and mostly white CEOs being driven in limos stocked with bottled water. Or celebrities and hedge fund managers bribing college coaches to get their children into Ivy League and other prestige-bestowing schools.

It's the mostly Black folks in Flint and Detroit whose water is poisoned or shut off who are experiencing these systemic failures to the greatest degree. It's people who rely on public transportation to get them to their hourly wage jobs--and who get docked pay or fired if they come in late because of a broken-down subway. It's low-income families who do the best they can by their kids in resource-starved public K-12 schools.

The source of the wealth divide

When looking at this enormous disparity in the U.S., it's clear that the ultra-wealthy are the beneficiaries of this system. But it's also important to follow this wealth disparity to the source: transnational corporations.

U.S.-based transnational corporations are generating--and protecting--enormous profits that are adding to the fortunes of the wealthy. One way they do so is by avoiding paying taxes. Less money paid into our common pool of resources means more money going into already wealthy shareholders' pockets.

From offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

So, from offshoring money to demanding subsidies and tax incentives from cities (think Amazon ), to exploiting loopholes in tax law to the fullest extent possible (think General Electric)--corporations have found every way possible to hold on to and grow their profits.

And the 2017 tax cuts made that even easier.

Corporations, flush with cash from the new tax cuts, bought back stock--which often raises stock prices and enriches shareholders. Goldman Sachs analysts estimated corporations spent $1.3 trillion in buybacks in 2018, to the alarm of politicians across the political spectrum. The research group Just Capital estimated that for the 1000 corporations it tracks, 56 percent of their tax-cut related spending went to shareholders.

(As a point of comparison: the same corporations spent just 6 percent of their tax savings onworkers in the form of raises or one-time bonuses--mostly one-time bonuses--at an average of $225 per worker.)

Unleash the dams

Even though economists call the U.S. economy "healthy," only a tiny percentage of people are prospering. There is no rising tide lifting all boats. It's more like a river dammed up to create a small, deep, exclusive reservoir--while the rest of us are making do with a tiny trickle in a dried out riverbed.

That's why, as politicians like Rep. Alexandria Ocasio-Cortez and Sen. Elizabeth Warren are driving forward a call to tax the ultra-wealthy, they are seeing great interest in and support of their plans. Even a Fox News poll shows that 70 percent of voters in the U.S. favor taxing the wealthy.

But taxing the ultra-wealthy is only addressing half the solution. We must also apply the same scrutiny to corporations and enact policies that ensure corporations pay what they owe in taxes (not to mention what they owe in externalized costs). Sen. Warren's new proposal is a welcome policy proposal in that direction.

The argument against doing so is that the U.S. already has too high of a corporate tax rate, and if we actually make corporations pay their fair share, more of them will move their headquarters somewhere else with lenient tax laws, offshore their profits, and/or take jobs elsewhere.

But the truth is, without effective regulation and enforcement, transnational corporations will keep gaming the system, no matter what. Today, few corporations pay the actual tax rate, which is now at 21 percent, down from 35 thanks to the 2017 law.

In fact, this year, Amazon (the corporation owned by the richest man in the world today) filed for a $129 million refund.

That's why we need to take the system back. We need transformative, deep-seated changes where corporations do not get to write the rules and where people and our government hold them accountable.

This is the right time for this vision and demand for change. People across the political spectrum are outraged at our rigged system that is leaving them behind. To unrig the system we need to not only tax the ultra-wealthy. We also need to tax and hold accountable the driving force behind their wealth and our nation's overall income inequality: transnational corporations.