How Canada's Harper Helped Push World Toward Austerity

In June 2010, the transformation of the city's downtown core into a pseudo war zone seemed like the worst aspect of the Harper government's handling of the G20 summit in Toronto.

In June 2010, the transformation of the city's downtown core into a pseudo war zone seemed like the worst aspect of the Harper government's handling of the G20 summit in Toronto.

But perhaps just as insidious was Stephen Harper's personal role at that summit in pushing the developed world to abandon stimulus spending and veer sharply toward austerity.

That embrace of austerity has led to deep government spending cuts, with devastating consequences, particularly in some southern European nations. Canadians have suffered, too.

Harper likes to boast that he's shepherded the Canadian economy to a full recovery from the 2008 crash -- even though 1.4 million Canadians remain unemployed. Our employment rate is stuck at 61.9 per cent, down from 63.8 per cent just before the crash, notes Jim Stanford, economist for the Canadian Auto Workers.

This explains Canada's poor ranking in a recent OECD Employment Outlook report, where Canada ranks 20th out of 34 nations.

Similarly, Canada's Parliamentary Budget Office estimated last fall that Ottawa's spending reductions will cost Canada approximately 125,000 jobs in 2016 . (Reports like that angered the Harper government, which last spring ended Parliamentary Budget Officer Kevin Page's impressive stint in the watchdog job.)

The embrace of austerity at the 2010 Toronto summit was a dramatic reversal of the stimulus spending that the world's rich nations had quite effectively adopted to counter the devastating 2008 financial crash -- in line with the lessons taught by the great 20th century British economist John Maynard Keynes.

Keynes argued that, when businesses are unwilling to invest during a major downturn, the only solution is for governments to invest, and on a massive scale. This insight sharply contradicted the dogma of austerity that prevailed after the 1929 crash, prolonging the 1930s Depression. Although fiercely resisted, Keynes' insight was eventually accepted.

But right-wing economists, including Stephen Harper, have long bristled at Keynesianism -- with its important role for government -- and opposed its revival after the 2008 crash. (The minority Harper government only introduced a stimulus package in Canada because the opposition threatened to topple it otherwise.)

By early 2010, Keynesianism was losing ground on the international scene. But it was the G20 summit in Toronto later that year which "above all" resulted in the world's rich nations changing course and embracing austerity, according to a recent article by British financial journalist Martin Wolf in the New York Review of Books.

Harper played a key role in that lamentable change of direction. At his urging, the G20 nations agreed to commit themselves to halve their deficits by 2013 -- a draconian approach that returned the developed world to obsessing about deficits and ignoring unemployment.

(Ironically, the high unemployment produced by austerity reduces tax revenues and increases social spending, making deficit-reduction difficult. Much to its embarrassment, the Harper government has had to revise its deficit estimates upward. So far this year, Canada's deficit is rising, not falling.)

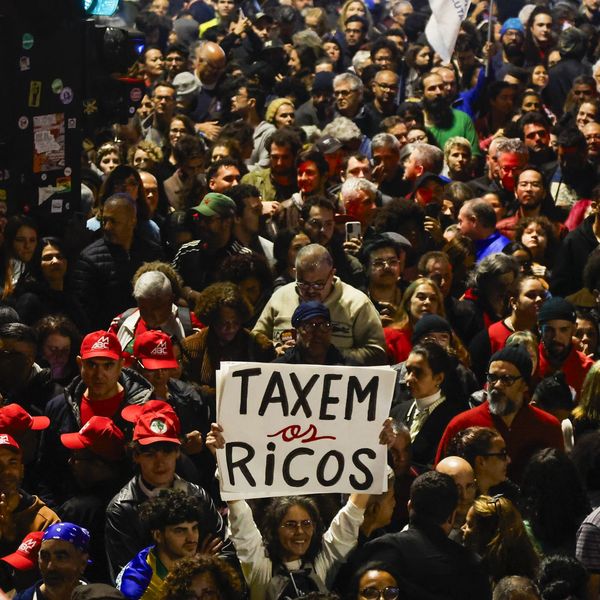

But the fixation on deficits, which has dominated public discourse for much of the last 30 years, has helped divert attention from the fact that austerity is part of a larger agenda (including tax cuts and privatization) that's redistributed money toward the top.

While members of the public are guilted into believing they're living beyond their means and must tighten their belts, they've been distracted from noticing the transfer of income and wealth to the rich.

Thaddeus Hwong, a professor of tax policy at York University, has calculated just how much inequality has increased in Canada.

Using the model developed by University of California professor Emmanel Saez, one of the world's leading experts in income inequality, Hwong found that between 1982 and 2010, the top-earning 1 per cent of Canadians captured fully 60.3 per cent of all the income growth in Canada.

That was even more dramatic than the U.S., where the top 1 per cent captured 59.6 per cent of income growth in the same period. This highlights that, while inequality is more extreme in the U.S., it is growing faster in Canada.

But with all those deficits to obsess about, who's noticing the rich, slightly offstage, quietly getting richer.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In June 2010, the transformation of the city's downtown core into a pseudo war zone seemed like the worst aspect of the Harper government's handling of the G20 summit in Toronto.

But perhaps just as insidious was Stephen Harper's personal role at that summit in pushing the developed world to abandon stimulus spending and veer sharply toward austerity.

That embrace of austerity has led to deep government spending cuts, with devastating consequences, particularly in some southern European nations. Canadians have suffered, too.

Harper likes to boast that he's shepherded the Canadian economy to a full recovery from the 2008 crash -- even though 1.4 million Canadians remain unemployed. Our employment rate is stuck at 61.9 per cent, down from 63.8 per cent just before the crash, notes Jim Stanford, economist for the Canadian Auto Workers.

This explains Canada's poor ranking in a recent OECD Employment Outlook report, where Canada ranks 20th out of 34 nations.

Similarly, Canada's Parliamentary Budget Office estimated last fall that Ottawa's spending reductions will cost Canada approximately 125,000 jobs in 2016 . (Reports like that angered the Harper government, which last spring ended Parliamentary Budget Officer Kevin Page's impressive stint in the watchdog job.)

The embrace of austerity at the 2010 Toronto summit was a dramatic reversal of the stimulus spending that the world's rich nations had quite effectively adopted to counter the devastating 2008 financial crash -- in line with the lessons taught by the great 20th century British economist John Maynard Keynes.

Keynes argued that, when businesses are unwilling to invest during a major downturn, the only solution is for governments to invest, and on a massive scale. This insight sharply contradicted the dogma of austerity that prevailed after the 1929 crash, prolonging the 1930s Depression. Although fiercely resisted, Keynes' insight was eventually accepted.

But right-wing economists, including Stephen Harper, have long bristled at Keynesianism -- with its important role for government -- and opposed its revival after the 2008 crash. (The minority Harper government only introduced a stimulus package in Canada because the opposition threatened to topple it otherwise.)

By early 2010, Keynesianism was losing ground on the international scene. But it was the G20 summit in Toronto later that year which "above all" resulted in the world's rich nations changing course and embracing austerity, according to a recent article by British financial journalist Martin Wolf in the New York Review of Books.

Harper played a key role in that lamentable change of direction. At his urging, the G20 nations agreed to commit themselves to halve their deficits by 2013 -- a draconian approach that returned the developed world to obsessing about deficits and ignoring unemployment.

(Ironically, the high unemployment produced by austerity reduces tax revenues and increases social spending, making deficit-reduction difficult. Much to its embarrassment, the Harper government has had to revise its deficit estimates upward. So far this year, Canada's deficit is rising, not falling.)

But the fixation on deficits, which has dominated public discourse for much of the last 30 years, has helped divert attention from the fact that austerity is part of a larger agenda (including tax cuts and privatization) that's redistributed money toward the top.

While members of the public are guilted into believing they're living beyond their means and must tighten their belts, they've been distracted from noticing the transfer of income and wealth to the rich.

Thaddeus Hwong, a professor of tax policy at York University, has calculated just how much inequality has increased in Canada.

Using the model developed by University of California professor Emmanel Saez, one of the world's leading experts in income inequality, Hwong found that between 1982 and 2010, the top-earning 1 per cent of Canadians captured fully 60.3 per cent of all the income growth in Canada.

That was even more dramatic than the U.S., where the top 1 per cent captured 59.6 per cent of income growth in the same period. This highlights that, while inequality is more extreme in the U.S., it is growing faster in Canada.

But with all those deficits to obsess about, who's noticing the rich, slightly offstage, quietly getting richer.

In June 2010, the transformation of the city's downtown core into a pseudo war zone seemed like the worst aspect of the Harper government's handling of the G20 summit in Toronto.

But perhaps just as insidious was Stephen Harper's personal role at that summit in pushing the developed world to abandon stimulus spending and veer sharply toward austerity.

That embrace of austerity has led to deep government spending cuts, with devastating consequences, particularly in some southern European nations. Canadians have suffered, too.

Harper likes to boast that he's shepherded the Canadian economy to a full recovery from the 2008 crash -- even though 1.4 million Canadians remain unemployed. Our employment rate is stuck at 61.9 per cent, down from 63.8 per cent just before the crash, notes Jim Stanford, economist for the Canadian Auto Workers.

This explains Canada's poor ranking in a recent OECD Employment Outlook report, where Canada ranks 20th out of 34 nations.

Similarly, Canada's Parliamentary Budget Office estimated last fall that Ottawa's spending reductions will cost Canada approximately 125,000 jobs in 2016 . (Reports like that angered the Harper government, which last spring ended Parliamentary Budget Officer Kevin Page's impressive stint in the watchdog job.)

The embrace of austerity at the 2010 Toronto summit was a dramatic reversal of the stimulus spending that the world's rich nations had quite effectively adopted to counter the devastating 2008 financial crash -- in line with the lessons taught by the great 20th century British economist John Maynard Keynes.

Keynes argued that, when businesses are unwilling to invest during a major downturn, the only solution is for governments to invest, and on a massive scale. This insight sharply contradicted the dogma of austerity that prevailed after the 1929 crash, prolonging the 1930s Depression. Although fiercely resisted, Keynes' insight was eventually accepted.

But right-wing economists, including Stephen Harper, have long bristled at Keynesianism -- with its important role for government -- and opposed its revival after the 2008 crash. (The minority Harper government only introduced a stimulus package in Canada because the opposition threatened to topple it otherwise.)

By early 2010, Keynesianism was losing ground on the international scene. But it was the G20 summit in Toronto later that year which "above all" resulted in the world's rich nations changing course and embracing austerity, according to a recent article by British financial journalist Martin Wolf in the New York Review of Books.

Harper played a key role in that lamentable change of direction. At his urging, the G20 nations agreed to commit themselves to halve their deficits by 2013 -- a draconian approach that returned the developed world to obsessing about deficits and ignoring unemployment.

(Ironically, the high unemployment produced by austerity reduces tax revenues and increases social spending, making deficit-reduction difficult. Much to its embarrassment, the Harper government has had to revise its deficit estimates upward. So far this year, Canada's deficit is rising, not falling.)

But the fixation on deficits, which has dominated public discourse for much of the last 30 years, has helped divert attention from the fact that austerity is part of a larger agenda (including tax cuts and privatization) that's redistributed money toward the top.

While members of the public are guilted into believing they're living beyond their means and must tighten their belts, they've been distracted from noticing the transfer of income and wealth to the rich.

Thaddeus Hwong, a professor of tax policy at York University, has calculated just how much inequality has increased in Canada.

Using the model developed by University of California professor Emmanel Saez, one of the world's leading experts in income inequality, Hwong found that between 1982 and 2010, the top-earning 1 per cent of Canadians captured fully 60.3 per cent of all the income growth in Canada.

That was even more dramatic than the U.S., where the top 1 per cent captured 59.6 per cent of income growth in the same period. This highlights that, while inequality is more extreme in the U.S., it is growing faster in Canada.

But with all those deficits to obsess about, who's noticing the rich, slightly offstage, quietly getting richer.