SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

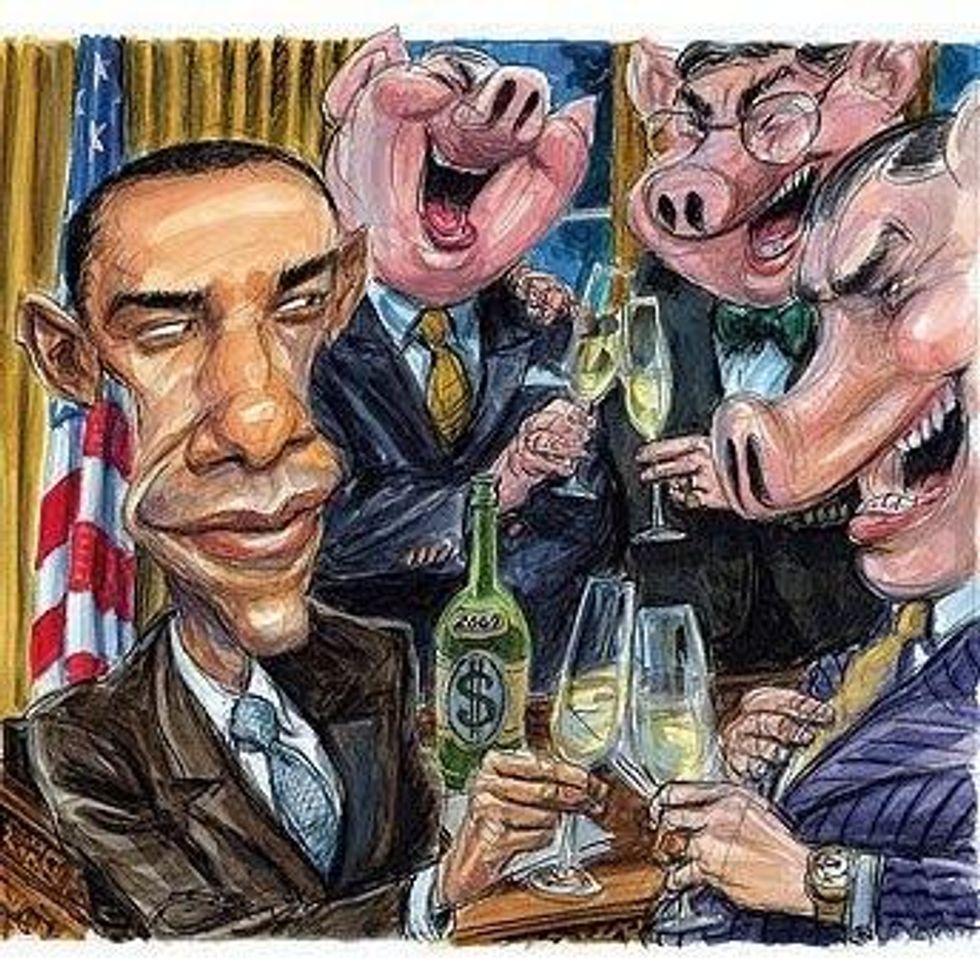

Wall Street is a beast.

And proud of it! In fact, a pair of animals are the stock market's longtime symbols: One is a snorting bull, representing surging stock prices; the other is a bear, representing a down market devouring stock value.

Wall Street is a beast.

And proud of it! In fact, a pair of animals are the stock market's longtime symbols: One is a snorting bull, representing surging stock prices; the other is a bear, representing a down market devouring stock value.

But I recently received a letter from a creative fellow named Charles saying that we need a third animal to depict the true nature of the Wall Street beast: a hog. Not just a little piggy, writes Charles -- but a HOG, a really big one.

Yes! And we could name it "Jamie." Jamie Dimon -- I mean the multimillionaire, silver-haired, golden-tongued CEO of JPMorgan Chase, America's biggest bank.

For years, Dimon has wallowed in the warm glow of America's financial, political and media limelight, hailed as a paragon of sound management and banker ethics. He's been publicly lauded by President Obama, celebrated by The New York Times and courted by leaders of both parties.

But, suddenly last summer, a big "oink" erupted from Chase, and Jamie's inner hoggishness was revealed. It started when one of Chase's investment arms went awry and lost $2 billion. At first, Dimon haughtily dismissed this as "a tempest in a teapot." But the loss of investors' money soon grew to a staggering $6 billion dollars. Criminal probes began, investors squirmed, media coverage grew testy, and then came the revelation that took all the glitter off of Dimon.

On March 14, a U.S. Senate committee issued a scathing 300-page report documenting that the loss was not a mere "trade blunder" by Chase underlings, but the product of a systemic corporate culture of recklessness, greed and deception. An internal email from Jamie himself, with the words "I approve," traced the stench all the way to the top. Not only did Dimon know what was going on, he enabled it.

JPMorgan's mess stems from the same dangerous combo that rocked America's financial system in 2007 and crashed our economy: ethical rot in executive suites, sycophantic politicians and reporters and willfully blind regulators. Meanwhile, Jamie is still Boss Hog at the giant bank and still drawing millions of dollars in annual pay and perks.

Also, only one week after the Senate report came out, he was even given a media award for best 2012 performance by a CEO facing a corporate crisis. E-I-E-I-O!

For a better performance on containing banker narcissism, our lawmakers might look to Europe. I know that it's considered un-American to like anything those "namby-pamby" European nations do, but still: Let's hear it for the Swiss!

In a March 3 referendum, the mild-mannered, pacifist-minded Swiss people rose up and hammered their corporate executives who've been grabbing rip-off pay packages, despite having made massive financial messes.

Two-thirds of voters emphatically shouted "yes" to a maverick ballot proposal requiring that shareholders be given the binding say on executive pay. Violators of the new rules would sacrifice up to six years of salary and face three years in jail. That's hardly namby-pamby.

Indeed, America's lawmakers and regulators are the ones who've been squishy-soft on banksterism. Jamie is not the only one being coddled -- none of the Wall Street titans whose greed wrecked our economy have even been pursued by the law, much less put in jail.

It's no surprise, then, that those bankers have gone right back to scamming -- and gleefully enriching themselves. Hardly a week goes by without another revelation of big-bank fraud, yet the banks simply pay an inconsequential fine and the culprits skate free.

Forget about too-big-to-fail, banks have become "too big to jail." Our nation's top prosecutor, Attorney General Eric Holder, recently conceded that finagling financial giants are being given a pass: "It does become difficult for us to prosecute them," he told a Senate subcommittee, "when we are hit with indications that if we do prosecute -- if we do bring a criminal charge -- it will have a negative impact on the national economy."

Meanwhile, just four giants -- Bank of America, Goldman Sachs, Morgan Stanley and Wells Fargo -- put nearly $20 million into last year's elections, mostly to back Republicans promising to weaken the few feeble restraints we now have on banker thievery. With such Keystone Kops overseeing them, why would any Wall Streeter even think of going straight? Nothing will change until officials gut it up, go after lawless bankers and bust up the banks that are too big to exist.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Wall Street is a beast.

And proud of it! In fact, a pair of animals are the stock market's longtime symbols: One is a snorting bull, representing surging stock prices; the other is a bear, representing a down market devouring stock value.

But I recently received a letter from a creative fellow named Charles saying that we need a third animal to depict the true nature of the Wall Street beast: a hog. Not just a little piggy, writes Charles -- but a HOG, a really big one.

Yes! And we could name it "Jamie." Jamie Dimon -- I mean the multimillionaire, silver-haired, golden-tongued CEO of JPMorgan Chase, America's biggest bank.

For years, Dimon has wallowed in the warm glow of America's financial, political and media limelight, hailed as a paragon of sound management and banker ethics. He's been publicly lauded by President Obama, celebrated by The New York Times and courted by leaders of both parties.

But, suddenly last summer, a big "oink" erupted from Chase, and Jamie's inner hoggishness was revealed. It started when one of Chase's investment arms went awry and lost $2 billion. At first, Dimon haughtily dismissed this as "a tempest in a teapot." But the loss of investors' money soon grew to a staggering $6 billion dollars. Criminal probes began, investors squirmed, media coverage grew testy, and then came the revelation that took all the glitter off of Dimon.

On March 14, a U.S. Senate committee issued a scathing 300-page report documenting that the loss was not a mere "trade blunder" by Chase underlings, but the product of a systemic corporate culture of recklessness, greed and deception. An internal email from Jamie himself, with the words "I approve," traced the stench all the way to the top. Not only did Dimon know what was going on, he enabled it.

JPMorgan's mess stems from the same dangerous combo that rocked America's financial system in 2007 and crashed our economy: ethical rot in executive suites, sycophantic politicians and reporters and willfully blind regulators. Meanwhile, Jamie is still Boss Hog at the giant bank and still drawing millions of dollars in annual pay and perks.

Also, only one week after the Senate report came out, he was even given a media award for best 2012 performance by a CEO facing a corporate crisis. E-I-E-I-O!

For a better performance on containing banker narcissism, our lawmakers might look to Europe. I know that it's considered un-American to like anything those "namby-pamby" European nations do, but still: Let's hear it for the Swiss!

In a March 3 referendum, the mild-mannered, pacifist-minded Swiss people rose up and hammered their corporate executives who've been grabbing rip-off pay packages, despite having made massive financial messes.

Two-thirds of voters emphatically shouted "yes" to a maverick ballot proposal requiring that shareholders be given the binding say on executive pay. Violators of the new rules would sacrifice up to six years of salary and face three years in jail. That's hardly namby-pamby.

Indeed, America's lawmakers and regulators are the ones who've been squishy-soft on banksterism. Jamie is not the only one being coddled -- none of the Wall Street titans whose greed wrecked our economy have even been pursued by the law, much less put in jail.

It's no surprise, then, that those bankers have gone right back to scamming -- and gleefully enriching themselves. Hardly a week goes by without another revelation of big-bank fraud, yet the banks simply pay an inconsequential fine and the culprits skate free.

Forget about too-big-to-fail, banks have become "too big to jail." Our nation's top prosecutor, Attorney General Eric Holder, recently conceded that finagling financial giants are being given a pass: "It does become difficult for us to prosecute them," he told a Senate subcommittee, "when we are hit with indications that if we do prosecute -- if we do bring a criminal charge -- it will have a negative impact on the national economy."

Meanwhile, just four giants -- Bank of America, Goldman Sachs, Morgan Stanley and Wells Fargo -- put nearly $20 million into last year's elections, mostly to back Republicans promising to weaken the few feeble restraints we now have on banker thievery. With such Keystone Kops overseeing them, why would any Wall Streeter even think of going straight? Nothing will change until officials gut it up, go after lawless bankers and bust up the banks that are too big to exist.

Wall Street is a beast.

And proud of it! In fact, a pair of animals are the stock market's longtime symbols: One is a snorting bull, representing surging stock prices; the other is a bear, representing a down market devouring stock value.

But I recently received a letter from a creative fellow named Charles saying that we need a third animal to depict the true nature of the Wall Street beast: a hog. Not just a little piggy, writes Charles -- but a HOG, a really big one.

Yes! And we could name it "Jamie." Jamie Dimon -- I mean the multimillionaire, silver-haired, golden-tongued CEO of JPMorgan Chase, America's biggest bank.

For years, Dimon has wallowed in the warm glow of America's financial, political and media limelight, hailed as a paragon of sound management and banker ethics. He's been publicly lauded by President Obama, celebrated by The New York Times and courted by leaders of both parties.

But, suddenly last summer, a big "oink" erupted from Chase, and Jamie's inner hoggishness was revealed. It started when one of Chase's investment arms went awry and lost $2 billion. At first, Dimon haughtily dismissed this as "a tempest in a teapot." But the loss of investors' money soon grew to a staggering $6 billion dollars. Criminal probes began, investors squirmed, media coverage grew testy, and then came the revelation that took all the glitter off of Dimon.

On March 14, a U.S. Senate committee issued a scathing 300-page report documenting that the loss was not a mere "trade blunder" by Chase underlings, but the product of a systemic corporate culture of recklessness, greed and deception. An internal email from Jamie himself, with the words "I approve," traced the stench all the way to the top. Not only did Dimon know what was going on, he enabled it.

JPMorgan's mess stems from the same dangerous combo that rocked America's financial system in 2007 and crashed our economy: ethical rot in executive suites, sycophantic politicians and reporters and willfully blind regulators. Meanwhile, Jamie is still Boss Hog at the giant bank and still drawing millions of dollars in annual pay and perks.

Also, only one week after the Senate report came out, he was even given a media award for best 2012 performance by a CEO facing a corporate crisis. E-I-E-I-O!

For a better performance on containing banker narcissism, our lawmakers might look to Europe. I know that it's considered un-American to like anything those "namby-pamby" European nations do, but still: Let's hear it for the Swiss!

In a March 3 referendum, the mild-mannered, pacifist-minded Swiss people rose up and hammered their corporate executives who've been grabbing rip-off pay packages, despite having made massive financial messes.

Two-thirds of voters emphatically shouted "yes" to a maverick ballot proposal requiring that shareholders be given the binding say on executive pay. Violators of the new rules would sacrifice up to six years of salary and face three years in jail. That's hardly namby-pamby.

Indeed, America's lawmakers and regulators are the ones who've been squishy-soft on banksterism. Jamie is not the only one being coddled -- none of the Wall Street titans whose greed wrecked our economy have even been pursued by the law, much less put in jail.

It's no surprise, then, that those bankers have gone right back to scamming -- and gleefully enriching themselves. Hardly a week goes by without another revelation of big-bank fraud, yet the banks simply pay an inconsequential fine and the culprits skate free.

Forget about too-big-to-fail, banks have become "too big to jail." Our nation's top prosecutor, Attorney General Eric Holder, recently conceded that finagling financial giants are being given a pass: "It does become difficult for us to prosecute them," he told a Senate subcommittee, "when we are hit with indications that if we do prosecute -- if we do bring a criminal charge -- it will have a negative impact on the national economy."

Meanwhile, just four giants -- Bank of America, Goldman Sachs, Morgan Stanley and Wells Fargo -- put nearly $20 million into last year's elections, mostly to back Republicans promising to weaken the few feeble restraints we now have on banker thievery. With such Keystone Kops overseeing them, why would any Wall Streeter even think of going straight? Nothing will change until officials gut it up, go after lawless bankers and bust up the banks that are too big to exist.