May 23, 2012

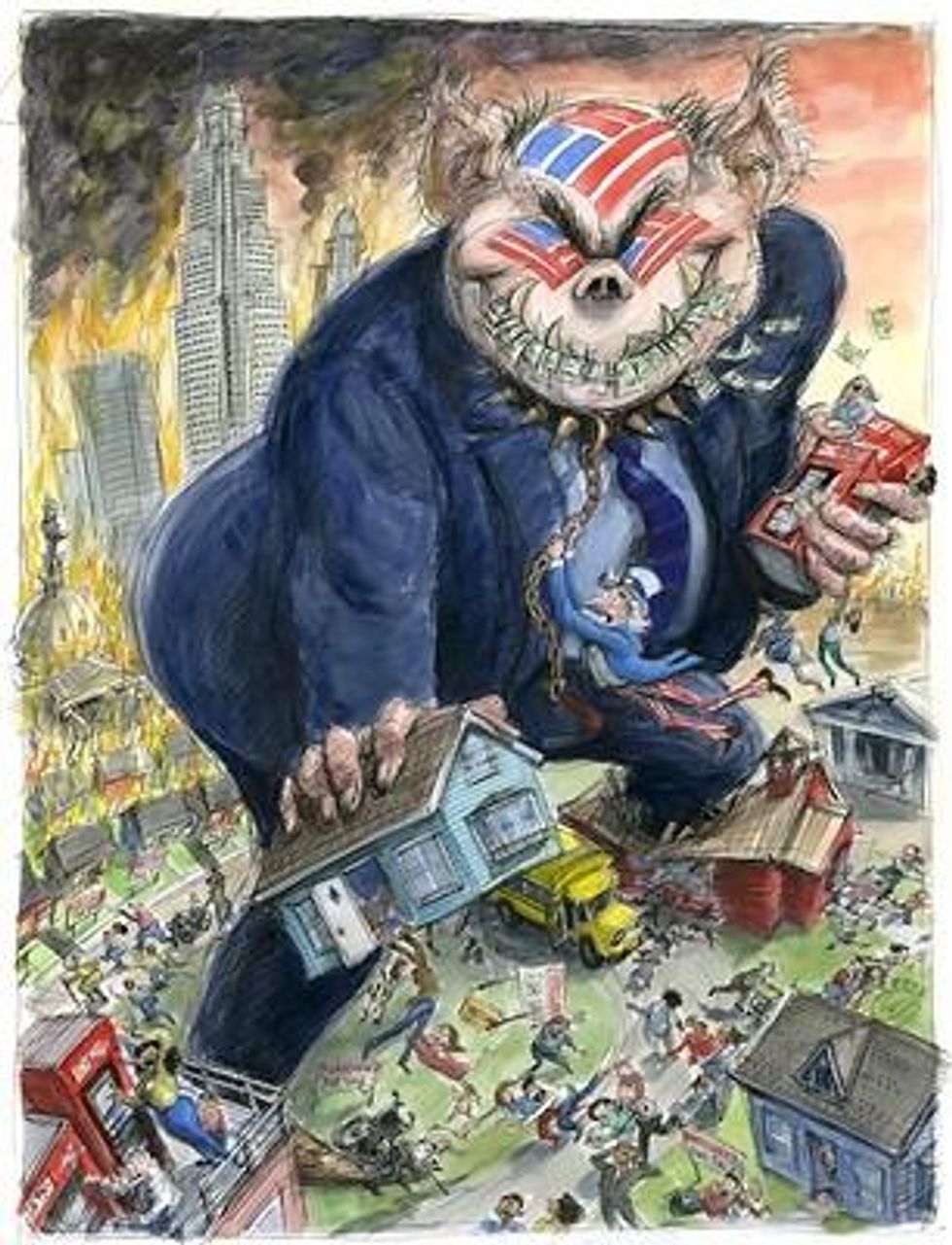

We're sick and tired of being bullied and stomped on by the Powers That Be in Washington, and by gollies, we're not going to take it anymore!

Hooray! It's about time that workers, consumers, small farmers and other "small fry" joined together in a populist rebellion to make big-shot Congress critters of both parties listen to us. But -- uh-oh -- wait a minute. These mad-as-hellers aren't wielding pitchforks and torches, but big bags of cash. Holy Thom Payne -- they're bankers!

Very few Americans on this side of the ATM machine think that the biggest problem in Washington is that the moneychangers don't have enough clout. But, incredibly, here they come with a super PAC intended to force lawmakers to bow even deeper to their needs.

"Congress isn't afraid of bankers," declared one of the bank honchos who organized the Friends of Traditional Banking super PAC. "They don't think we'll do anything to kick them out of office," he said, but that's exactly the plan.

In a dramatic and wholly destructive escalation of Big Money's assault on America's democracy, FTB's funders are not out to support candidates, but "to defeat our enemies." A Utah banker who chairs the new super PAC explains that giving $10,000 or so to the opponent of an incumbent who sides with the people has no impact, "but if you say the bankers are going to put ... $1 million into your opponent's campaign, that starts to draw some attention." He calls this a "surgical" approach to carving out political power. Yeah -- like doing surgery with a chainsaw and sledgehammer!

Thank you, Supreme Court, for making this crass money play possible with your plutocratic Citizens United decision. Now that bankers are going to intimidate officeholders with the threat to put unlimited campaign cash against them, we can expect Big Oil, Big Pharma and all the other Bigs to join the fun.

But bankers don't throw their weight around only in terms of campaign contributions. Indeed, Woody Guthrie wrote a song titled "Jolly Banker," a perfect-pitch parody of the propensity of Depression-era bankers to feel good about gouging their small borrowers.

Woody's song could also apply to the gouging we're getting from today's national chain banks (the very ones that have a super PAC), except the song's title should be "Snarling Banker." Only a couple of years ago, Bank of America, Citigroup, Wells Fargo and others were quite jolly, because they were piling up mountains of profits through such sneaky schemes as secretly enrolling customers in checking accounts that charged $35-a-pop for every overdrawn check, then rigging the flow of checks so unwitting customers would be overdrawn.

Public outrage exploded, especially because only a year earlier, We the People had bailed out these same banks. Thus, Congress shut down some of the worst gouges. This pinched bankers' exorbitant profits a bit, and they've been snarling ever since. "Banks aren't charities," they barked -- apparently thinking that someone might've mistaken them as such.

One thing you can count on is that banker greed is bottomless, and it's now coming back with a vengeance. Of course, they could make money honestly (as community banks and credit unions do) by making good loans and delivering good service, but instead they're returning to what they call "creative banking." You would call it "fee gouging."

Wells Fargo now hits you for $15 a month just to have a checking account, unless you keep at least $7,500 in your account. Citibank charges $20 a month, unless you keep $15,000 on deposit -- more than double last year's level. Bank fees for money orders have doubled, and fees for cashier's checks have quadrupled.

There is a way out of this endless abuse-the-customer game: Move your money out of their vaults! For help, go to www.MoveYourMoneyProject.org.

Why Your Ongoing Support Is Essential

Donald Trump’s attacks on democracy, justice, and a free press are escalating — putting everything we stand for at risk. We believe a better world is possible, but we can’t get there without your support. Common Dreams stands apart. We answer only to you — our readers, activists, and changemakers — not to billionaires or corporations. Our independence allows us to cover the vital stories that others won’t, spotlighting movements for peace, equality, and human rights. Right now, our work faces unprecedented challenges. Misinformation is spreading, journalists are under attack, and financial pressures are mounting. As a reader-supported, nonprofit newsroom, your support is crucial to keep this journalism alive. Whatever you can give — $10, $25, or $100 — helps us stay strong and responsive when the world needs us most. Together, we’ll continue to build the independent, courageous journalism our movement relies on. Thank you for being part of this community. |

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

Jim Hightower

Jim Hightower is a national radio commentator, writer, public speaker, and author of the books "Swim Against The Current: Even A Dead Fish Can Go With The Flow" (2008) and "There's Nothing in the Middle of the Road But Yellow Stripes and Dead Armadillos: A Work of Political Subversion" (1998). Hightower has spent three decades battling the Powers That Be on behalf of the Powers That Ought To Be - consumers, working families, environmentalists, small businesses, and just-plain-folks.

We're sick and tired of being bullied and stomped on by the Powers That Be in Washington, and by gollies, we're not going to take it anymore!

Hooray! It's about time that workers, consumers, small farmers and other "small fry" joined together in a populist rebellion to make big-shot Congress critters of both parties listen to us. But -- uh-oh -- wait a minute. These mad-as-hellers aren't wielding pitchforks and torches, but big bags of cash. Holy Thom Payne -- they're bankers!

Very few Americans on this side of the ATM machine think that the biggest problem in Washington is that the moneychangers don't have enough clout. But, incredibly, here they come with a super PAC intended to force lawmakers to bow even deeper to their needs.

"Congress isn't afraid of bankers," declared one of the bank honchos who organized the Friends of Traditional Banking super PAC. "They don't think we'll do anything to kick them out of office," he said, but that's exactly the plan.

In a dramatic and wholly destructive escalation of Big Money's assault on America's democracy, FTB's funders are not out to support candidates, but "to defeat our enemies." A Utah banker who chairs the new super PAC explains that giving $10,000 or so to the opponent of an incumbent who sides with the people has no impact, "but if you say the bankers are going to put ... $1 million into your opponent's campaign, that starts to draw some attention." He calls this a "surgical" approach to carving out political power. Yeah -- like doing surgery with a chainsaw and sledgehammer!

Thank you, Supreme Court, for making this crass money play possible with your plutocratic Citizens United decision. Now that bankers are going to intimidate officeholders with the threat to put unlimited campaign cash against them, we can expect Big Oil, Big Pharma and all the other Bigs to join the fun.

But bankers don't throw their weight around only in terms of campaign contributions. Indeed, Woody Guthrie wrote a song titled "Jolly Banker," a perfect-pitch parody of the propensity of Depression-era bankers to feel good about gouging their small borrowers.

Woody's song could also apply to the gouging we're getting from today's national chain banks (the very ones that have a super PAC), except the song's title should be "Snarling Banker." Only a couple of years ago, Bank of America, Citigroup, Wells Fargo and others were quite jolly, because they were piling up mountains of profits through such sneaky schemes as secretly enrolling customers in checking accounts that charged $35-a-pop for every overdrawn check, then rigging the flow of checks so unwitting customers would be overdrawn.

Public outrage exploded, especially because only a year earlier, We the People had bailed out these same banks. Thus, Congress shut down some of the worst gouges. This pinched bankers' exorbitant profits a bit, and they've been snarling ever since. "Banks aren't charities," they barked -- apparently thinking that someone might've mistaken them as such.

One thing you can count on is that banker greed is bottomless, and it's now coming back with a vengeance. Of course, they could make money honestly (as community banks and credit unions do) by making good loans and delivering good service, but instead they're returning to what they call "creative banking." You would call it "fee gouging."

Wells Fargo now hits you for $15 a month just to have a checking account, unless you keep at least $7,500 in your account. Citibank charges $20 a month, unless you keep $15,000 on deposit -- more than double last year's level. Bank fees for money orders have doubled, and fees for cashier's checks have quadrupled.

There is a way out of this endless abuse-the-customer game: Move your money out of their vaults! For help, go to www.MoveYourMoneyProject.org.

Jim Hightower

Jim Hightower is a national radio commentator, writer, public speaker, and author of the books "Swim Against The Current: Even A Dead Fish Can Go With The Flow" (2008) and "There's Nothing in the Middle of the Road But Yellow Stripes and Dead Armadillos: A Work of Political Subversion" (1998). Hightower has spent three decades battling the Powers That Be on behalf of the Powers That Ought To Be - consumers, working families, environmentalists, small businesses, and just-plain-folks.

We're sick and tired of being bullied and stomped on by the Powers That Be in Washington, and by gollies, we're not going to take it anymore!

Hooray! It's about time that workers, consumers, small farmers and other "small fry" joined together in a populist rebellion to make big-shot Congress critters of both parties listen to us. But -- uh-oh -- wait a minute. These mad-as-hellers aren't wielding pitchforks and torches, but big bags of cash. Holy Thom Payne -- they're bankers!

Very few Americans on this side of the ATM machine think that the biggest problem in Washington is that the moneychangers don't have enough clout. But, incredibly, here they come with a super PAC intended to force lawmakers to bow even deeper to their needs.

"Congress isn't afraid of bankers," declared one of the bank honchos who organized the Friends of Traditional Banking super PAC. "They don't think we'll do anything to kick them out of office," he said, but that's exactly the plan.

In a dramatic and wholly destructive escalation of Big Money's assault on America's democracy, FTB's funders are not out to support candidates, but "to defeat our enemies." A Utah banker who chairs the new super PAC explains that giving $10,000 or so to the opponent of an incumbent who sides with the people has no impact, "but if you say the bankers are going to put ... $1 million into your opponent's campaign, that starts to draw some attention." He calls this a "surgical" approach to carving out political power. Yeah -- like doing surgery with a chainsaw and sledgehammer!

Thank you, Supreme Court, for making this crass money play possible with your plutocratic Citizens United decision. Now that bankers are going to intimidate officeholders with the threat to put unlimited campaign cash against them, we can expect Big Oil, Big Pharma and all the other Bigs to join the fun.

But bankers don't throw their weight around only in terms of campaign contributions. Indeed, Woody Guthrie wrote a song titled "Jolly Banker," a perfect-pitch parody of the propensity of Depression-era bankers to feel good about gouging their small borrowers.

Woody's song could also apply to the gouging we're getting from today's national chain banks (the very ones that have a super PAC), except the song's title should be "Snarling Banker." Only a couple of years ago, Bank of America, Citigroup, Wells Fargo and others were quite jolly, because they were piling up mountains of profits through such sneaky schemes as secretly enrolling customers in checking accounts that charged $35-a-pop for every overdrawn check, then rigging the flow of checks so unwitting customers would be overdrawn.

Public outrage exploded, especially because only a year earlier, We the People had bailed out these same banks. Thus, Congress shut down some of the worst gouges. This pinched bankers' exorbitant profits a bit, and they've been snarling ever since. "Banks aren't charities," they barked -- apparently thinking that someone might've mistaken them as such.

One thing you can count on is that banker greed is bottomless, and it's now coming back with a vengeance. Of course, they could make money honestly (as community banks and credit unions do) by making good loans and delivering good service, but instead they're returning to what they call "creative banking." You would call it "fee gouging."

Wells Fargo now hits you for $15 a month just to have a checking account, unless you keep at least $7,500 in your account. Citibank charges $20 a month, unless you keep $15,000 on deposit -- more than double last year's level. Bank fees for money orders have doubled, and fees for cashier's checks have quadrupled.

There is a way out of this endless abuse-the-customer game: Move your money out of their vaults! For help, go to www.MoveYourMoneyProject.org.

We've had enough. The 1% own and operate the corporate media. They are doing everything they can to defend the status quo, squash dissent and protect the wealthy and the powerful. The Common Dreams media model is different. We cover the news that matters to the 99%. Our mission? To inform. To inspire. To ignite change for the common good. How? Nonprofit. Independent. Reader-supported. Free to read. Free to republish. Free to share. With no advertising. No paywalls. No selling of your data. Thousands of small donations fund our newsroom and allow us to continue publishing. Can you chip in? We can't do it without you. Thank you.