'As Expensive as It Is Cruel': CBO Says Trump-GOP Budget Law Will Explode Deficit by $4.1 Trillion

"It's a disgraceful law that forces working families to pay the price so the ultra-rich can profit," said Rep. Brendan Boyle.

The nonpartisan Congressional Budget Office on Monday said the Republican budget package that President Donald Trump signed into law last month will push up interest rates and add at least $4.1 trillion to the deficit over the next decade—largely due to the measure's massive tax cuts for the rich and large corporations.

According to the CBO, growing interest payments on the national debt will account for $718 billion of the estimated $4.1 trillion total deficit increase. Economist Josh Bivens has noted that it would cost the federal government $4.1 trillion to send a $12,000 check to every adult and child in the United States.

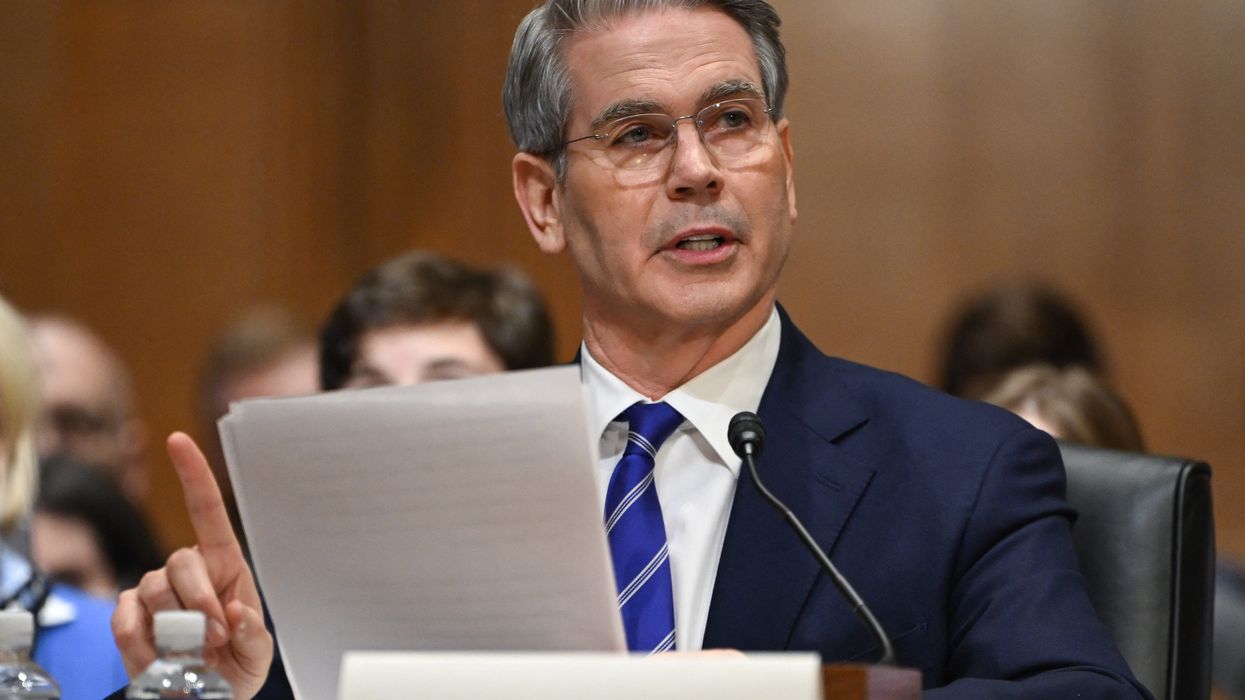

If temporary tax provisions of the highly regressive Trump-GOP law are made permanent, the estimated deficit impact would soar to nearly $5 trillion, CBO Director Phillip Swagel—a Republican—wrote in a letter to Sen. Jeff Merkley (D-Ore.) on Monday.

"Each and every analysis from the nonpartisan Congressional Budget Office continues to show the same result regardless of how you look at it: this bill explodes the debt by trillions of dollars to fund tax breaks for billionaires," Merkley, the top Democrat on the Senate Budget Committee, said in a statement. "Republicans can't spin the fact that this bill is bad policy that kicks more than 15 million people off of their health insurance, will force millions of kids to go hungry, and explodes the national debt by $5 trillion over the next 10 years—pushing the cost of this bill onto future generations to ensure billionaires can pay less in taxes."

"It is the height of hypocrisy coming from the party that claims to be fiscally responsible," Merkley added.

The deeply unpopular Republican law includes the largest cuts to Medicaid and federal nutrition assistance in U.S. history, alongside major handouts to profitable corporations—including oil and gas firms, pharmaceutical giants, and tech companies.

Zion Research Group estimates that 369 companies in the S&P 500 are set to reap a combined $148 billion in cash tax savings this year as a result of the Trump-GOP law, which extends tax breaks in Republicans' 2017 Tax Cuts and Jobs Act. Just four companies—Amazon, Meta, Alphabet, and Microsoft—are expected to rake in 38% of the $148 billion total.

The poorest 40% of Americans, meanwhile are set to see their taxes rise next year under the Trump-GOP bill, mostly due to Republican lawmakers' refusal to extend Affordable Care Act tax credits.

Wow, Amazon, Microsoft, Meta, and Google are getting 38% of the total cash savings from the part of Trump’s tax law going to corporations. That’s $15.7B to Amazon alone! https://t.co/l9AZth20RJ pic.twitter.com/XFVekRmrrp

— Matt Stoller (@matthewstoller) August 5, 2025

Rep. Brendan Boyle (D-Pa.), the ranking member of the House Budget Committee, said the new CBO analysis "yet again confirms Republicans' Big Ugly Law is as expensive as it is cruel."

"It explodes the deficit by over $4 trillion to pay for massive tax breaks for billionaires, while ripping healthcare and food assistance away from millions of Americans," said Boyle. "It's a disgraceful law that forces working families to pay the price so the ultra-rich can profit."