SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Newly elected Pope Leo XIV, Robert Prevost, appears at the main central loggia balcony of the St Peter's Basilica for the first time, after the cardinals ended the conclave, in The Vatican, on May 8, 2025.

But there's a solution: The recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker.

In his first interview since becoming the leader of the Catholic Church, Pope Leo XIV fielded a question about the polarization that is tearing societies apart around the world.

A significant factor, he said, is the “continuously wider gap between the income levels of the working class and the money that the wealthiest receive.”

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

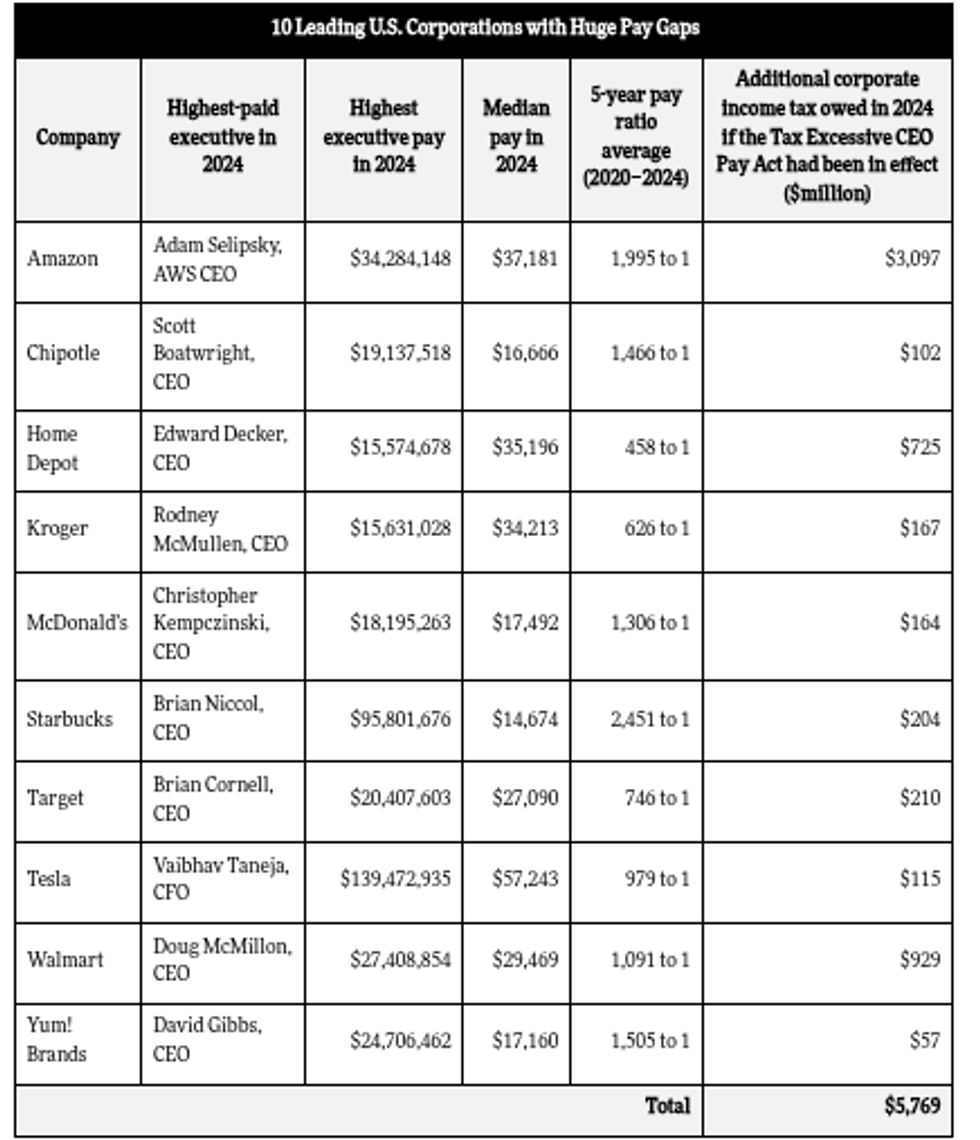

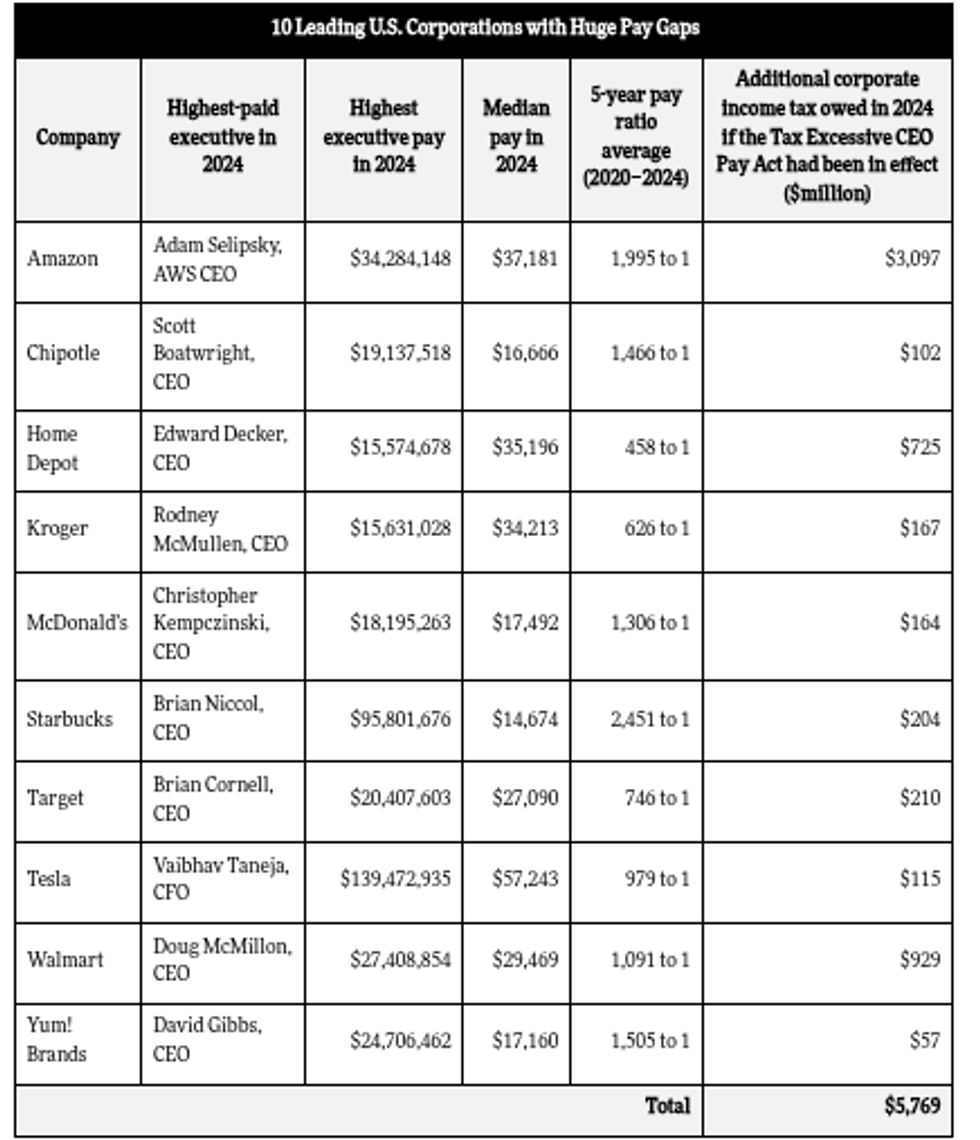

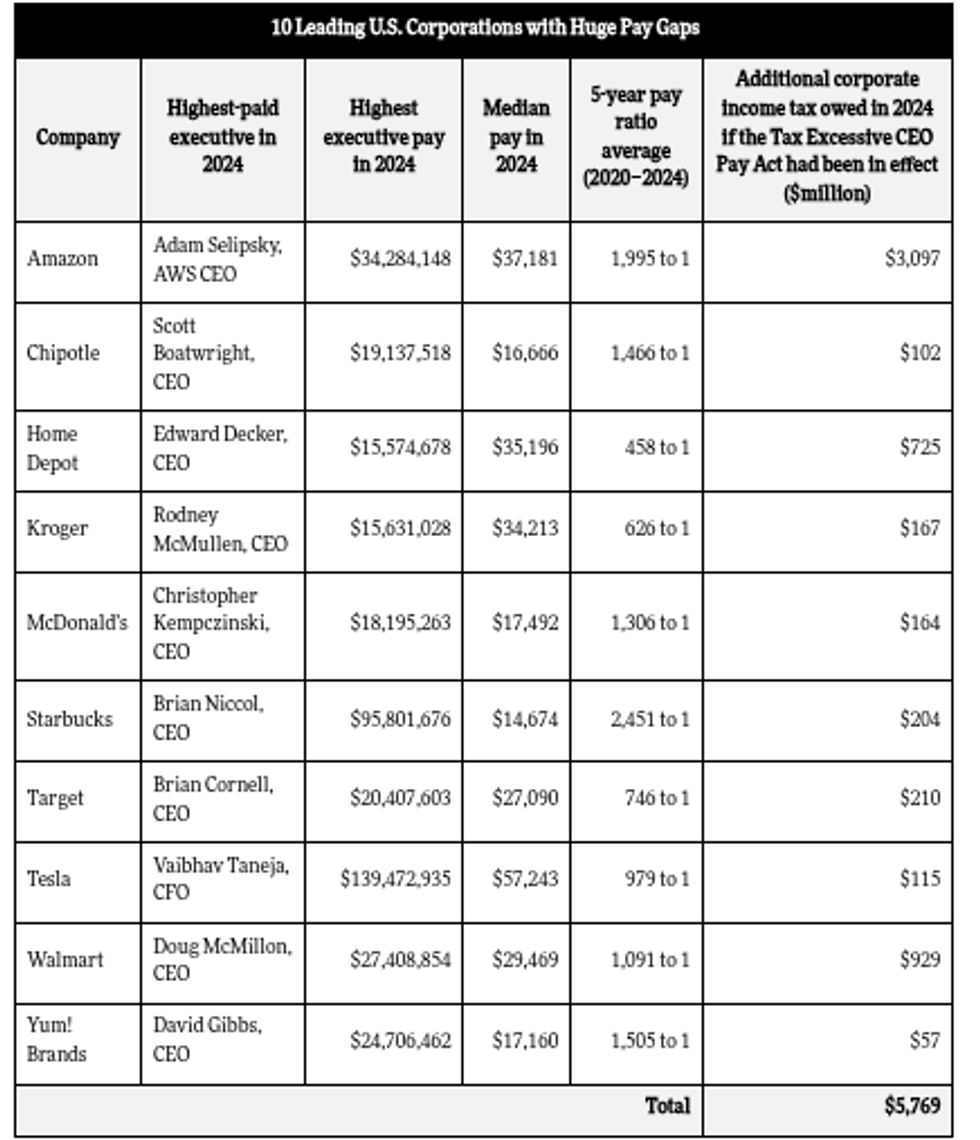

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In his first interview since becoming the leader of the Catholic Church, Pope Leo XIV fielded a question about the polarization that is tearing societies apart around the world.

A significant factor, he said, is the “continuously wider gap between the income levels of the working class and the money that the wealthiest receive.”

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.

In his first interview since becoming the leader of the Catholic Church, Pope Leo XIV fielded a question about the polarization that is tearing societies apart around the world.

A significant factor, he said, is the “continuously wider gap between the income levels of the working class and the money that the wealthiest receive.”

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.