SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"Americans understand we're living in a rigged economy," said Sen. Bernie Sanders. "Together, we can and must change that."

Elon Musk is the world's richest person, with an estimated net worth of nearly $500 billion, but the Tesla CEO could become the world's first trillionaire, thanks to a controversial pay package approved Thursday by the electric vehicle company's shareholders.

Ahead of the vote, a coalition of labor unions and progressive advocacy groups launched the "Take Back Tesla" campaign, urging shareholders to reject the package for its CEO, who spent much of this year spearheading President Donald Trump's so-called Department of Government Efficiency (DOGE), which prompted nationwide protests targeting the company.

Musk's nearly $1 trillion package would be the biggest corporate compensation plan in history if he gets the full amount by boosting share value "eightfold over the next decade" and staying at Tesla for at least that long. It was approved at the company's annual meeting after the billionaire's previous payout, worth $56 billion, was invalidated by a judge.

The approval vote sparked another wave of intense criticism from progressive groups and politicians who opposed it—including on Musk's own social media platform, X.

"Musk, who spent $270 million to get Trump elected, is now in line to become a trillionaire," Sen. Bernie Sanders (I-Vt.) wrote on X. "Meanwhile, 60% of our people are living paycheck to paycheck. Americans understand we're living in a rigged economy. Together, we can and must change that."

The vote came during the longest-ever federal government shutdown, which has sparked court battles over the Supplemental Nutrition Assistance Program. A judge on Thursday ordered the full funding of 42 million low-income Americans' November SNAP benefits, but it is not yet clear whether the Trump administration will comply.

The Sunrise Movement, a youth-led climate group, noted the uncertainty over federal food aid in response to the Tesla vote, saying: "Meanwhile, millions of kids are losing SNAP benefits and healthcare because of Musk's allies in DC. In a country rich enough to have trillionaires, there's no excuse for letting kids go hungry."

Robert Reich, a former labor secretary who's now a professor at the University of California, Berkeley, said: "Remember: Wealth cannot be separated from power. We've seen how the extreme concentration of wealth is distorting our politics, rigging our markets, and granting unprecedented power to a handful of billionaires. Be warned."

In remarks to the Washington Post, another professor warned that other companies could soon follow suit:

Rohan Williamson, professor of finance at Georgetown University, said Musk's argument for commanding such a vast paycheck is largely unique to Tesla—though similar deals may become more prevalent in an age of founder-led startups.

"No matter how you slice it, it's a lot," Williamson said. But the deal seeks to emphasize Musk’s central—even singular—role in the company's rise, and its fate going forward.

"I drove this to where it is and without me it's going to fail," Williamson said, summarizing Musk's argument.

"No CEO is 'worth' $1 trillion. Full stop," the advocacy group Patriotic Millionaires argued Wednesday, ahead of the vote. "We need legislative solutions like the Tax Excessive CEO Pay Act, which would raise taxes on corporations that pay their executives more than 50 times the wages of their workers."

The world's richest man "has wiped billions off of Tesla's share value, trashed the company's reputation, and driven millions of its customers away," one campaigner said, urging shareholders to reject his pay plan.

A coalition of labor unions and progressive advocacy organizations on Tuesday launched the "Take Back Tesla" campaign, urging shareholders of the electric vehicle giant to reject a pay package that could make CEO Elon Musk the world's first trillionaire.

Musk is already the richest person on the planet, with an estimated net worth of $458-485.9 billion as of Wednesday. His previous 10-year proposal, worth $56 billion, was invalidated by a judge. He's now on an interim plan that has not been approved by shareholders, who are set to vote on the $1 trillion package at the company's annual meeting next month.

Tesla's board unveiled the proposed $1 trillion plan—which would be the biggest corporate compensation package in history—last month. Musk would get the full amount if he boosted share value "eightfold over the next decade" and stayed at Tesla for at least that long. He would own 29% of the company, one of several in which he holds a leadership position.

Top unions, such as the American Federation of Teachers (AFT) and Communications Workers of America (CWA), joined groups including Americans for Financial Reform, Ekō, People's Action Institute, Public Citizen, and Stop the Money Pipeline for the new campaign against "Musk's money grab." As part of it, they launched the website TakeBackTesla.com.

"How shareholders vote on Musk's trillion-dollar pay package and other important Tesla ballot items will likely set the stage for similar attempts by other oligarchs to consolidate their own power."

Several coalition leaders pointed to Musk's recent efforts to get President Donald Trump elected and then help the Republican gut the federal government—which has been shut down for 22 days due to a congressional funding fight—via their so-called Department of Government Efficiency. The billionaire's DOGE activities provoked nationwide protests targeting Tesla.

"In the last 12 months, Elon Musk's attempts to destroy the American government have caused huge damage to the Tesla brand and contributed to a significant decline in the company's sales in multiple key markets," Stop the Money Pipeline's Alex Connon noted, urging shareholders to "reject this insane proposal."

AFT president Randi Weingarten said that "the Tesla board, instead of upholding basic governance standards, wants to green-light an outrageous $1 trillion pay package for a CEO who has spent most of the year engaged in childish political brawls, rather than working to create shareholder value."

"To reward this destructive behavior with an obscene salary is a slap in the face—not only to the federal workers he's fired, but to the retirees whose pensions are invested in Tesla stock," she declared.

Dubbing the proposal "Musk's corporate heist," CWA president Claude Cummings Jr. similarly stressed that "Elon Musk is enriching himself by stealing from the American worker—from our infrastructure dollars for rural broadband to workers' private data from the Department of Labor—and now he wants to steal $1 trillion from our pensions and retirement accounts."

Natalia Renta, Americans for Financial Reform's associate director of corporate governance and power, emphasized that the vote is bigger than Musk. She said that "how shareholders vote on Musk's trillion-dollar pay package and other important Tesla ballot items will likely set the stage for similar attempts by other oligarchs to consolidate their own power."

"This new website allows people to get their voices heard by sending letters to their state financial officer and mutual fund manager (if they have one)," Renta added. State treasurers of Connecticut, Nevada, and New Mexico have already joined mounting calls for shareholders to vote down Musk's compensation package.

Ekō executive director Emma Ruby-Sachs argued that "no CEO is worth a trillion-dollar pay package, but especially not Elon Musk, who has wiped billions off of Tesla's share value, trashed the company's reputation, and driven millions of its customers away. Tesla's shareholders need to show the judgment Musk so clearly lacks, and reject this pay deal."

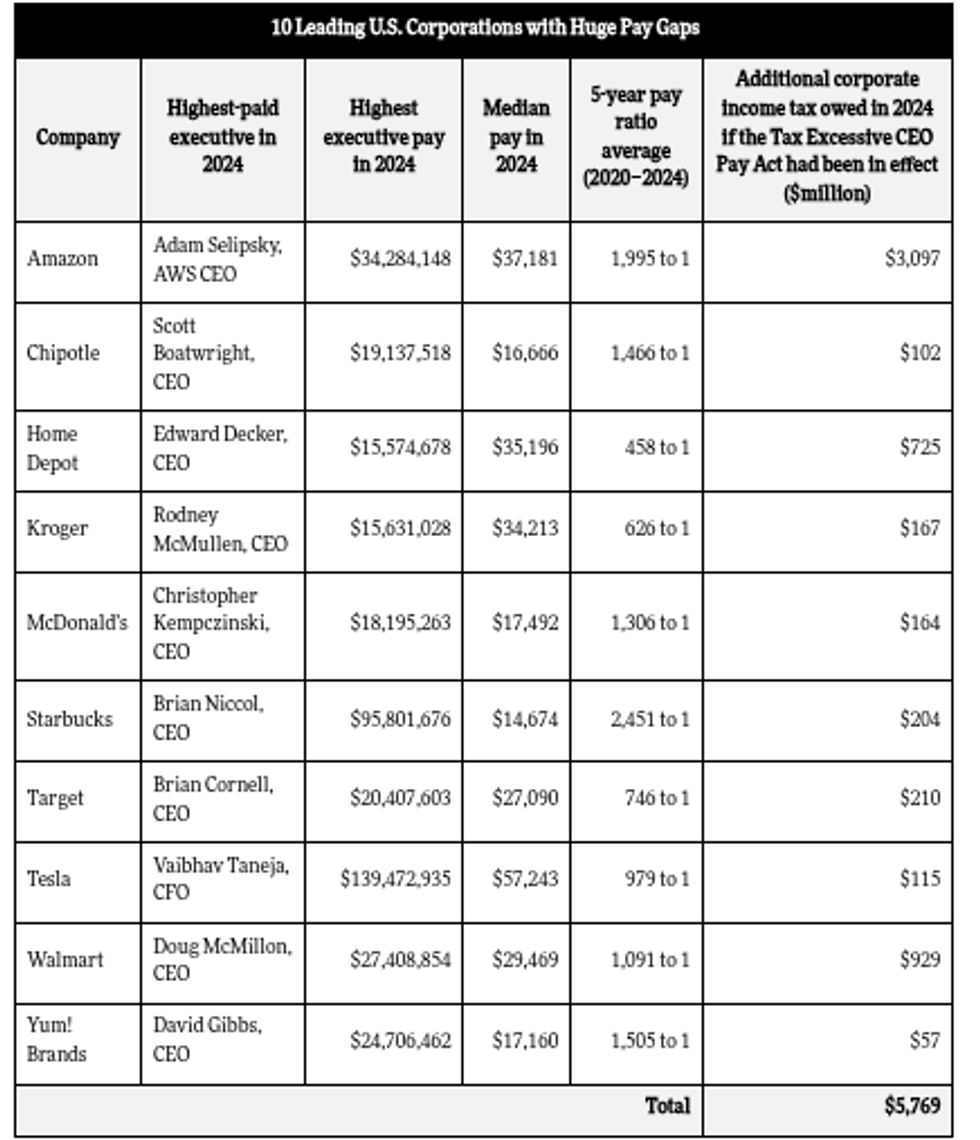

But there's a solution: The recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker.

In his first interview since becoming the leader of the Catholic Church, Pope Leo XIV fielded a question about the polarization that is tearing societies apart around the world.

A significant factor, he said, is the “continuously wider gap between the income levels of the working class and the money that the wealthiest receive.”

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.