SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Today, the Environmental Protection Agency (EPA) released its first-ever legal standard for two PFAS “forever chemicals” -- PFOS and PFOA -- proposing a limit of no more than 4 parts per trillion (ppt) for each chemical in drinking water. EPA is also setting a combined standard for the total hazard posed by four other PFAS chemicals -- PFHxS, PFBS, PFNA, and HFPO-DA or GenX -- in drinking water. More than 200 million people in the United States are estimated to currently have unhealthy levels of PFAS in their water. EPA estimates the new standard, when enacted in 2024, will save billions of dollars in healthcare costs per year and prevent death and serious diseases like cancer, heart attacks, and strokes.

The announcement is a rare move for EPA which has not updated any drinking water standards for dangerous chemicals for more than two decades. In the short term, the costs of testing and removing PFAS from water will largely be covered by Federal funding, , including $5 billion for PFAS and other emerging contaminants in the Inflation Reduction Act.

The announcement is a clear acknowledgment that PFAS chemicals are more potent than previously believed. Last summer, EPA dramatically lowered its lifetime health advisory levels for PFOS and PFOA from 70 parts per trillion combined to 20 and 4 parts per quadrillion, respectively. When finalized, the new drinking water standard for PFOS and PFOA will be the lowest limit for any chemical the EPA regulates in water. While the proposed limits are a notable improvement from no limit, they are still more than 250 to 1,000 times higher than the amount EPA says is “safe” or ideal in water.

In response, Sierra Club Senior Toxics Policy Advisor Sonya Lunder issued the following statement:

“EPA’s strong new limits for these six PFAS chemicals will prevent serious illnesses and save lives. EPA must keep its momentum by issuing rules to limit the production and use of PFAS chemicals and control their cleanup and disposal. In the long term, polluting industries, not the public, must pay the full cost of removing these ‘forever chemicals’ from the environment.”

Mark Favors, military veteran, registered nurse, and Sierra Club member issued the following statement:

“Unfortunately, today’s protections arrived too late for my family members who drank water contaminated by the use of PFAS at Peterson Air Force Base in Colorado Springs for decades. Sixteen people in my extended family have had cancer, including five military veterans. But the new rules will have far-reaching implications for future generations, particularly people living near military bases. The Department of Defense (DoD) has a long history of failing to honor safer drinking water standards in many states, forcing military service members and the public to drink unhealthy water and water utilities to pay out of pocket for expensive treatment. By swiftly implementing and enforcing the proposed PFAS standards, the EPA can mandate DoD follow these standards and ultimately prevent future illness, even death, for many Americans.”

Liz Rosenbaum of the Fountain Valley Clean Water Coalition in El Paso County, Colorado issued the following statement:

“EPA-required testing led to the discovery of PFAS contamination in my county in 2016. While I relocated my family out of Fountain, Colorado to avoid drinking more PFAS, I didn’t move far enough. Testing kits provided by the Sierra Club demonstrated that water in the community I moved to was also contaminated, with water levels even exceeding EPA’s new limits. The PFAS problem is much worse than we’ve been told, especially for people living in rural areas near military sites.”

The Sierra Club is the most enduring and influential grassroots environmental organization in the United States. We amplify the power of our 3.8 million members and supporters to defend everyone's right to a healthy world.

(415) 977-5500"An unmistakable majority wants a party that will fight harder against the corporations and rich people they see as responsible for keeping them down," wrote the New Republic's editorial director.

Democratic voters overwhelmingly want a leader who will fight the superrich and corporate America, and they believe Rep. Alexandria Ocasio-Cortez is the person to do it, according to a poll released this week.

While Democrats are often portrayed as squabbling and directionless, the poll conducted last month by the New Republic with Embold Research demonstrated a remarkable unity among the more than 2,400 Democratic voters it surveyed.

This was true with respect to policy: More than 9 in 10 want to raise taxes on corporations and on the wealthiest Americans, while more than three-quarters want to break up tech monopolies and believe the government should conduct stronger oversight of business.

But it was also reflected in sentiments that a more confrontational governing philosophy should prevail and general agreement that the party in its current form is not doing enough to take on its enemies.

Three-quarters said they wanted Democrats to "be more aggressive in calling out Republicans," while nearly 7 in 10 said it was appropriate to describe their party as "weak."

This appears to have translated to support for a more muscular view of government. Where the label once helped to sink Sen. Bernie Sanders' (I-Vt.) two runs for president, nearly three-quarters of Democrats now say they are either unconcerned with the label of "socialist" or view it as an asset.

Meanwhile, 46% said they want to see a "progressive" at the top of the Democratic ticket in 2028, higher than the number who said they wanted a "liberal" or a "moderate."

It's an environment that appears to be fertile ground for Ocasio-Cortez, who pitched her vision for a "working-class-centered politics" at this week's Munich summit in what many suspected was a soft-launch of her presidential candidacy in 2028.

With 85% favorability, Bronx congresswoman had the highest approval rating of any Democratic figure in the country among the voters surveyed.

It's a higher mark than either of the figures who head-to-head polls have shown to be presumptive favorites for the nomination: Former Vice President Kamala Harris and California Gov. Gavin Newsom.

Early polls show AOC lagging considerably behind these top two. However, there are signs in the New Republic's poll that may give her supporters cause for hope.

While Harris is also well-liked, 66% of Democrats surveyed said they believe she's "had her shot" at the presidency and should not run again after losing to President Donald Trump in 2024.

Newsom does not have a similar electoral history holding him back and is riding high from the passage of Proposition 50, which will allow Democrats to add potentially five more US House seats this November.

But his policy approach may prove an ill fit at a time when Democrats overwhelmingly say their party is "too timid" about taxing the rich and corporations and taking on tech oligarchs.

As labor unions in California have pushed for a popular proposal to introduce a billionaire's tax, Newsom has made himself the chiseled face of the resistance to this idea, joining with right-wing Silicon Valley barons in an aggressive campaign to kill it.

While polls can tell us little two years out about what voters will do in 2028, New Republic editorial director Emily Cooke said her magazine's survey shows an unmistakable pattern.

"It’s impossible to come away from these results without concluding that economic populism is a winning message for loyal Democrats," she wrote. "This was true across those who identify as liberals, moderates, or progressives: An unmistakable majority wants a party that will fight harder against the corporations and rich people they see as responsible for keeping them down."

In some cases, the administration has kept immigrants locked up even after a judge has ordered their release, according to an investigation by Reuters.

Judges across the country have ruled more than 4,400 times since the start of October that US Immigration and Customs Enforcement has illegally detained immigrants, according to a Reuters investigation published Saturday.

As President Donald Trump carries out his unprecedented "mass deportation" crusade, the number of people in ICE custody ballooned to 68,000 this month, up 75% from when he took office.

Midway through 2025, the administration had begun pushing for a daily quota of 3,000 arrests per day, with the goal of reaching 1 million per year. This has led to the targeting of mostly people with no criminal records rather than the "worst of the worst," as the administration often claims.

Reuters' reporting suggests chasing this number has also resulted in a staggering number of arrests that judges have later found to be illegal.

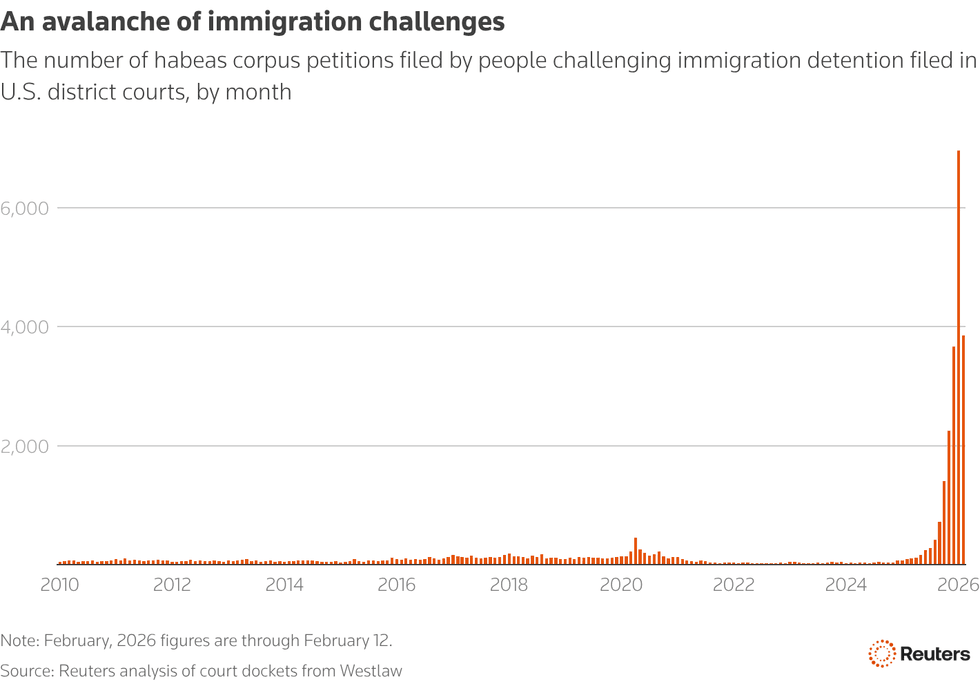

Since the beginning of Trump's term, immigrants have filed more than 20,200 habeas corpus petitions, claiming they were held indefinitely without trial in violation of the Constitution.

In at least 4,421 cases, more than 400 federal judges have ruled that their detentions were illegal.

Last month, more than 6,000 habeas petitions were filed. Prior to the second Trump administration, no other month dating back to 2010 had seen even 500.

In part due to the sheer volume of legal challenges, the Trump administration has often failed to comply with court rulings, leaving people locked up even after judges ordered them to be released.

Reuters' new report is the most comprehensive examination to date of the administration's routine violation of the law with respect to immigration enforcement. But the extent to which federal immigration agencies have violated the law under Trump is hardly new information.

In a ruling last month, Chief Judge Patrick J. Schiltz of the US District Court in Minnesota—a conservative jurist appointed by former President George W. Bush—provided a list of nearly 100 court orders ICE had violated just that month while deployed as part of Trump's Operation Metro Surge.

The report of ICE's systemic violation of the law comes as the agency faces heightened scrutiny on Capitol Hill, with leaders of the agency called to testify and Democrats attempting to hold up funding in order to force reforms to ICE's conduct, which resulted in a partial shutdown beginning Saturday.

Following the release of Reuters' report, Rep. Ted Lieu (D-Calif.) directed a pointed question over social media to Kristi Noem, the secretary of the Department of Homeland Security, which oversees ICE.

"Why do your out-of-control agents keep violating federal law?" he said. "I look forward to seeing you testify under oath at the House Judiciary Committee in early March."

"Aggies do what is necessary for our rights, for our survival, and for our people,” said one student organizer at North Carolina A&T State University, the largest historically Black college in the nation.

As early voting began for the state primaries, North Carolina college students found themselves walking more than a mile to cast their ballots after the Republican-controlled State Board of Elections closed polling places on their campuses.

The board, which shifted to a 3-2 GOP majority, voted last month to close a polling site at Western Carolina University and to reject the creation of polling sites at two other colleges—the University of North Carolina at Greensboro (UNC Greensboro), and the North Carolina Agricultural and Technical State University (NC A&T), the largest historically Black college in the nation. Each of these schools had polling places available on campus during the 2024 election.

The decision, which came just weeks before early voting was scheduled to begin, left many of the 40,000 students who attend these schools more than a mile away from the nearest polling place.

It was the latest of many efforts by North Carolina Republicans to restrict voting ahead of the 2026 midterms: They also cut polling place hours in dozens of counties and eliminated early voting on Sundays in some, which dealt a blow to "Souls to the Polls" efforts led by Black churches.

A lawsuit filed late last month by a group of students at the three schools said, “as a result, students who do not have access to private transportation must now walk that distance—which includes walking along a highway that lacks any pedestrian infrastructure—to exercise their right to vote.

The students argued that this violates their access to the ballot and to same-day registration, which is only available during the early voting period.

Last week, a federal judge rejected their demand to open the three polling centers. Jay Pavey, a Republican member of the Jackson County elections board, who voted to close the WCU polling site, dismissed fears that it would limit voting.

“If you really want to vote, you'll find a way to go one mile,” Pavey said.

Despite the hurdles, hundreds of students in the critical battleground state remained determined to cast a ballot as early voting opened.

On Friday, a video posted by the Smoky Mountain News showed dozens of students marching in a line from WCU "to their new polling place," at the Jackson County Recreation Center, "1.7 miles down a busy highway with no sidewalks."

The university and on-campus groups also organized shuttles to and from the polling place.

A similar scene was documented at NC A&T, where about 60 students marched to their nearest polling place at a courthouse more than 1.3 miles away.

The students described their march as a protest against the state's decision, which they viewed as an attempt to limit their power at the ballot box.

The campus is no stranger to standing up against injustice. February 1 marked the 66th anniversary of when four Black NC A&T students launched one of the most pivotal protests of the civil rights movement, sitting down at a segregated Woolworth's lunch counter in downtown Greensboro—an act that sparked a wave of nonviolent civil disobedience across the South.

"Aggies do what is necessary for our rights, for our survival, and for our people,” Jae'lah Monet, one of the student organizers of the march, told Spectrum News 1.

Monet said she and other students will do what is necessary to get students to the polls safely and to demonstrate to the state board the importance of having a polling place on campus. She said several similar events will take place throughout the early voting period.

"We will be there all day, and we will all get a chance to vote," Monet said.