April, 08 2021, 12:00am EDT

"Don't Feed the Greed Kristalina": Citizen Call for Debt Reform (or Revolt) at IMF/WBG Spring Meetings

To mark the start of two important days of debt negotiations, the international campaigning group Avaaz has invited a special guest to perform in front of IMF headquarters at the spring meetings: Evita Peron.

Singing in English, an activist dressed as Evita performed a debt-restructured version of the hit "Don't Cry for me Argentina," which includes the refrain: Don't feed the greed, Argentina / The truth is you give them Nature / All through your wildlife / Your green resilience /Just keep your glaciers / And save the planet!

WASHINGTON

To mark the start of two important days of debt negotiations, the international campaigning group Avaaz has invited a special guest to perform in front of IMF headquarters at the spring meetings: Evita Peron.

Singing in English, an activist dressed as Evita performed a debt-restructured version of the hit "Don't Cry for me Argentina," which includes the refrain: Don't feed the greed, Argentina / The truth is you give them Nature / All through your wildlife / Your green resilience /Just keep your glaciers / And save the planet!

Evita's composition is intended to draw attention to the fact that while Argentina holds a significant IMF debt, it also shares crucial climate and biodiversity wealth, free of charge. A similar imbalance (of monetary poverty despite biodiversity wealth) exists in the majority of highly-indebted poor countries (HIPC) whose IMF debts are set to be renegotiated to allow for additional urgent needs resulting from the COVID-19 pandemic.

The lyrics highlight the fact that Argentina has one of the biggest environmental surpluses in the world, in contrast to its financial creditors, the majority of whom have a green deficit.

Avaaz is calling upon Argentina to start an international debt rebellion which would take into account contributions of climate and biodiversity wealth in overall debt calculations. This would allow poor countries to stop paying money to rich countries and invest instead in the well-being if their people and the protection of their natural wealth, with a benefit for all of us. Avaaz also calls upon the IMF's Managing Director, Kristalina Georgieva to stand her ground in negotiations towards a radical debt reform.

Oscar Soria, Campaign Director at Avaaz, said in a press conference at the front of IMF HQ:

"To mark the start of these crucial spring meetings, Avaaz brought an Argentine icon to call for social inclusion and ecological justice in the current debt negotiations. The ecological debt should be considered in any further negotiations between rich and poor nations."

"Given the emerging global recognition of the need to include nature in economic models it is time that debt calculations take into account the biodiversity and climate protections provided by many developing countries, usually for little or no financial reward. By rethinking who is indebted to whom we will establish a new green economy that protects our planet while tackling debt through a sustainable and equitable lens

The perpetual renegotiation of sovereign debt between rich and poor countries is a cruel feature of a colonial mindset that believes it is fine for the wealthy to profit from the natural riches and resources of the poor, with little concern for helping them out of poverty. As a result, too many governments, especially in the Global South, find themselves stuck in spirals of indebtedness that prohibit them from investing in the health and well-being of their citizens. We fear this will only be exacerbated by the social and economic blows of the Covid-19 pandemic."

What Avaaz would like to see happen at the IMF/WB Spring Meetings:

Special Drawing Rights (SDRs): The world's wealthiest countries (primarily G7 and G20) should be called upon to:

* Reallocate a significant proportion of

their SDRs to support rapid access to liquidity for vulnerable countries. A collective target of 90% of SDR allocation to G20 countries should be reallocated to vulnerable countries.

* Put these new SDRs to good use: whether the new SDRs remain at the IMF or are poured into a new "SDRs Trust Fund" to make grants and concessional lending, the actual use of the money should be aligned with recipient countries' development priorities, and always be fully aligned with fulfilling the SDGs and the Paris Climate Agreement objectives.

Modernizing the Role of the IMF: The IMF should seize the opportunity of the ongoing Comprehensive Surveillance Review (CSR) (which will reform the IMF's surveillance for the next decade) to implement steps that ensure it is up to the challenge of supporting a more resilient and sustainable global economy. These steps could include:

* Strengthen the IMF's surveillance mechanisms and funding to recognize and avoid increasing risks posed by climate change and biodiversity loss. Despite the emerging threats they pose to macro-stability, the IMF has yet to include such risks into Article IV surveillance. Several publications (including from Carbon Tracker, IRENA, Mark Carney) show increasing "transition risks" due to the rapid transition to a net zero economy, including the growing risks of stranded assets estimated between $3-7 trillion by IRENA.

* The Fund's debt policies should be tailored to the challenge of addressing climate change. The joint World Bank-IMF Debt Sustainability Analysis Framework (DSA) should include climate related risks (including transition risks) and better assess the fiscal multipliers associated with green investments. With a longer term time horizon, the DSA must recognize the benefits of green (and blue) over grey investments, as recommended by the Joint V20-IMF Action Agenda, and the increasing risks of investing in unsustainable fossil-based infrastructures. Key points to support from the V20-IMF Joint Action Agenda are:

1. Mainstreaming systematic and transparent assessments of climate-related financial risks in all IMF operations.

2. Consistent, systematic, and universal appraisal and treatment of physical climate risks and transition risks for all countries in Article IV consultations and Financial Sector Assessment Programs.

3. Advancing disclosure of climate-related financial risks and promoting sustainable finance and investment practices.

4. Exploring synergies between fiscal and monetary policies.

5. Mainstreaming of climate risk analysis in public financial management and supporting the development of a climate disaster risk financing and insurance architecture.

6. Supporting climate vulnerable countries with debt sustainability problems.

7. Developing the IMF toolkit for climate emergency financing.

8. Exploring options to use Special Drawing Rights (SDRs) to support climate vulnerable countries.

9. Supporting the design and implementation of carbon pricing mechanisms.

10. Institutionalizing collaboration between the Fund and the V20.

Avaaz.org is a new global web movement with a simple democratic mission: to close the gap between the world we have, and the world most people everywhere want. "Avaaz" means "Voice" in many Asian, Middle Eastern and Eastern European languages. Across the world, most people want stronger protections for the environment, greater respect for human rights, and concerted efforts to end poverty, corruption and war. Yet globalization faces a huge democratic deficit as international decisions are shaped by political elites and unaccountable corporations -- not the views and values of the world's people.

LATEST NEWS

Rights Group Leads Push for UN to Declare US-Israeli Assault on Iran 'War of Aggression'

"No legal framework, international or domestic, can justify this."

Mar 02, 2026

A leading human rights group on Monday urged the United Nations General Assembly to declare the unprovoked US-Israeli assault on Iran—which has already killed more than 500 people in just three days, including many children—a "war of aggression."

In a letter sent to the permanent missions of all UN member states in New York City, Democracy for the Arab World Now (DAWN) "called on governments to formally request an emergency special session of the UN General Assembly to declare the assault a war of aggression in violation of the UN Charter and to demand the immediate cessation of all hostilities."

"The [UN] Security Council is unable to make that determination because the United States, as a permanent member and a party to the conflict, will veto any resolution," DAWN explained. "The General Assembly should act in its place."

DAWN's call came as the death toll from three days of US-Israeli bombardment of cities, towns, and sites throughout Iran rose to at least 555, according to the Iranian Red Crescent Society. Multiple massacres—including a bombing of a girls' school in Minab that officials said killed at least 180 people, many of them students—have been reported.

"The United States has initiated a war of aggression, which UN General Assembly Resolution 3314 defines as 'a crime against international peace' and which the Nuremberg Tribunal—established by the United States itself—called 'the supreme international crime,'" the group noted.

DAWN continued:

The US and Israeli decision to go to war violates the foundations of jus ad bellum, the body of international law governing when a state may lawfully use force against another. Under UN Charter Article 2(4), all member states are prohibited from using force against the territorial integrity or political independence of another state. There are only two explicit exceptions: self-defense under Article 51, or authorization by the UN Security Council under Chapter VII. Neither applies here. Article 51 permits self-defense only "if an armed attack occurs," and Iran had not attacked the United States. Even under the doctrine of anticipatory self-defense, the war is unlawful.

"No legal framework, international or domestic, can justify this US-Israeli war of aggression against Iran," DAWN executive director Omar Shakir said in a statement. "This war is patently illegal, and it must be stopped."

DAWN's call came on the same day that US First Lady Melania Trump chaired a UN Security Council meeting about the role of education in "advancing tolerance and world peace."

Just to be clear, sending his wife Melania to preside over the United Nations Security Council is a display of contempt for the UN by Trump.During his first term, Trump similarly sent his daughter Ivanka to multiple United Nations General Assembly sessions.

[image or embed]

— Leah McElrath (@leahmcelrath.bsky.social) March 2, 2026 at 1:02 PM

"We've become the laughingstock of the entire world," lamented the social media group Occupy Democrats. "This is an unprecedented appearance by an American first dady and yet another sign that [President] Donald Trump prizes loyalty and proximity to himself over competence."

"In fact, this is the first time that the spouse of ANY world leader has been allowed to take the president's seat on the Security Council," Occupy Democrats added. "It sends a clear signal to the world that the United States is now little more than a nepotistic, tin-pot dictatorship."

DAWN also sent a letter to members of Congress urging them to pass a pair of war powers resolutions that would bar US forces from waging an unconstitutional war on Iran. H.Con.Res.38 and S.J.Res.59—introduced last year respectively by Rep. Thomas Massie (R-Ky.) and Sen. Tim Kaine (D-Va.)—would direct Trump to withdraw US forces from unconstitutional attacks on Iran.

"The question before Congress is not whether to authorize this war retroactively," the letter states. "Given that... this war has been illegal under US domestic law from the moment it began... the question before you is whether to end it now, and Congress has the power to do so."

Keep ReadingShow Less

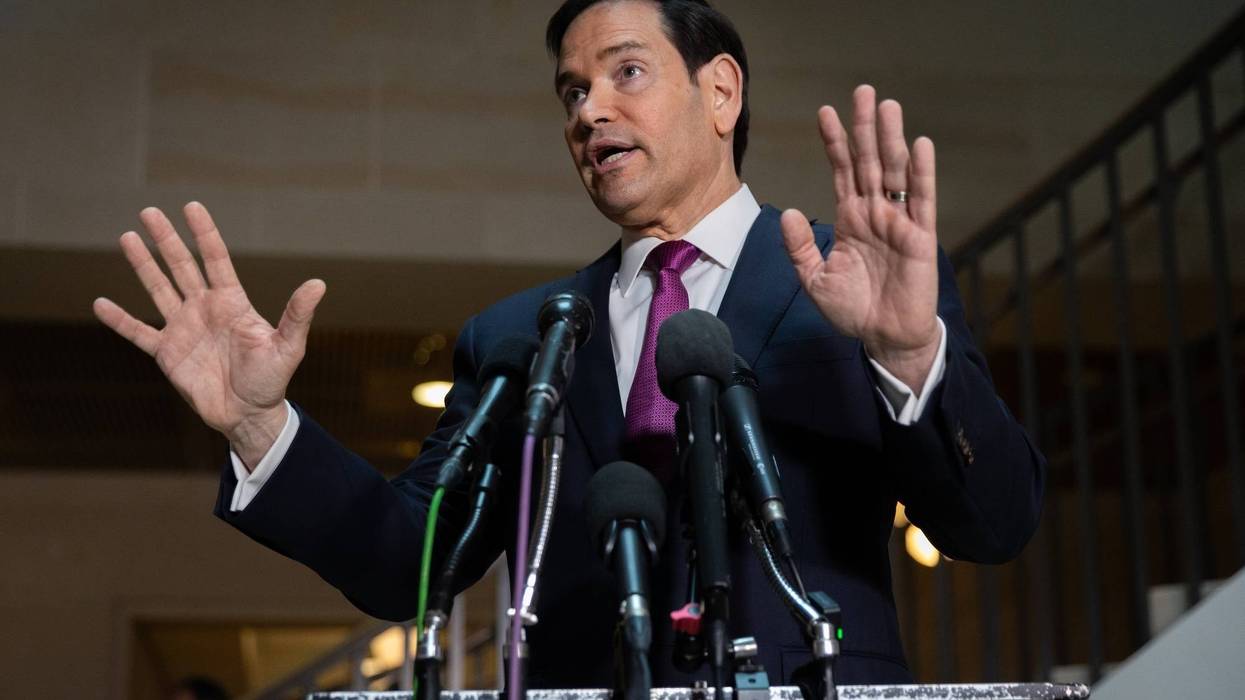

Rubio Suggests Trump Joined Israel's Planned Attack on Iran Instead of Stopping It

"This is the most insane and absurd definition of an 'imminent threat' I have ever heard in my life," said one journalist.

Mar 02, 2026

"What the fuck happened to America First?" US Sen. Ruben Gallego asked on social media Monday in response to a video of Secretary of State Marco Rubio attempting to justify President Donald Trump and Israeli Prime Minister Benjamin Netanyahu's war on Iran.

As the death toll climbed above 550 in Iran, with at least six US service members killed, Rubio told reporters on Capitol Hill that "there absolutely was an imminent threat, and the imminent threat was that we knew that if Iran was attacked, and we believed they would be attacked, that they would immediately come after us. And we were not gonna sit there and absorb a blow before we responded."

According to Rubio, the US Department of Defense assessed that "if we waited for them to hit us first after they were attacked... by someone else—Israel attacked them, they hit us first, and we waited for them to hit us—we would suffer more casualties and more deaths. We went proactively, in a defensive way, to prevent them from inflicting higher damage. Had we not done so, there would've been hearings on Capitol Hill about how we knew that this was gonna happen, and we didn't act preemptively to prevent more casualties and more loss of life."

In a follow-up post, Gallego (D-Ariz.), an Iraq War veteran, added: "So Netanyahu now decides when we go to war? So much for America First."

The senator wasn't alone in ripping Rubio's remarks. Congresswoman Sarah Jacobs (D-Calif.) said that "Secretary Rubio says the quiet part out loud: This is an unnecessary war of choice. Israel forced our hand—there was no imminent threat to the United States. And instead of talking Israel out of going to war, President Trump went along with it and put US lives at risk."

Stanford University political science professor Michael McFaul said: "Such strange logic. We had to go to war because Israel was going to attack Iran? So Bibi gets a say as to whether the US goes to war but the US Senate and the American people do not?"

Zeteo editor-in-chief Mehdi Hasan declared: "This is the most insane and absurd definition of an 'imminent threat' I have ever heard in my life. Our ally and proxy, Israel, that we arm and fund, was about to illegally attack Iran so we joined in the attack because that illegal attack would have led to an attack on us."

Progressive organizer and attorney Aaron Regunberg also weighed in on social media: "Quite literally—and I've used that word too freely in the past, but in this case I mean literally—Rubio is saying they've made America into Netanyahu's bitch. We go where Bibi points, regardless of the American blood it will cost. Trump is an absolute cuck. Pathetic."

While critics of Trump's "Operation Epic Fury" have slammed it as illegal and clearly motivated by regime change, Rubio claimed that the Trump administration would welcome a new government in Iran, but the war—which has taken out top Iranians, including the supreme leader, Ayatollan Ali Hosseini Khamenei—is about preventing the Middle Eastern nation from developing a nuclear weapon.

A year ago, a US intelligence report said that "we continue to assess Iran is not building a nuclear weapon and that Khamenei has not reauthorized the nuclear weapons program he suspended in 2003, though pressure has probably built on him to do so." Despite that conclusion, the Trump administration bombed the country's nuclear facilities a few months later—and, as CNN's Aaron Blake pointed out last week, Trump has repeatedly said that his June airstrikes "obliterated" Iran's program.

There are now mounting calls for the Republican-controlled Senate and House of Representatives to end Trump's assault on Iran by passing a war powers resolution. Despite the US Constitution giving Congress clear authority to declare war, several presidents have taken military action without any such declaration.

Discussing the administration's interaction with Congress about Iran, Rubio said Monday that "we notified the Gang of Eight," which is made up of the Senate and House leaders for both major parties, as well as the chairs and ranking members of each chamber's intelligence panel. Before taking on his current role, the secretary was the top Republican on the Senate Intelligence Committee.

"There's no law that requires us to do that. The law says we have to notify them 48 hours after beginning hostilities. We've done that," Rubio said, referring to a requirement in the War Powers Act of 1973. "But we can't notify 535 members of Congress."

"If they want to take a war powers vote, they can do that. They've done that. They’ve done that a bunch of times," he added. "There's no law that requires the president to have done anything with regards to this... No presidential administration has ever accepted the War Powers Act as constitutional—not Republican presidents, not Democratic presidents."

Congressman Ted Lieu (D-Calif.) responded: "Dear Secretary Rubio: There is a law. It's called the frickin' Constitution of the United States."

Separately on Monday, the State Department urged Americans to leave a list of Middle Eastern countries.

Lieu responded: "Dear Secretary Rubio: You told Americans to depart now via commercial means when you know many airports/airspace are closed. YOU MUST IMMEDIATELY SCHEDULE US GOVERNMENT EVACUATION FLIGHTS FOR THE STRANDED AMERICANS IN DANGER. Maybe you should have thought of a frickin' plan first."

Keep ReadingShow Less

US, Israel 'Going Gaza on Iran' as Death Toll Tops 500 Amid New Massacres

"This is carpet-bombing, which has struck everything from playgrounds, to an emergency services HQ, schools, media buildings, and medical facilities," said one observer.

Mar 02, 2026

US and Israeli forces were accused Monday of "seemingly indiscriminate" bombing of Iran as the country's Red Crescent said that at least 555 people have been killed amid reports of fresh mass casualty attacks across the country.

The Iranian Red Crescent Society said at least 555 people have been killed so far during three days of a US and Israeli war of choice aimed at toppling Iran's long-ruling Islamist government. US Secretary of State Marco Rubio on Monday continued to insist that the war is not about regime change, but rather enduring yet bogus claims that Iran is close to developing nuclear weapons.

Those killed include many civilians as well as former Iranian Supreme Leader Ayatollah Ali Hosseini Khamenei and dozens of senior government and military officials. Iranian counterattacks have killed half a dozen US troops, 9 Israelis, and a handful of people in Gulf nations allied with the United States.

An attack on the Abbasabad Police Station—where anti-government protesters were allegedly tortured during the recent deadly crackdown—in Niloofar Square in central Tehran killed at least 20 people, local media reported.

"This is carpet-bombing, which has struck everything from playgrounds, to an emergency services HQ, schools, media buildings, and medical facilities," documentary filmmaker Robert Inlakesh said in a social media post showing the aftermath of the strike.

Local residents said that the site was attacked for the second time in three days. This was part of broader US-Israeli strikes on Tehran, including attacks on the Revolutionary Court, Defense Ministry, other government sites, and civilian infrastructure including at least eight medical facilities and state media outlets.

Carpet bombing in Iran is stark reminder of how air superiority shapes modern warfare. In May 2025, Pakistan faced similar escalation from India—yet credible air defense and a combat-ready air force altered strategic calculus decisively.

Invest in air power, instead of proxies! pic.twitter.com/H3rx2tYS7T

— Sarah Khan (@sarahkhanjourno) March 2, 2026

Video footage of another attack on central Tehran—this one in Ferdowsi Square—showed devastation from what political analyst Trita Parsi called "seemingly indiscriminate" bombing.

"Increasingly, Israel and the US appear to be following the Gaza playbook, having failed to achieve a quick regime implosion," Parsi said on social media.

Parsi also shared video of a distraught woman who described an apparent so-called "double-tap" strike, a common tactic used by the US, Israel, and other militaries in which an initial bombing is followed up with a second one in a bid to kill and injure survivors and first responders.

"They killed everyone," the woman said of the attackers. "They dropped the first bomb, then when people went to help, they dropped another bomb."

Local and international media reported at least 35 people killed in multiple attacks on targets in the southern Fars province, which neighbors Hormozgan province, where the deadliest massacre of the young war took place on Saturday. Officials said at least 175 people—mostly children—were killed in a strike on the Shajareh Tayyebeh girls' elementary school in Minab.

Several hours later, a missile strike on a gymnasium in Lamerd, Pars province, where dozens of teenage girls were playing sports reportedly killed at least 18 people.

"Like the destruction of the school in Minab, basic protections to safeguard the lives of civilians in war either failed or were disregarded, leading to catastrophic loss among Iran’s civilian population," the National Iranian American Council said in a statement Monday.

Iranian Red Crescent chief Pirhossein Kolivand said in a video posted on social media Sunday that “the Minab school incident has no comparison with any other incident, even in Gaza."

Comparisons with Gaza—where Israel's genocidal assault has left more than 250,000 Palestinians dead, maimed, or missing since October 2023 and the coastal strip in ruins—have been numerous.

Condemning what it called the "barbarous" and "treacherous" US-Israeli attacks on Iran, Hezbollah, the Lebanon-based resistance group targeted by Israel during the Gaza war, said, “This aggression confirms the full and direct partnership between America and Israel in planning and execution, not only in the war against the Islamic Republic, but also in all the wars and crimes the region is facing, in Gaza, Lebanon, Syria, and Yemen.”

Ori Goldberg, an Israeli political analyst, said that, in Israeli society, "there’s a sense of triumphalism, of having attacked an enemy regime."

"Not really because we’re greatly invested in the future of the Iranian people, but because, through the genocide on Gaza, we’ve devalued human life,” he added.

Parsi said that "Israel appears to be going Gaza on Iran."

The renewed US and Israeli attacks on Iran follow last year's limited war on the country that left thousands of Iranians dead or wounded, including at least 436 civilians killed and over 2,000 others injured, according to officials and activists.

United Nations officials and international human rights defenders were also among those condemning the US-Israeli war of choice.

Addressing the Minab school strike, UNESCO—the UN's educational, scientific, and cultural agency—said that "the killing of pupils in a place dedicated to learning constitutes a grave violation of the protection afforded to schools under international humanitarian law."

UN Messenger of Peace and Nobel Peace laureate Malala Yousafzai asserted that “all states and parties must uphold their obligations under international law to protect civilians and safeguard schools," adding that "every child deserves to live and learn in peace.”

In the United States—where Democratic and a handful of Republican lawmakers are reportedly drafting a war powers resolution in a bid to rein in President Donald Trump's aggression—Rep. Rashida Tlaib (D-Mich.) took to social media to note the "over 555 Iranians already killed by US-Israeli bombs, including at least 165 at a girls' elementary school."

"At least four US service members are dead," she also wrote, before that figure rose to six. "Any member of Congress who votes against the war powers resolution is voting for more of this."

The Not Above the Law coalition was among the civil society groups urging Congress to pass an Iran war powers resolution.

“President Trump has launched deadly military strikes against Iran without congressional approval, in flagrant violation of the Constitution," the coalition's co-chairs said Monday. "Article I, Section 8 is crystal clear: Only Congress can declare war. Yet Trump has secured neither a declaration of war nor congressional authorization for military force."

"Trump’s reckless unilateral action puts American lives and global security at risk while trampling the foundational principle that no president is above the law," Not Above the Law added. “Congress must act immediately. Pass war powers resolutions to reject this unconstitutional power grab and reassert its authority over matters of war and peace. The rule of law demands it."

Keep ReadingShow Less

Most Popular