SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

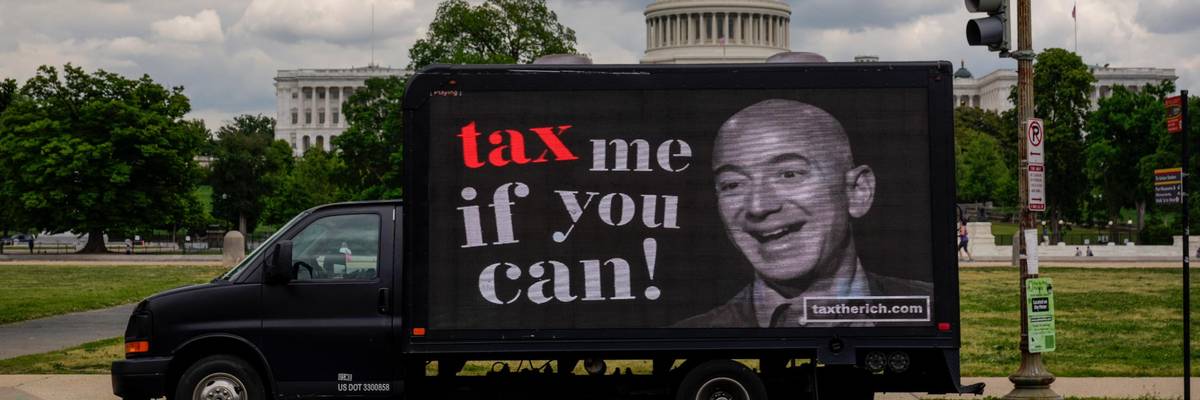

A mobile billboard calling for higher taxes on the ultra-wealthy depicts an image of billionaire businessman Jeff Bezos, the founder of Amazon, near the U.S. Capitol on May 17, 2021. (Photo: Drew Angerer/Getty Images)

A first-of-its-kind analysis released Thursday shows how the amount of corporate profits being diverted to tax havens has skyrocketed in recent years with nearly $1 trillion in global profits being stored in places where corporate giants don't have to pay taxes.

The United Nations University World Institute for Development Economics Research (UNU-WIDER) studied corporate profits and profit-shifting between 1975 and 2019, finding that the diversion of massive profits is a "relatively new phenomenon."

In the 1970s, about 2% of profits made by corporations were shifted to tax havens such as Bahamas, Anguilla, and Panama. By 2019, the amount had grown to 40%, with the use of corporate tax havens rising sharply in the past decade.

"Profit-shifting has increased relentlessly," tweeted Ludvig Wier, a co-author of the study and the head of secretariat at the Danish Ministry of Finance.

\u201cHow has global profit shifting to tax havens evolved from 1975-2019?\ud83d\udcb8\n\nMe & @gabriel_zucman investigate this in a new WP. https://t.co/god22Q4udb\n\nKey finding: profit shifting has increased relentlessly. In 2019, nearly $1Tn. was shifted to havens. (1/9)\ud83d\udc47\u201d— Ludvig Wier (@Ludvig Wier) 1667474445

The shift of profits to corporate tax havens has contributed to the loss of 10% of corporate tax revenues, estimated the authors, including Wier and French economist Gabriel Zucman.

"Of course, if there had been no profit-shifting, then countries may have chosen other policy paths, e.g. some might have been less likely to cut their corporate tax rate and engage in the 'race to the bottom,'" the study reads. "It illustrates, however, that the revenue losses caused by profit-shifting are a quantitatively important aspect of the decline in effective corporate income tax rates globally since the 1970s."

The researchers based the study on their analysis of which countries have lost the most in corporate tax revenue annually. Sixteen percent of tax revenue is lost to tax havens in the U.S. each year, according to that analysis, while 32% is lost in the U.K., 22% in France, and 29% in Germany.

"U.S. multinationals shift comparatively more profits (about 60% of their foreign profits) than multinationals from other countries (40% for the world on average)," wrote the authors. "The shareholders of U.S. multinationals thus appear to be the main winners from global profit-shifting."

The authors noted that the significant shifting of corporate profits to tax havens came after "major policy initiatives from the Organization for Economic Cooperation and Development (OECD)" and the 2017 tax reform package pushed through the U.S. Congress by the Republican Party, which included measures to ostensibly reduce corporate tax-dodging.

"The finding suggests that there remains a dire need for additional policy initiatives to significantly reduce global profit-shifting--such as implementing the global minimum corporate tax that more than 130 countries signed onto in 2021, but now remains in limbo as it is being blocked in the E.U. and the U.S.," said Wier.

The global corporate minimum tax would ensure all companies worldwide pay a minimum tax of 15% and would require higher taxes of large companies in countries where they have customers.

"The United Nations sustainable development goals clearly state that in order to deliver poverty reduction and to decrease global inequalities, illicit financial flows such as profit-shifting must decline," Wier said.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A first-of-its-kind analysis released Thursday shows how the amount of corporate profits being diverted to tax havens has skyrocketed in recent years with nearly $1 trillion in global profits being stored in places where corporate giants don't have to pay taxes.

The United Nations University World Institute for Development Economics Research (UNU-WIDER) studied corporate profits and profit-shifting between 1975 and 2019, finding that the diversion of massive profits is a "relatively new phenomenon."

In the 1970s, about 2% of profits made by corporations were shifted to tax havens such as Bahamas, Anguilla, and Panama. By 2019, the amount had grown to 40%, with the use of corporate tax havens rising sharply in the past decade.

"Profit-shifting has increased relentlessly," tweeted Ludvig Wier, a co-author of the study and the head of secretariat at the Danish Ministry of Finance.

\u201cHow has global profit shifting to tax havens evolved from 1975-2019?\ud83d\udcb8\n\nMe & @gabriel_zucman investigate this in a new WP. https://t.co/god22Q4udb\n\nKey finding: profit shifting has increased relentlessly. In 2019, nearly $1Tn. was shifted to havens. (1/9)\ud83d\udc47\u201d— Ludvig Wier (@Ludvig Wier) 1667474445

The shift of profits to corporate tax havens has contributed to the loss of 10% of corporate tax revenues, estimated the authors, including Wier and French economist Gabriel Zucman.

"Of course, if there had been no profit-shifting, then countries may have chosen other policy paths, e.g. some might have been less likely to cut their corporate tax rate and engage in the 'race to the bottom,'" the study reads. "It illustrates, however, that the revenue losses caused by profit-shifting are a quantitatively important aspect of the decline in effective corporate income tax rates globally since the 1970s."

The researchers based the study on their analysis of which countries have lost the most in corporate tax revenue annually. Sixteen percent of tax revenue is lost to tax havens in the U.S. each year, according to that analysis, while 32% is lost in the U.K., 22% in France, and 29% in Germany.

"U.S. multinationals shift comparatively more profits (about 60% of their foreign profits) than multinationals from other countries (40% for the world on average)," wrote the authors. "The shareholders of U.S. multinationals thus appear to be the main winners from global profit-shifting."

The authors noted that the significant shifting of corporate profits to tax havens came after "major policy initiatives from the Organization for Economic Cooperation and Development (OECD)" and the 2017 tax reform package pushed through the U.S. Congress by the Republican Party, which included measures to ostensibly reduce corporate tax-dodging.

"The finding suggests that there remains a dire need for additional policy initiatives to significantly reduce global profit-shifting--such as implementing the global minimum corporate tax that more than 130 countries signed onto in 2021, but now remains in limbo as it is being blocked in the E.U. and the U.S.," said Wier.

The global corporate minimum tax would ensure all companies worldwide pay a minimum tax of 15% and would require higher taxes of large companies in countries where they have customers.

"The United Nations sustainable development goals clearly state that in order to deliver poverty reduction and to decrease global inequalities, illicit financial flows such as profit-shifting must decline," Wier said.

A first-of-its-kind analysis released Thursday shows how the amount of corporate profits being diverted to tax havens has skyrocketed in recent years with nearly $1 trillion in global profits being stored in places where corporate giants don't have to pay taxes.

The United Nations University World Institute for Development Economics Research (UNU-WIDER) studied corporate profits and profit-shifting between 1975 and 2019, finding that the diversion of massive profits is a "relatively new phenomenon."

In the 1970s, about 2% of profits made by corporations were shifted to tax havens such as Bahamas, Anguilla, and Panama. By 2019, the amount had grown to 40%, with the use of corporate tax havens rising sharply in the past decade.

"Profit-shifting has increased relentlessly," tweeted Ludvig Wier, a co-author of the study and the head of secretariat at the Danish Ministry of Finance.

\u201cHow has global profit shifting to tax havens evolved from 1975-2019?\ud83d\udcb8\n\nMe & @gabriel_zucman investigate this in a new WP. https://t.co/god22Q4udb\n\nKey finding: profit shifting has increased relentlessly. In 2019, nearly $1Tn. was shifted to havens. (1/9)\ud83d\udc47\u201d— Ludvig Wier (@Ludvig Wier) 1667474445

The shift of profits to corporate tax havens has contributed to the loss of 10% of corporate tax revenues, estimated the authors, including Wier and French economist Gabriel Zucman.

"Of course, if there had been no profit-shifting, then countries may have chosen other policy paths, e.g. some might have been less likely to cut their corporate tax rate and engage in the 'race to the bottom,'" the study reads. "It illustrates, however, that the revenue losses caused by profit-shifting are a quantitatively important aspect of the decline in effective corporate income tax rates globally since the 1970s."

The researchers based the study on their analysis of which countries have lost the most in corporate tax revenue annually. Sixteen percent of tax revenue is lost to tax havens in the U.S. each year, according to that analysis, while 32% is lost in the U.K., 22% in France, and 29% in Germany.

"U.S. multinationals shift comparatively more profits (about 60% of their foreign profits) than multinationals from other countries (40% for the world on average)," wrote the authors. "The shareholders of U.S. multinationals thus appear to be the main winners from global profit-shifting."

The authors noted that the significant shifting of corporate profits to tax havens came after "major policy initiatives from the Organization for Economic Cooperation and Development (OECD)" and the 2017 tax reform package pushed through the U.S. Congress by the Republican Party, which included measures to ostensibly reduce corporate tax-dodging.

"The finding suggests that there remains a dire need for additional policy initiatives to significantly reduce global profit-shifting--such as implementing the global minimum corporate tax that more than 130 countries signed onto in 2021, but now remains in limbo as it is being blocked in the E.U. and the U.S.," said Wier.

The global corporate minimum tax would ensure all companies worldwide pay a minimum tax of 15% and would require higher taxes of large companies in countries where they have customers.

"The United Nations sustainable development goals clearly state that in order to deliver poverty reduction and to decrease global inequalities, illicit financial flows such as profit-shifting must decline," Wier said.