SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

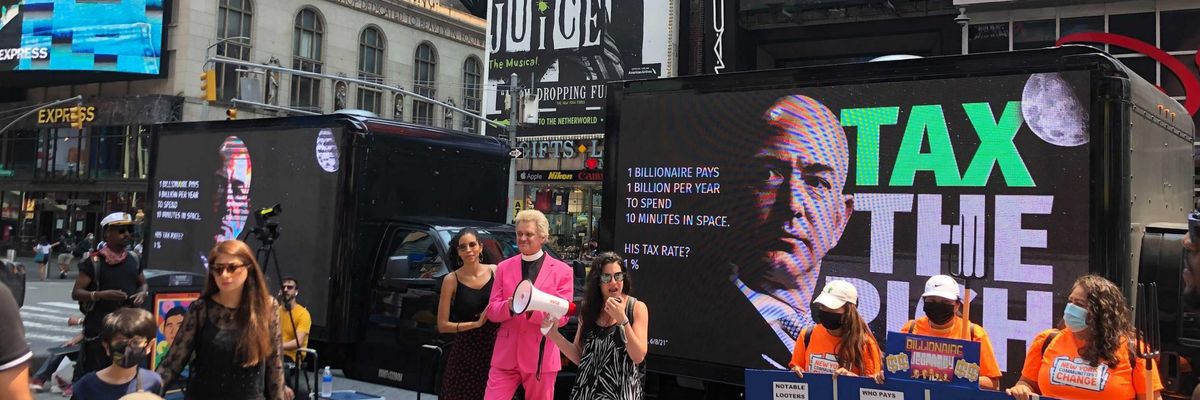

Demonstrators gathered in Times Square in New York City on July 27, 2021 to participate in a "Tax the Rich Game Show" and demand higher taxes on big corporations and wealthy people. (Photo: Tax March)

As the bombshell Pandora Papers continue to expose dubious details about how the world's superrich hide their fortunes and avoid paying their fair share of taxes, Bloomberg on Friday published an analysis of U.S. Federal Reserve data revealing that Americans in the top 1% income tier now have more wealth than the entire middle class.

According to Bloomberg:

The middle 60% of U.S. households by income--a measure economists often use as a definition of the middle class--saw their combined assets drop to 26.6% of national wealth as of June, the lowest in Federal Reserve data going back three decades. For the first time, the superrich had a bigger share, at 27%.

"Middle class" is defined here as households earning $27,000 to $141,000 annually, while the income threshold for membership in the 1% is $500,000 per year. According to the Fed data, 1.3 million U.S. households now have more wealth than the 77.8 million families in the middle 60%.

By comparison, in 1990 the top 1% held just 17% of the nation's wealth--less than half of the middle class' 36%. Since the Occupy Wall Street movement elevated conversation about "the 99% v. the 1%" from the lexicon of class warfare to mainstream debate a decade ago, the top 1% now enjoy a 5% bigger slice of the wealth "pie," at the expense of everyone else.

The middle class' share of real estate, equities, and private businesses has also steadily declined in recent decades. While the middle class owned 44% of U.S. real estate assets in 1991, its share is down to 38% today.

The new analysis comes as American politicians and people debate what fair taxation looks like.

While Republicans and right-wing Democrats in Congress vehemently oppose raising taxes on the wealthiest individuals and corporations, most Americans--including a slim majority of self-described Republicans--back President Joe Biden's plan to raise taxes on people earning over $400,000 annually, according to a recent survey by Data for Progress and Invest in America. The poll also found that a majority of Americans, including 47% of Republicans, support raising the tax rate on large corporations from 21% to 28%.

The Bloomberg report also comes amid ongoing revelations from the Pandora Papers, a tremendous trove of nearly 12 million documents whose contents include details about how the U.S. is a "spectacularly corrupt tax haven," as one journalist described the findings.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As the bombshell Pandora Papers continue to expose dubious details about how the world's superrich hide their fortunes and avoid paying their fair share of taxes, Bloomberg on Friday published an analysis of U.S. Federal Reserve data revealing that Americans in the top 1% income tier now have more wealth than the entire middle class.

According to Bloomberg:

The middle 60% of U.S. households by income--a measure economists often use as a definition of the middle class--saw their combined assets drop to 26.6% of national wealth as of June, the lowest in Federal Reserve data going back three decades. For the first time, the superrich had a bigger share, at 27%.

"Middle class" is defined here as households earning $27,000 to $141,000 annually, while the income threshold for membership in the 1% is $500,000 per year. According to the Fed data, 1.3 million U.S. households now have more wealth than the 77.8 million families in the middle 60%.

By comparison, in 1990 the top 1% held just 17% of the nation's wealth--less than half of the middle class' 36%. Since the Occupy Wall Street movement elevated conversation about "the 99% v. the 1%" from the lexicon of class warfare to mainstream debate a decade ago, the top 1% now enjoy a 5% bigger slice of the wealth "pie," at the expense of everyone else.

The middle class' share of real estate, equities, and private businesses has also steadily declined in recent decades. While the middle class owned 44% of U.S. real estate assets in 1991, its share is down to 38% today.

The new analysis comes as American politicians and people debate what fair taxation looks like.

While Republicans and right-wing Democrats in Congress vehemently oppose raising taxes on the wealthiest individuals and corporations, most Americans--including a slim majority of self-described Republicans--back President Joe Biden's plan to raise taxes on people earning over $400,000 annually, according to a recent survey by Data for Progress and Invest in America. The poll also found that a majority of Americans, including 47% of Republicans, support raising the tax rate on large corporations from 21% to 28%.

The Bloomberg report also comes amid ongoing revelations from the Pandora Papers, a tremendous trove of nearly 12 million documents whose contents include details about how the U.S. is a "spectacularly corrupt tax haven," as one journalist described the findings.

As the bombshell Pandora Papers continue to expose dubious details about how the world's superrich hide their fortunes and avoid paying their fair share of taxes, Bloomberg on Friday published an analysis of U.S. Federal Reserve data revealing that Americans in the top 1% income tier now have more wealth than the entire middle class.

According to Bloomberg:

The middle 60% of U.S. households by income--a measure economists often use as a definition of the middle class--saw their combined assets drop to 26.6% of national wealth as of June, the lowest in Federal Reserve data going back three decades. For the first time, the superrich had a bigger share, at 27%.

"Middle class" is defined here as households earning $27,000 to $141,000 annually, while the income threshold for membership in the 1% is $500,000 per year. According to the Fed data, 1.3 million U.S. households now have more wealth than the 77.8 million families in the middle 60%.

By comparison, in 1990 the top 1% held just 17% of the nation's wealth--less than half of the middle class' 36%. Since the Occupy Wall Street movement elevated conversation about "the 99% v. the 1%" from the lexicon of class warfare to mainstream debate a decade ago, the top 1% now enjoy a 5% bigger slice of the wealth "pie," at the expense of everyone else.

The middle class' share of real estate, equities, and private businesses has also steadily declined in recent decades. While the middle class owned 44% of U.S. real estate assets in 1991, its share is down to 38% today.

The new analysis comes as American politicians and people debate what fair taxation looks like.

While Republicans and right-wing Democrats in Congress vehemently oppose raising taxes on the wealthiest individuals and corporations, most Americans--including a slim majority of self-described Republicans--back President Joe Biden's plan to raise taxes on people earning over $400,000 annually, according to a recent survey by Data for Progress and Invest in America. The poll also found that a majority of Americans, including 47% of Republicans, support raising the tax rate on large corporations from 21% to 28%.

The Bloomberg report also comes amid ongoing revelations from the Pandora Papers, a tremendous trove of nearly 12 million documents whose contents include details about how the U.S. is a "spectacularly corrupt tax haven," as one journalist described the findings.