Amazon Watch and Stand.earth revealed Thursday that major European and U.S. banks are at high risk of funding corruption, environmental harms, and human rights violations in the Amazon basin--along with exacerbating the climate emergency and escalating deforestation--due to their relationships with fossil fuel companies and traders.

"These policies have loopholes that allow money to continue to flow to companies involved in oil expansion, deforestation, biodiversity loss, pollution, corruption, and the violation of Indigenous peoples' rights."

--Angeline Robertson, Stand.earth

The advocacy groups' new report, entitled Banking on Amazon Destruction (pdf), evaluates banks' environmental and social risk (ESR) policies compared with their finance and investment decisions in the incredibly biodiverse Amazon.

In other words, the report and resulting scorecard weigh banks' risk management versus exposure in one of the world's most vital yet gravely threatened regions..

"Our research reveals the environmental and social risk frameworks banks rely on are inherently flawed," said Angeline Robertson, senior investigative researcher at Stand.earth Research Group and one of the lead authors of the report, in a statement.

Robertson explained that "banks might follow what they consider best practices in ESR, but these policies have loopholes that allow money to continue to flow to companies involved in oil expansion, deforestation, biodiversity loss, pollution, corruption, and the violation of Indigenous peoples' rights."

"To put it simply, banks' current ESR policies are failing them," she said. "These policies do not adequately manage risks, are not strong enough to avoid Amazon destruction, and do not meet the urgent need to stop fossil fuel expansion globally."

The report, which references the recent conclusion by the International Energy Agency (IEA) that fossil fuel extraction must cease for the world to achieve a net-zero energy system by 2050, begins with a warning:

The Amazon is at a tipping point. Further oil and gas extraction, a major driver of deforestation, will push the biome--essential for climate change mitigation and home to 400+ Indigenous nationalities that defend and depend on it--to the brink of irreversible collapse. It is one of the last places in the world to be expanding oil exploration or production, particularly as Paris climate agreement imperatives make clear no new fossil fuel expansion should happen anywhere.

The Paris agreement--which aims to limit global temperature rise to "well below" 2degC, and preferably to 1.5degC, compared to pre-industrial levels by 2100--will be the focus of a November climate summit in Scotland.

Despite the impact on the global climate, as well as on the local environment and human rights, "many banks continue to fund oil and gas companies and traders active in the Amazon," the report says.

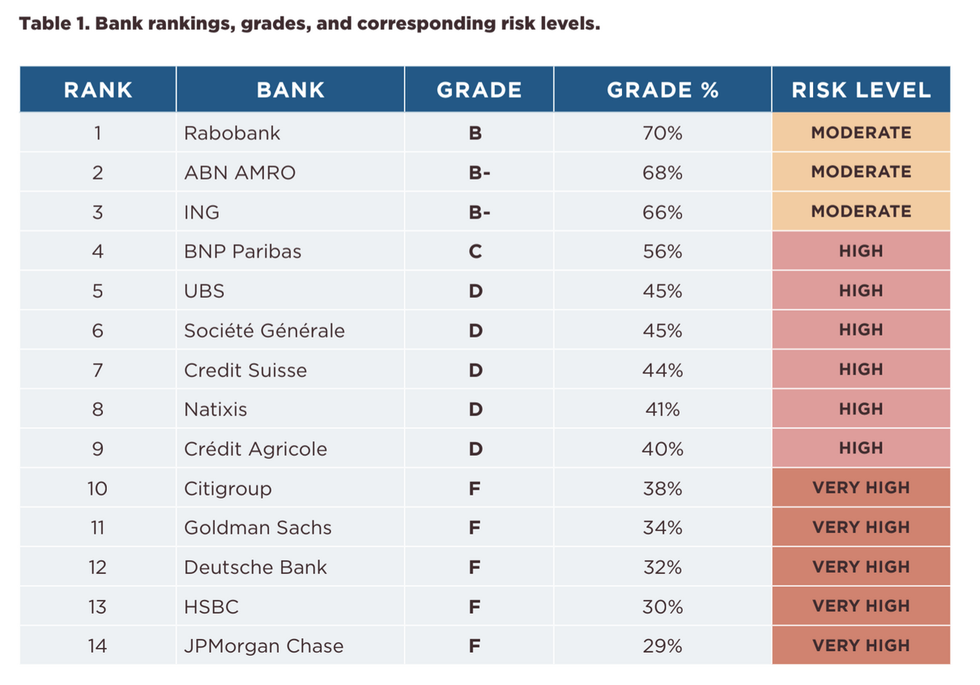

Of the 14 banks ranked by Amazon Watch and Stand.earth, five--Citigroup, Goldman Sachs, Deutsche Bank, HSBC, and JPMorgan Chase--received "F" grades and were deemed at "very high" risk of complicity in Amazon destruction.

"All of the banks in this scorecard were provided with a copy of their initial score and given a chance to respond," the report notes. "In most instances, these clarifications improved their scores."

One key finding was that several of the banks named in the report "hold hundreds of millions of dollars in bonds issued to Petroamazonas," Ecuador's national oil company, which is responsible for thousands of spills over the past decade. Petroamazonas, the groups explain, is leading oil expansion in Yasuni National Park, a UNESCO Biosphere Reserve "where the process of building roads to access new oil drilling sites often triggers deforestation, and brings drilling to the doorstep of Indigenous peoples living in voluntary isolation."

Amazon Watch and Stand.earth also accuse JPMorgan Chase and Deutsche Bank of "dragging their heels on implementing sound ESR policies," and call out Credit Suisse for continuing to "finance the trade of oil from the Putumayo region in the Colombian Amazon, which faces heavy Indigenous resistance and brutal police crackdowns, despite existing biodiversity and human rights policies that clearly indicate it should not be financing in the region."

In their statement Thursday, the groups noted:

Since the report text was finalized, Amazon Watch investigators have learned that JPMorgan Chase and Credit Suisse, along with another bank not listed in this report, recently helped arrange the issuance of a $150 million dollar bond for GeoPark, a Chilean oil company currently operating in the Colombian Amazon that is allegedly paying paramilitary groups to ensure the continuation of its operations on and near the territories of Indigenous groups that opposed oil operations.

Under global pressure, many major banks have recently enacted policies of refusing to support fossil fuel development in the Arctic. The advocacy groups encourage a similar approach to the Amazon, calling for an end to new financing by 2022 and existing financing by 2025.

"If banks have Arctic exclusions to protect biodiversity and fragile ecosystems, and the same logic can be applied to the Amazon, then why don't banks have exclusions for the Amazon?" asked Moira Birss, climate and finance director at Amazon Watch.

"Are banks going to continue to rely on mediocre risk management policies that they don't even follow," Birss added, "or take a bold step that will actually end their contribution to the destruction of this critical ecosystem?"

The report and a related video also highlight a call for policy changes from Jose Gregorio Diaz Mirabal, general coordinator of the Coordinating Body of the Indigenous Organizations of the Amazon Basin (COICA).

"For centuries, the Indigenous peoples have been responsible for the preservation of the largest forest on the planet," he said. "We are being killed for defending our home."

Diaz Mirabal said that "an Amazon biome-wide exclusion of all oil and gas finance and investment, aimed at stopping oil expansion in the most biodiverse place on the planet, will keep the Amazon Rainforest off the precipice of a disastrous ecological tipping point, eliminate toxic oil-related disasters, and end rights violations perpetrated by the industry."

"This is the path for a possible planet and the way for us to guarantee that our rights are respected," he concluded. "The financial sector must invest in recovering what has already been lost and finance the solutions our peoples offer to humanity in the climate change era."

The new report comes after an August 2020 investigation by Amazon Watch and Stand.earth into European banks financing the trade of oil from the Amazon Sacred Headwaters region in Ecuador to the United States.

While that expose led to commitments from the top lenders to uphold their ESR policies, Thursday's report says, "as we engaged in dialogue with these and other banks, we uncovered additional issues, loopholes, and relationships, leading us to eventually identify 14 banks in Europe and the U.S. that are involved in the oil industry across the Amazon basin, seemingly in contradiction to their sustainability commitments and policies."

Some of those same institutions are also prominently featured in a March 2021 report from Rainforest Action Network (RAN) and other advocacy groups detailing how the world's 60 largest banks have poured over $3.8 trillion into the fossil fuel industry since the Paris agreement was adopted in 2015.

"U.S.-based banks continue to be the worst financiers of fossil fuels by a wide margin. Going into the Glasgow climate summit at the end of the year, the stakes could not be higher," RAN executive director Ginger Cassady said at the time. "Wall Street must act now to stop financing fossil expansion and commit to fossil zero, so as to truly align its financing practices with keeping our planet from heating up more than 1.5 degrees."