SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry," Bartlett Naylor, financial policy advocate for Public Citizen's Congress Watch division, said in a statement. (Photo: Bloomberg)

The 2008 financial meltdown inflicted devastating financial and psychological damage upon millions of ordinary Americans, but a new report released by Public Citizen on Tuesday shows the Wall Street banks that caused the crash with their reckless speculation and outright fraud have done phenomenally well in the ten years since the crisis.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry."

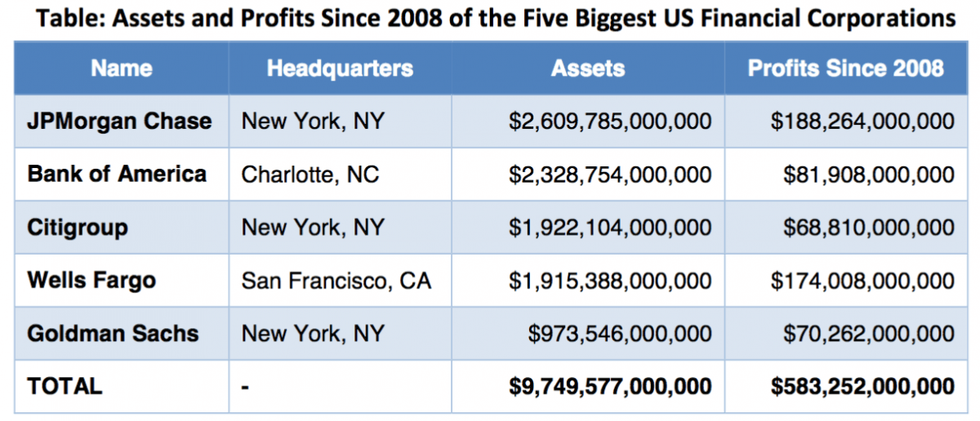

--Bartlett Naylor, Public CitizenThanks to the Obama administration's decision to rescue collapsing Wall Street banks with taxpayer cash and the Trump administration's massive tax cuts and deregulatory push, America's five largest banks--JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs--have raked in more than $583 billion in combined profits over the past decade, Public Citizen found in its analysis marking the ten-year anniversary of the crisis.

"With no jail time for executives and half a trillion in post-crisis profits," said Robert Weissman, president of Public Citizen, "the big banks have made out like bandits during the post-crash period. Like bandits."

Using data from the Federal Reserve, Public Citizen also calculated that America's the banks now hold a combined $9.7 trillion in assets.

"In the aftermath of the Great Recession, American families continue to struggle. A new report by the Urban Institute finds that nearly 40 percent of Americans had trouble paying for basic needs such as food, housing or utilities in 2017," Public Citizen notes in its report. "The banks, on the other hand--with more than half a trillion dollars in profits over the past decade--are doing just fine."

If recent earnings reports are any indicator, big banks are on track to continue shattering profit records thanks to President Donald Trump's $1.5 trillion in tax cuts. Big banks are also expected to see a boost from a recently passed bipartisan deregulatory bill that analysts argue significantly heightens the risk of another crash.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry," Bartlett Naylor, financial policy advocate for Public Citizen's Congress Watch division, said in a statement.

According to a Washington Post analysis published on Saturday, many of the lawmakers and congressional aides who helped craft the Democratic Congress' regulatory response to the 2008 crisis have gone on to work for Wall Street in the hopes of benefiting from big banks' booming profits.

"Ten years after the financial crisis brought the U.S. economy to its knees, about 30 percent of the lawmakers and 40 percent of the senior staff who crafted Congress' response have gone to work for or on behalf of the financial industry," noted the Post's Jeff Stein.

Meanwhile, Main Street Americans who lost their homes, jobs, and savings as a result of the greed-driven crash are still struggling to get by on stagnant or declining wages, even as unemployment falls and the economy continues to grow at a steady clip.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The 2008 financial meltdown inflicted devastating financial and psychological damage upon millions of ordinary Americans, but a new report released by Public Citizen on Tuesday shows the Wall Street banks that caused the crash with their reckless speculation and outright fraud have done phenomenally well in the ten years since the crisis.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry."

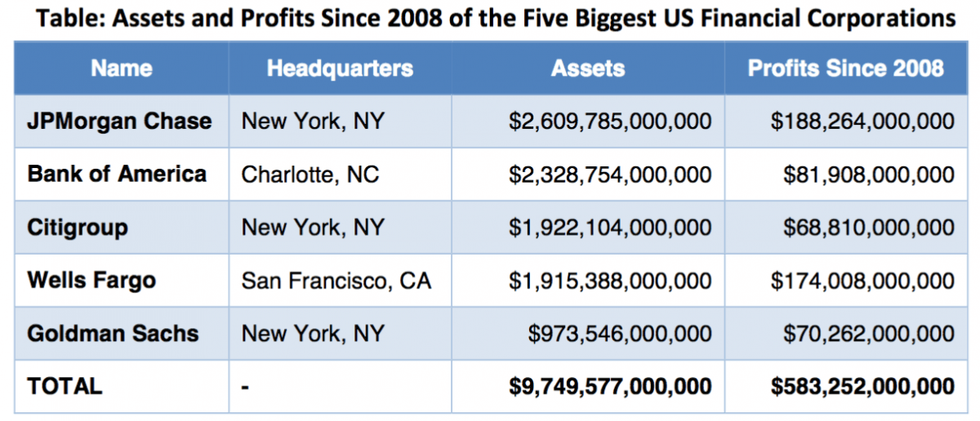

--Bartlett Naylor, Public CitizenThanks to the Obama administration's decision to rescue collapsing Wall Street banks with taxpayer cash and the Trump administration's massive tax cuts and deregulatory push, America's five largest banks--JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs--have raked in more than $583 billion in combined profits over the past decade, Public Citizen found in its analysis marking the ten-year anniversary of the crisis.

"With no jail time for executives and half a trillion in post-crisis profits," said Robert Weissman, president of Public Citizen, "the big banks have made out like bandits during the post-crash period. Like bandits."

Using data from the Federal Reserve, Public Citizen also calculated that America's the banks now hold a combined $9.7 trillion in assets.

"In the aftermath of the Great Recession, American families continue to struggle. A new report by the Urban Institute finds that nearly 40 percent of Americans had trouble paying for basic needs such as food, housing or utilities in 2017," Public Citizen notes in its report. "The banks, on the other hand--with more than half a trillion dollars in profits over the past decade--are doing just fine."

If recent earnings reports are any indicator, big banks are on track to continue shattering profit records thanks to President Donald Trump's $1.5 trillion in tax cuts. Big banks are also expected to see a boost from a recently passed bipartisan deregulatory bill that analysts argue significantly heightens the risk of another crash.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry," Bartlett Naylor, financial policy advocate for Public Citizen's Congress Watch division, said in a statement.

According to a Washington Post analysis published on Saturday, many of the lawmakers and congressional aides who helped craft the Democratic Congress' regulatory response to the 2008 crisis have gone on to work for Wall Street in the hopes of benefiting from big banks' booming profits.

"Ten years after the financial crisis brought the U.S. economy to its knees, about 30 percent of the lawmakers and 40 percent of the senior staff who crafted Congress' response have gone to work for or on behalf of the financial industry," noted the Post's Jeff Stein.

Meanwhile, Main Street Americans who lost their homes, jobs, and savings as a result of the greed-driven crash are still struggling to get by on stagnant or declining wages, even as unemployment falls and the economy continues to grow at a steady clip.

The 2008 financial meltdown inflicted devastating financial and psychological damage upon millions of ordinary Americans, but a new report released by Public Citizen on Tuesday shows the Wall Street banks that caused the crash with their reckless speculation and outright fraud have done phenomenally well in the ten years since the crisis.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry."

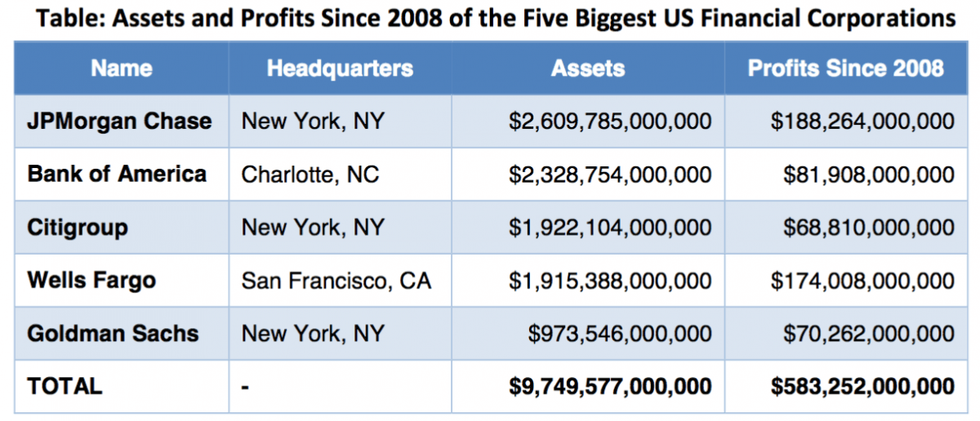

--Bartlett Naylor, Public CitizenThanks to the Obama administration's decision to rescue collapsing Wall Street banks with taxpayer cash and the Trump administration's massive tax cuts and deregulatory push, America's five largest banks--JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs--have raked in more than $583 billion in combined profits over the past decade, Public Citizen found in its analysis marking the ten-year anniversary of the crisis.

"With no jail time for executives and half a trillion in post-crisis profits," said Robert Weissman, president of Public Citizen, "the big banks have made out like bandits during the post-crash period. Like bandits."

Using data from the Federal Reserve, Public Citizen also calculated that America's the banks now hold a combined $9.7 trillion in assets.

"In the aftermath of the Great Recession, American families continue to struggle. A new report by the Urban Institute finds that nearly 40 percent of Americans had trouble paying for basic needs such as food, housing or utilities in 2017," Public Citizen notes in its report. "The banks, on the other hand--with more than half a trillion dollars in profits over the past decade--are doing just fine."

If recent earnings reports are any indicator, big banks are on track to continue shattering profit records thanks to President Donald Trump's $1.5 trillion in tax cuts. Big banks are also expected to see a boost from a recently passed bipartisan deregulatory bill that analysts argue significantly heightens the risk of another crash.

"Wall Street's grip on Washington is painfully evident in the corporate tax giveaways and deregulatory favors that Congress routinely bestows to this bonus-besotted industry," Bartlett Naylor, financial policy advocate for Public Citizen's Congress Watch division, said in a statement.

According to a Washington Post analysis published on Saturday, many of the lawmakers and congressional aides who helped craft the Democratic Congress' regulatory response to the 2008 crisis have gone on to work for Wall Street in the hopes of benefiting from big banks' booming profits.

"Ten years after the financial crisis brought the U.S. economy to its knees, about 30 percent of the lawmakers and 40 percent of the senior staff who crafted Congress' response have gone to work for or on behalf of the financial industry," noted the Post's Jeff Stein.

Meanwhile, Main Street Americans who lost their homes, jobs, and savings as a result of the greed-driven crash are still struggling to get by on stagnant or declining wages, even as unemployment falls and the economy continues to grow at a steady clip.