"By running up a $1.4 trillion deficit, the Republicans are paving the way for massive cuts to Social Securirty, Medicare, and Medicaid," Sen. Bernie Sanders concluded in a statement. (Photo: takomabibelot/Flickr/cc)

GOP Tax Plan Would Give 15 of America's Largest Corporations a $236B Tax Cut: Report

If you needed any more evidence that the GOP tax bill is a massive giveaway to the most profitable corporations in the country, a new report prepared for Sen. Bernie Sanders provides it

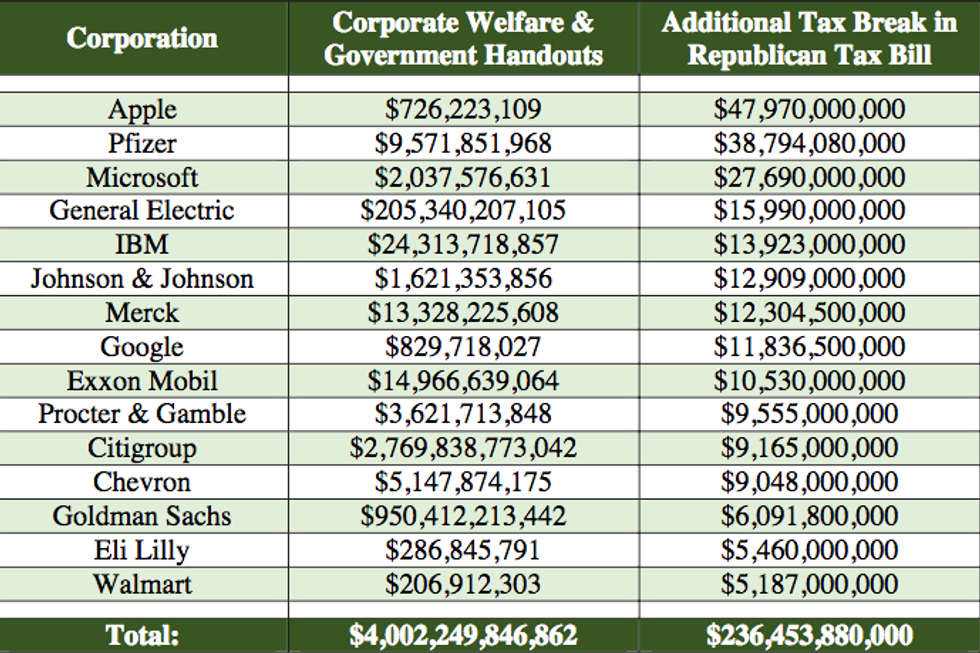

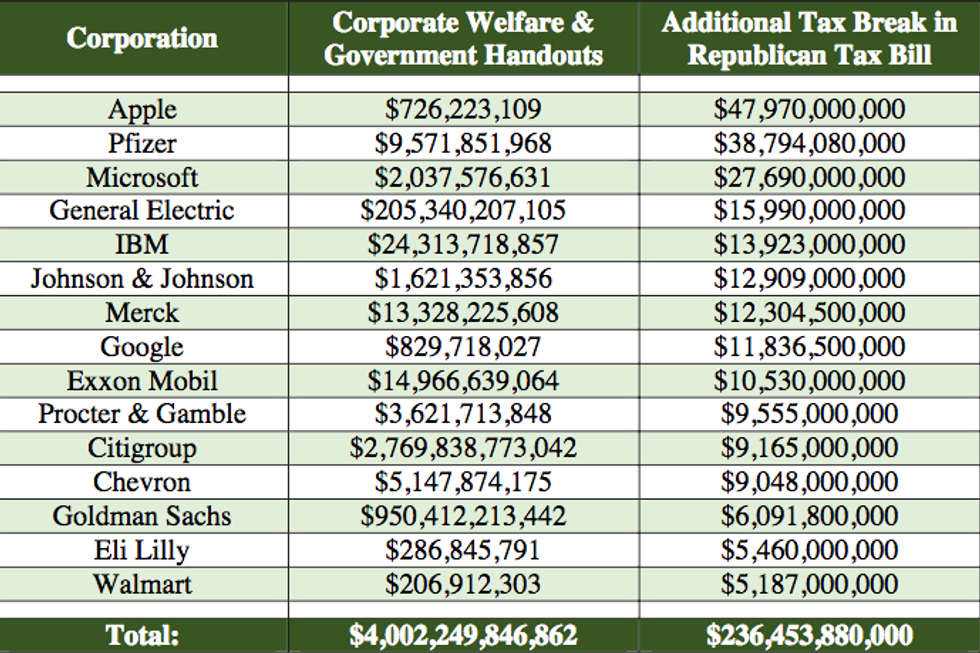

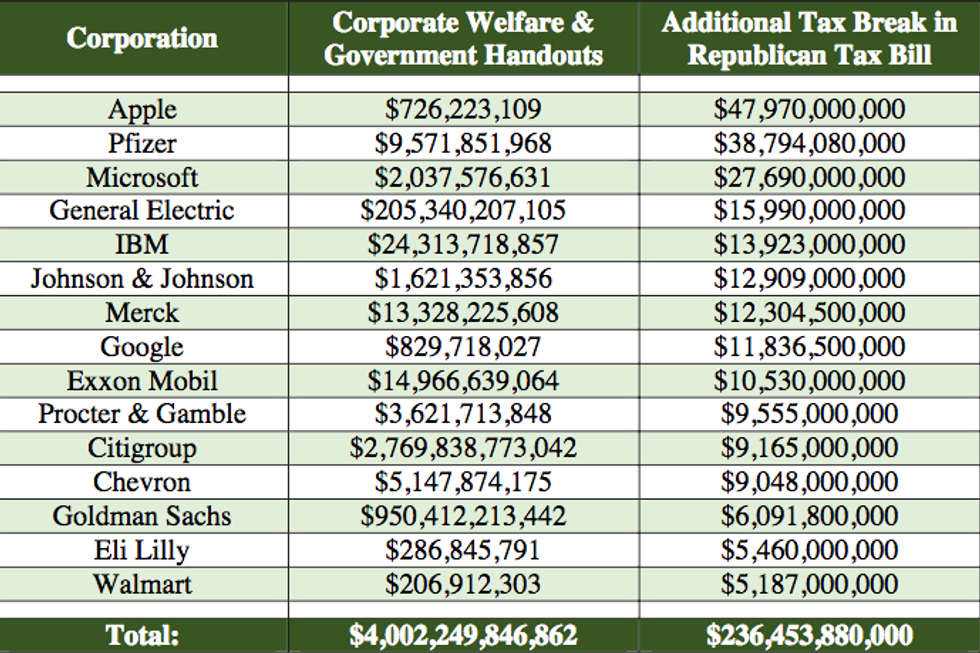

In "further proof that the Republican tax bill is a massive giveaway to the largest corporations in the country," a new report (pdf) prepared for Sen. Bernie Sanders (I-Vt.) and published on Monday found that 15 of America's most profitable corporations would receive a combined $236 billion tax cut if the GOP plan becomes law.

Released as Republicans gear up for a final vote on their tax bill as early as Tuesday, the report notes that "[o]ver the last 30 years, 15 of the largest U.S. corporations have accepted $3.9 trillion of corporate welfare in the form of subsidies, tax credits, and bailouts, and another $108 billion in government handouts in the form of federal contracts."

"On top of this $4 trillion boondoggle," the analysis adds, "Republicans want to give these corporations an additional $236 billion tax cut."

Among the companies the report highlights are Apple, Pfizer, and Walmart, all of which utilize fancy "accounting tricks to dodge taxes" while also taking advantage of government programs that add to their bottomlines at the expense of American taxpayers.

The report goes on to observe that far from living up to its lofty goal of discouraging outsourcing, the deeply unpopular GOP tax bill actually "encourages companies to shift their jobs and profits overseas by moving to a 'territorial' tax system that would exempt future offshore profits of U.S. subsidiaries from taxation."

While these companies stand to benefit massively from the GOP's bill, "more than half of middle class families will pay more in taxes at the end of ten years," Sanders said in a statement.

"Further, by running up a $1.4 trillion deficit, the Republicans are paving the way for massive cuts to Social Securirty, Medicare, and Medicaid," Sanders concluded. "This is a tax bill written for wealthy Republican campaign contributors, not for the average American. It must be defeated."

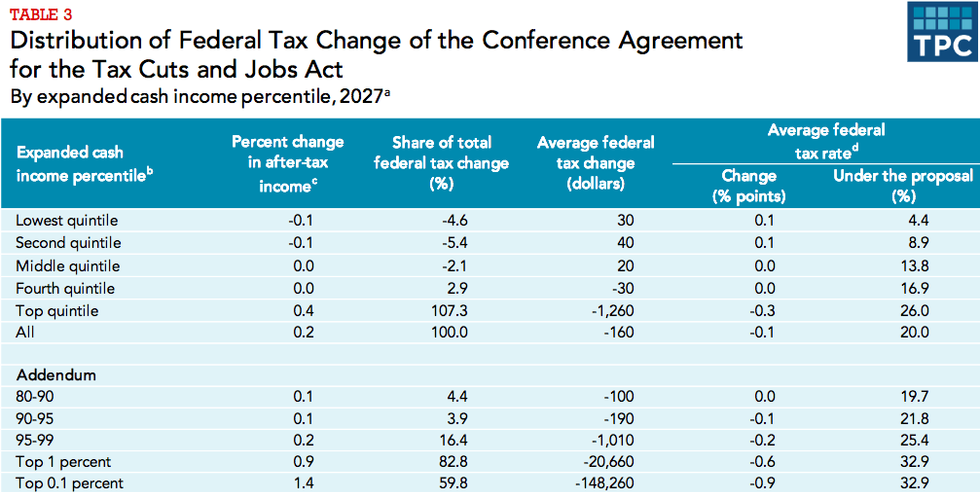

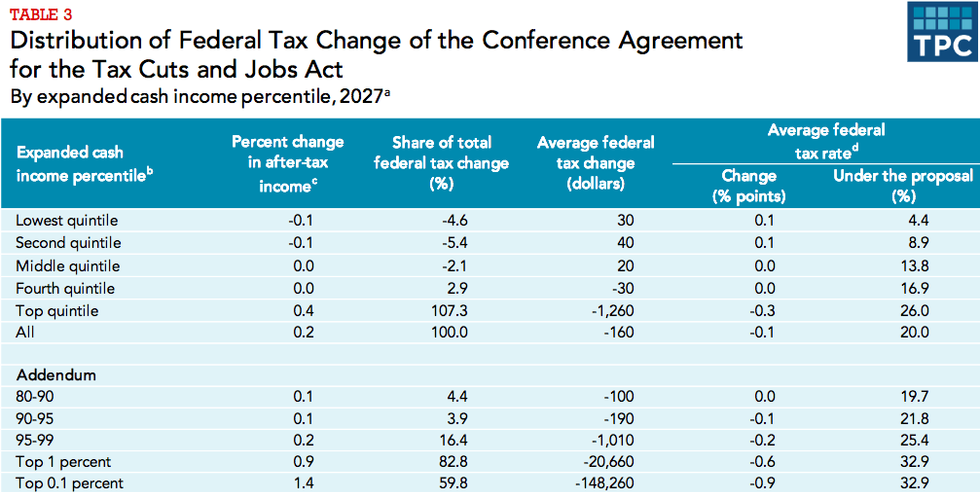

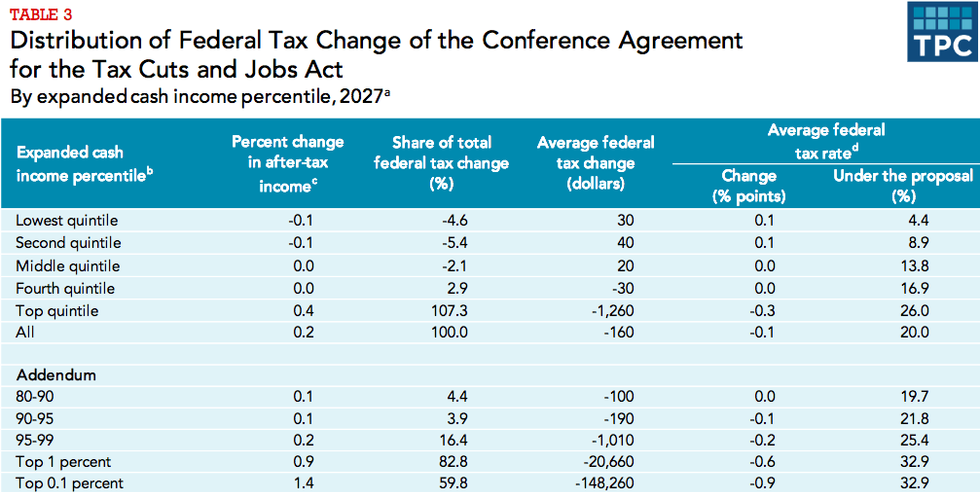

Sanders' report coincides with an analysis (pdf) released Monday by the nonpartisan Tax Policy Center, which found that over 82 percent of the GOP bill's benefits would go to the top one percent of Americans and nearly 60 percent would go to the top 0.1 percent by 2027.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In "further proof that the Republican tax bill is a massive giveaway to the largest corporations in the country," a new report (pdf) prepared for Sen. Bernie Sanders (I-Vt.) and published on Monday found that 15 of America's most profitable corporations would receive a combined $236 billion tax cut if the GOP plan becomes law.

Released as Republicans gear up for a final vote on their tax bill as early as Tuesday, the report notes that "[o]ver the last 30 years, 15 of the largest U.S. corporations have accepted $3.9 trillion of corporate welfare in the form of subsidies, tax credits, and bailouts, and another $108 billion in government handouts in the form of federal contracts."

"On top of this $4 trillion boondoggle," the analysis adds, "Republicans want to give these corporations an additional $236 billion tax cut."

Among the companies the report highlights are Apple, Pfizer, and Walmart, all of which utilize fancy "accounting tricks to dodge taxes" while also taking advantage of government programs that add to their bottomlines at the expense of American taxpayers.

The report goes on to observe that far from living up to its lofty goal of discouraging outsourcing, the deeply unpopular GOP tax bill actually "encourages companies to shift their jobs and profits overseas by moving to a 'territorial' tax system that would exempt future offshore profits of U.S. subsidiaries from taxation."

While these companies stand to benefit massively from the GOP's bill, "more than half of middle class families will pay more in taxes at the end of ten years," Sanders said in a statement.

"Further, by running up a $1.4 trillion deficit, the Republicans are paving the way for massive cuts to Social Securirty, Medicare, and Medicaid," Sanders concluded. "This is a tax bill written for wealthy Republican campaign contributors, not for the average American. It must be defeated."

Sanders' report coincides with an analysis (pdf) released Monday by the nonpartisan Tax Policy Center, which found that over 82 percent of the GOP bill's benefits would go to the top one percent of Americans and nearly 60 percent would go to the top 0.1 percent by 2027.

In "further proof that the Republican tax bill is a massive giveaway to the largest corporations in the country," a new report (pdf) prepared for Sen. Bernie Sanders (I-Vt.) and published on Monday found that 15 of America's most profitable corporations would receive a combined $236 billion tax cut if the GOP plan becomes law.

Released as Republicans gear up for a final vote on their tax bill as early as Tuesday, the report notes that "[o]ver the last 30 years, 15 of the largest U.S. corporations have accepted $3.9 trillion of corporate welfare in the form of subsidies, tax credits, and bailouts, and another $108 billion in government handouts in the form of federal contracts."

"On top of this $4 trillion boondoggle," the analysis adds, "Republicans want to give these corporations an additional $236 billion tax cut."

Among the companies the report highlights are Apple, Pfizer, and Walmart, all of which utilize fancy "accounting tricks to dodge taxes" while also taking advantage of government programs that add to their bottomlines at the expense of American taxpayers.

The report goes on to observe that far from living up to its lofty goal of discouraging outsourcing, the deeply unpopular GOP tax bill actually "encourages companies to shift their jobs and profits overseas by moving to a 'territorial' tax system that would exempt future offshore profits of U.S. subsidiaries from taxation."

While these companies stand to benefit massively from the GOP's bill, "more than half of middle class families will pay more in taxes at the end of ten years," Sanders said in a statement.

"Further, by running up a $1.4 trillion deficit, the Republicans are paving the way for massive cuts to Social Securirty, Medicare, and Medicaid," Sanders concluded. "This is a tax bill written for wealthy Republican campaign contributors, not for the average American. It must be defeated."

Sanders' report coincides with an analysis (pdf) released Monday by the nonpartisan Tax Policy Center, which found that over 82 percent of the GOP bill's benefits would go to the top one percent of Americans and nearly 60 percent would go to the top 0.1 percent by 2027.