SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

According to the Center on Budget and Policy Priorities, corporate profits are "near all-time highs." Wages for most workers, meanwhile, have been stagnant for decades. (Photo: Jason Hargrove/Flickr/cc)

Corporate profits are up. Wages remain low. And, as always, the richest are angling for ever-lower tax rates.

Only 0.1 percent of full-time workers earning the minimum wage can afford to rent a one-bedroom apartment in any state in the U.S., but judging by their tax agenda, the Republican Party and President Donald Trump appear to feel it is massive corporations and billionaires--not American workers--who need an income boost.

"Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe."

-- Economic Policy Institute

Attempting to justify his push to give massive tax breaks to the wealthiest Americans and the largest corporations, Trump has repeatedly argued that businesses are being strangled by high tax rates. The GOP's new televised ad campaign blares the same message: American corporations pay the "highest tax rates in the world," it states.

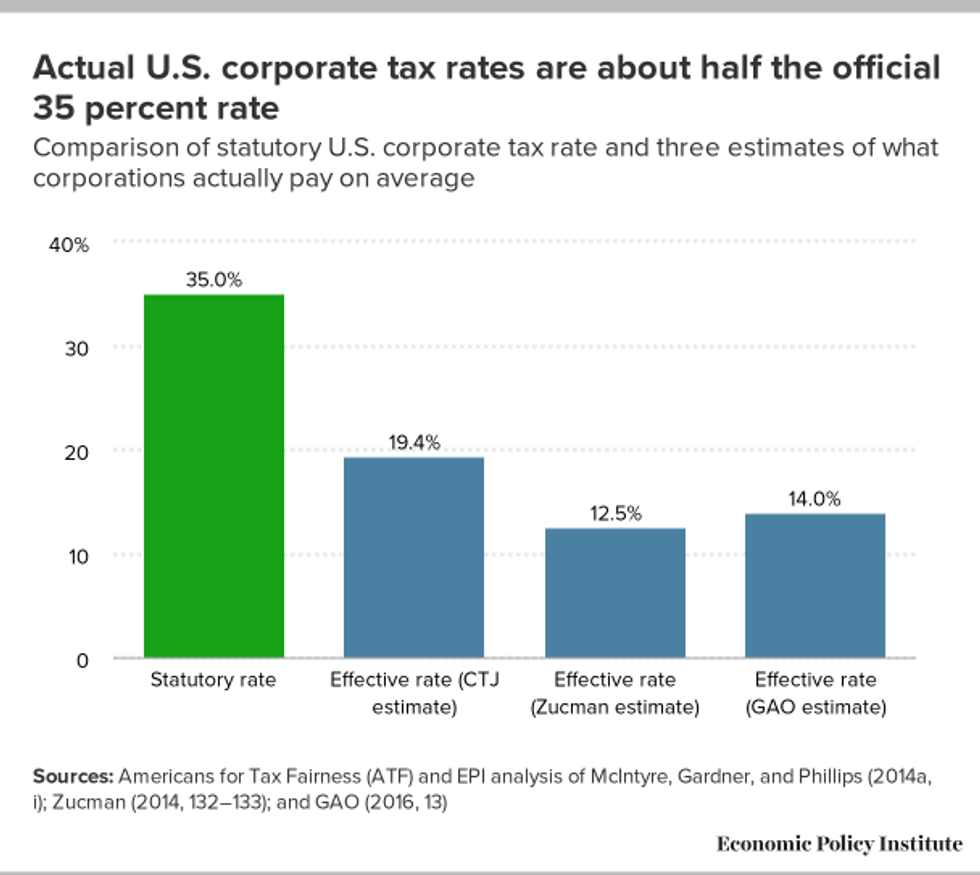

A new analysis by the Economic Policy Institute (EPI) finds, however, that this "talking point" is "misleading because what corporations actually pay (their effective rate) is far lower" than the statutory rate of 35 percent.

By taking advantage of various loopholes and tax avoidance strategies, EPI's Hunter Blair notes, American corporations are able to pay far less than what they owe, thus drastically reducing government revenue and bolstering their bottom lines.

Their efforts have been very effective: According to the Center on Budget and Policy Priorities, corporate profits are "near all-time highs." Wages for most workers, meanwhile, have been stagnant for decades.

EPI goes on to argue that any genuine overhaul of the tax system would focus not on cutting corporate taxes, but on closing tax loopholes.

But Trump has indicated that he plans to do the opposite, the organization notes:

Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe. Instead, the Trump administration has reversed its position on commitments to close the deferral loophole, and their most recent proposal followed congressional Republicans' plans to institute a territorial tax system, which would no longer tax multinational corporations' offshore profits at all. At its core, a territorial tax system makes the deferral loophole permanent.

As Common Dreams reported on Wednesday, Republicans and their corporate benefactors have begun to aggressively promote their pivot to tax reform following their failed attempt to repeal the Affordable Care Act.

Activist groups have warned that in order to achieve their expressed goal of lowering tax rates "as much as possible," Republicans will take aim--as they already have--at key safety net programs that primarily benefit low-income families.

Indivisible has published a toolkit for those looking to resist Republicans' proposed "giveaway to corporations."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Corporate profits are up. Wages remain low. And, as always, the richest are angling for ever-lower tax rates.

Only 0.1 percent of full-time workers earning the minimum wage can afford to rent a one-bedroom apartment in any state in the U.S., but judging by their tax agenda, the Republican Party and President Donald Trump appear to feel it is massive corporations and billionaires--not American workers--who need an income boost.

"Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe."

-- Economic Policy Institute

Attempting to justify his push to give massive tax breaks to the wealthiest Americans and the largest corporations, Trump has repeatedly argued that businesses are being strangled by high tax rates. The GOP's new televised ad campaign blares the same message: American corporations pay the "highest tax rates in the world," it states.

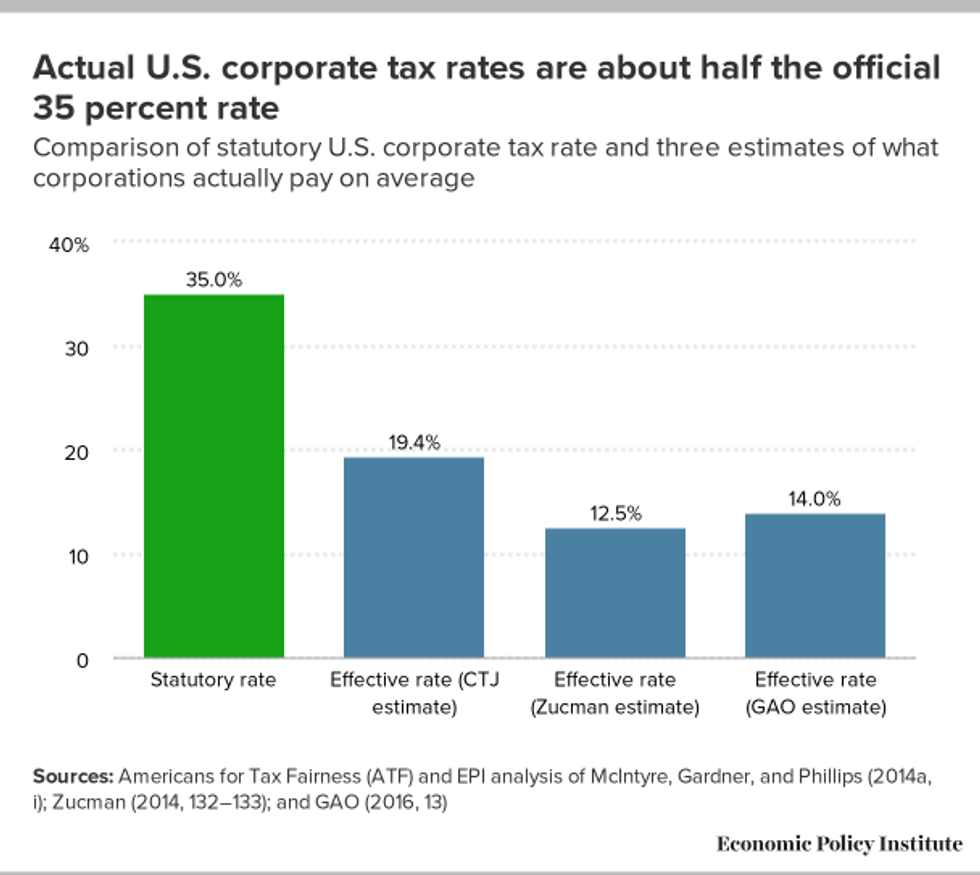

A new analysis by the Economic Policy Institute (EPI) finds, however, that this "talking point" is "misleading because what corporations actually pay (their effective rate) is far lower" than the statutory rate of 35 percent.

By taking advantage of various loopholes and tax avoidance strategies, EPI's Hunter Blair notes, American corporations are able to pay far less than what they owe, thus drastically reducing government revenue and bolstering their bottom lines.

Their efforts have been very effective: According to the Center on Budget and Policy Priorities, corporate profits are "near all-time highs." Wages for most workers, meanwhile, have been stagnant for decades.

EPI goes on to argue that any genuine overhaul of the tax system would focus not on cutting corporate taxes, but on closing tax loopholes.

But Trump has indicated that he plans to do the opposite, the organization notes:

Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe. Instead, the Trump administration has reversed its position on commitments to close the deferral loophole, and their most recent proposal followed congressional Republicans' plans to institute a territorial tax system, which would no longer tax multinational corporations' offshore profits at all. At its core, a territorial tax system makes the deferral loophole permanent.

As Common Dreams reported on Wednesday, Republicans and their corporate benefactors have begun to aggressively promote their pivot to tax reform following their failed attempt to repeal the Affordable Care Act.

Activist groups have warned that in order to achieve their expressed goal of lowering tax rates "as much as possible," Republicans will take aim--as they already have--at key safety net programs that primarily benefit low-income families.

Indivisible has published a toolkit for those looking to resist Republicans' proposed "giveaway to corporations."

Corporate profits are up. Wages remain low. And, as always, the richest are angling for ever-lower tax rates.

Only 0.1 percent of full-time workers earning the minimum wage can afford to rent a one-bedroom apartment in any state in the U.S., but judging by their tax agenda, the Republican Party and President Donald Trump appear to feel it is massive corporations and billionaires--not American workers--who need an income boost.

"Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe."

-- Economic Policy Institute

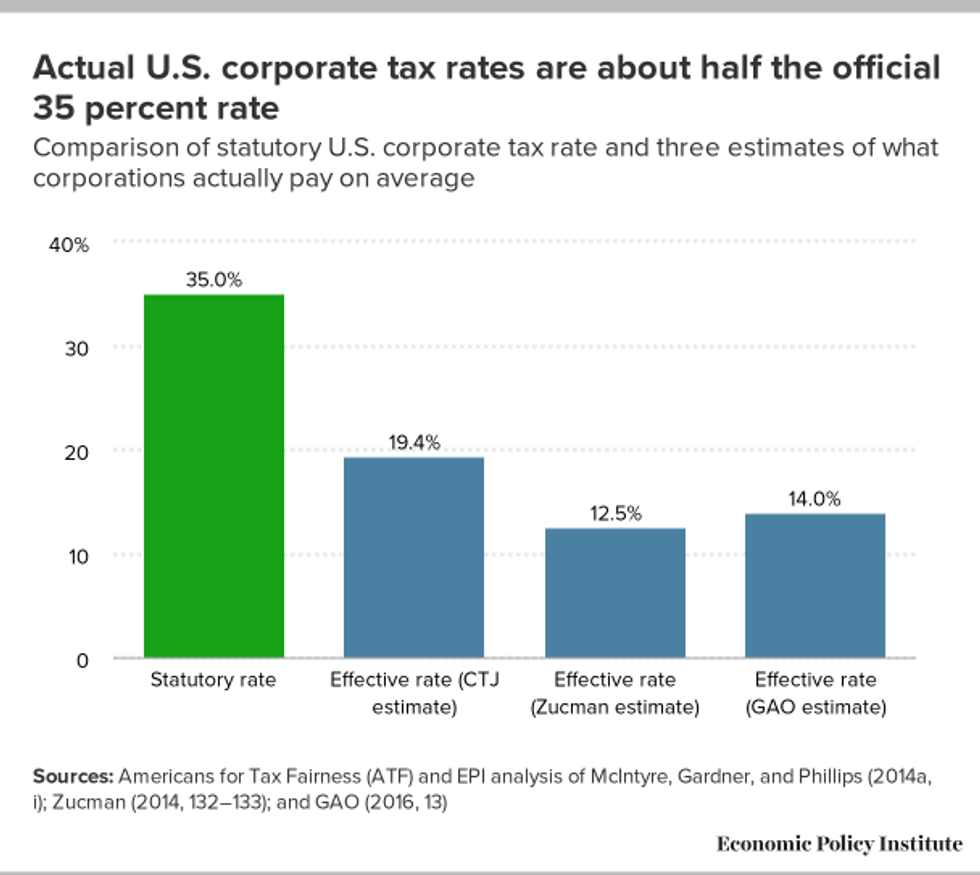

Attempting to justify his push to give massive tax breaks to the wealthiest Americans and the largest corporations, Trump has repeatedly argued that businesses are being strangled by high tax rates. The GOP's new televised ad campaign blares the same message: American corporations pay the "highest tax rates in the world," it states.

A new analysis by the Economic Policy Institute (EPI) finds, however, that this "talking point" is "misleading because what corporations actually pay (their effective rate) is far lower" than the statutory rate of 35 percent.

By taking advantage of various loopholes and tax avoidance strategies, EPI's Hunter Blair notes, American corporations are able to pay far less than what they owe, thus drastically reducing government revenue and bolstering their bottom lines.

Their efforts have been very effective: According to the Center on Budget and Policy Priorities, corporate profits are "near all-time highs." Wages for most workers, meanwhile, have been stagnant for decades.

EPI goes on to argue that any genuine overhaul of the tax system would focus not on cutting corporate taxes, but on closing tax loopholes.

But Trump has indicated that he plans to do the opposite, the organization notes:

Real tax reform would close the deferral loophole and ensure that large multinational corporations cannot continue to dodge the taxes they owe. Instead, the Trump administration has reversed its position on commitments to close the deferral loophole, and their most recent proposal followed congressional Republicans' plans to institute a territorial tax system, which would no longer tax multinational corporations' offshore profits at all. At its core, a territorial tax system makes the deferral loophole permanent.

As Common Dreams reported on Wednesday, Republicans and their corporate benefactors have begun to aggressively promote their pivot to tax reform following their failed attempt to repeal the Affordable Care Act.

Activist groups have warned that in order to achieve their expressed goal of lowering tax rates "as much as possible," Republicans will take aim--as they already have--at key safety net programs that primarily benefit low-income families.

Indivisible has published a toolkit for those looking to resist Republicans' proposed "giveaway to corporations."