Decrying Greedy Vulture Funds, Sanders and Warren Call for Relief in Puerto Rico

'The people in Puerto Rico should not be forced to suffer so that a handful of wealthy investors can make a 100 percent return on their investments.'

As Puerto Rico grapples with a deepening economic crisis and U.S. officials weigh whether--and how--to help, U.S. Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) on Thursday slammed the vulture fund investors that are fueling the debt disaster as well as the U.S. Treasury Department for its lax approach toward the U.S. territory.

At a Senate hearing Thursday, Warren said she supports congressional efforts to aid Puerto Rico, but urged the Treasury to be "just as creative in coming up with solutions as it was when the big banks called" for help during the 2008 financial crisis.

"I find it morally repugnant," Sanders added at the Energy and Natural Resources Committee hearing, "that vulture funds and Wall Street investment banks have been calling for even more austerity in Puerto Rico. In my view, the people in Puerto Rico should not be forced to suffer even more so that a handful of wealthy investors can make a 100 percent return on their investments."

The island commonwealth, home to 3.5 million people, currently faces a $72 billion debt and 45 percent poverty rate. A payment of more than $300 million is due to creditors on Dec. 1, and Gov. Alejandro Garcia Padilla warned Congress on Thursday that because his treasury expects to have a negative cash balance of $29 million by the end of November, "a default on some of our debt obligations is inevitable."

Meanwhile, Wall Street institutions like Goldman Sachs, Citigroup, and UBS--who bought up huge amounts of Puerto Rican debt at a discount and have been pushing the territory into crippling austerity measures to meet payments--continue to receive a steady flow of funds from the island.

"They are receiving 11 percent [interest rates] and children in Puerto Rico are going hungry--somehow that equation does not make a lot of sense to me," Sanders said at the hearing.

Earlier this week, the Treasury Department released a "Roadmap for Congressional Action" (pdf) to deal with the debt crisis. It suggested allowing Puerto Rico to obtain bankruptcy protection, which is currently barred by U.S. law and thus would require congressional approval. Of that prospect, the Huffington Post wrote Thursday: "Some members of Congress have avoided the issue, likening bankruptcy relief to a government bailout, despite the fact that reorganizing the debt doesn't imply a cost to taxpayers unless they personally hold Puerto Rican bonds."

Meanwhile, the Treasury report clearly stated that, while administration officials are working closely with the Puerto Rican government, "there is no set of administrative authorities that can fully address and resolve this crisis... only Congress can provide the critical tools Puerto Rico needs to restructure its debt."

Warren conveyed skepticism that the agency is doing all it can. "Treasury needs to step up and show more leadership here," she said. "When the banks were in trouble, Treasury did a lot more than just bail them out. Treasury stretched the limits of its authority to make sure that the banks stayed afloat. It helped broker deals between banks. It applied pressure to get parties to accept deals they may not have liked very much."

The Fiscal Times reports:

While legally, Puerto Rican debt cannot be extinguished, Warren appeared to be saying that the U.S. Treasury has leverage over creditors unavailable to the island commonwealth, and should be willing to use it.

The people of Puerto Rico "understand there is no bailout on the table for them and they are not asking for one -- after all, they're not a giant bank," Warren said. But she thought Treasury had the ability to "stand up to the vulture funds," perhaps by brokering deals acceptable to all sides.

Watch Warren below:

Echoing Warren's criticisms, Sanders declared that "the economic situation in Puerto Rico will not improve by eliminating more public schools, slashing pensions, laying off workers and allowing corporations to pay workers starvation wages by suspending the minimum wage and relaxing labor laws--you simply cannot get blood out of a stone."

Watch Sanders here:

"I would urge you to convene a meeting as soon as possible with the government of Puerto Rico, key elected officials, its major creditors, labor unions, business leaders, and pension advocates, to work out a debt repayment plan that is fair to all sides," Sanders wrote in a letter to Treasury Secretary Jacob Lew this week. "At this meeting, it should be made clear that the last thing Puerto Rico needs right now is further austerity."

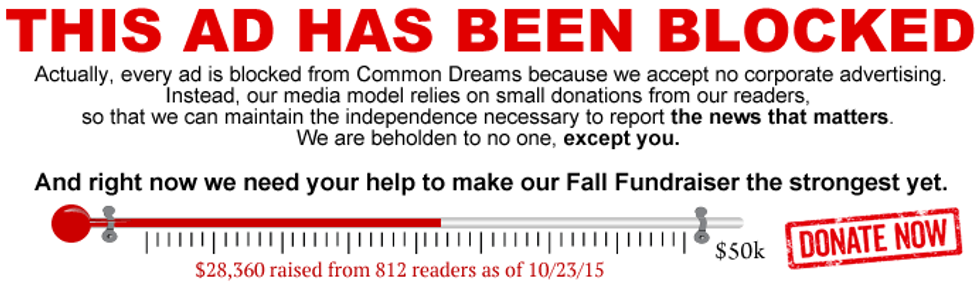

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As Puerto Rico grapples with a deepening economic crisis and U.S. officials weigh whether--and how--to help, U.S. Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) on Thursday slammed the vulture fund investors that are fueling the debt disaster as well as the U.S. Treasury Department for its lax approach toward the U.S. territory.

At a Senate hearing Thursday, Warren said she supports congressional efforts to aid Puerto Rico, but urged the Treasury to be "just as creative in coming up with solutions as it was when the big banks called" for help during the 2008 financial crisis.

"I find it morally repugnant," Sanders added at the Energy and Natural Resources Committee hearing, "that vulture funds and Wall Street investment banks have been calling for even more austerity in Puerto Rico. In my view, the people in Puerto Rico should not be forced to suffer even more so that a handful of wealthy investors can make a 100 percent return on their investments."

The island commonwealth, home to 3.5 million people, currently faces a $72 billion debt and 45 percent poverty rate. A payment of more than $300 million is due to creditors on Dec. 1, and Gov. Alejandro Garcia Padilla warned Congress on Thursday that because his treasury expects to have a negative cash balance of $29 million by the end of November, "a default on some of our debt obligations is inevitable."

Meanwhile, Wall Street institutions like Goldman Sachs, Citigroup, and UBS--who bought up huge amounts of Puerto Rican debt at a discount and have been pushing the territory into crippling austerity measures to meet payments--continue to receive a steady flow of funds from the island.

"They are receiving 11 percent [interest rates] and children in Puerto Rico are going hungry--somehow that equation does not make a lot of sense to me," Sanders said at the hearing.

Earlier this week, the Treasury Department released a "Roadmap for Congressional Action" (pdf) to deal with the debt crisis. It suggested allowing Puerto Rico to obtain bankruptcy protection, which is currently barred by U.S. law and thus would require congressional approval. Of that prospect, the Huffington Post wrote Thursday: "Some members of Congress have avoided the issue, likening bankruptcy relief to a government bailout, despite the fact that reorganizing the debt doesn't imply a cost to taxpayers unless they personally hold Puerto Rican bonds."

Meanwhile, the Treasury report clearly stated that, while administration officials are working closely with the Puerto Rican government, "there is no set of administrative authorities that can fully address and resolve this crisis... only Congress can provide the critical tools Puerto Rico needs to restructure its debt."

Warren conveyed skepticism that the agency is doing all it can. "Treasury needs to step up and show more leadership here," she said. "When the banks were in trouble, Treasury did a lot more than just bail them out. Treasury stretched the limits of its authority to make sure that the banks stayed afloat. It helped broker deals between banks. It applied pressure to get parties to accept deals they may not have liked very much."

The Fiscal Times reports:

While legally, Puerto Rican debt cannot be extinguished, Warren appeared to be saying that the U.S. Treasury has leverage over creditors unavailable to the island commonwealth, and should be willing to use it.

The people of Puerto Rico "understand there is no bailout on the table for them and they are not asking for one -- after all, they're not a giant bank," Warren said. But she thought Treasury had the ability to "stand up to the vulture funds," perhaps by brokering deals acceptable to all sides.

Watch Warren below:

Echoing Warren's criticisms, Sanders declared that "the economic situation in Puerto Rico will not improve by eliminating more public schools, slashing pensions, laying off workers and allowing corporations to pay workers starvation wages by suspending the minimum wage and relaxing labor laws--you simply cannot get blood out of a stone."

Watch Sanders here:

"I would urge you to convene a meeting as soon as possible with the government of Puerto Rico, key elected officials, its major creditors, labor unions, business leaders, and pension advocates, to work out a debt repayment plan that is fair to all sides," Sanders wrote in a letter to Treasury Secretary Jacob Lew this week. "At this meeting, it should be made clear that the last thing Puerto Rico needs right now is further austerity."

As Puerto Rico grapples with a deepening economic crisis and U.S. officials weigh whether--and how--to help, U.S. Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) on Thursday slammed the vulture fund investors that are fueling the debt disaster as well as the U.S. Treasury Department for its lax approach toward the U.S. territory.

At a Senate hearing Thursday, Warren said she supports congressional efforts to aid Puerto Rico, but urged the Treasury to be "just as creative in coming up with solutions as it was when the big banks called" for help during the 2008 financial crisis.

"I find it morally repugnant," Sanders added at the Energy and Natural Resources Committee hearing, "that vulture funds and Wall Street investment banks have been calling for even more austerity in Puerto Rico. In my view, the people in Puerto Rico should not be forced to suffer even more so that a handful of wealthy investors can make a 100 percent return on their investments."

The island commonwealth, home to 3.5 million people, currently faces a $72 billion debt and 45 percent poverty rate. A payment of more than $300 million is due to creditors on Dec. 1, and Gov. Alejandro Garcia Padilla warned Congress on Thursday that because his treasury expects to have a negative cash balance of $29 million by the end of November, "a default on some of our debt obligations is inevitable."

Meanwhile, Wall Street institutions like Goldman Sachs, Citigroup, and UBS--who bought up huge amounts of Puerto Rican debt at a discount and have been pushing the territory into crippling austerity measures to meet payments--continue to receive a steady flow of funds from the island.

"They are receiving 11 percent [interest rates] and children in Puerto Rico are going hungry--somehow that equation does not make a lot of sense to me," Sanders said at the hearing.

Earlier this week, the Treasury Department released a "Roadmap for Congressional Action" (pdf) to deal with the debt crisis. It suggested allowing Puerto Rico to obtain bankruptcy protection, which is currently barred by U.S. law and thus would require congressional approval. Of that prospect, the Huffington Post wrote Thursday: "Some members of Congress have avoided the issue, likening bankruptcy relief to a government bailout, despite the fact that reorganizing the debt doesn't imply a cost to taxpayers unless they personally hold Puerto Rican bonds."

Meanwhile, the Treasury report clearly stated that, while administration officials are working closely with the Puerto Rican government, "there is no set of administrative authorities that can fully address and resolve this crisis... only Congress can provide the critical tools Puerto Rico needs to restructure its debt."

Warren conveyed skepticism that the agency is doing all it can. "Treasury needs to step up and show more leadership here," she said. "When the banks were in trouble, Treasury did a lot more than just bail them out. Treasury stretched the limits of its authority to make sure that the banks stayed afloat. It helped broker deals between banks. It applied pressure to get parties to accept deals they may not have liked very much."

The Fiscal Times reports:

While legally, Puerto Rican debt cannot be extinguished, Warren appeared to be saying that the U.S. Treasury has leverage over creditors unavailable to the island commonwealth, and should be willing to use it.

The people of Puerto Rico "understand there is no bailout on the table for them and they are not asking for one -- after all, they're not a giant bank," Warren said. But she thought Treasury had the ability to "stand up to the vulture funds," perhaps by brokering deals acceptable to all sides.

Watch Warren below:

Echoing Warren's criticisms, Sanders declared that "the economic situation in Puerto Rico will not improve by eliminating more public schools, slashing pensions, laying off workers and allowing corporations to pay workers starvation wages by suspending the minimum wage and relaxing labor laws--you simply cannot get blood out of a stone."

Watch Sanders here:

"I would urge you to convene a meeting as soon as possible with the government of Puerto Rico, key elected officials, its major creditors, labor unions, business leaders, and pension advocates, to work out a debt repayment plan that is fair to all sides," Sanders wrote in a letter to Treasury Secretary Jacob Lew this week. "At this meeting, it should be made clear that the last thing Puerto Rico needs right now is further austerity."