Senate Judiciary Committee member Sen. Orrin Hatch (R-UT) (L) and Chairman Charles Grassley (R-IA) during a hearing on Capitol Hill April 3, 2017 in Washington, DC. (Photo by Chip Somodevilla/Getty Images)

Two Top Republican Tax Writers Reveal Their Prejudice and Their Strategy

Because they have used the deficit to pay for a tax cut that blatantly favors the rich over the rest, Republicans have forfeited their ability to tell us what we can and can’t afford.

On Saturday, Sen. Charles E. Grassley, a Republican from Iowa and member of the Senate's tax writing committee, said this about repealing the estate tax:

"I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies."

A few days before that, the chair of the committee, Sen. Orrin G. Hatch (R-Utah), said the following regarding Congress's failure to reauthorize the Children's Health Insurance Program, which provides Medicaid coverage to 9 million kids in low-income families.

"The reason CHIP's having trouble is because we don't have money anymore, and to just add more and more spending and more and more spending, and you can look at the rest of the bill for the more and more spending," Hatch said.

Let us examine these statements in turn.

The pure meanness and inaccuracy of Grassley's prejudicial, ignorant statement lit up the Twitterverse, as it should. There's no correlation between the estate tax and investment. Its repeal is nothing more than a gift to a tiny sliver of rich heirs (only the richest 0.2 percent of estates are hit by the tax). But what I want to stress here is that his abhorrent words are clearly embedded in the tax policy he and his fellow Republicans are busy rushing to legislate.

The tax plan is written in such a way as to favor asset-based incomes, passive business investments and inherited wealth, and to penalize, once it's fully phased in, those foolish enough to depend on their paychecks. If your income derives from your stock portfolio or your rich parent, this plan loves you. Otherwise, tough luck.

The mechanisms that push this tilt are the aforementioned repeal (House plan) or doubled exemption level (Senate plan) of the estate tax; the large cut in the corporate tax, as most of those benefits accrue to shareholders and corporate chief executives; the tax decrease on profits from high-end "pass-through" businesses such as hedge funds and real estate trusts (about 70 percent of pass-through income accrues to the top 1 percent of taxpayers); the elimination of domestic taxation on foreign earnings; and the ability of U.S. multinational companies to take years of deferred foreign earnings at a much reduced rate, a change that would save these companies an estimated $500 billion. All of the above significantly raise the value of nonlabor income.

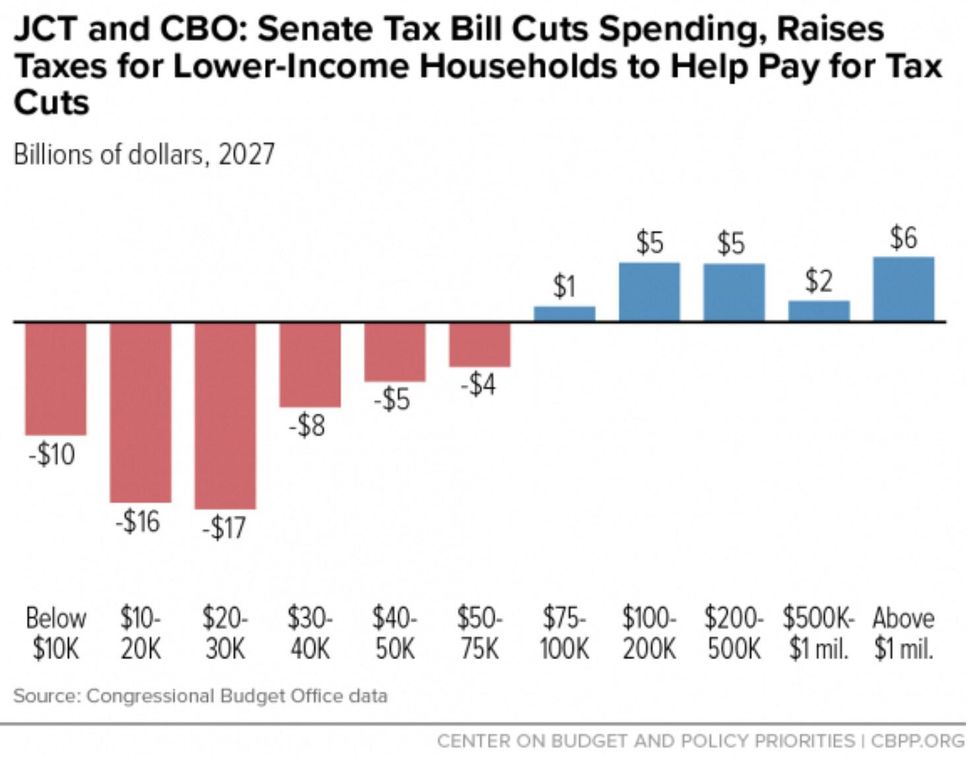

Meanwhile, the phasing out of the individual tax cuts and the Senate's repeal of the individual health-care mandate end up costing low-income households -- who, of course, disproportionately depend on their paychecks -- as shown in the figure below.

It's awful enough for Grassley to spout such ignorance. But the worse crime was to embed it in tax policy.

Turning to Hatch's statement, I cannot state the following adamantly enough:

Because they have used the deficit to pay for a tax cut that blatantly favors the rich over the rest, Republicans have forfeited their ability to tell us what we can and can't afford.

Of course, they will continue to make that argument, as Hatch himself has, along with many of his colleagues. But do not forget this: They could have made their tax plan revenue-neutral. They decided not to, and they further decided, based on their revealed preferences, that the parts that help middle- and low-income families should expire, while those that help the rich should live on forever (see figure above).

Supporters of the plan say they'll never let that happen. They claim future policymakers will extend those cuts scheduled to expire. Maybe they will; maybe they won't. But if they do, that will add another $500 billion to the federal debt, which will only amplify their calls for more spending cuts.

For decades, the Republicans have employed deficit-induced fearmongering as a reason to oppose any ideas from Democrats. They never stop caterwauling about the unsustainability of our social insurance and safety-net programs. But their deficit-financed gift to wealthy asset holders belies such posturing. Affordability is a choice, and they've shown whose side they're choosing.

All of which leaves us with a terrible, and terribly revealing, tax plan.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

On Saturday, Sen. Charles E. Grassley, a Republican from Iowa and member of the Senate's tax writing committee, said this about repealing the estate tax:

"I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies."

A few days before that, the chair of the committee, Sen. Orrin G. Hatch (R-Utah), said the following regarding Congress's failure to reauthorize the Children's Health Insurance Program, which provides Medicaid coverage to 9 million kids in low-income families.

"The reason CHIP's having trouble is because we don't have money anymore, and to just add more and more spending and more and more spending, and you can look at the rest of the bill for the more and more spending," Hatch said.

Let us examine these statements in turn.

The pure meanness and inaccuracy of Grassley's prejudicial, ignorant statement lit up the Twitterverse, as it should. There's no correlation between the estate tax and investment. Its repeal is nothing more than a gift to a tiny sliver of rich heirs (only the richest 0.2 percent of estates are hit by the tax). But what I want to stress here is that his abhorrent words are clearly embedded in the tax policy he and his fellow Republicans are busy rushing to legislate.

The tax plan is written in such a way as to favor asset-based incomes, passive business investments and inherited wealth, and to penalize, once it's fully phased in, those foolish enough to depend on their paychecks. If your income derives from your stock portfolio or your rich parent, this plan loves you. Otherwise, tough luck.

The mechanisms that push this tilt are the aforementioned repeal (House plan) or doubled exemption level (Senate plan) of the estate tax; the large cut in the corporate tax, as most of those benefits accrue to shareholders and corporate chief executives; the tax decrease on profits from high-end "pass-through" businesses such as hedge funds and real estate trusts (about 70 percent of pass-through income accrues to the top 1 percent of taxpayers); the elimination of domestic taxation on foreign earnings; and the ability of U.S. multinational companies to take years of deferred foreign earnings at a much reduced rate, a change that would save these companies an estimated $500 billion. All of the above significantly raise the value of nonlabor income.

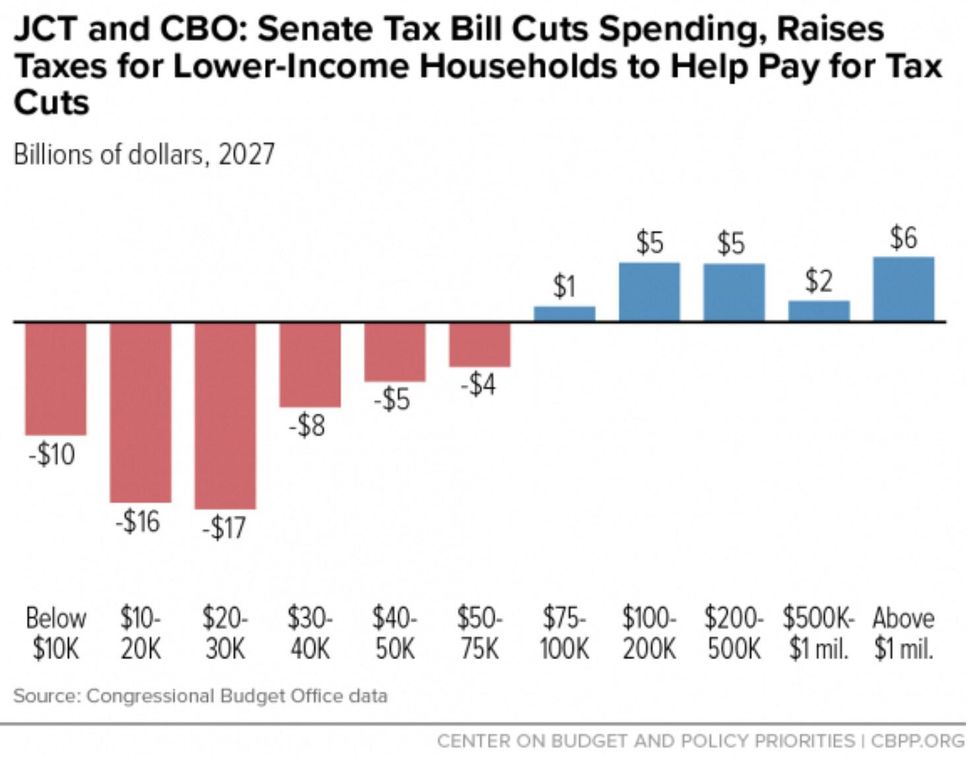

Meanwhile, the phasing out of the individual tax cuts and the Senate's repeal of the individual health-care mandate end up costing low-income households -- who, of course, disproportionately depend on their paychecks -- as shown in the figure below.

It's awful enough for Grassley to spout such ignorance. But the worse crime was to embed it in tax policy.

Turning to Hatch's statement, I cannot state the following adamantly enough:

Because they have used the deficit to pay for a tax cut that blatantly favors the rich over the rest, Republicans have forfeited their ability to tell us what we can and can't afford.

Of course, they will continue to make that argument, as Hatch himself has, along with many of his colleagues. But do not forget this: They could have made their tax plan revenue-neutral. They decided not to, and they further decided, based on their revealed preferences, that the parts that help middle- and low-income families should expire, while those that help the rich should live on forever (see figure above).

Supporters of the plan say they'll never let that happen. They claim future policymakers will extend those cuts scheduled to expire. Maybe they will; maybe they won't. But if they do, that will add another $500 billion to the federal debt, which will only amplify their calls for more spending cuts.

For decades, the Republicans have employed deficit-induced fearmongering as a reason to oppose any ideas from Democrats. They never stop caterwauling about the unsustainability of our social insurance and safety-net programs. But their deficit-financed gift to wealthy asset holders belies such posturing. Affordability is a choice, and they've shown whose side they're choosing.

All of which leaves us with a terrible, and terribly revealing, tax plan.

On Saturday, Sen. Charles E. Grassley, a Republican from Iowa and member of the Senate's tax writing committee, said this about repealing the estate tax:

"I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies."

A few days before that, the chair of the committee, Sen. Orrin G. Hatch (R-Utah), said the following regarding Congress's failure to reauthorize the Children's Health Insurance Program, which provides Medicaid coverage to 9 million kids in low-income families.

"The reason CHIP's having trouble is because we don't have money anymore, and to just add more and more spending and more and more spending, and you can look at the rest of the bill for the more and more spending," Hatch said.

Let us examine these statements in turn.

The pure meanness and inaccuracy of Grassley's prejudicial, ignorant statement lit up the Twitterverse, as it should. There's no correlation between the estate tax and investment. Its repeal is nothing more than a gift to a tiny sliver of rich heirs (only the richest 0.2 percent of estates are hit by the tax). But what I want to stress here is that his abhorrent words are clearly embedded in the tax policy he and his fellow Republicans are busy rushing to legislate.

The tax plan is written in such a way as to favor asset-based incomes, passive business investments and inherited wealth, and to penalize, once it's fully phased in, those foolish enough to depend on their paychecks. If your income derives from your stock portfolio or your rich parent, this plan loves you. Otherwise, tough luck.

The mechanisms that push this tilt are the aforementioned repeal (House plan) or doubled exemption level (Senate plan) of the estate tax; the large cut in the corporate tax, as most of those benefits accrue to shareholders and corporate chief executives; the tax decrease on profits from high-end "pass-through" businesses such as hedge funds and real estate trusts (about 70 percent of pass-through income accrues to the top 1 percent of taxpayers); the elimination of domestic taxation on foreign earnings; and the ability of U.S. multinational companies to take years of deferred foreign earnings at a much reduced rate, a change that would save these companies an estimated $500 billion. All of the above significantly raise the value of nonlabor income.

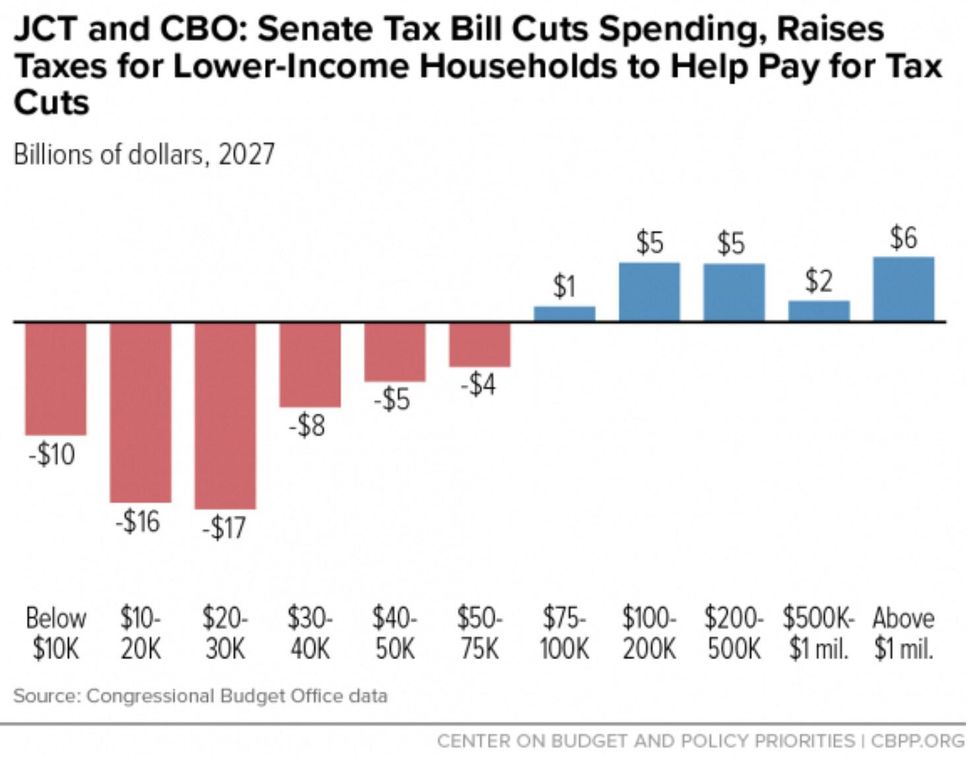

Meanwhile, the phasing out of the individual tax cuts and the Senate's repeal of the individual health-care mandate end up costing low-income households -- who, of course, disproportionately depend on their paychecks -- as shown in the figure below.

It's awful enough for Grassley to spout such ignorance. But the worse crime was to embed it in tax policy.

Turning to Hatch's statement, I cannot state the following adamantly enough:

Because they have used the deficit to pay for a tax cut that blatantly favors the rich over the rest, Republicans have forfeited their ability to tell us what we can and can't afford.

Of course, they will continue to make that argument, as Hatch himself has, along with many of his colleagues. But do not forget this: They could have made their tax plan revenue-neutral. They decided not to, and they further decided, based on their revealed preferences, that the parts that help middle- and low-income families should expire, while those that help the rich should live on forever (see figure above).

Supporters of the plan say they'll never let that happen. They claim future policymakers will extend those cuts scheduled to expire. Maybe they will; maybe they won't. But if they do, that will add another $500 billion to the federal debt, which will only amplify their calls for more spending cuts.

For decades, the Republicans have employed deficit-induced fearmongering as a reason to oppose any ideas from Democrats. They never stop caterwauling about the unsustainability of our social insurance and safety-net programs. But their deficit-financed gift to wealthy asset holders belies such posturing. Affordability is a choice, and they've shown whose side they're choosing.

All of which leaves us with a terrible, and terribly revealing, tax plan.