SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Undercutting President Donald Trump's assertion that U.S. corporate taxes are too high--the justification for his and Republican leaders' pitches to lower the business tax rate--a new report finds that many profitable American companies pay far less than the 35 percent often cited by lobbyists and GOP officials.

"For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

--Robert McIntyre, Citizens for Tax Justice

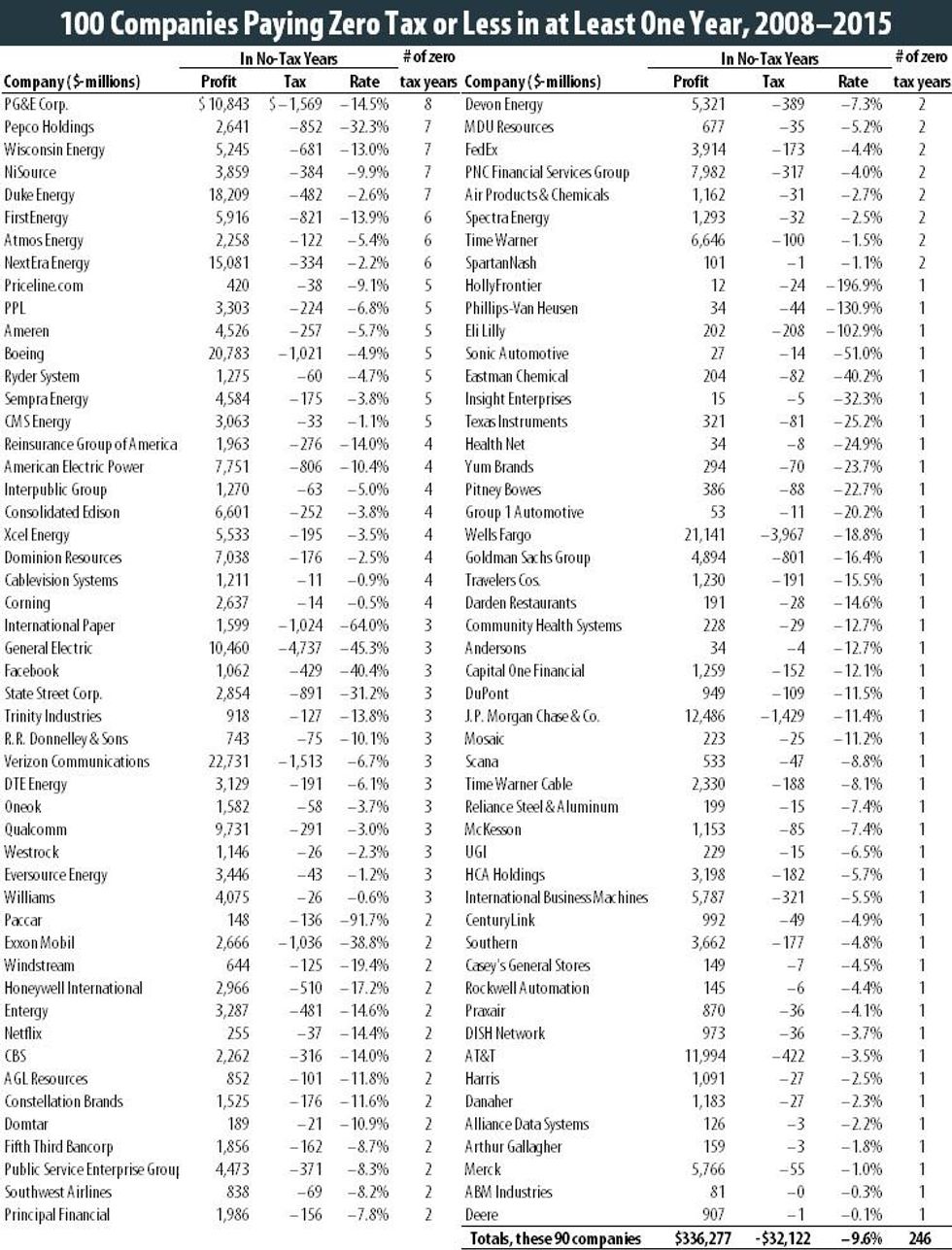

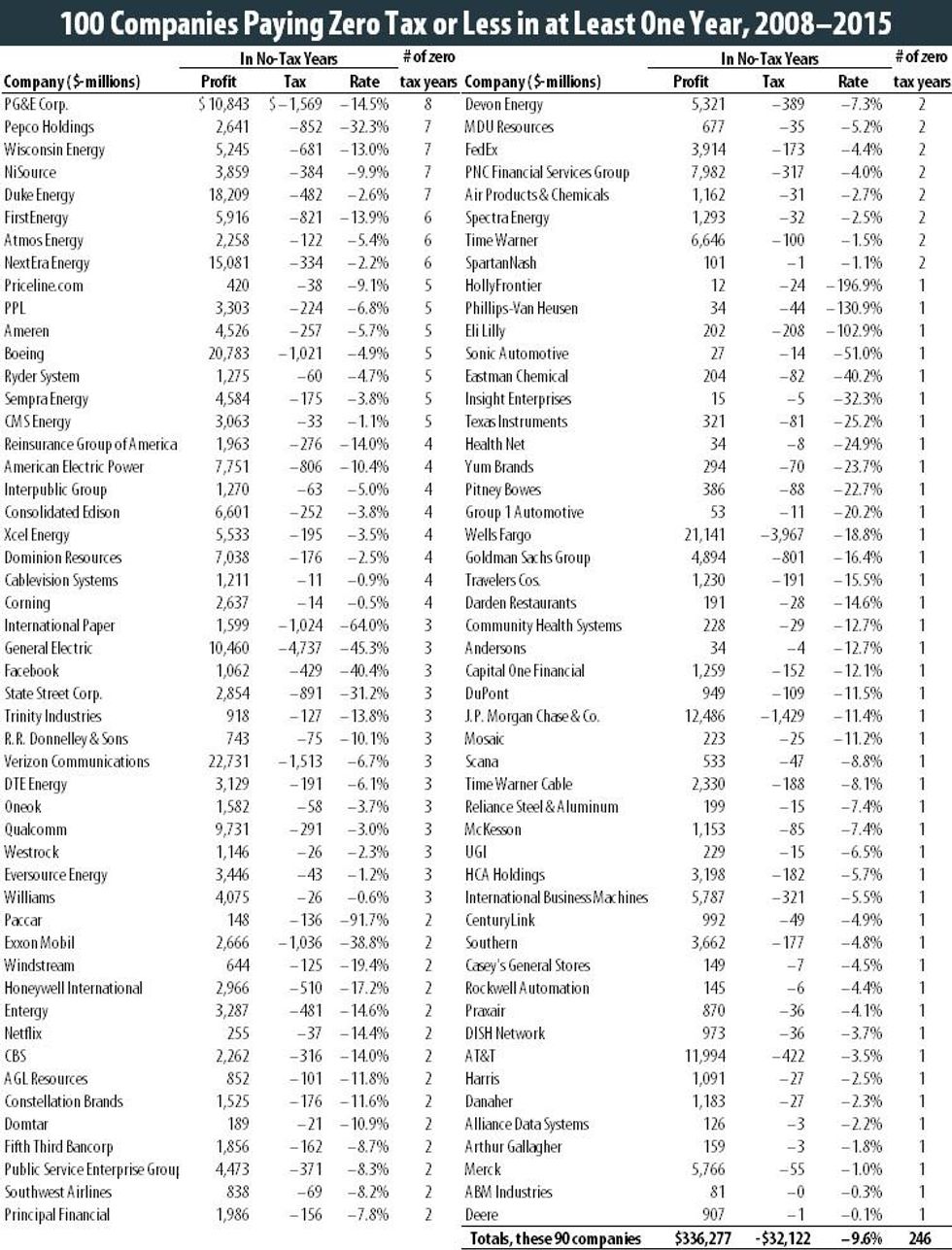

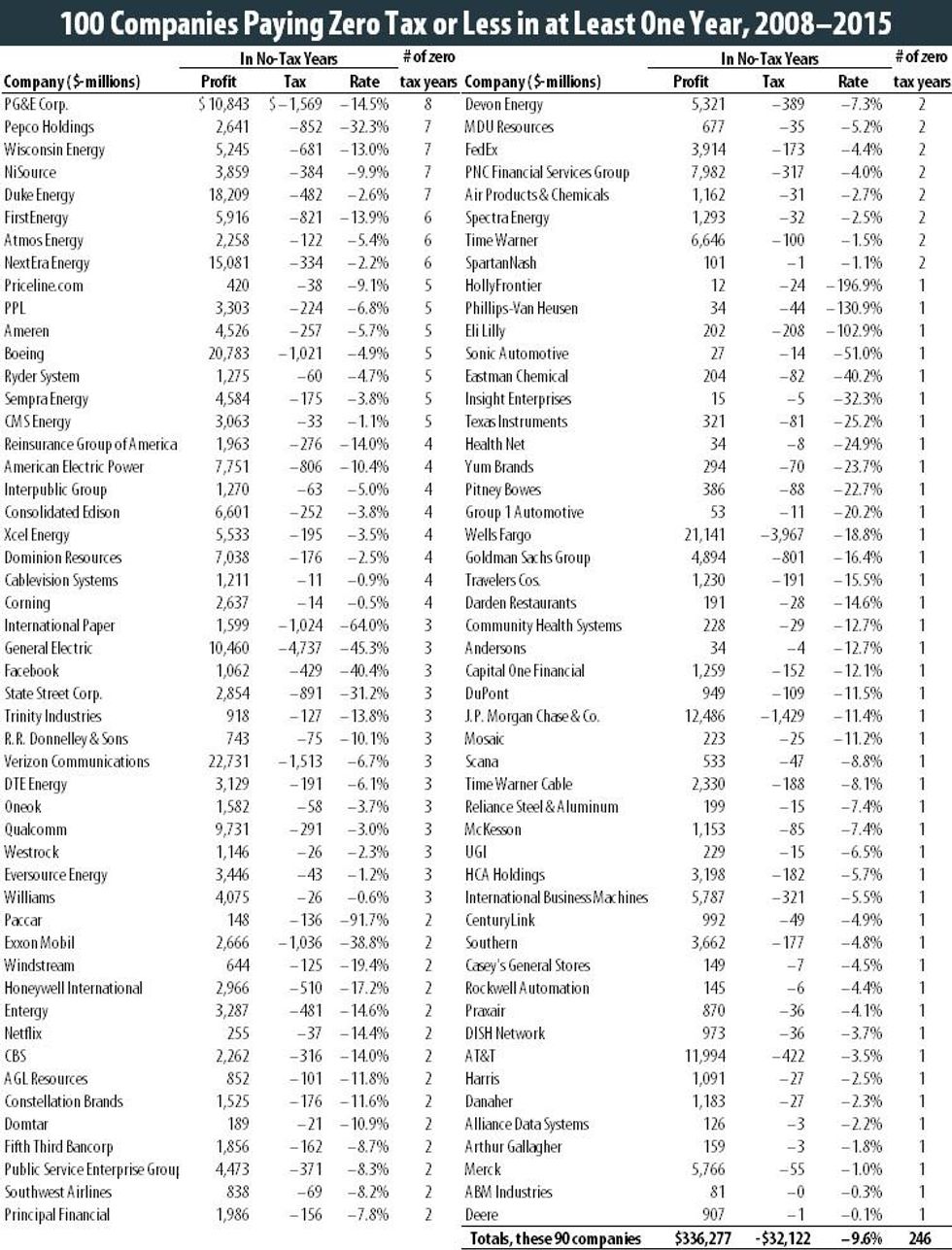

In fact, the analysis reveals, 18 of the country's most profitable corporations paid nothing in taxes between 2008 and 2015, and fully 100 companies enjoyed at least one year in which their federal income tax was zero or less.

"This study is a long-term, unprecedented examination of corporation taxes paid--or not paid--by the nation's biggest, most profitable firms," said Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy (ITEP) and lead author of the report. "It reveals that many of the big corporations that are lobbying for a lower corporate tax rate to be more 'competitive' already pay substantially less than the 35 percent statutory rate."

Indeed, added Robert McIntyre, a co-author of the report and director of ITEP sister organization Citizens for Tax Justice (CTJ): "For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

The ITEP report, entitled The 35 Percent Corporate Tax Myth, additionally found:

The study looked only at companies that were consistently profitable over the eight-year period of 2008-2015. "By leaving out corporations that had losses (which means they wouldn't pay any tax), this report provides a straightforward picture of average effective tax rates paid by our nation's biggest and consistently profitable companies," the authors explained.

Such low tax payments were made possible by "copious loopholes in the tax code," the report said, including deferred payments on profits stashed offshore; the ability to write off executive stock options; and industry-specific tax subsidies that effectively function as tax breaks.

Spring-boarding off the report, Sens. Bernie Sanders (I-Vt.) and Brian Schatz (D-Hawaii) on Thursday introduced a bill in the Senate to eliminate tax breaks that encourage corporations to shift jobs and profits offshore and tax the $2.4 trillion that American firms currently hold in such tax havens at the full corporate rate of 35 percent. Rep. Jan Schakowsky (D-Ill.) introduced a companion bill in the House.

"Instead of giving a $550 billion tax break to corporate tax dodgers as President Trump has proposed," Sanders said in a statement, "our legislation will raise at least $1 trillion in new revenue over the next decade."

And while such reforms as the ones laid out in the lawmakers' Corporate Tax Dodging Prevention Act (pdf) are the ones that would actually make the U.S. tax code fairer, ITEP's Gardner expressed his fear that "when Congress engages on tax reform later this year, our leaders will prioritize damaging cuts in corporate tax rates while giving short shrift to needed loophole-closing reforms."

"[T]hese priorities are backwards," he said. "The starting point should be ending harmful corporate giveaways and requiring all profitable corporations to pay their fair share."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Undercutting President Donald Trump's assertion that U.S. corporate taxes are too high--the justification for his and Republican leaders' pitches to lower the business tax rate--a new report finds that many profitable American companies pay far less than the 35 percent often cited by lobbyists and GOP officials.

"For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

--Robert McIntyre, Citizens for Tax Justice

In fact, the analysis reveals, 18 of the country's most profitable corporations paid nothing in taxes between 2008 and 2015, and fully 100 companies enjoyed at least one year in which their federal income tax was zero or less.

"This study is a long-term, unprecedented examination of corporation taxes paid--or not paid--by the nation's biggest, most profitable firms," said Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy (ITEP) and lead author of the report. "It reveals that many of the big corporations that are lobbying for a lower corporate tax rate to be more 'competitive' already pay substantially less than the 35 percent statutory rate."

Indeed, added Robert McIntyre, a co-author of the report and director of ITEP sister organization Citizens for Tax Justice (CTJ): "For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

The ITEP report, entitled The 35 Percent Corporate Tax Myth, additionally found:

The study looked only at companies that were consistently profitable over the eight-year period of 2008-2015. "By leaving out corporations that had losses (which means they wouldn't pay any tax), this report provides a straightforward picture of average effective tax rates paid by our nation's biggest and consistently profitable companies," the authors explained.

Such low tax payments were made possible by "copious loopholes in the tax code," the report said, including deferred payments on profits stashed offshore; the ability to write off executive stock options; and industry-specific tax subsidies that effectively function as tax breaks.

Spring-boarding off the report, Sens. Bernie Sanders (I-Vt.) and Brian Schatz (D-Hawaii) on Thursday introduced a bill in the Senate to eliminate tax breaks that encourage corporations to shift jobs and profits offshore and tax the $2.4 trillion that American firms currently hold in such tax havens at the full corporate rate of 35 percent. Rep. Jan Schakowsky (D-Ill.) introduced a companion bill in the House.

"Instead of giving a $550 billion tax break to corporate tax dodgers as President Trump has proposed," Sanders said in a statement, "our legislation will raise at least $1 trillion in new revenue over the next decade."

And while such reforms as the ones laid out in the lawmakers' Corporate Tax Dodging Prevention Act (pdf) are the ones that would actually make the U.S. tax code fairer, ITEP's Gardner expressed his fear that "when Congress engages on tax reform later this year, our leaders will prioritize damaging cuts in corporate tax rates while giving short shrift to needed loophole-closing reforms."

"[T]hese priorities are backwards," he said. "The starting point should be ending harmful corporate giveaways and requiring all profitable corporations to pay their fair share."

Undercutting President Donald Trump's assertion that U.S. corporate taxes are too high--the justification for his and Republican leaders' pitches to lower the business tax rate--a new report finds that many profitable American companies pay far less than the 35 percent often cited by lobbyists and GOP officials.

"For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

--Robert McIntyre, Citizens for Tax Justice

In fact, the analysis reveals, 18 of the country's most profitable corporations paid nothing in taxes between 2008 and 2015, and fully 100 companies enjoyed at least one year in which their federal income tax was zero or less.

"This study is a long-term, unprecedented examination of corporation taxes paid--or not paid--by the nation's biggest, most profitable firms," said Matthew Gardner, a senior fellow at the Institute for Taxation and Economic Policy (ITEP) and lead author of the report. "It reveals that many of the big corporations that are lobbying for a lower corporate tax rate to be more 'competitive' already pay substantially less than the 35 percent statutory rate."

Indeed, added Robert McIntyre, a co-author of the report and director of ITEP sister organization Citizens for Tax Justice (CTJ): "For years, corporate lobbyists have claimed that they can't be competitive because the corporate tax rate is too high. They have a receptive audience for those complaints in the current Congress and Trump administration, but it doesn't make these claims any less false."

The ITEP report, entitled The 35 Percent Corporate Tax Myth, additionally found:

The study looked only at companies that were consistently profitable over the eight-year period of 2008-2015. "By leaving out corporations that had losses (which means they wouldn't pay any tax), this report provides a straightforward picture of average effective tax rates paid by our nation's biggest and consistently profitable companies," the authors explained.

Such low tax payments were made possible by "copious loopholes in the tax code," the report said, including deferred payments on profits stashed offshore; the ability to write off executive stock options; and industry-specific tax subsidies that effectively function as tax breaks.

Spring-boarding off the report, Sens. Bernie Sanders (I-Vt.) and Brian Schatz (D-Hawaii) on Thursday introduced a bill in the Senate to eliminate tax breaks that encourage corporations to shift jobs and profits offshore and tax the $2.4 trillion that American firms currently hold in such tax havens at the full corporate rate of 35 percent. Rep. Jan Schakowsky (D-Ill.) introduced a companion bill in the House.

"Instead of giving a $550 billion tax break to corporate tax dodgers as President Trump has proposed," Sanders said in a statement, "our legislation will raise at least $1 trillion in new revenue over the next decade."

And while such reforms as the ones laid out in the lawmakers' Corporate Tax Dodging Prevention Act (pdf) are the ones that would actually make the U.S. tax code fairer, ITEP's Gardner expressed his fear that "when Congress engages on tax reform later this year, our leaders will prioritize damaging cuts in corporate tax rates while giving short shrift to needed loophole-closing reforms."

"[T]hese priorities are backwards," he said. "The starting point should be ending harmful corporate giveaways and requiring all profitable corporations to pay their fair share."