SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

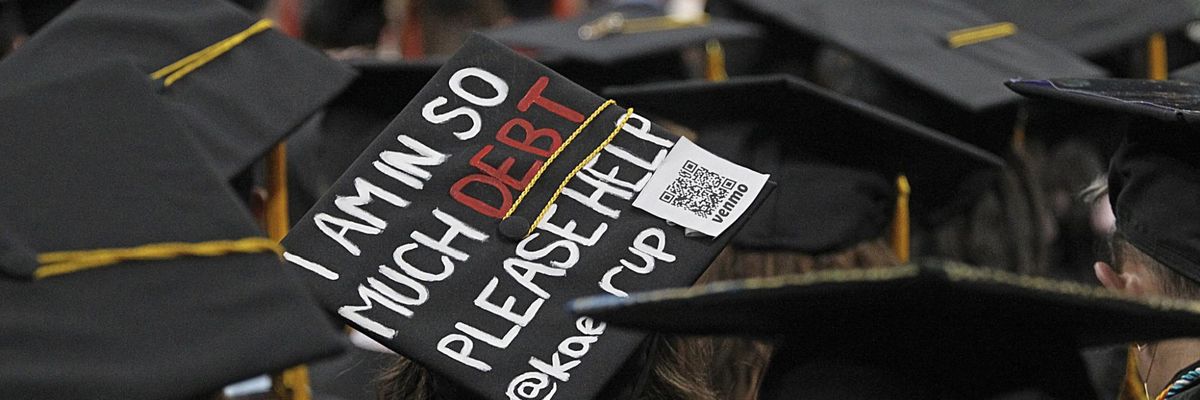

The reality of college tuition debt was on display at the Northeastern University graduation at the TD Garden on May 3, 2019. (Photo: Suzanne Kreiter/The Boston Globe via Getty Images)

As a student borrower, I've experienced a flood of emotions since hearing President Joe Biden's announcement about federal student loan relief. This is an enormously welcome surprise. I'm among the 60% of all federal student loan borrowers who were Pell Grant recipients and will receive a $20,000 reprieve. But that joy is tempered by the reminder that I'll still be saddled with $60,000 left to pay.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe.

As the cost of higher education continues to grow, debt that large is all too common for members of communities like mine. I'm a proud citizen of both the Shinnecock Indian Nation of Long Island, New York and the Kiowa Tribe of Oklahoma. The federal government has historically failed to honor its treaty obligations to tribal communities like ours, much less make deep investments in our education.

So for the majority of us, the only way to get a college education is to take on debt--76% of us take out student loans to attend college. We also have the costliest monthly repayments.

I was raised on a small reservation. My father had only a middle-school education. But my mother, who was in the first generation of her family to attend college, made sure my siblings and I understood that the pathway to a better life for ourselves and our community was a college education.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe. So I took on the debt, went to college, and earned a master's degree in social work.

I did this because I felt called to service work that would benefit my people. Unfortunately, I've learned this kind of employment doesn't pay remotely enough to afford my student loan payments. But I've pursued a career in social work anyway in order to support my community.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us.

So to learn my debt burden will now drop by $20,000 is incredible. It's not nearly enough, but it gives me some breathing room to live and work and help my community. Of course, I'm not the only one who benefits: Around 90% of the relief benefits will go to lower- and middle-income borrowers, with the most relief headed to those most in need--including communities of color and working families of all races.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us. In fact, the cost of the program just about equals the revenues raised by the corporate tax reforms in the recently passed Inflation Reduction Act.

Taxing the extremely wealthy and corporations more fairly to pay for student debt relief is an important step toward equity, but it still leaves borrowers like me with plenty left to pay. And it doesn't address the underlying problem: our fundamentally unjust debt-for-diploma higher education system.

For real equity, we must eliminate the need for student debt altogether by pushing to make all public higher education free. For that, we'll need to make our voices heard at the ballot box and in our lawmakers' inboxes.

We are all stronger when we can all afford an education and the ability to help ourselves, our families, and our communities.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As a student borrower, I've experienced a flood of emotions since hearing President Joe Biden's announcement about federal student loan relief. This is an enormously welcome surprise. I'm among the 60% of all federal student loan borrowers who were Pell Grant recipients and will receive a $20,000 reprieve. But that joy is tempered by the reminder that I'll still be saddled with $60,000 left to pay.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe.

As the cost of higher education continues to grow, debt that large is all too common for members of communities like mine. I'm a proud citizen of both the Shinnecock Indian Nation of Long Island, New York and the Kiowa Tribe of Oklahoma. The federal government has historically failed to honor its treaty obligations to tribal communities like ours, much less make deep investments in our education.

So for the majority of us, the only way to get a college education is to take on debt--76% of us take out student loans to attend college. We also have the costliest monthly repayments.

I was raised on a small reservation. My father had only a middle-school education. But my mother, who was in the first generation of her family to attend college, made sure my siblings and I understood that the pathway to a better life for ourselves and our community was a college education.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe. So I took on the debt, went to college, and earned a master's degree in social work.

I did this because I felt called to service work that would benefit my people. Unfortunately, I've learned this kind of employment doesn't pay remotely enough to afford my student loan payments. But I've pursued a career in social work anyway in order to support my community.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us.

So to learn my debt burden will now drop by $20,000 is incredible. It's not nearly enough, but it gives me some breathing room to live and work and help my community. Of course, I'm not the only one who benefits: Around 90% of the relief benefits will go to lower- and middle-income borrowers, with the most relief headed to those most in need--including communities of color and working families of all races.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us. In fact, the cost of the program just about equals the revenues raised by the corporate tax reforms in the recently passed Inflation Reduction Act.

Taxing the extremely wealthy and corporations more fairly to pay for student debt relief is an important step toward equity, but it still leaves borrowers like me with plenty left to pay. And it doesn't address the underlying problem: our fundamentally unjust debt-for-diploma higher education system.

For real equity, we must eliminate the need for student debt altogether by pushing to make all public higher education free. For that, we'll need to make our voices heard at the ballot box and in our lawmakers' inboxes.

We are all stronger when we can all afford an education and the ability to help ourselves, our families, and our communities.

As a student borrower, I've experienced a flood of emotions since hearing President Joe Biden's announcement about federal student loan relief. This is an enormously welcome surprise. I'm among the 60% of all federal student loan borrowers who were Pell Grant recipients and will receive a $20,000 reprieve. But that joy is tempered by the reminder that I'll still be saddled with $60,000 left to pay.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe.

As the cost of higher education continues to grow, debt that large is all too common for members of communities like mine. I'm a proud citizen of both the Shinnecock Indian Nation of Long Island, New York and the Kiowa Tribe of Oklahoma. The federal government has historically failed to honor its treaty obligations to tribal communities like ours, much less make deep investments in our education.

So for the majority of us, the only way to get a college education is to take on debt--76% of us take out student loans to attend college. We also have the costliest monthly repayments.

I was raised on a small reservation. My father had only a middle-school education. But my mother, who was in the first generation of her family to attend college, made sure my siblings and I understood that the pathway to a better life for ourselves and our community was a college education.

As a Native woman, I carry the privilege and responsibility of improving the lives of my family, my extended kin, and my tribe. So I took on the debt, went to college, and earned a master's degree in social work.

I did this because I felt called to service work that would benefit my people. Unfortunately, I've learned this kind of employment doesn't pay remotely enough to afford my student loan payments. But I've pursued a career in social work anyway in order to support my community.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us.

So to learn my debt burden will now drop by $20,000 is incredible. It's not nearly enough, but it gives me some breathing room to live and work and help my community. Of course, I'm not the only one who benefits: Around 90% of the relief benefits will go to lower- and middle-income borrowers, with the most relief headed to those most in need--including communities of color and working families of all races.

Biden's student debt relief program costs just a fraction of what the GOP tax cuts for the wealthy cost us. In fact, the cost of the program just about equals the revenues raised by the corporate tax reforms in the recently passed Inflation Reduction Act.

Taxing the extremely wealthy and corporations more fairly to pay for student debt relief is an important step toward equity, but it still leaves borrowers like me with plenty left to pay. And it doesn't address the underlying problem: our fundamentally unjust debt-for-diploma higher education system.

For real equity, we must eliminate the need for student debt altogether by pushing to make all public higher education free. For that, we'll need to make our voices heard at the ballot box and in our lawmakers' inboxes.

We are all stronger when we can all afford an education and the ability to help ourselves, our families, and our communities.