SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

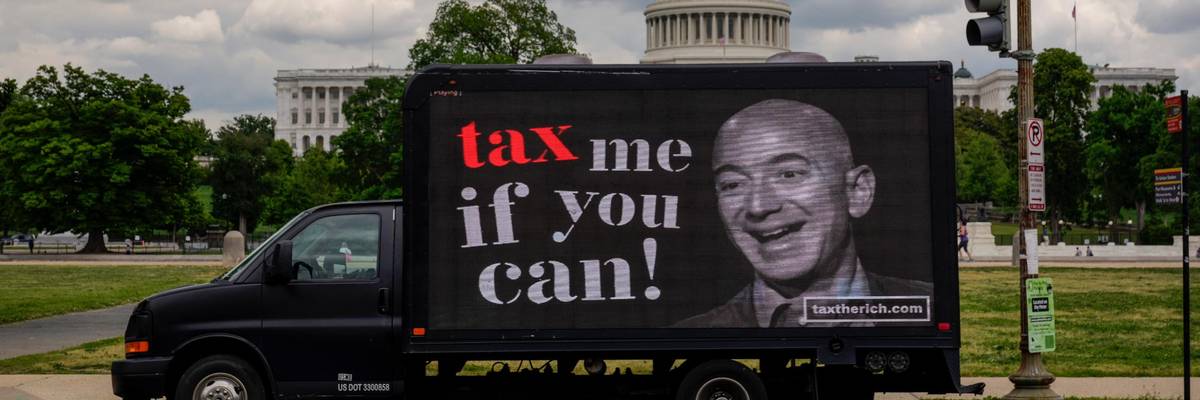

A mobile billboard calling for higher taxes on the ultra-wealthy depicts an image of billionaire businessman Jeff Bezos, the founder of Amazon, near the U.S. Capitol on May 17, 2021. (Photo: Drew Angerer/Getty Images)

Whenever there are new or proposed changes to tax law, your eyes may glaze over as they skim the headlines. Meanwhile, the wealth defense industry -- and its legions of accountants, financial advisors, and lawyers -- is quietly mobilizing.

Last year, the Biden administration unveiled a proposal for a revitalized IRS, including a stronger "wealth squad" to take on tax evasion by the extremely wealthy, that is, people with tens of millions of dollars. Soon after, the wealth defense industry announced strategies that wealth advisors should use to prepare.

The wealth squad, officially called the Global High Wealth Industry Group, was formed in 2009. But the following year was a pivotal shift in U.S. politics, and due to conservative blowback against the agency, the IRS has since bled funding. Combine budget cuts with the power of billionaires and multimillionaires to hire seemingly endless teams of lawyers and accountants, and it's clear how the wealth squad has not always been an effective force.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth--and wealth hiding--over the past decade.

Emphasizing both the unrealized purpose of the squad and the hope that enforcement will increase, a recent report from the Government Accountability Office (GAO) highlights how audit rates have significantly declined over the past decade. This is particularly true for high-income households. Between 2010 and 2019, audit rates of households earning more than $5 million per year declined by 86 percent, falling from a more than 16 percent audit rate to just over 2 percent.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth -- and wealth hiding -- over the past decade.

Let's take, for example, the wealth of the top ten billionaires from Forbes' list of billionaires in 2010. That year, the list was topped by Mexican billionaire Carlos Slim; Jeff Bezos had yet to break the top 40 and Elon Musk's Tesla had only just gone public. The total wealth of the world's ten richest people totaled $342.2 billion.

Fast forward almost a decade later, to 2019, when Bezos was number one. By then, the total wealth of the top ten billionaires in the world had more than doubled, to $744 billion.

The start of the pandemic the following year was particularly lucrative, too. As the Institute for Policy Studies reports, U.S. billionaire wealth has soared by more than half -- $1.7 trillion -- since the pandemic began.

As the rich get richer, they need somewhere to park their billions beyond the traditional financial markets. That's why the uber-wealthy choose a wide variety of physical assets, like real estate, yachts, and expensive art, as vessels for wealth storage. They also create complex trusts to house their wealth, hiring skilled lawyers to extort loopholes and manipulate laws to protect wealth from the worst thing that could happen to it: taxation.

The International Consortium of Investigative Journalists revealed in last year's Pandora Papers how exactly the world's wealthy use trusts to avoid taxes and accountability. Some of the world's top destinations for trusts are U.S. states like South Dakota, Nevada, Alaska, and Delaware. These states have passed laws that attract the wealthy to state trust companies; both international and domestic ultra-high-net-worth people are increasingly setting up trusts in these states. South Dakota, for example, hosts more than $500 billion in trust assets, up from $57 billion in 2010. Nationwide, according to estimates by Gabriel Zucman, Thomas Piketty, and Emmanuel Saez, the U.S. was home to at least $5.6 trillion in trust assets in 2021, more than double the approximately $2.3 trillion it hosted in 2010.

In short, strong IRS oversight is needed now more than ever. But as the GAO report contends, that's not what we've seen.

Unfortunately, the IRS doesn't exactly have the resources for a robust effort against tax evasion and avoidance. In a comment on a draft of the GAO report, IRS deputy commissioner Douglas O'Donnell said that budget cuts have hampered the agency's ability to fully carry out its mission. He wrote that reduced funds have led to a staffing shortage that "has resulted in challenges to overall tax administration, including our ability to deliver adequate customer service, audit coverage, collecting on taxes owed, closing the tax gap, funding the government, and IT modernization."

In inflation-adjusted dollars, IRS funding has fallen by approximately 21 percent since 2010. More than 13,000 enforcement employees were lost to attrition between 2010 and 2020, and the number of agents handling complex cases specifically fell by more than a third.

Though higher-income individuals are more likely to misreport their taxes, those who claim the Earned Income Tax Credit (EITC) -- low- and middle-income households -- are audited at higher-than-average rates. According to the IRS, this is because EITC audits can be automated, while high-income audits require much more work by teams with specialized skills -- skills that the IRS has increasingly lost.

The IRS itself estimates underreporting and underpayment led to a $441 billion annual gap between taxes owed and taxes paid between 2011 and 2013, and that just $60 billion of that would eventually be collected. In recent years, more than half of what's known as the "tax gap" is due to underpayment by those in the top 5 percent of income -- and more than a quarter of the gap is the responsibility of the top 1 percent.

Over the next decade, the tax gap is estimated to reach approximately $7 trillion.

Multimillionaires and billionaires have immeasurable resources to defend their wealth... If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow.

"[W]hen you have fewer employees doing compliance work, you end up leaving tax revenue on the table," said then IRS commissioner John Koskinen in 2015, addressing the American Institute of Certified Public Accountants at its National Tax Conference. "In cutting the IRS budget, the government is forgoing billions just to achieve budget savings of a few hundred million dollars."

The Treasury Department estimated that the $80 billion investment in the IRS would generate $480 billion in revenue over the next decade due to increased tax enforcement. This is consistent with IRS data that suggest each dollar invested in enforcement yields a return of about $5.

Yet, even if the IRS gets increased appropriations, the wealth defense industry will be prepared -- it began preparing when there were mere whispers of a better-funded wealth squad. A spring 2021 webinar from WealthManagement.com suggested that clients should expect a "holistic" and "intrusive" auditing process and to start preparing immediately -- an excellent way to advertise wealth advisor services.

Multimillionaires and billionaires have immeasurable resources to defend their wealth against taxation and creditors. If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow -- and inequality will only continue to widen.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Whenever there are new or proposed changes to tax law, your eyes may glaze over as they skim the headlines. Meanwhile, the wealth defense industry -- and its legions of accountants, financial advisors, and lawyers -- is quietly mobilizing.

Last year, the Biden administration unveiled a proposal for a revitalized IRS, including a stronger "wealth squad" to take on tax evasion by the extremely wealthy, that is, people with tens of millions of dollars. Soon after, the wealth defense industry announced strategies that wealth advisors should use to prepare.

The wealth squad, officially called the Global High Wealth Industry Group, was formed in 2009. But the following year was a pivotal shift in U.S. politics, and due to conservative blowback against the agency, the IRS has since bled funding. Combine budget cuts with the power of billionaires and multimillionaires to hire seemingly endless teams of lawyers and accountants, and it's clear how the wealth squad has not always been an effective force.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth--and wealth hiding--over the past decade.

Emphasizing both the unrealized purpose of the squad and the hope that enforcement will increase, a recent report from the Government Accountability Office (GAO) highlights how audit rates have significantly declined over the past decade. This is particularly true for high-income households. Between 2010 and 2019, audit rates of households earning more than $5 million per year declined by 86 percent, falling from a more than 16 percent audit rate to just over 2 percent.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth -- and wealth hiding -- over the past decade.

Let's take, for example, the wealth of the top ten billionaires from Forbes' list of billionaires in 2010. That year, the list was topped by Mexican billionaire Carlos Slim; Jeff Bezos had yet to break the top 40 and Elon Musk's Tesla had only just gone public. The total wealth of the world's ten richest people totaled $342.2 billion.

Fast forward almost a decade later, to 2019, when Bezos was number one. By then, the total wealth of the top ten billionaires in the world had more than doubled, to $744 billion.

The start of the pandemic the following year was particularly lucrative, too. As the Institute for Policy Studies reports, U.S. billionaire wealth has soared by more than half -- $1.7 trillion -- since the pandemic began.

As the rich get richer, they need somewhere to park their billions beyond the traditional financial markets. That's why the uber-wealthy choose a wide variety of physical assets, like real estate, yachts, and expensive art, as vessels for wealth storage. They also create complex trusts to house their wealth, hiring skilled lawyers to extort loopholes and manipulate laws to protect wealth from the worst thing that could happen to it: taxation.

The International Consortium of Investigative Journalists revealed in last year's Pandora Papers how exactly the world's wealthy use trusts to avoid taxes and accountability. Some of the world's top destinations for trusts are U.S. states like South Dakota, Nevada, Alaska, and Delaware. These states have passed laws that attract the wealthy to state trust companies; both international and domestic ultra-high-net-worth people are increasingly setting up trusts in these states. South Dakota, for example, hosts more than $500 billion in trust assets, up from $57 billion in 2010. Nationwide, according to estimates by Gabriel Zucman, Thomas Piketty, and Emmanuel Saez, the U.S. was home to at least $5.6 trillion in trust assets in 2021, more than double the approximately $2.3 trillion it hosted in 2010.

In short, strong IRS oversight is needed now more than ever. But as the GAO report contends, that's not what we've seen.

Unfortunately, the IRS doesn't exactly have the resources for a robust effort against tax evasion and avoidance. In a comment on a draft of the GAO report, IRS deputy commissioner Douglas O'Donnell said that budget cuts have hampered the agency's ability to fully carry out its mission. He wrote that reduced funds have led to a staffing shortage that "has resulted in challenges to overall tax administration, including our ability to deliver adequate customer service, audit coverage, collecting on taxes owed, closing the tax gap, funding the government, and IT modernization."

In inflation-adjusted dollars, IRS funding has fallen by approximately 21 percent since 2010. More than 13,000 enforcement employees were lost to attrition between 2010 and 2020, and the number of agents handling complex cases specifically fell by more than a third.

Though higher-income individuals are more likely to misreport their taxes, those who claim the Earned Income Tax Credit (EITC) -- low- and middle-income households -- are audited at higher-than-average rates. According to the IRS, this is because EITC audits can be automated, while high-income audits require much more work by teams with specialized skills -- skills that the IRS has increasingly lost.

The IRS itself estimates underreporting and underpayment led to a $441 billion annual gap between taxes owed and taxes paid between 2011 and 2013, and that just $60 billion of that would eventually be collected. In recent years, more than half of what's known as the "tax gap" is due to underpayment by those in the top 5 percent of income -- and more than a quarter of the gap is the responsibility of the top 1 percent.

Over the next decade, the tax gap is estimated to reach approximately $7 trillion.

Multimillionaires and billionaires have immeasurable resources to defend their wealth... If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow.

"[W]hen you have fewer employees doing compliance work, you end up leaving tax revenue on the table," said then IRS commissioner John Koskinen in 2015, addressing the American Institute of Certified Public Accountants at its National Tax Conference. "In cutting the IRS budget, the government is forgoing billions just to achieve budget savings of a few hundred million dollars."

The Treasury Department estimated that the $80 billion investment in the IRS would generate $480 billion in revenue over the next decade due to increased tax enforcement. This is consistent with IRS data that suggest each dollar invested in enforcement yields a return of about $5.

Yet, even if the IRS gets increased appropriations, the wealth defense industry will be prepared -- it began preparing when there were mere whispers of a better-funded wealth squad. A spring 2021 webinar from WealthManagement.com suggested that clients should expect a "holistic" and "intrusive" auditing process and to start preparing immediately -- an excellent way to advertise wealth advisor services.

Multimillionaires and billionaires have immeasurable resources to defend their wealth against taxation and creditors. If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow -- and inequality will only continue to widen.

Whenever there are new or proposed changes to tax law, your eyes may glaze over as they skim the headlines. Meanwhile, the wealth defense industry -- and its legions of accountants, financial advisors, and lawyers -- is quietly mobilizing.

Last year, the Biden administration unveiled a proposal for a revitalized IRS, including a stronger "wealth squad" to take on tax evasion by the extremely wealthy, that is, people with tens of millions of dollars. Soon after, the wealth defense industry announced strategies that wealth advisors should use to prepare.

The wealth squad, officially called the Global High Wealth Industry Group, was formed in 2009. But the following year was a pivotal shift in U.S. politics, and due to conservative blowback against the agency, the IRS has since bled funding. Combine budget cuts with the power of billionaires and multimillionaires to hire seemingly endless teams of lawyers and accountants, and it's clear how the wealth squad has not always been an effective force.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth--and wealth hiding--over the past decade.

Emphasizing both the unrealized purpose of the squad and the hope that enforcement will increase, a recent report from the Government Accountability Office (GAO) highlights how audit rates have significantly declined over the past decade. This is particularly true for high-income households. Between 2010 and 2019, audit rates of households earning more than $5 million per year declined by 86 percent, falling from a more than 16 percent audit rate to just over 2 percent.

The reduction in audits of the wealthy is concerning not only because of the substantial revenue lost from tax evasion, but also because of the explosion of wealth -- and wealth hiding -- over the past decade.

Let's take, for example, the wealth of the top ten billionaires from Forbes' list of billionaires in 2010. That year, the list was topped by Mexican billionaire Carlos Slim; Jeff Bezos had yet to break the top 40 and Elon Musk's Tesla had only just gone public. The total wealth of the world's ten richest people totaled $342.2 billion.

Fast forward almost a decade later, to 2019, when Bezos was number one. By then, the total wealth of the top ten billionaires in the world had more than doubled, to $744 billion.

The start of the pandemic the following year was particularly lucrative, too. As the Institute for Policy Studies reports, U.S. billionaire wealth has soared by more than half -- $1.7 trillion -- since the pandemic began.

As the rich get richer, they need somewhere to park their billions beyond the traditional financial markets. That's why the uber-wealthy choose a wide variety of physical assets, like real estate, yachts, and expensive art, as vessels for wealth storage. They also create complex trusts to house their wealth, hiring skilled lawyers to extort loopholes and manipulate laws to protect wealth from the worst thing that could happen to it: taxation.

The International Consortium of Investigative Journalists revealed in last year's Pandora Papers how exactly the world's wealthy use trusts to avoid taxes and accountability. Some of the world's top destinations for trusts are U.S. states like South Dakota, Nevada, Alaska, and Delaware. These states have passed laws that attract the wealthy to state trust companies; both international and domestic ultra-high-net-worth people are increasingly setting up trusts in these states. South Dakota, for example, hosts more than $500 billion in trust assets, up from $57 billion in 2010. Nationwide, according to estimates by Gabriel Zucman, Thomas Piketty, and Emmanuel Saez, the U.S. was home to at least $5.6 trillion in trust assets in 2021, more than double the approximately $2.3 trillion it hosted in 2010.

In short, strong IRS oversight is needed now more than ever. But as the GAO report contends, that's not what we've seen.

Unfortunately, the IRS doesn't exactly have the resources for a robust effort against tax evasion and avoidance. In a comment on a draft of the GAO report, IRS deputy commissioner Douglas O'Donnell said that budget cuts have hampered the agency's ability to fully carry out its mission. He wrote that reduced funds have led to a staffing shortage that "has resulted in challenges to overall tax administration, including our ability to deliver adequate customer service, audit coverage, collecting on taxes owed, closing the tax gap, funding the government, and IT modernization."

In inflation-adjusted dollars, IRS funding has fallen by approximately 21 percent since 2010. More than 13,000 enforcement employees were lost to attrition between 2010 and 2020, and the number of agents handling complex cases specifically fell by more than a third.

Though higher-income individuals are more likely to misreport their taxes, those who claim the Earned Income Tax Credit (EITC) -- low- and middle-income households -- are audited at higher-than-average rates. According to the IRS, this is because EITC audits can be automated, while high-income audits require much more work by teams with specialized skills -- skills that the IRS has increasingly lost.

The IRS itself estimates underreporting and underpayment led to a $441 billion annual gap between taxes owed and taxes paid between 2011 and 2013, and that just $60 billion of that would eventually be collected. In recent years, more than half of what's known as the "tax gap" is due to underpayment by those in the top 5 percent of income -- and more than a quarter of the gap is the responsibility of the top 1 percent.

Over the next decade, the tax gap is estimated to reach approximately $7 trillion.

Multimillionaires and billionaires have immeasurable resources to defend their wealth... If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow.

"[W]hen you have fewer employees doing compliance work, you end up leaving tax revenue on the table," said then IRS commissioner John Koskinen in 2015, addressing the American Institute of Certified Public Accountants at its National Tax Conference. "In cutting the IRS budget, the government is forgoing billions just to achieve budget savings of a few hundred million dollars."

The Treasury Department estimated that the $80 billion investment in the IRS would generate $480 billion in revenue over the next decade due to increased tax enforcement. This is consistent with IRS data that suggest each dollar invested in enforcement yields a return of about $5.

Yet, even if the IRS gets increased appropriations, the wealth defense industry will be prepared -- it began preparing when there were mere whispers of a better-funded wealth squad. A spring 2021 webinar from WealthManagement.com suggested that clients should expect a "holistic" and "intrusive" auditing process and to start preparing immediately -- an excellent way to advertise wealth advisor services.

Multimillionaires and billionaires have immeasurable resources to defend their wealth against taxation and creditors. If the IRS continues to hobble and the capacity of the IRS wealth squad recedes, those resources will only continue to grow -- and inequality will only continue to widen.