SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

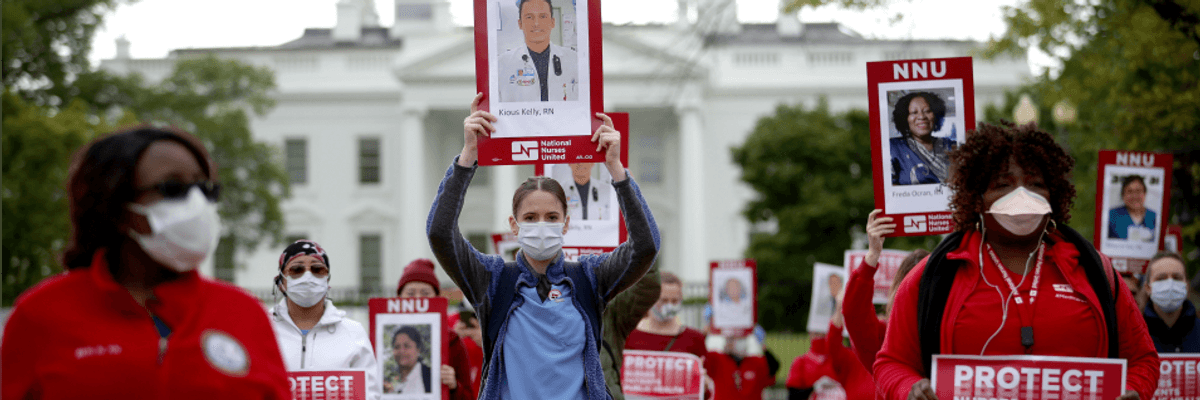

Members of National Nurses United, the largest nurses union in the United States, protest in front of the White House April 21, 2020 in Washington, D.C. (Photo: Win McNamee/Getty Images)

How's pandemic life been going for you? If you work in America's healthcare industry, that depends. That totally depends.

If you happen to provide healthcare services to actual Covid-19 patients--as a nurse or a doctor, an orderly or a physician's assistant--this has been the year from hell. Amid the worst worldwide pandemic in over a century, you've been working long, intense, chaotic hours. You've watched patients die at rates unimaginable just six months ago. You've watched colleagues die. You've worried that you may be bringing death home to your families.

If you work in healthcare but don't interact with pandemic patients, the months since March haven't exactly been easy street either. In April alone, 1.4 million healthcare workers lost their jobs, as virus-free Americans delayed and cancelled appointments and elective procedures.

If, on the other hand, you swivel your day away in a corporate healthcare executive suite, these difficult and horrific months of Covid-19 have been among the most rewarding--financially--you've ever seen. The "vast majority" of healthcare companies, Axios reports, "are reporting profits that many people assumed would not have been possible as the pandemic raged on."

Health insurers are leading the way, enjoying earnings, as a New York Times analysis puts it, "double what they were a year ago." UnitedHealth, for instance, registered $6.7 billion in 2020 second-quarter profits, up from $3.4 billion in last year's second quarter.

What explains this huge insurance industry profit spike? The simple story: Insurers like UnitedHealth, Aetna, and Anthem are continuing to collect their regular premiums from the Americans they insure, but they're paying out far less--as the pandemic rages on--for claims on normal maladies.

Now the Affordable Care Act--Obamacare --does have a provision that requires insurers to spend at least 80 percent of the premium dollars they collect on providing direct healthcare services. If they miss that target, they have to rebate dollars to the businesses and individuals they insure. Those rebates, unfortunately, seldom amount to much.

One reason: Many of the giant health insurers don't just sell insurance. They also control networks of doctors and own health services firms like pharmacy benefit managers. These auxiliary companies charge--and overcharge--their parent health insurer for the healthcare services they provide. These relationships, in effect, let health insurers launder their profits and sidestep the Obamacare profit limits.

A second reason the Obamacare rebates provision has been less than an effective check on corporate greed: Health insurers can delay paying any rebates to customers for up to three years. In the meantime, their excessive profits can trigger one windfall after another for the CEOs who engineer them.

At CVS Health, the corporation that owns Aetna, CEO Larry Merlo pocketed $36.5 million last year, up from $21.9 million the year before. Merlo took home 790 times the pay of his company's most typical worker.

The lowest-paid CEO among America's seven biggest health insurers, Anthem chief Gail Boudreaux, grabbed a healthy $15.5 million in 2019, the equivalent of just under $300,000 a week.

If current pandemic-time trends continue, top execs like Merlo and Boudreaux will end up doing even better in 2020. But they might not do quite as well as their counterparts in Big Pharma.

The Trump administration is currently shoveling cash to the nation's biggest drugmakers--for the development of coronavirus vaccines--at a furious pace. If the vaccines these companies are developing and testing end up flubbing, the drugmakers get to keep all that cash. If the vaccines work, these companies will get still more cash--since their deals with the White House entitle them to register patents they can exploit for years to come.

The most visible of these corona vaccine companies has so far been Moderna, a Massachusetts-based start-up founded ten years ago. The federal government, notes economist Dean Baker from the Center for Economic and Policy Research, has signed Moderna to nearly $1 billion in contracts, $483 million for pre-clinical research and initial testing and another $472 million for advanced testing. In the process, notes Baker, the federal government is taking all the risk.

"If Moderna's vaccine turns out to be ineffective," he points out, "the government will be out the money, not Moderna."

Already "in" the money: Moderna CEO Stephane Bancel. His company's soaring share price now has him a billionaire three times over.

How can we put the kibosh on this sort of shameless profiteering? We need, no more than ever, systemic change in healthcare, starting with Medicare for All.

In the shorter term, legislation along the line of the "Make Billionaires Pay Act" that Sens. Bernie Sanders (I-Vt.), Ed Markey (D-Mass.), and Kirsten Gillibrand (D-N.Y.) have just introduced would speak directly to Corporate America's pandemic jackpots.

This new legislation would, if enacted, place a one-time 60 percent tax on the $732 billion in new wealth that 467 top U.S. billionaires have added to their fortunes since the corona lockdown in March.

Some of those billionaires--most notably Tesla CEO Elon Musk--have openly defied the pandemic's public health protections. Musk reopened his flagship California Tesla plant in a direct challenge to local safety rules. His defiance of these rules has helped Musk triple his personal fortune since the pandemic began. Under the new Senate legislation, he would face a richly deserved wealth tax of $27.5 billion.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

How's pandemic life been going for you? If you work in America's healthcare industry, that depends. That totally depends.

If you happen to provide healthcare services to actual Covid-19 patients--as a nurse or a doctor, an orderly or a physician's assistant--this has been the year from hell. Amid the worst worldwide pandemic in over a century, you've been working long, intense, chaotic hours. You've watched patients die at rates unimaginable just six months ago. You've watched colleagues die. You've worried that you may be bringing death home to your families.

If you work in healthcare but don't interact with pandemic patients, the months since March haven't exactly been easy street either. In April alone, 1.4 million healthcare workers lost their jobs, as virus-free Americans delayed and cancelled appointments and elective procedures.

If, on the other hand, you swivel your day away in a corporate healthcare executive suite, these difficult and horrific months of Covid-19 have been among the most rewarding--financially--you've ever seen. The "vast majority" of healthcare companies, Axios reports, "are reporting profits that many people assumed would not have been possible as the pandemic raged on."

Health insurers are leading the way, enjoying earnings, as a New York Times analysis puts it, "double what they were a year ago." UnitedHealth, for instance, registered $6.7 billion in 2020 second-quarter profits, up from $3.4 billion in last year's second quarter.

What explains this huge insurance industry profit spike? The simple story: Insurers like UnitedHealth, Aetna, and Anthem are continuing to collect their regular premiums from the Americans they insure, but they're paying out far less--as the pandemic rages on--for claims on normal maladies.

Now the Affordable Care Act--Obamacare --does have a provision that requires insurers to spend at least 80 percent of the premium dollars they collect on providing direct healthcare services. If they miss that target, they have to rebate dollars to the businesses and individuals they insure. Those rebates, unfortunately, seldom amount to much.

One reason: Many of the giant health insurers don't just sell insurance. They also control networks of doctors and own health services firms like pharmacy benefit managers. These auxiliary companies charge--and overcharge--their parent health insurer for the healthcare services they provide. These relationships, in effect, let health insurers launder their profits and sidestep the Obamacare profit limits.

A second reason the Obamacare rebates provision has been less than an effective check on corporate greed: Health insurers can delay paying any rebates to customers for up to three years. In the meantime, their excessive profits can trigger one windfall after another for the CEOs who engineer them.

At CVS Health, the corporation that owns Aetna, CEO Larry Merlo pocketed $36.5 million last year, up from $21.9 million the year before. Merlo took home 790 times the pay of his company's most typical worker.

The lowest-paid CEO among America's seven biggest health insurers, Anthem chief Gail Boudreaux, grabbed a healthy $15.5 million in 2019, the equivalent of just under $300,000 a week.

If current pandemic-time trends continue, top execs like Merlo and Boudreaux will end up doing even better in 2020. But they might not do quite as well as their counterparts in Big Pharma.

The Trump administration is currently shoveling cash to the nation's biggest drugmakers--for the development of coronavirus vaccines--at a furious pace. If the vaccines these companies are developing and testing end up flubbing, the drugmakers get to keep all that cash. If the vaccines work, these companies will get still more cash--since their deals with the White House entitle them to register patents they can exploit for years to come.

The most visible of these corona vaccine companies has so far been Moderna, a Massachusetts-based start-up founded ten years ago. The federal government, notes economist Dean Baker from the Center for Economic and Policy Research, has signed Moderna to nearly $1 billion in contracts, $483 million for pre-clinical research and initial testing and another $472 million for advanced testing. In the process, notes Baker, the federal government is taking all the risk.

"If Moderna's vaccine turns out to be ineffective," he points out, "the government will be out the money, not Moderna."

Already "in" the money: Moderna CEO Stephane Bancel. His company's soaring share price now has him a billionaire three times over.

How can we put the kibosh on this sort of shameless profiteering? We need, no more than ever, systemic change in healthcare, starting with Medicare for All.

In the shorter term, legislation along the line of the "Make Billionaires Pay Act" that Sens. Bernie Sanders (I-Vt.), Ed Markey (D-Mass.), and Kirsten Gillibrand (D-N.Y.) have just introduced would speak directly to Corporate America's pandemic jackpots.

This new legislation would, if enacted, place a one-time 60 percent tax on the $732 billion in new wealth that 467 top U.S. billionaires have added to their fortunes since the corona lockdown in March.

Some of those billionaires--most notably Tesla CEO Elon Musk--have openly defied the pandemic's public health protections. Musk reopened his flagship California Tesla plant in a direct challenge to local safety rules. His defiance of these rules has helped Musk triple his personal fortune since the pandemic began. Under the new Senate legislation, he would face a richly deserved wealth tax of $27.5 billion.

How's pandemic life been going for you? If you work in America's healthcare industry, that depends. That totally depends.

If you happen to provide healthcare services to actual Covid-19 patients--as a nurse or a doctor, an orderly or a physician's assistant--this has been the year from hell. Amid the worst worldwide pandemic in over a century, you've been working long, intense, chaotic hours. You've watched patients die at rates unimaginable just six months ago. You've watched colleagues die. You've worried that you may be bringing death home to your families.

If you work in healthcare but don't interact with pandemic patients, the months since March haven't exactly been easy street either. In April alone, 1.4 million healthcare workers lost their jobs, as virus-free Americans delayed and cancelled appointments and elective procedures.

If, on the other hand, you swivel your day away in a corporate healthcare executive suite, these difficult and horrific months of Covid-19 have been among the most rewarding--financially--you've ever seen. The "vast majority" of healthcare companies, Axios reports, "are reporting profits that many people assumed would not have been possible as the pandemic raged on."

Health insurers are leading the way, enjoying earnings, as a New York Times analysis puts it, "double what they were a year ago." UnitedHealth, for instance, registered $6.7 billion in 2020 second-quarter profits, up from $3.4 billion in last year's second quarter.

What explains this huge insurance industry profit spike? The simple story: Insurers like UnitedHealth, Aetna, and Anthem are continuing to collect their regular premiums from the Americans they insure, but they're paying out far less--as the pandemic rages on--for claims on normal maladies.

Now the Affordable Care Act--Obamacare --does have a provision that requires insurers to spend at least 80 percent of the premium dollars they collect on providing direct healthcare services. If they miss that target, they have to rebate dollars to the businesses and individuals they insure. Those rebates, unfortunately, seldom amount to much.

One reason: Many of the giant health insurers don't just sell insurance. They also control networks of doctors and own health services firms like pharmacy benefit managers. These auxiliary companies charge--and overcharge--their parent health insurer for the healthcare services they provide. These relationships, in effect, let health insurers launder their profits and sidestep the Obamacare profit limits.

A second reason the Obamacare rebates provision has been less than an effective check on corporate greed: Health insurers can delay paying any rebates to customers for up to three years. In the meantime, their excessive profits can trigger one windfall after another for the CEOs who engineer them.

At CVS Health, the corporation that owns Aetna, CEO Larry Merlo pocketed $36.5 million last year, up from $21.9 million the year before. Merlo took home 790 times the pay of his company's most typical worker.

The lowest-paid CEO among America's seven biggest health insurers, Anthem chief Gail Boudreaux, grabbed a healthy $15.5 million in 2019, the equivalent of just under $300,000 a week.

If current pandemic-time trends continue, top execs like Merlo and Boudreaux will end up doing even better in 2020. But they might not do quite as well as their counterparts in Big Pharma.

The Trump administration is currently shoveling cash to the nation's biggest drugmakers--for the development of coronavirus vaccines--at a furious pace. If the vaccines these companies are developing and testing end up flubbing, the drugmakers get to keep all that cash. If the vaccines work, these companies will get still more cash--since their deals with the White House entitle them to register patents they can exploit for years to come.

The most visible of these corona vaccine companies has so far been Moderna, a Massachusetts-based start-up founded ten years ago. The federal government, notes economist Dean Baker from the Center for Economic and Policy Research, has signed Moderna to nearly $1 billion in contracts, $483 million for pre-clinical research and initial testing and another $472 million for advanced testing. In the process, notes Baker, the federal government is taking all the risk.

"If Moderna's vaccine turns out to be ineffective," he points out, "the government will be out the money, not Moderna."

Already "in" the money: Moderna CEO Stephane Bancel. His company's soaring share price now has him a billionaire three times over.

How can we put the kibosh on this sort of shameless profiteering? We need, no more than ever, systemic change in healthcare, starting with Medicare for All.

In the shorter term, legislation along the line of the "Make Billionaires Pay Act" that Sens. Bernie Sanders (I-Vt.), Ed Markey (D-Mass.), and Kirsten Gillibrand (D-N.Y.) have just introduced would speak directly to Corporate America's pandemic jackpots.

This new legislation would, if enacted, place a one-time 60 percent tax on the $732 billion in new wealth that 467 top U.S. billionaires have added to their fortunes since the corona lockdown in March.

Some of those billionaires--most notably Tesla CEO Elon Musk--have openly defied the pandemic's public health protections. Musk reopened his flagship California Tesla plant in a direct challenge to local safety rules. His defiance of these rules has helped Musk triple his personal fortune since the pandemic began. Under the new Senate legislation, he would face a richly deserved wealth tax of $27.5 billion.