SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A worker at Mother Hubbards Cupboard, a food pantry in partnership with the Hoosier Hills Foodbank, distributes food to people experiencing food insecurity, during the Covid-19-Coronavirus national emergency in Bloomington. .Amanda Nickey, President and CEO at Mother Hubbard's Cupboard, said she'd already seen more people arriving for emergency food after the mass layoffs of local workers during the COVID-19/Coronavirus emergency in Indiana. (Photo: Jeremy Hogan / Echoes Wire/Barcroft Media via Getty Images)

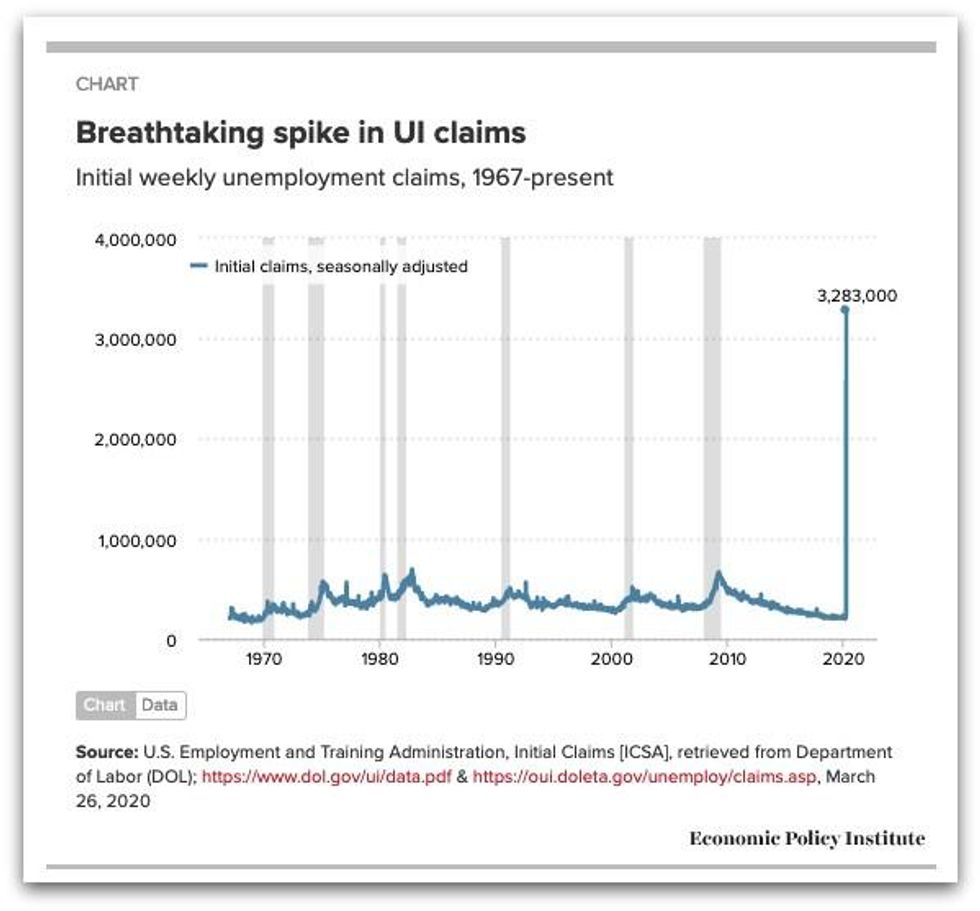

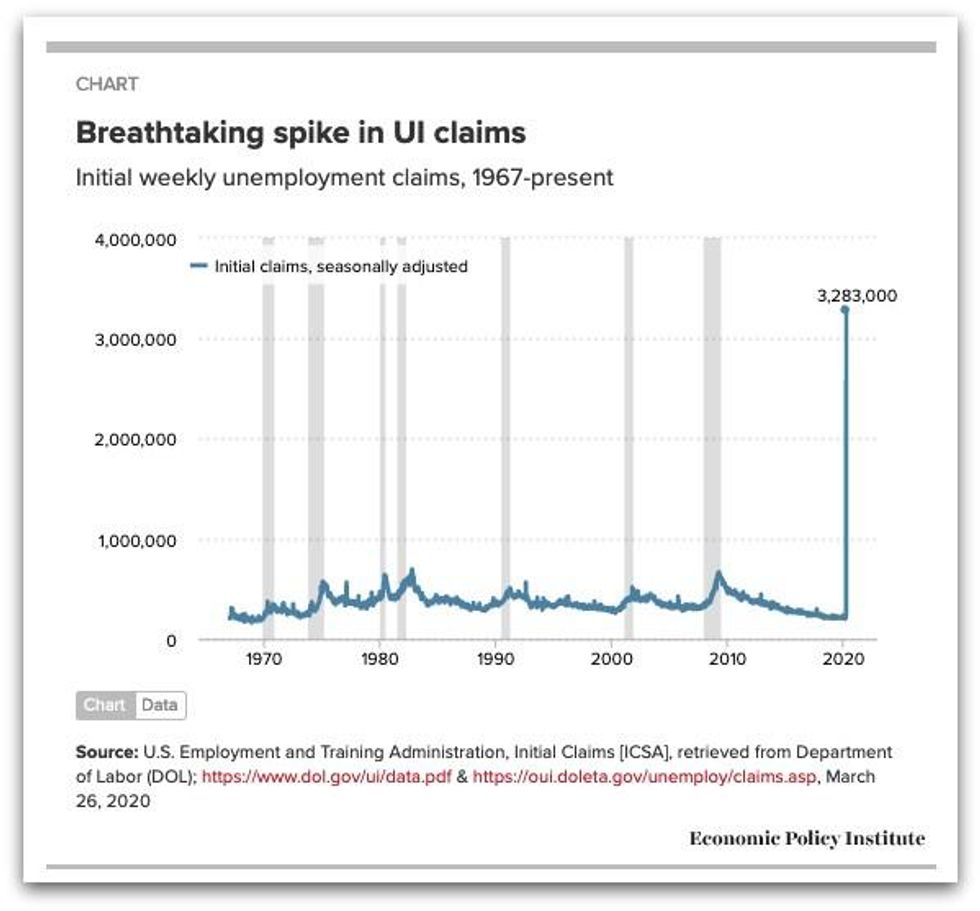

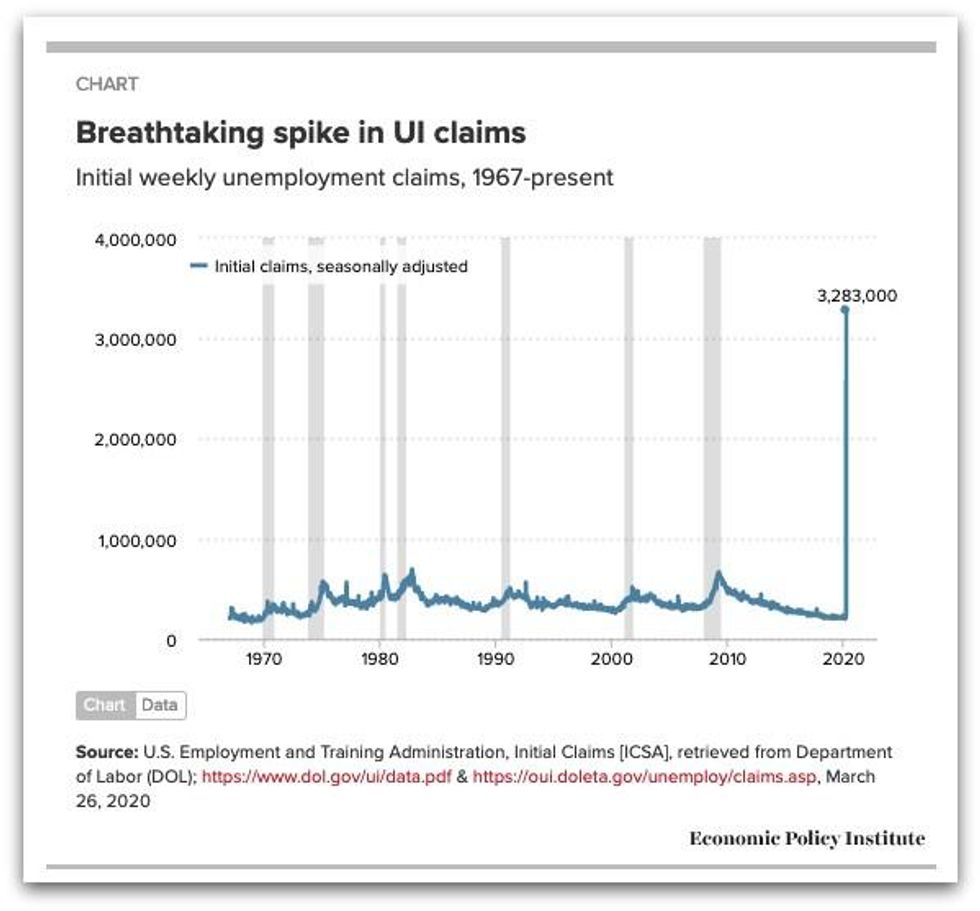

We just got the first piece of government labor market data that really shows--in a breathtaking manner--the impact the coronavirus shock is having on the labor market. The data are last week's initial unemployment insurance (UI) claims. Initial UI claims jumped from 211,000 three weeks ago to 282,000 two weeks ago to 3.3 million last week. That is nearly a 1500% increase in two weeks. I have been a labor economist for a very long time and I have never seen anything like this. This is a case where a picture is worth a thousand words.

The figure shows initial unemployment insurance claims over the last 50+ years. The spike at the end shows what unprecedented territory we are in right now. Furthermore, this is just the tip of the iceberg. We estimate that by the summer, 14 million workers will lose their jobs due to the coronavirus shock, with significant losses in every state.

Congress is currently debating a $2 trillion stimulus package to help the United States through this unprecedented crisis. This package would represent a very important step in the U.S. response to the coronavirus pandemic. It includes a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which would be available to many workers who are not eligible for regular unemployment insurance (independent contractors, for example). These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness. Last week's spike in UI claims provides a sense of the mass economic harm this crisis is causing to the working families of this country. After the bill currently under debate passes, further help from policymakers will clearly be needed to stem the economic damage.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

We just got the first piece of government labor market data that really shows--in a breathtaking manner--the impact the coronavirus shock is having on the labor market. The data are last week's initial unemployment insurance (UI) claims. Initial UI claims jumped from 211,000 three weeks ago to 282,000 two weeks ago to 3.3 million last week. That is nearly a 1500% increase in two weeks. I have been a labor economist for a very long time and I have never seen anything like this. This is a case where a picture is worth a thousand words.

The figure shows initial unemployment insurance claims over the last 50+ years. The spike at the end shows what unprecedented territory we are in right now. Furthermore, this is just the tip of the iceberg. We estimate that by the summer, 14 million workers will lose their jobs due to the coronavirus shock, with significant losses in every state.

Congress is currently debating a $2 trillion stimulus package to help the United States through this unprecedented crisis. This package would represent a very important step in the U.S. response to the coronavirus pandemic. It includes a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which would be available to many workers who are not eligible for regular unemployment insurance (independent contractors, for example). These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness. Last week's spike in UI claims provides a sense of the mass economic harm this crisis is causing to the working families of this country. After the bill currently under debate passes, further help from policymakers will clearly be needed to stem the economic damage.

We just got the first piece of government labor market data that really shows--in a breathtaking manner--the impact the coronavirus shock is having on the labor market. The data are last week's initial unemployment insurance (UI) claims. Initial UI claims jumped from 211,000 three weeks ago to 282,000 two weeks ago to 3.3 million last week. That is nearly a 1500% increase in two weeks. I have been a labor economist for a very long time and I have never seen anything like this. This is a case where a picture is worth a thousand words.

The figure shows initial unemployment insurance claims over the last 50+ years. The spike at the end shows what unprecedented territory we are in right now. Furthermore, this is just the tip of the iceberg. We estimate that by the summer, 14 million workers will lose their jobs due to the coronavirus shock, with significant losses in every state.

Congress is currently debating a $2 trillion stimulus package to help the United States through this unprecedented crisis. This package would represent a very important step in the U.S. response to the coronavirus pandemic. It includes a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program which would be available to many workers who are not eligible for regular unemployment insurance (independent contractors, for example). These provisions are very important and will help millions. However, the broader stimulus package contains many weaknesses that reduce its effectiveness. Last week's spike in UI claims provides a sense of the mass economic harm this crisis is causing to the working families of this country. After the bill currently under debate passes, further help from policymakers will clearly be needed to stem the economic damage.