SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

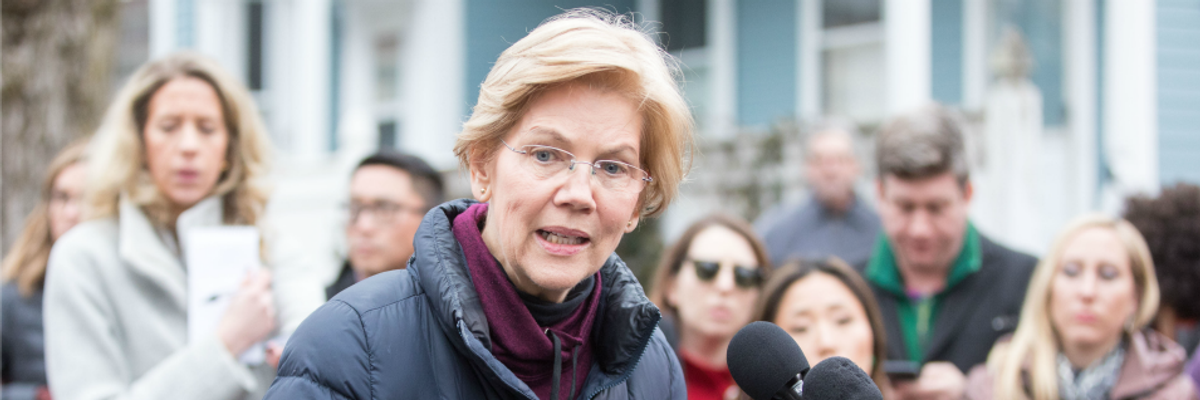

The fact that two women have kick-started a much-needed debate about taxes in the United States is not a coincidence. (Photo: Scott Eisen/Getty Images)

Two American women lawmakers, Senator Elizabeth Warren and Congresswoman Alexandria Ocasio-Cortez, are determined to make taxation one of the central issues in the United States 2020 election campaign. They both express the will to do away with the taboo on taxing the rich. They are right. In the United States as in the rest of the world, there exists an inequality crisis. The growing gap between the super-rich and everyone else is increasing. The richest one percent now have more wealth than the rest of the world combined, as recently shown by Oxfam.

Countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

The fact that two women have kick-started a much-needed debate about taxes in the United States is not a coincidence. As revealed by a 2015 IMF study, countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

In recent years, women's organizations, movements and advocates around the world have been outspoken about the links between tax evasion and tax avoidance and gender equality. When corporations do not pay their fair share of taxes, there is less money to invest in public services, sustainable infrastructure and social protection, which are the key drivers for gender equality. Providing education, health care and care facilities has a direct impact on women. Due to social norms, the unpaid care burden falls disproportionately on their shoulders--on average, they spend 3.3 times as much time as men do on unpaid care. Without affordable childcare services, for example, women often struggle to remain in the labour market and secure social protection entitlements through employment.

Lower tax revenue also means less funding in infrastructure. Without investment in electricity, the productivity of women's household work and of women farmers is also limited. Without investment, the digital gender gap will continue to increase, denying women equal access to information and educational opportunities. Poor water and sanitation systems also impacts women and girls. In sub-Saharan African countries, where two-thirds of the population do not have access to clean and safe water, the chore of fetching drinking water falls disproportionately on girls and women, considerably reducing their time go to school or to work.

Without resources, countries cannot keep on investing in non-contributory social protection or social assistance. Nearly 65% of people above retirement age living without a regular pension are women. In Latin America and Asia, for example, the expansion of social assistance pensions has contributed to reducing gender gaps in coverage and provided women with greater access to personal income in their old age. Cash transfers have been associated with a rise in women's empowerment relating to marriage, safe sex and fertility as well as reductions in physical abuse by male partners. Take Brazil: the program "Bolsa Familia" significantly increased women's decision-making power regarding contraception.

Aggressive tax planning by corporations also forces countries to cover their fiscal deficits by increasing indirect taxes such as consumption taxes. These policies have a very negative effect on poor people and informal workers--where women are largely represented--as they spend a large part of their income on essential goods, perpetuating the vicious cycle of poverty.

It is time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise.

The existing system of taxing the global profits of multinational corporations enables systemic tax avoidance by large multinational corporations. Amazon, for example, does not plan to pay any taxes in the US this tax season - the second year in a row it will not. In developing countries, the situation is even more worrying. The think-tank Global Financial Integrity (GFI) calculated that US$1.1 trillion left developing countries in illicit financial flows (mostly the result of tax avoidance schemes) in 2013. That is much more than all official development assistance poor countries receive combined.

Public discontent over corporate tax scandals, as revealed by government investigations and whistle-blowers, has increased. As a result, after years of denial, the Organisation for Economic Cooperation and Development (OECD) has recently conceded that it is necessary to reform the global international tax system to put an end to all tax avoidance mechanisms. At the Independent Commission for the Reform of International Corporate Taxation (ICRICT), of which I am a member, we welcome this move. We hope a new opportunity has finally emerged to redesign an international progressive taxation system with the potential to reduce inequalities, including the gender one.

As the world prepares to celebrate International Women's Day on March 8th, we should add our voices to those of feminist organizations calling States to promote gender-equal taxation reforms in all international fora, including OECD and the United Nations. It is also time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise. There is no gender equality without fiscal justice.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Two American women lawmakers, Senator Elizabeth Warren and Congresswoman Alexandria Ocasio-Cortez, are determined to make taxation one of the central issues in the United States 2020 election campaign. They both express the will to do away with the taboo on taxing the rich. They are right. In the United States as in the rest of the world, there exists an inequality crisis. The growing gap between the super-rich and everyone else is increasing. The richest one percent now have more wealth than the rest of the world combined, as recently shown by Oxfam.

Countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

The fact that two women have kick-started a much-needed debate about taxes in the United States is not a coincidence. As revealed by a 2015 IMF study, countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

In recent years, women's organizations, movements and advocates around the world have been outspoken about the links between tax evasion and tax avoidance and gender equality. When corporations do not pay their fair share of taxes, there is less money to invest in public services, sustainable infrastructure and social protection, which are the key drivers for gender equality. Providing education, health care and care facilities has a direct impact on women. Due to social norms, the unpaid care burden falls disproportionately on their shoulders--on average, they spend 3.3 times as much time as men do on unpaid care. Without affordable childcare services, for example, women often struggle to remain in the labour market and secure social protection entitlements through employment.

Lower tax revenue also means less funding in infrastructure. Without investment in electricity, the productivity of women's household work and of women farmers is also limited. Without investment, the digital gender gap will continue to increase, denying women equal access to information and educational opportunities. Poor water and sanitation systems also impacts women and girls. In sub-Saharan African countries, where two-thirds of the population do not have access to clean and safe water, the chore of fetching drinking water falls disproportionately on girls and women, considerably reducing their time go to school or to work.

Without resources, countries cannot keep on investing in non-contributory social protection or social assistance. Nearly 65% of people above retirement age living without a regular pension are women. In Latin America and Asia, for example, the expansion of social assistance pensions has contributed to reducing gender gaps in coverage and provided women with greater access to personal income in their old age. Cash transfers have been associated with a rise in women's empowerment relating to marriage, safe sex and fertility as well as reductions in physical abuse by male partners. Take Brazil: the program "Bolsa Familia" significantly increased women's decision-making power regarding contraception.

Aggressive tax planning by corporations also forces countries to cover their fiscal deficits by increasing indirect taxes such as consumption taxes. These policies have a very negative effect on poor people and informal workers--where women are largely represented--as they spend a large part of their income on essential goods, perpetuating the vicious cycle of poverty.

It is time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise.

The existing system of taxing the global profits of multinational corporations enables systemic tax avoidance by large multinational corporations. Amazon, for example, does not plan to pay any taxes in the US this tax season - the second year in a row it will not. In developing countries, the situation is even more worrying. The think-tank Global Financial Integrity (GFI) calculated that US$1.1 trillion left developing countries in illicit financial flows (mostly the result of tax avoidance schemes) in 2013. That is much more than all official development assistance poor countries receive combined.

Public discontent over corporate tax scandals, as revealed by government investigations and whistle-blowers, has increased. As a result, after years of denial, the Organisation for Economic Cooperation and Development (OECD) has recently conceded that it is necessary to reform the global international tax system to put an end to all tax avoidance mechanisms. At the Independent Commission for the Reform of International Corporate Taxation (ICRICT), of which I am a member, we welcome this move. We hope a new opportunity has finally emerged to redesign an international progressive taxation system with the potential to reduce inequalities, including the gender one.

As the world prepares to celebrate International Women's Day on March 8th, we should add our voices to those of feminist organizations calling States to promote gender-equal taxation reforms in all international fora, including OECD and the United Nations. It is also time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise. There is no gender equality without fiscal justice.

Two American women lawmakers, Senator Elizabeth Warren and Congresswoman Alexandria Ocasio-Cortez, are determined to make taxation one of the central issues in the United States 2020 election campaign. They both express the will to do away with the taboo on taxing the rich. They are right. In the United States as in the rest of the world, there exists an inequality crisis. The growing gap between the super-rich and everyone else is increasing. The richest one percent now have more wealth than the rest of the world combined, as recently shown by Oxfam.

Countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

The fact that two women have kick-started a much-needed debate about taxes in the United States is not a coincidence. As revealed by a 2015 IMF study, countries with higher levels of income inequality also generate higher gender inequalities across health, education, labour market participation and representation.

In recent years, women's organizations, movements and advocates around the world have been outspoken about the links between tax evasion and tax avoidance and gender equality. When corporations do not pay their fair share of taxes, there is less money to invest in public services, sustainable infrastructure and social protection, which are the key drivers for gender equality. Providing education, health care and care facilities has a direct impact on women. Due to social norms, the unpaid care burden falls disproportionately on their shoulders--on average, they spend 3.3 times as much time as men do on unpaid care. Without affordable childcare services, for example, women often struggle to remain in the labour market and secure social protection entitlements through employment.

Lower tax revenue also means less funding in infrastructure. Without investment in electricity, the productivity of women's household work and of women farmers is also limited. Without investment, the digital gender gap will continue to increase, denying women equal access to information and educational opportunities. Poor water and sanitation systems also impacts women and girls. In sub-Saharan African countries, where two-thirds of the population do not have access to clean and safe water, the chore of fetching drinking water falls disproportionately on girls and women, considerably reducing their time go to school or to work.

Without resources, countries cannot keep on investing in non-contributory social protection or social assistance. Nearly 65% of people above retirement age living without a regular pension are women. In Latin America and Asia, for example, the expansion of social assistance pensions has contributed to reducing gender gaps in coverage and provided women with greater access to personal income in their old age. Cash transfers have been associated with a rise in women's empowerment relating to marriage, safe sex and fertility as well as reductions in physical abuse by male partners. Take Brazil: the program "Bolsa Familia" significantly increased women's decision-making power regarding contraception.

Aggressive tax planning by corporations also forces countries to cover their fiscal deficits by increasing indirect taxes such as consumption taxes. These policies have a very negative effect on poor people and informal workers--where women are largely represented--as they spend a large part of their income on essential goods, perpetuating the vicious cycle of poverty.

It is time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise.

The existing system of taxing the global profits of multinational corporations enables systemic tax avoidance by large multinational corporations. Amazon, for example, does not plan to pay any taxes in the US this tax season - the second year in a row it will not. In developing countries, the situation is even more worrying. The think-tank Global Financial Integrity (GFI) calculated that US$1.1 trillion left developing countries in illicit financial flows (mostly the result of tax avoidance schemes) in 2013. That is much more than all official development assistance poor countries receive combined.

Public discontent over corporate tax scandals, as revealed by government investigations and whistle-blowers, has increased. As a result, after years of denial, the Organisation for Economic Cooperation and Development (OECD) has recently conceded that it is necessary to reform the global international tax system to put an end to all tax avoidance mechanisms. At the Independent Commission for the Reform of International Corporate Taxation (ICRICT), of which I am a member, we welcome this move. We hope a new opportunity has finally emerged to redesign an international progressive taxation system with the potential to reduce inequalities, including the gender one.

As the world prepares to celebrate International Women's Day on March 8th, we should add our voices to those of feminist organizations calling States to promote gender-equal taxation reforms in all international fora, including OECD and the United Nations. It is also time to stress the need to have equal participation of women and men in these bodies, ensuring that these institutions have gender taxation expertise. There is no gender equality without fiscal justice.