SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," an Alaskan in medical debt said. "I don't think anyone should have to go into financial ruin to live."

A majority of Americans support medical debt relief, with about half showing strong support, according to a new poll from the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research.

The poll, first reported by The Associated Press on Tuesday, found that 51% of Americans believe it's "extremely or very important" for the U.S. government to provide relief to people with medical debt, while another 30% believe it's "somewhat important."

The support for government action comes as a glimmer of hope for the roughly 14 million Americans who owe $1,000 or more in medical debt—a common cause of bankruptcy in the U.S.—and the even greater number who have medical debt on their credit reports.

Janille Williams, a 38-year-old retail sales manager in Fairbanks, Alaska who is saddled with $50,000 in medical debt that makes it hard to buy a house, told The Associated Press that he didn't have any choice about taking the debt on—it was the only way to save his life when he had a blood infection.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," Williams said. "I don't think anyone should have to go into financial ruin to live."

"I generally think it's never anybody’s fault when they have a medical condition. If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

Last month, four progressive lawmakers, including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.), introduced the Medical Debt Cancellation Act in both houses of the U.S. Congress. The bill would prevent the collection of previously accrued debt, create a federal program for canceling debt, and take measures to limit future medical debts. Certain states and cities have already taken action to forgive medical debt, often using funds from the 2021 federal stimulus package.

Sanders and Khanna helped launch a "Freedom From Medical Debt" initiative last year, and the Biden administration has taken steps to relieve the burden of medical debt. Last week, the Consumer Financial Protection Bureau announced new rules that will forbid the inclusion of medical debt on credit reports, a move aimed at preventing debt collectors from "using the credit reporting system to coerce people to pay."

Vice President Kamala Harris came out in support of the new CFPB rules, which are unlikely to be finalized before the presidential election in November.

"Medical debt makes it more difficult for millions of Americans to be approved for a car loan, a home loan or a small business loans," she said. "All of which in turn makes it more difficult to just get by, much less get ahead. And that is simply not fair."

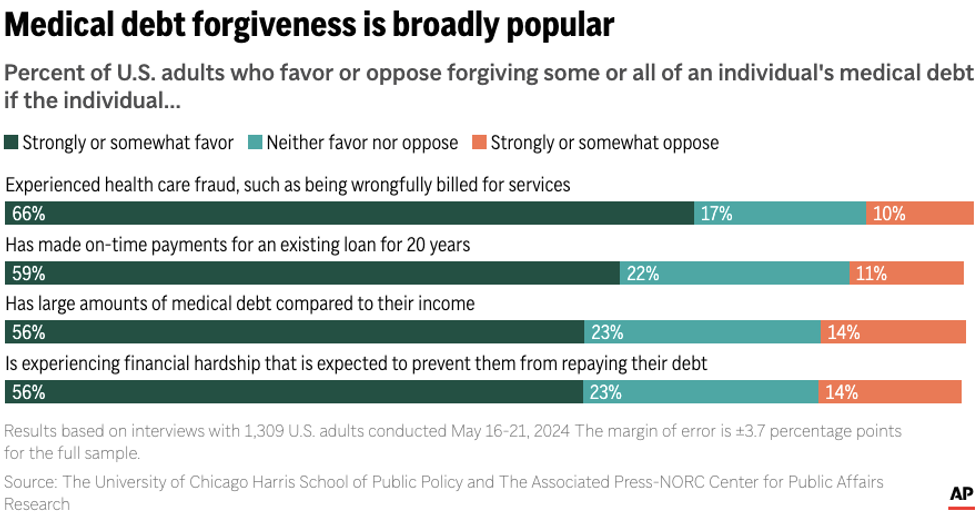

The new poll, which was released last week, found that medical debt relief is especially popular with people who have personal experience with medical debt or billing issues. People who've experienced healthcare fraud favor medical debt relief 66% to 10%, and those with large medical debts relative to their income favor it 56% to 14%.

There's also strong support for medical debt relief among Democrats, the poll found, with 65% expressing strong support, compared to only 31% of Republicans, though other members of both parties showed some support, with only a small proportion deeming the issue not important.

The data came from a survey of 1,309 Americans between May 16 and May 21, 2024.

The burden of medical debt is disproportionately carried by people of low- or middle-income, the middle-aged, and Black people, according to the Peterson-KFF Health System Tracker.

Matt Haskell, 24, of Englewood, Florida, told the AP that he supported medical debt relief following his own expensive hospitalization. He got a metal flake in his cornea while working on rusty cars and eventually went to the emergency room. The treatment cost him $4,500.

"I generally think it's never anybody’s fault when they have a medical condition," he said. "If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

"It is immoral that families are being evicted, having their heat disconnected, or having their wages garnished because of crippling medical debt," said Sen. Bernie Sanders.

Sen. Bernie Sanders on Tuesday welcomed news that the Consumer Financial Protection Bureau will soon announce rules to prevent medical debt from appearing on Americans' credit reports, a move the Vermont senator called "an important step in the right direction."

"It is immoral that families are being evicted, having their heat disconnected, or having their wages garnished because of crippling medical debt while the healthcare industry made more than $100 billion in profits last year," Sanders, the chair of the Senate Health, Education, Labor, and Pensions Committee, wrote on social media.

The Washington Post reported that the Biden administration's new rules, expected to be unveiled Tuesday, would "block medical debt from being used to evaluate borrowers' fitness for mortgages and other types of loans."

The rules, according to the Post, would "ban credit reporting agencies from incorporating medical debt when calculating credit scores" and "bar lenders from using medical debt to determine loan eligibility."

"The proposal will undergo weeks of public comment—meaning this November's election will probably determine whether the measures are finalized," the newspaper added. "GOP presidential candidate Donald Trump did not seek to remove medical debt from consumers' credit reports during his four years in the White House."

"People's credit scores are being unjustly and inappropriately harmed by this practice."

The CFPB, headed by longtime consumer advocate Rohit Chopra, estimated in April that 15 million people in the U.S. have medical bills on their credit reports despite recent changes by Equifax and other major credit reporting agencies, which announced last year that they would remove medical collection debt of $500 or less from consumer credit reports.

The 15 million Americans with medical debt on their credit reports "disproportionately live in the South and low-income communities," the CFPB observed in its April analysis. "Collectively, they have more than $49 billion in outstanding medical bills in collections."

KFF, a health policy organization, estimates based on government data that roughly 3 million U.S. adults owe medical debt of more than $10,000. Most Americans with medical debt owe money to hospitals, according to an Urban Institute analysis.

KFF Health News reported in late 2022 that "hundreds of U.S. hospitals maintain policies to aggressively pursue patients for unpaid bills, using tactics such as lawsuits, selling patient accounts to debt buyers, and reporting patients to credit rating agencies."

Out of a sample of more than 500 hospitals across the U.S., KFF Health News found that "more than two-thirds sue patients or take other legal action against them, such as garnishing wages or placing liens on property."

In an interview with ABC News Tuesday morning, Chopra said that CFPB "research shows that medical bills on your credit report aren't even predictive of whether you'll repay another type of loan."

"That means people's credit scores are being unjustly and inappropriately harmed by this practice," Chopra said, noting that the CFPB estimates 22,000 additional Americans would be approved for mortgages each year if the new rules are allowed to take effect.

The CFPB is set to release the new rules a month after Sanders joined Rep. Ro Khanna (D-Calif.) and other progressive lawmakers in introducing legislation that would eliminate the roughly $220 billion in medical debt collectively held by tens of millions of Americans.

The bill, titled the Medical Debt Cancellation Act, would also wipe all outstanding medical debt from credit reports.

"This is the United States of America, the richest country in the history of the world," Sanders said last month. "People in our country should not be going bankrupt because they got cancer and could not afford to pay their medical bills. No one in America should face financial ruin because of the outrageous cost of an unexpected medical emergency or a hospital stay."

"The time has come to cancel all medical debt and guarantee healthcare to all as a human right, not a privilege," said Sen. Bernie Sanders.

A quartet of progressive U.S. lawmakers on Wednesday introduced bicameral legislation "to eliminate all $220 billion in medical debt held by millions of Americans, wipe it from credit reports, and drastically limit the accrual of future medical debt."

The Medical Debt Cancellation Act—introduced by Sen. Bernie Sanders (I-Vt.), Rep. Ro Khanna (D-Calif.), Sen. Jeff Merkley (D-Ore.), and Rep. Rashida Tlaib (D-Mich.)—is a four-point plan for ending the medical debt that's crushing so many working-class Americans.

"Our current healthcare system is bankrupting Americans."

"The medical debt crisis has exploded in recent years, decimating Americans' bank accounts and deterring them from seeking healthcare," Sanders' office said in a statement. "Among all working-age adults in the United States, an estimated 27% are currently carrying medical debt of more than $500, and 15% have medical debt loads of $2,000 or more."

If passed, the Medical Debt Cancellation Act would:

"This is the United States of America, the richest country in the history of the world," said Sanders. "People in our country should not be going bankrupt because they got cancer and could not afford to pay their medical bills. No one in America should face financial ruin because of the outrageous cost of an unexpected medical emergency or a hospital stay."

But many do. In 2018 alone, 8 million people in the U.S. were driven into poverty due to medical debt. According to Sanders' office, nearly three-quarters of U.S. adults say they are worried about unexpected medical bills and nearly 1 in 4 people report having foregone medical treatment over cost concerns—including almost 20% of adults covered by health insurance.

"The time has come to cancel all medical debt and guarantee healthcare to all as a human right, not a privilege," said Sanders, a longtime proponent for Medicare for All in the only industrialized nation without universal coverage.

Khanna lamented that "our current healthcare system is bankrupting Americans."

"I've heard heartbreaking stories from constituents who have skipped doctor's appointments due to cost, who have lost loved ones because they couldn't afford their medication, and who aren't able to buy a house or get a job because of crippling medical debt," the congressman said.

"I'm so proud to join Sen. Sanders to cancel medical debt, wipe it from credit reports, and reform our system going forward," he added. "This bill would transform the lives of millions of Americans and I couldn't ask for a better partner in the fight."

This isn't Congress' first attempt to address the issue of medical debt. Last year, Tlaib

introduced the Restoring Unfairly Impaired Credit and Protecting Consumers Act, which would reduce the amount of time that negative information remains on a credit report from seven years to four and compel reporting agencies to erase adverse data stemming from "predatory loans and fraudulent activity."