SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A health insurance claim form is seen on a medical bill.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," an Alaskan in medical debt said. "I don't think anyone should have to go into financial ruin to live."

A majority of Americans support medical debt relief, with about half showing strong support, according to a new poll from the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research.

The poll, first reported by The Associated Press on Tuesday, found that 51% of Americans believe it's "extremely or very important" for the U.S. government to provide relief to people with medical debt, while another 30% believe it's "somewhat important."

The support for government action comes as a glimmer of hope for the roughly 14 million Americans who owe $1,000 or more in medical debt—a common cause of bankruptcy in the U.S.—and the even greater number who have medical debt on their credit reports.

Janille Williams, a 38-year-old retail sales manager in Fairbanks, Alaska who is saddled with $50,000 in medical debt that makes it hard to buy a house, told The Associated Press that he didn't have any choice about taking the debt on—it was the only way to save his life when he had a blood infection.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," Williams said. "I don't think anyone should have to go into financial ruin to live."

"I generally think it's never anybody’s fault when they have a medical condition. If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

Last month, four progressive lawmakers, including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.), introduced the Medical Debt Cancellation Act in both houses of the U.S. Congress. The bill would prevent the collection of previously accrued debt, create a federal program for canceling debt, and take measures to limit future medical debts. Certain states and cities have already taken action to forgive medical debt, often using funds from the 2021 federal stimulus package.

Sanders and Khanna helped launch a "Freedom From Medical Debt" initiative last year, and the Biden administration has taken steps to relieve the burden of medical debt. Last week, the Consumer Financial Protection Bureau announced new rules that will forbid the inclusion of medical debt on credit reports, a move aimed at preventing debt collectors from "using the credit reporting system to coerce people to pay."

Vice President Kamala Harris came out in support of the new CFPB rules, which are unlikely to be finalized before the presidential election in November.

"Medical debt makes it more difficult for millions of Americans to be approved for a car loan, a home loan or a small business loans," she said. "All of which in turn makes it more difficult to just get by, much less get ahead. And that is simply not fair."

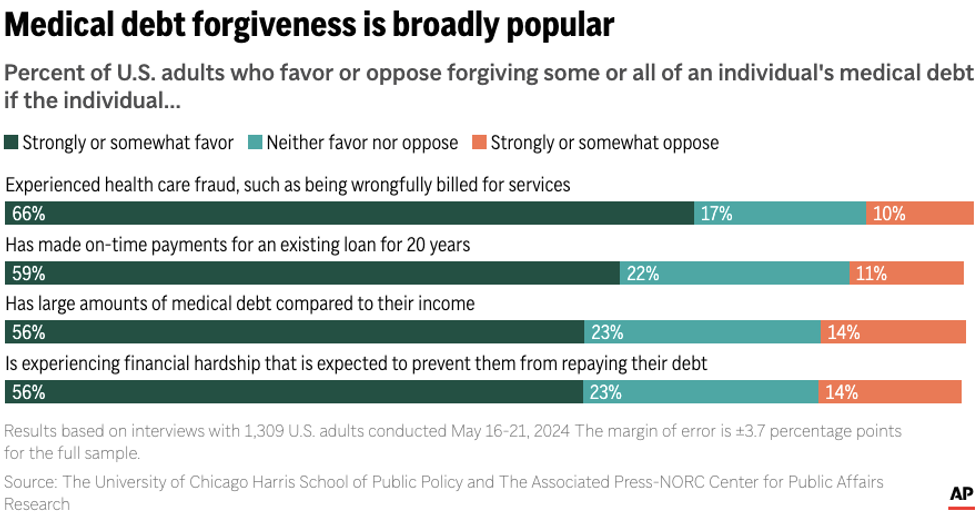

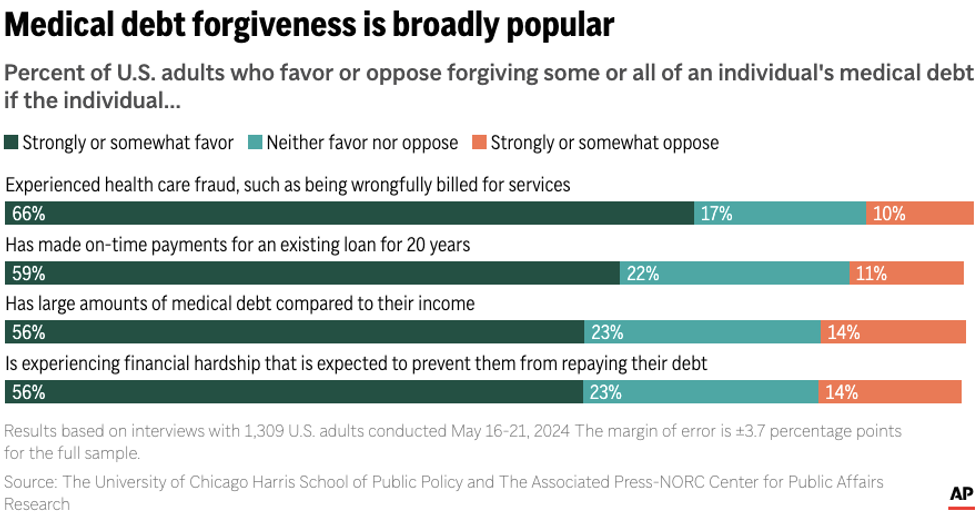

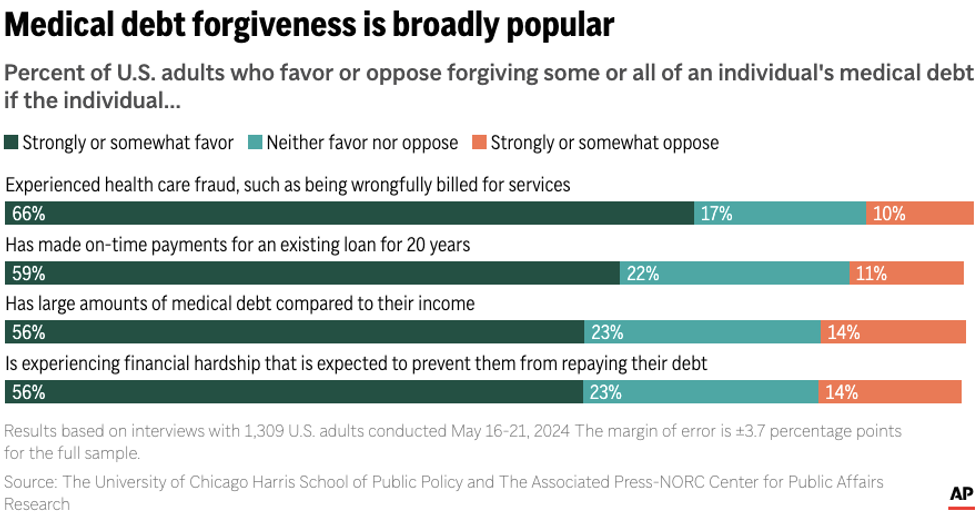

The new poll, which was released last week, found that medical debt relief is especially popular with people who have personal experience with medical debt or billing issues. People who've experienced healthcare fraud favor medical debt relief 66% to 10%, and those with large medical debts relative to their income favor it 56% to 14%.

There's also strong support for medical debt relief among Democrats, the poll found, with 65% expressing strong support, compared to only 31% of Republicans, though other members of both parties showed some support, with only a small proportion deeming the issue not important.

The data came from a survey of 1,309 Americans between May 16 and May 21, 2024.

The burden of medical debt is disproportionately carried by people of low- or middle-income, the middle-aged, and Black people, according to the Peterson-KFF Health System Tracker.

Matt Haskell, 24, of Englewood, Florida, told the AP that he supported medical debt relief following his own expensive hospitalization. He got a metal flake in his cornea while working on rusty cars and eventually went to the emergency room. The treatment cost him $4,500.

"I generally think it's never anybody’s fault when they have a medical condition," he said. "If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A majority of Americans support medical debt relief, with about half showing strong support, according to a new poll from the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research.

The poll, first reported by The Associated Press on Tuesday, found that 51% of Americans believe it's "extremely or very important" for the U.S. government to provide relief to people with medical debt, while another 30% believe it's "somewhat important."

The support for government action comes as a glimmer of hope for the roughly 14 million Americans who owe $1,000 or more in medical debt—a common cause of bankruptcy in the U.S.—and the even greater number who have medical debt on their credit reports.

Janille Williams, a 38-year-old retail sales manager in Fairbanks, Alaska who is saddled with $50,000 in medical debt that makes it hard to buy a house, told The Associated Press that he didn't have any choice about taking the debt on—it was the only way to save his life when he had a blood infection.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," Williams said. "I don't think anyone should have to go into financial ruin to live."

"I generally think it's never anybody’s fault when they have a medical condition. If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

Last month, four progressive lawmakers, including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.), introduced the Medical Debt Cancellation Act in both houses of the U.S. Congress. The bill would prevent the collection of previously accrued debt, create a federal program for canceling debt, and take measures to limit future medical debts. Certain states and cities have already taken action to forgive medical debt, often using funds from the 2021 federal stimulus package.

Sanders and Khanna helped launch a "Freedom From Medical Debt" initiative last year, and the Biden administration has taken steps to relieve the burden of medical debt. Last week, the Consumer Financial Protection Bureau announced new rules that will forbid the inclusion of medical debt on credit reports, a move aimed at preventing debt collectors from "using the credit reporting system to coerce people to pay."

Vice President Kamala Harris came out in support of the new CFPB rules, which are unlikely to be finalized before the presidential election in November.

"Medical debt makes it more difficult for millions of Americans to be approved for a car loan, a home loan or a small business loans," she said. "All of which in turn makes it more difficult to just get by, much less get ahead. And that is simply not fair."

The new poll, which was released last week, found that medical debt relief is especially popular with people who have personal experience with medical debt or billing issues. People who've experienced healthcare fraud favor medical debt relief 66% to 10%, and those with large medical debts relative to their income favor it 56% to 14%.

There's also strong support for medical debt relief among Democrats, the poll found, with 65% expressing strong support, compared to only 31% of Republicans, though other members of both parties showed some support, with only a small proportion deeming the issue not important.

The data came from a survey of 1,309 Americans between May 16 and May 21, 2024.

The burden of medical debt is disproportionately carried by people of low- or middle-income, the middle-aged, and Black people, according to the Peterson-KFF Health System Tracker.

Matt Haskell, 24, of Englewood, Florida, told the AP that he supported medical debt relief following his own expensive hospitalization. He got a metal flake in his cornea while working on rusty cars and eventually went to the emergency room. The treatment cost him $4,500.

"I generally think it's never anybody’s fault when they have a medical condition," he said. "If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

A majority of Americans support medical debt relief, with about half showing strong support, according to a new poll from the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research.

The poll, first reported by The Associated Press on Tuesday, found that 51% of Americans believe it's "extremely or very important" for the U.S. government to provide relief to people with medical debt, while another 30% believe it's "somewhat important."

The support for government action comes as a glimmer of hope for the roughly 14 million Americans who owe $1,000 or more in medical debt—a common cause of bankruptcy in the U.S.—and the even greater number who have medical debt on their credit reports.

Janille Williams, a 38-year-old retail sales manager in Fairbanks, Alaska who is saddled with $50,000 in medical debt that makes it hard to buy a house, told The Associated Press that he didn't have any choice about taking the debt on—it was the only way to save his life when he had a blood infection.

"They don't give you a choice in the hospital. 'If you leave, you'll die,' they told me. I didn't feel like dying," Williams said. "I don't think anyone should have to go into financial ruin to live."

"I generally think it's never anybody’s fault when they have a medical condition. If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."

Last month, four progressive lawmakers, including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.), introduced the Medical Debt Cancellation Act in both houses of the U.S. Congress. The bill would prevent the collection of previously accrued debt, create a federal program for canceling debt, and take measures to limit future medical debts. Certain states and cities have already taken action to forgive medical debt, often using funds from the 2021 federal stimulus package.

Sanders and Khanna helped launch a "Freedom From Medical Debt" initiative last year, and the Biden administration has taken steps to relieve the burden of medical debt. Last week, the Consumer Financial Protection Bureau announced new rules that will forbid the inclusion of medical debt on credit reports, a move aimed at preventing debt collectors from "using the credit reporting system to coerce people to pay."

Vice President Kamala Harris came out in support of the new CFPB rules, which are unlikely to be finalized before the presidential election in November.

"Medical debt makes it more difficult for millions of Americans to be approved for a car loan, a home loan or a small business loans," she said. "All of which in turn makes it more difficult to just get by, much less get ahead. And that is simply not fair."

The new poll, which was released last week, found that medical debt relief is especially popular with people who have personal experience with medical debt or billing issues. People who've experienced healthcare fraud favor medical debt relief 66% to 10%, and those with large medical debts relative to their income favor it 56% to 14%.

There's also strong support for medical debt relief among Democrats, the poll found, with 65% expressing strong support, compared to only 31% of Republicans, though other members of both parties showed some support, with only a small proportion deeming the issue not important.

The data came from a survey of 1,309 Americans between May 16 and May 21, 2024.

The burden of medical debt is disproportionately carried by people of low- or middle-income, the middle-aged, and Black people, according to the Peterson-KFF Health System Tracker.

Matt Haskell, 24, of Englewood, Florida, told the AP that he supported medical debt relief following his own expensive hospitalization. He got a metal flake in his cornea while working on rusty cars and eventually went to the emergency room. The treatment cost him $4,500.

"I generally think it's never anybody’s fault when they have a medical condition," he said. "If they get cancer or a tumor or have an episode from undiagnosed diabetes—it's not someone’s fault if they develop something and now they're thousands or hundreds of thousands of dollars in debt."