Trump Treasury Pick's Economic Plan Would 'Require Massive Cuts to Anti-Poverty Programs': Analysis

Scott Bessent's "3-3-3" agenda "requires brutal cuts to health and nutrition and higher costs for families at the grocery store," said analysts at the Center for American Progress.

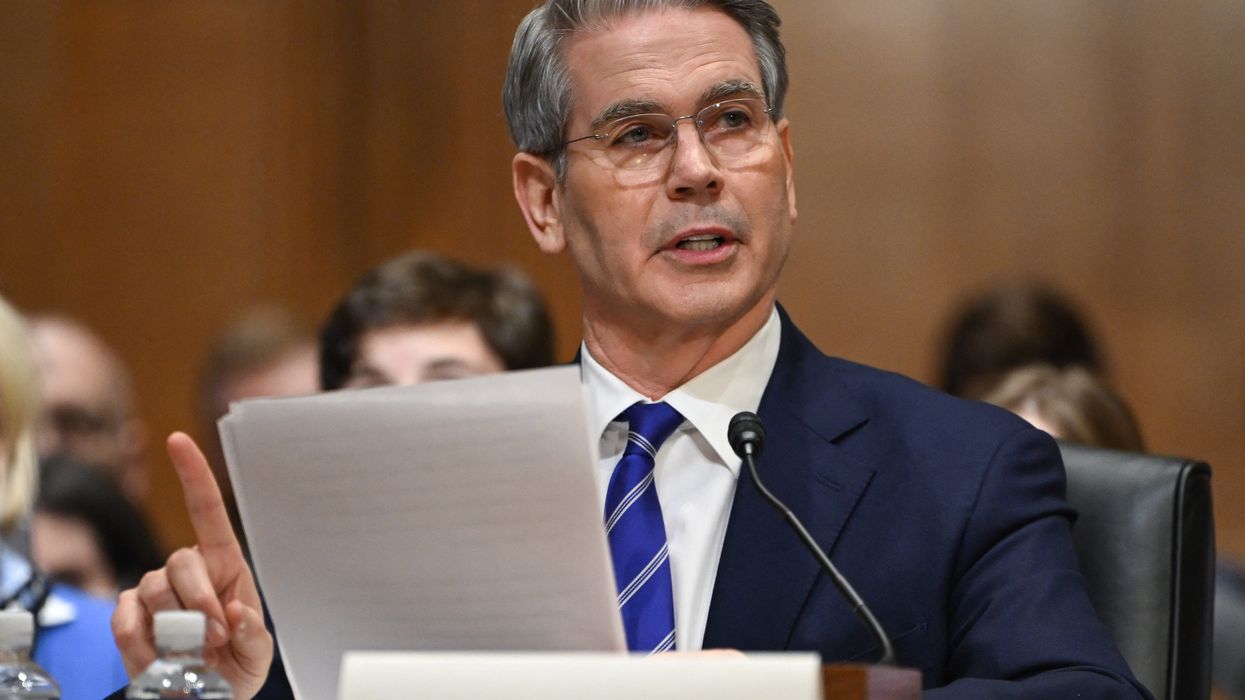

At his confirmation hearing on Thursday, hedge fund manager and U.S. treasury secretary nominee Scott Bessent told the Senate Finance Committee that at the helm of the Treasury Department he would usher in an "economic golden age."

But a report by two policy analysts details how Bessent's signature "3-3-3" plan would only be achievable by gutting programs for some of the nation's most vulnerable households—extending the "golden age" only to wealthy people and corporations for whom the Trump administration plans to slash taxes.

At the Center for American Progress, senior director of economic policy Brendan Duke and senior director of federal budget policy Bobby Kogan completed "the accounting to determine what it would take to achieve" Bessent's 3-3-3 agenda, particularly his plan to cut the federal budget deficit down to 3% of the gross domestic product (GDP). The plan also calls for real GDP growth to reach 3% and the production of 3 million barrels of oil by 2028.

While reducing the budget deficit and simultaneously protecting programs American families rely on is a "laudable goal," wrote Duke and Kogan, Bessent has "explicitly stated that extending the expiring 2017 tax cuts is a priority, and he would likely rule out tax increases on the wealthy to pay for them"—suggesting that the Treasury nominee's 3-3-3 agenda would require new taxes on imported goods and "massive cuts to anti-poverty programs."

The Congressional Budget Office has projected that the budget deficit will represent 5.8% of the nation's GDP in 2028.

"The president-elect is stacking his cabinet with one goal in mind: more tax breaks for his billionaire boys club and major corporations."

With Bessent proposing an extension of the 2017 tax cuts—which are projected to grow the budget deficit by about $4 trillion over a decade—the elimination of Inflation Reduction Act energy investments, and a pause on nondefense discretionary spending increases, said Duke and Kogan, Bessent's plan would "actually increase the projected 2028 budget deficit from 5.8 to 6.0% of GDP, or $1 trillion above the 3% target.

Without any cuts to Medicare and Social Security—which Trump has said he would exempt from cuts—or defense spending, says the analysis, Bessent's deficit target would require both:

- A 20% tax on all imported goods and a 60% tax increase on imports from China, costing the average family between $2,200-$3,900, and

- Cutting the federal budget by nearly $500 billion in 2028 alone, which couldn't be done without a 31% cut to spending including Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and veterans' compensation and pensions—on top of Bessent's 6% cut to nondefense discretionary spending.

"The combination of policies that would deliver the deficit reduction proposed in Bessent's 3-3-3 economic plan would raise taxes on low- and middle-income families and gut healthcare, nutrition assistance, and veterans' programs while still cutting taxes for the wealthy," wrote Duke and Kogan. "Such a plan would hike families' costs both because broad-based tariffs would increase prices and because Americans would have to pay more for healthcare and food due to cuts to federal programs that help lower the cost of living."

With families across the U.S. facing "brutal cuts to health and nutrition" and higher prices at the grocery store under Bessent's plan, said Duke, the wealthiest households would still get "a net tax cut."

At The Washington Post, columnist Catherine Rampell wrote that "the magnitude of cuts required to make Bessent's arithmetic work is breathtaking."

"If you add up all the tax-cut promises Trump made during his campaign, the budget hole swells to almost $10 trillion," wrote Rampell. "To compensate, government programs would have to shrink by two-thirds. Alternatively, Trump could raise taxes on the middle class. Pick your poison."

On social media, government watchdog Accountable.US denounced Bessent's defense of Trump's tax cuts—under which "the top 1% saw benefits nearly three times larger than families in the bottom 60%"—and of the president-elect's proposed tariffs, which leading economists say would "reignite" inflation.

"Scott Bessent's nomination isn't about helping American families," said the group. "It's about lining the pockets of the ultra-wealthy and doubling down on policies that hurt the middle class."

Meanwhile, critics of Bessent on Thursday pointed to new reporting from Politico that Senate Democrats have accused the Treasury nominee of dodging $910,182 in Medicare taxes for income he made through his hedge fund from 2021-23. A memo circulated by Democrats stated that Bessent argued that as a "limited partner" in his fund, he was not liable for taxes on certain income.

Sen. Ron Wyden (D-Ore.) addressed the memo at Bessent's hearing, saying: "Like a number of Wall Street fund managers, Mr. Bessent makes use of a tricky legal maneuver to opt out of paying into Medicare."

"The billionaire hedge fund manager Trump handpicked to oversee a massive tax giveaway for the ultra-wealthy doesn't pay his own taxes," said Lindsay Owens, executive director of Groundwork Collaborative. "It's almost too on the nose. The president-elect is stacking his cabinet with one goal in mind: more tax breaks for his billionaire boys club and major corporations."