For some decades most Republican members of Congress have taken the "Norquist Pledge" never to vote for tax increases. Many of them have carried this pledge even further by reducing the Internal Revenue Service budget, impairing the agency's ability to collect taxes that are already in the law books. Lately, however, these Republicans have supported major increases in federal taxes imposed by US President Donald Trump---high tariffs on goods imported into the United States.

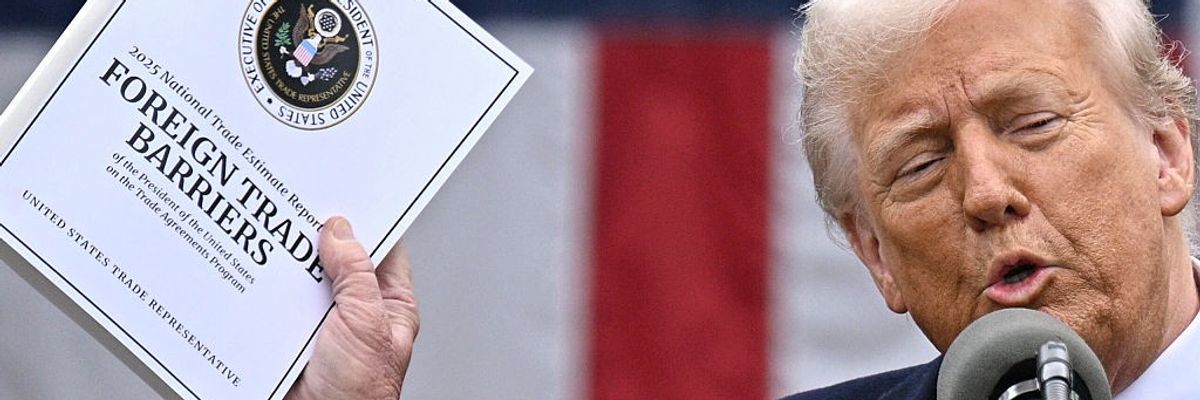

Although Mr. Trump repeatedly speaks of "making Brazil pay, " "making China pay," etc., he is actually imposing a tax on goods imported into the US from those countries. This tax will either be passed along to American consumers in the form of higher prices, or it will be absorbed by the importing company, making it a tax on American business owners.

No money is coming in from Brazil or China.

These new taxes have been putting decent amounts of money into the federal treasury, which it certainly can use. But it is all coming in from Americans.

Congress clearly did not specifically authorize the president to impose tariffs on Brazil because it is prosecuting its former president for trying to remain in office after he lost an election.

I have often attacked the Norquist Pledge and accused politicians who take it of political malpractice, since changed circumstances may sometimes require tax increases to support needed spending or reduce out of control deficits. So why am I not happy that Republicans have found a way to weasel out of their pledge never to increase taxes?

Americans are afflicted with increasing economic inequality. We should therefore avoid regressive tax increases, which put the highest increase on poor or average Americans. But tariffs are highly regressive. Poor people must spend all of their meager incomes, mostly on goods. Better-off people save some of their income and spend more on services, which tariffs do not greatly affect.

Of course regressive taxes suit the interests of the wealthy, whose campaign donations politicians covet, and who also benefit from legislation impairing the ability of the IRS to audit them.

Unfortunately for Mr. Trump and his entourage, the claimed legal basis for his power to impose tariffs is extremely weak. Congress has authorized the president to adjust tariffs in unforeseen domestic or international emergencies. But Mr. Trump has pushed this authorization beyond all reasonable limits and has a propensity to declare emergencies that clearly are not emergencies.

In recent years the newly conservative US Supreme Court has invented a new "major questions" doctrine. This doctrine is not unreasonable. It says that when US Congress has authorized a government agency to regulate something, if that agency enacts a regulation that has large scale consequences, the court will strike that regulation down unless Congress has clearly and specifically authorized that kind of regulation.

The tariffs are a presidential action, not that of a government agency, but this is an even more appropriate case for applying the major questions doctrine. Government agencies can only impose new regulations after lengthy deliberations required by the Administrative Procedures Act. Unlike federal administrative agencies, the president—claiming congressional authorization—can just do things without any required procedures or consultation.

Congress clearly did not specifically authorize the president to impose tariffs on Brazil because it is prosecuting its former president for trying to remain in office after he lost an election. And it clearly did not specify that the president could increase tariffs in order to increase federal revenues, or to deal with imaginary emergencies that he himself dreamed up.

Presidentially imposed tariffs are obviously a case where the major questions doctrine would be an appropriate guide to the justices.

No doubt the court's conservative majority invented the major questions doctrine because it supported some decision that they wanted to make. Fair enough. But will they respect this doctrine when it requires a decision they do not want to make?