SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

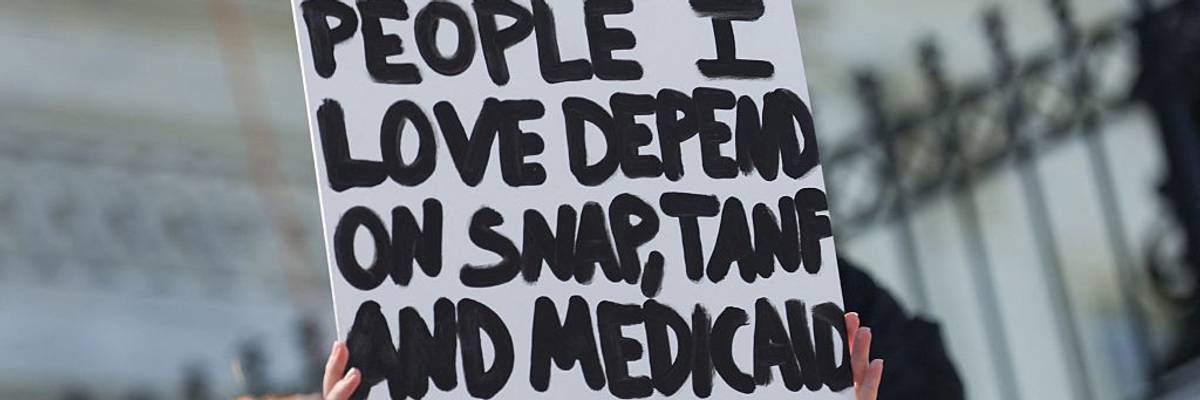

A demonstrator holds a sign reading 'People I love depend on SNAP, TANF, and Medicaid' during a sit-in protest against a Republican budget plan on the House steps of the U.S. Capitol in Washington, D.C. on April 27, 2025.

The House bill will drive up hunger and deepen poverty, including among children, and take access to life-saving healthcare away from millions of people. The Senate must reject it.

At the end of a rushed, chaotic process, House Republicans passed a bill early Thursday morning that fails the people they promised to help. It would raise costs on millions of families across the country, making it harder for them to meet basic needs and weather life’s ups and downs—while showering ever larger tax breaks on the wealthiest households.

The bill will drive up hunger and deepen poverty, including among children, and take access to life-saving healthcare away from millions of people. The Senate must reject it.

Congressional Budget Office data and other analyses make the House Republican agenda’s harmful impacts crystal clear: about 15 million people losing health coverage; millions losing food assistance or having their food assistance cut, including 2 million or more children; the 10% of households with the lowest incomes made worse off while the richest get richer by tens or even hundreds of thousands of dollars each year; and trillions of dollars added to our debt over the decade, worsening our long-term fiscal picture and increasing the risk to our economy.

In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts.

The bill’s SNAP provisions are so extreme that some states, faced with backfilling deep federal funding cuts that total billions of dollars a year nationally, could take steps to dramatically take food assistance away from large numbers of people and could even decide to end their SNAP programs entirely. Simply put, House Republicans are walking away from a 50-year, bipartisan commitment to ensure that children in families with low incomes get the help they need, no matter what state they live in—with potentially devastating impacts on their health, education, and future success.

The extreme health provisions would lead to an unprecedented drop in health coverage and drive up health costs for millions. Make no mistake—the main way the bill cuts more than $800 billion from healthcare is by taking away Medicaid and affordable marketplace coverage from people who are eligible.

The bill also makes higher education more expensive for millions by driving up the cost of student loans and reducing the level of Pell education grants for college students.

The bill directs some of its harshest cuts toward people who are immigrants and their families. House Republicans falsely claim that they are restricting access to basic needs programs for people who don’t have a documented status. But the reality is that people without a documented immigration status already do not qualify for these benefits. The cuts in federal benefits will fall entirely on immigrants in the country lawfully—including some pregnant women and children who need food assistance. Refugees, people granted asylum, and victims of trafficking—people who have had to prove that they face persecution in their home countries or have been victimized by sex or labor traffickers—are among those who would see their food assistance, Medicare benefits they paid into, and affordable health marketplace coverage terminated. And the bill will also take away the Child Tax Credit from millions of U.S. citizen children in immigrant families.

The House Republican bill showers more tax cuts on the wealthy, extending the highly skewed provisions of the 2017 tax law and adding permanent expansions for wealthy households, while leaving millions of children in working families with low incomes out of even the temporary increase in the Child Tax Credit. In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts—even while these households bear the brunt of cuts to Medicaid and SNAP and face higher prices due to the president’s tariffs, which the bill does nothing to address.

There’s a better path forward, but it requires the Senate to tear up this legislation and start again, rejecting any proposals that raise costs on families, take health coverage and food assistance away from families who need them, or drive up poverty and the number of people who are uninsured.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

At the end of a rushed, chaotic process, House Republicans passed a bill early Thursday morning that fails the people they promised to help. It would raise costs on millions of families across the country, making it harder for them to meet basic needs and weather life’s ups and downs—while showering ever larger tax breaks on the wealthiest households.

The bill will drive up hunger and deepen poverty, including among children, and take access to life-saving healthcare away from millions of people. The Senate must reject it.

Congressional Budget Office data and other analyses make the House Republican agenda’s harmful impacts crystal clear: about 15 million people losing health coverage; millions losing food assistance or having their food assistance cut, including 2 million or more children; the 10% of households with the lowest incomes made worse off while the richest get richer by tens or even hundreds of thousands of dollars each year; and trillions of dollars added to our debt over the decade, worsening our long-term fiscal picture and increasing the risk to our economy.

In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts.

The bill’s SNAP provisions are so extreme that some states, faced with backfilling deep federal funding cuts that total billions of dollars a year nationally, could take steps to dramatically take food assistance away from large numbers of people and could even decide to end their SNAP programs entirely. Simply put, House Republicans are walking away from a 50-year, bipartisan commitment to ensure that children in families with low incomes get the help they need, no matter what state they live in—with potentially devastating impacts on their health, education, and future success.

The extreme health provisions would lead to an unprecedented drop in health coverage and drive up health costs for millions. Make no mistake—the main way the bill cuts more than $800 billion from healthcare is by taking away Medicaid and affordable marketplace coverage from people who are eligible.

The bill also makes higher education more expensive for millions by driving up the cost of student loans and reducing the level of Pell education grants for college students.

The bill directs some of its harshest cuts toward people who are immigrants and their families. House Republicans falsely claim that they are restricting access to basic needs programs for people who don’t have a documented status. But the reality is that people without a documented immigration status already do not qualify for these benefits. The cuts in federal benefits will fall entirely on immigrants in the country lawfully—including some pregnant women and children who need food assistance. Refugees, people granted asylum, and victims of trafficking—people who have had to prove that they face persecution in their home countries or have been victimized by sex or labor traffickers—are among those who would see their food assistance, Medicare benefits they paid into, and affordable health marketplace coverage terminated. And the bill will also take away the Child Tax Credit from millions of U.S. citizen children in immigrant families.

The House Republican bill showers more tax cuts on the wealthy, extending the highly skewed provisions of the 2017 tax law and adding permanent expansions for wealthy households, while leaving millions of children in working families with low incomes out of even the temporary increase in the Child Tax Credit. In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts—even while these households bear the brunt of cuts to Medicaid and SNAP and face higher prices due to the president’s tariffs, which the bill does nothing to address.

There’s a better path forward, but it requires the Senate to tear up this legislation and start again, rejecting any proposals that raise costs on families, take health coverage and food assistance away from families who need them, or drive up poverty and the number of people who are uninsured.

At the end of a rushed, chaotic process, House Republicans passed a bill early Thursday morning that fails the people they promised to help. It would raise costs on millions of families across the country, making it harder for them to meet basic needs and weather life’s ups and downs—while showering ever larger tax breaks on the wealthiest households.

The bill will drive up hunger and deepen poverty, including among children, and take access to life-saving healthcare away from millions of people. The Senate must reject it.

Congressional Budget Office data and other analyses make the House Republican agenda’s harmful impacts crystal clear: about 15 million people losing health coverage; millions losing food assistance or having their food assistance cut, including 2 million or more children; the 10% of households with the lowest incomes made worse off while the richest get richer by tens or even hundreds of thousands of dollars each year; and trillions of dollars added to our debt over the decade, worsening our long-term fiscal picture and increasing the risk to our economy.

In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts.

The bill’s SNAP provisions are so extreme that some states, faced with backfilling deep federal funding cuts that total billions of dollars a year nationally, could take steps to dramatically take food assistance away from large numbers of people and could even decide to end their SNAP programs entirely. Simply put, House Republicans are walking away from a 50-year, bipartisan commitment to ensure that children in families with low incomes get the help they need, no matter what state they live in—with potentially devastating impacts on their health, education, and future success.

The extreme health provisions would lead to an unprecedented drop in health coverage and drive up health costs for millions. Make no mistake—the main way the bill cuts more than $800 billion from healthcare is by taking away Medicaid and affordable marketplace coverage from people who are eligible.

The bill also makes higher education more expensive for millions by driving up the cost of student loans and reducing the level of Pell education grants for college students.

The bill directs some of its harshest cuts toward people who are immigrants and their families. House Republicans falsely claim that they are restricting access to basic needs programs for people who don’t have a documented status. But the reality is that people without a documented immigration status already do not qualify for these benefits. The cuts in federal benefits will fall entirely on immigrants in the country lawfully—including some pregnant women and children who need food assistance. Refugees, people granted asylum, and victims of trafficking—people who have had to prove that they face persecution in their home countries or have been victimized by sex or labor traffickers—are among those who would see their food assistance, Medicare benefits they paid into, and affordable health marketplace coverage terminated. And the bill will also take away the Child Tax Credit from millions of U.S. citizen children in immigrant families.

The House Republican bill showers more tax cuts on the wealthy, extending the highly skewed provisions of the 2017 tax law and adding permanent expansions for wealthy households, while leaving millions of children in working families with low incomes out of even the temporary increase in the Child Tax Credit. In 2027, it gives households earning more than $1 million a year an average tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts—even while these households bear the brunt of cuts to Medicaid and SNAP and face higher prices due to the president’s tariffs, which the bill does nothing to address.

There’s a better path forward, but it requires the Senate to tear up this legislation and start again, rejecting any proposals that raise costs on families, take health coverage and food assistance away from families who need them, or drive up poverty and the number of people who are uninsured.