July, 13 2017, 05:00pm EDT

2017 Social Security Trustees Report Shows That Social Security Continues to Work for America

An Expanded Social Security Will Work Even Better

WASHINGTON

As reporters cover the just-released 2017 Social Security and Medicare Trustees Reports, Social Security Works provides you with this fact sheet that summarizes and puts in context the Social Security report's key findings. This fact sheet updates the figures in the media backgrounder Social Security Works issued in advance of the Trustees Report's release. Please note that this fact sheet addresses only the Social Security's cash benefits Trustees Report (Old Age, Survivors, and Disability Insurance Trustees Report), and not deal with the Medicare Trustees Report.

In addition to reviewing this fact sheet, we invite you to speak with our president, Nancy Altman, who is a nationally recognized Social Security expert (see bio below). We also urge you to review our fact sheet that discusses, among other things, misinterpretations by non-experts caused by over- emphasis of unrealistically long valuation periods. You may also want to read Columbia Journalism Review's "Report Card on Social Security Coverage," written in response to coverage of the 2012 Trustees Report.

The most important takeaways from the 2017 Trustees Report are that (1) Social Security has a large and growing surplus, and (2) Social Security is extremely affordable. At its most expensive, in 2095, Social Security is projected to cost just 6.17 percent of gross domestic product ("GDP"). That is considerably lower, as a percentage of GDP, than Germany, Austria, France, and most other industrialized countries spend on their counterpart programs today! In 2016, Social Security constituted just 5 percent of GDP.

The report shows that Social Security is fully and easily affordable. The question of whether to expand or cut Social Security's modest benefits is a question of values and choice, not affordability. Indeed, in light of Social Security's near universality, efficiency, fairness in its benefit distribution, portability from job to job, and security, the obvious solution to the nation's looming retirement income crisis, discussed below, is to increase Social Security's modest benefits. The average annual benefit received by Social Security's over 61 million beneficiaries is less than $15,000 this year.

Moreover, expanding Social Security not only addresses the retirement income crisis, it also is part of the answer to growing income and wealth inequality and the financial squeeze on working families. Expanding, not cutting, Social Security while requiring the wealthiest among us to contribute more - indeed, their fair share - is the best policy approach to addressing these challenges while restoring Social Security to long-range actuarial balance. Cutting those modest benefits will only exacerbate these challenges.

That is perhaps why the Democratic Party strongly favors expanding, not cutting Social Security. The 2016 Democratic Platform states:

We will fight every effort to cut, privatize, or weaken Social Security, including attempts to raise the retirement age, diminish benefits by cutting cost-of-living adjustments, or reducing earned benefits. Democrats will expand Social Security

Consistent with that pledge, nearly 20 Social Security expansion bills have been introduced in the House and Senate just since 2015. Recently, the Social Security 2100 Act, introduced by Rep. John Larson (D-CT01), has 158 cosponsors in the House of Representatives--the largest number of supporters for any expansion bill ever

The report projects that Social Security's cumulative surplus will be $2.9 trillion in 2017, growing to about $3 trillion around 2021. It reports that Social Security is fully funded for the next decade, 93 percent funded for the next 25 years, 87 percent funded over the next 50 years, and 84 percent funded over the next 75 years. Without a single penny of additional revenue, Social Security will have sufficient income and assets to pay all benefits to America's seniors, people with disabilities, and survivors of deceased workers, as well as all associated administrative costs, for around one and a half decades, until 2034, and 77 percent of all benefits and associated administrative costs thereafter. Moreover, the report shows that, with modest legislated increases in revenue, Social Security will be able to pay all scheduled benefits for the foreseeable future.

More specifically, journalists may want to give special attention to the following:

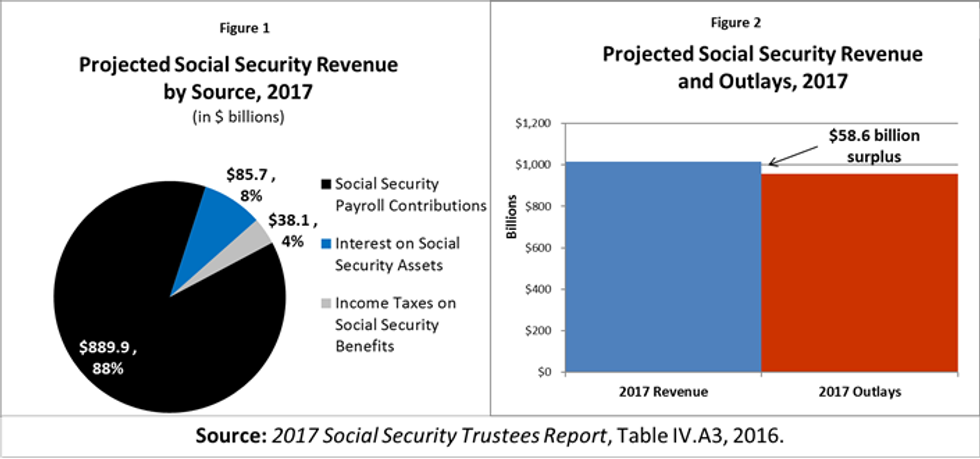

Income to Social Security from all sources exceeds all expenditures in 2017, which is why the program's reserves will continue to grow (see Figure 2 on p. 2). As Figure 1 (see p. 2) shows, Social Security has three revenue sources: 1) wage contributions from employees, matched by employers; 2) investment earnings on Social Security's U.S. Treasury bond holdings (which have the same legal standing and status as other interest-bearing Treasury bonds issued by the government); and 3) dedicated income taxes on the Social Security benefits of those with higher incomes.

It is sometimes reported that Social Security is paying out more money in benefits than it is collecting in income, but that is wrong. This claim counts only Social Security's income from payroll contributions, disregarding one or both of its other two dedicated sources of income: investment income and dedicated income tax revenue, as stated above. While viewing Social Security's finances in this fashion, i.e. ignoring one or two of its three sources of revenue, portrays it in "cash deficit," this view (and term) has no legal meaning with regard to Social Security's finances, and no bearing on its ability to pay benefits. Indeed, so-called "cash deficits" have happened 29 times since 1957, without ever affecting the system's ability to pay benefits. Moreover, as Figure 2 shows, when income from all of Social Security's statutory revenue sources is counted its 2017 revenue is projected to surpass its outlays.

The nation is facing a looming retirement income crisis where most workers will be unable to cease work without a drastic reduction in their standards of living. Over half (52 percent) of American households headed by someone of working age will not be able to maintain their standard of living in old age, and this figure rises to roughly two-thirds when health and long-term care costs are also considered. Traditional employer-sponsored defined benefit pension plans are disappearing, leaving workers with, at best, defined contribution retirement savings plans, which have proven inadequate. Around half of households aged 55 or older had zero retirement savings in 2013. Among those households age 55-64 with some retirement savings in 2013, the median amount of those savings was about $104,000, equivalent to an annuity of just $310 a month. Thus, it is not surprising that today two-thirds of senior beneficiaries rely on Social Security for a majority of their income. Social Security will certainly be even more important to tomorrow's seniors.

As important as restoring Social Security to long-range actuarial balance is, it is imperative to remember that it is simply a means to the end of providing America's families with basic economic security. Recognizing that Social Security is a solution to our looming retirement crisis and other challenges facing the nation, serious analysts, and a growing number of policymakers and nonprofit organizations have advanced responsible, fully-funded proposals to expand Social Security.

Social Security Works' mission is to: Protect and improve the economic security of disadvantaged and at-risk populations; Safeguard the economic security of those dependent, now or in the future, on Social Security; and Maintain Social Security as a vehicle of social justice.

LATEST NEWS

YouTube, TikTok Deleted ‘60 Minutes’ CECOT Clips Amid Paramount Takedown Push

The segment on the notorious torture prison—where the Trump administration has been unlawfully deporting Venezuelans—went viral on social media after being inadvertently aired in Canada.

Dec 23, 2025

Websites including YouTube and TikTok this week removed posts of a CBS News "60 Minutes" segment on a notorious prison in El Salvador, where Trump the administration has been illegally deporting Venezuelan immigrants, after being notified that publishing the clip violated parent company's copyright.

The segment on the Terrorism Confinement Center (CECOT)—which was intended to air on Sunday's episode of "60 Minutes"—was pulled by right-wing CBS News editor-in-chief Bari Weiss, who claimed that the story "was not ready" for broadcast, despite thorough editing and clearance by key company officials.

“Our story was screened five times and cleared by both CBS attorneys and Standards and Practices," said "60 Minutes" correspondent Sharyn Alfonsi, who reported the segment. “It is factually correct. In my view, pulling it now, after every rigorous internal check has been met, is not an editorial decision, it is a political one.”

The segment—which can still be viewed on sites including X—was shared by social media users after a Canadian network received and broadcast an original version of the "60 Minutes" episode containing the CECOT piece prior to CBS pulling the story. The social media posts containing the segment were reportedly removed after CBS parent company Paramount Skydance filed copyright claims.

A CBS News representative said that “Paramount’s content protection team is in the process of routine take down orders for the unaired and unauthorized segment.”

Weiss—who also founded and still edits the Paramount Skydance-owned Free Press—has faced criticism for other moves, including presiding over the removal of parts of a previous "60 Minutes" interview with President Donald Trump regarding potential corruption stemming from his family’s massive cryptocurrency profits.

On Tuesday, Axios reported that Weiss is planning a broad overhaul of standards and procedures at the network, where she was hired by Paramount Skydance CEO and Trump supporter David Ellison in October, despite a lack of broadcasting experience.

Keep ReadingShow Less

Israeli Defense Minister Tries to Walk Back Vow to 'Never Leave Gaza,' Build Settlements

The remarks drew critical responses, including from other Israelis and the White House.

Dec 23, 2025

Israeli Defense Minister Israel Katz "said the silent part out loud" on Tuesday, then promptly tried to walk back his comments that his country would not only never leave the Gaza Strip, but also reestablish settlements in the decimated exclave.

Israel evacuated Jewish settlements in Gaza two decades ago, but some officials have pushed for ethnically cleansing the strip of Palestinians and recolonizing it, particularly since the Hamas-led October 7, 2023 attack and the devastating Israeli assault that followed.

The Times of Israel on Tuesday translated Katz's remarks—made during an event about expanding Beit El, a Jewish settlement in the illegally occupied West Bank—from Hebrew to English:

"With God's help, when the time comes, also in northern Gaza, we will establish Nahal pioneer groups in place of the settlements that were evacuated," he said. "We'll do it in the right way, at the appropriate time."

Katz was referring to the Nahal military unit that, in part, lets youths combine pioneering activities with military service. In the past, many of the outposts established by the unit went on to evolve into full-fledged settlements.

"We are deep inside Gaza, and we will never leave Gaza—there will be no such thing," Katz said. "We are here to defend and to prevent what happened from happening again."

The so-called peace plan for Gaza that US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu announced at the White House in late September notably states that "Israel will not occupy or annex Gaza," and "the Israel Defense Forces (IDF) will withdraw based on standards, milestones, and timeframes linked to demilitarization."

Gadi Eisenkot, a former IDF chief of staff who launched a new political party a few months ago, responded to Katz on social media, writing in Hebrew, "While the government votes with one hand in favor of the Trump plan, it sells myths with the other hand about isolated settlement nuclei in the strip."

"Instead of strengthening security and bringing about an enlistment law that will bolster the IDF, the government, driven by narrow political considerations, continues to scatter irresponsible and empty declarations that only harm Israel's standing in the world," he added.

The White House was also critical of Katz's comments, with an unnamed official saying that "the more Israel provokes, the less the Arab countries want to work with them."

"The United States remains fully committed to President Trump's 20-point peace plan, which was agreed to by all parties and endorsed by the international community," the official continued. "The plan envisions a phased approach to security, governance, and reconstruction in Gaza. We expect all parties to adhere to the commitments they made under the 20-point plan."

Later Tuesday, Katz's office said that "the minister of defense's remarks regarding the integration of Nahal units in the northern Gaza Strip were made solely in a security context. The government has no intention of establishing settlements in the Gaza Strip. The minister of defense emphasized the central principle of border defense in every arena: The IDF is the first and last line of defense for Israel's citizens, and the state of Israel relies for its protection solely on it and on the security forces."

Katz became defense minister in November 2024, just weeks before the International Criminal Court issued arrest warrants for his fired predecessor, Yoav Gallat, and Netanyahu over Israel's assault on and blockade of Gaza. When Katz took on the new role after serving as foreign minister, Palestine defenders accused the prime minister of swapping one "genocidal lunatic" for another.

Israel faces an ongoing genocide case at the International Court of Justice for its mass slaughter of Palestinians in Gaza. As of Tuesday, local officials put the death toll since October 2023 at 70,942, with another 171,195 Palestinians wounded, though global experts warn the true tallies are likely far higher.

At least 406 of those confirmed deaths have occurred since Israel and Hamas agreed to a ceasefire that took effect October 10. In a Monday letter demanding action from the White House, dozens of Democratic US lawmakers noted Israel's "continued bombardment against civilians, destruction of property, and insufficient delivery of humanitarian aid."

Keep ReadingShow Less

Sanders Slams Private Equity Scrooges Ending Paid Holidays for Walgreens Workers

"While the rich get richer, workers are struggling, and your decision to cut workers' paid vacation is making the problem worse."

Dec 23, 2025

Independent US Sen. Bernie Sanders on Tuesday urged the private equity firm that recently acquired Walgreens to reverse its decision to strip hourly workers at the second-largest US pharmacy chain of paid days off on Christmas and other major holidays.

After Sycamore Partners finalized its $10 billion purchase of Walgreens in late August, the pharmacy chain—now headed by CEO Mike Motz—eliminated paid holidays for New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas. Workers were notified of the move, which was first reported by Bloomberg, in October.

The move is typical of what private equity firms—sometimes called vulture capitalists—often do in order to maximize profits. In addition to slashing paid time off and benefits, they often reduce or freeze pay, fire workers, close locations, introduce aggressive sales targets, and reduce job security by replacing full-time positions with hourly or independently contracted workers. Walgreens announced last year that it planned on closing around 1,200 of its roughly 8,000 US stores, citing their struggling performance.

"This Thanksgiving, Walgreens' hourly workers faced the impossible choice between losing pay and spending the holiday with their loved ones," Sanders (Vt.)—who is the ranking member of the Senate Health, Education, Labor, and Pensions (HELP) Committee—wrote Tuesday in a letter to Sycamore Partners founder and managing director Stefan Kaluzny.

"Walgreens employs 220,000 employees, the vast majority of whom are hourly workers... Sycamore Partners' decision to cut paid holidays for these hourly workers is unfortunately not surprising," the senator continued. "The firm follows the private equity playbook of buying businesses and aggressively extracting profit while using and abusing workers."

"For example, just one year after Sycamore Partners purchased Staples, the firm extracted $1 billion from the company as it closed 100 stores and laid off 7,000 workers," Sanders noted. "That same year, Sycamore Partners drove Nine West into bankruptcy and was accused of siphoning off over $1 billion in funds."

"Meanwhile, from 2016-22, companies owned by Sycamore Partners racked up over $3 million in labor violations, including wage-and-hour and workplace safety and health violations," he added.

During the holiday season, we all want to spend time with our loved ones. And yet, just two months after buying Walgreens for $10 billion, the private equity firm Sycamore Partners stripped hourly workers of paid vacation, including Christmas and New Year’s Day. Shameful.

[image or embed]

— Senator Bernie Sanders (@sanders.senate.gov) December 23, 2025 at 9:41 AM

Sanders contrasted a reality in which "60% of Americans are living paycheck to paycheck" with the fact that "more private equity managers make over $100 million annually than investment bankers, top financial executives, and professional athletes combined."

"While the rich get richer, workers are struggling, and your decision to cut workers' paid vacation leave is making the problem worse," he stressed. "Some Walgreens workers make as little as $15 an hour. Cutting their paid leave will make it even more difficult for these workers to pay for housing, childcare, healthcare, and groceries."

"In short," Sanders concluded, "Sycamore Partners is forcing workers to sacrifice their basic needs for private equity profit."

Keep ReadingShow Less

Most Popular