SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

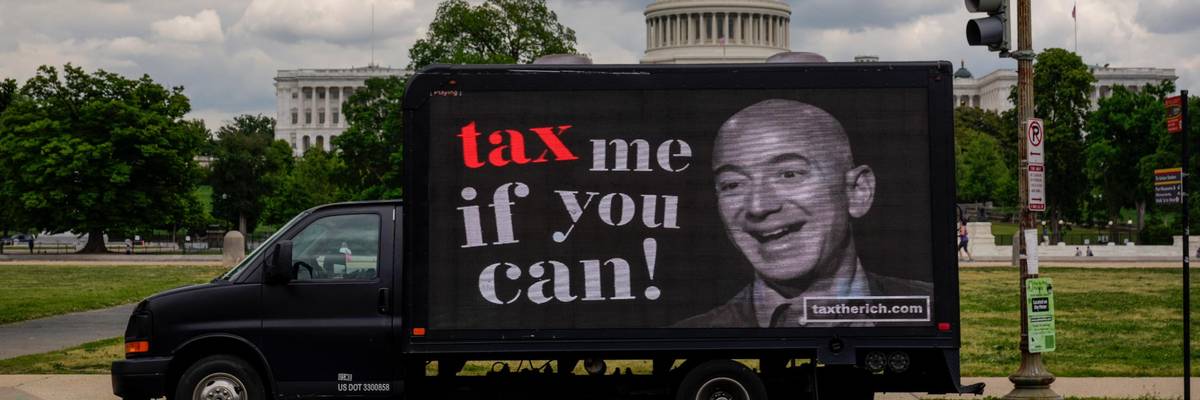

A mobile billboard calling for higher taxes on the ultra-wealthy depicts an image of billionaire businessman Jeff Bezos, the founder of Amazon, near the U.S. Capitol on May 17, 2021. (Photo: Drew Angerer/Getty Images)

Sen. Ron Wyden, chair of the Senate Finance Committee, warned Tuesday that House Democrats' newly released tax plan would let U.S. billionaires off the hook by omitting key reforms that progressive lawmakers, advocacy organizations, and President Joe Biden have embraced.

"The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

--Sen. Ron Wyden

"It would be a monumental mistake for Congress to pass a bill that really exempts billionaires," Wyden (D-Ore.) told the New York Times in response to the House Ways and Means Committee's proposal, which was spearheaded by Rep. Richard Neal (D-Mass.).

While the House plan (pdf) would hike taxes on large corporations and the top 1% of earners in the U.S., analysts and Democratic lawmakers have voiced concerns that it doesn't go nearly as far as it should to raise revenue for policy priorities and tackle the nation's runaway income inequality, which the coronavirus crisis has made even worse. According to one recent analysis, the collective wealth of U.S. billionaires has risen by $1.8 trillion--62%--during the pandemic.

Wyden's committee is in the process of crafting a tax plan of its own as Democrats race to compile their sprawling budget reconciliation package, which is expected to include major investments in green energy, healthcare, housing, and other key areas.

Specifically, Wyden and progressive organizations criticized the House Ways and Means Committee for failing to tackle a loophole that allows the ultra-wealthy to pass on massive fortunes to their heirs tax-free. Earlier this year, Biden released a tax plan that would close the loophole.

"It's important to address the fact that billionaire heirs may never pay tax on billions in stock gains," Wyden told HuffPost on Monday. "The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

Steve Wamhoff, director of federal tax policy at the Institute for Taxation and Economic Policy (ITEP), echoed Wyden's concern, noting in an interview with the Washington Post that "if the Ways and Means plan was enacted as is, Jeff Bezos and Elon Musk would still pay an effective rate of $0 on most of their income if they pass their assets on to their heirs."

"It's obviously a big improvement over the tax code we have now," Wamhoff said of the House plan, "but there are a lot of things Biden suggested that would go a lot further."

On Tuesday, the progressive advocacy group Patriotic Millionaires made the House plan's shortcomings the focus of a new mobile billboard campaign that features an image of Bezos--the richest man in the world--accompanied by the caption, "Oops! Missed me! (Thanks, Richie Neal!)"

"Richard Neal and the House Ways and Means Committee failed the president, failed the country, and failed history. It's that simple," Morris Pearl, chair of the Patriotic Millionaires, said in a statement. "This is not what the American people voted for when they elected Joe Biden as president."

To remedy the proposal, the Patriotic Millionaires urged the House Democratic leadership to make several changes, including:

Rep. Alexandria Ocasio-Cortez (D-N.Y.), whose "Tax the Rich" dress at the lavish 2021 Met Gala made waves on social media, said Tuesday that "members of both parties have tried to halt taxing the wealthiest in our society" even after billionaires made enormous wealth gains during the pandemic.

"It's unacceptable," the New York Democrat added. "We must tax the rich."

According to a June survey released by Americans for Tax Fairness, 72% of U.S. voters support closing "loopholes that let the wealthy avoid paying taxes on the profits from assets they transfer to heirs." The poll also found that 62% of voters support raising the corporate tax rate from 21% to 28%.

The House Ways and Means Committee proposal would only raise the corporate rate to 26.5%.

As Chuck Collins and Sarah Anderson of the Institute for Policy Studies argued in a blog post on Monday, "The public has a tremendous appetite to do much more to address the grotesque concentrations of democracy-distorting wealth and power--and to shut down the ways that billionaires and a few hundred global corporations manipulate our tax system."

"House Democratic tax writers do not go far enough to raise revenue or reduce extreme wealth inequality," Collins and Anderson wrote. "The tax reforms would generate an estimated $2.2 trillion--just barely more than the revenue lost due to the 2017 Republican tax cuts."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Sen. Ron Wyden, chair of the Senate Finance Committee, warned Tuesday that House Democrats' newly released tax plan would let U.S. billionaires off the hook by omitting key reforms that progressive lawmakers, advocacy organizations, and President Joe Biden have embraced.

"The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

--Sen. Ron Wyden

"It would be a monumental mistake for Congress to pass a bill that really exempts billionaires," Wyden (D-Ore.) told the New York Times in response to the House Ways and Means Committee's proposal, which was spearheaded by Rep. Richard Neal (D-Mass.).

While the House plan (pdf) would hike taxes on large corporations and the top 1% of earners in the U.S., analysts and Democratic lawmakers have voiced concerns that it doesn't go nearly as far as it should to raise revenue for policy priorities and tackle the nation's runaway income inequality, which the coronavirus crisis has made even worse. According to one recent analysis, the collective wealth of U.S. billionaires has risen by $1.8 trillion--62%--during the pandemic.

Wyden's committee is in the process of crafting a tax plan of its own as Democrats race to compile their sprawling budget reconciliation package, which is expected to include major investments in green energy, healthcare, housing, and other key areas.

Specifically, Wyden and progressive organizations criticized the House Ways and Means Committee for failing to tackle a loophole that allows the ultra-wealthy to pass on massive fortunes to their heirs tax-free. Earlier this year, Biden released a tax plan that would close the loophole.

"It's important to address the fact that billionaire heirs may never pay tax on billions in stock gains," Wyden told HuffPost on Monday. "The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

Steve Wamhoff, director of federal tax policy at the Institute for Taxation and Economic Policy (ITEP), echoed Wyden's concern, noting in an interview with the Washington Post that "if the Ways and Means plan was enacted as is, Jeff Bezos and Elon Musk would still pay an effective rate of $0 on most of their income if they pass their assets on to their heirs."

"It's obviously a big improvement over the tax code we have now," Wamhoff said of the House plan, "but there are a lot of things Biden suggested that would go a lot further."

On Tuesday, the progressive advocacy group Patriotic Millionaires made the House plan's shortcomings the focus of a new mobile billboard campaign that features an image of Bezos--the richest man in the world--accompanied by the caption, "Oops! Missed me! (Thanks, Richie Neal!)"

"Richard Neal and the House Ways and Means Committee failed the president, failed the country, and failed history. It's that simple," Morris Pearl, chair of the Patriotic Millionaires, said in a statement. "This is not what the American people voted for when they elected Joe Biden as president."

To remedy the proposal, the Patriotic Millionaires urged the House Democratic leadership to make several changes, including:

Rep. Alexandria Ocasio-Cortez (D-N.Y.), whose "Tax the Rich" dress at the lavish 2021 Met Gala made waves on social media, said Tuesday that "members of both parties have tried to halt taxing the wealthiest in our society" even after billionaires made enormous wealth gains during the pandemic.

"It's unacceptable," the New York Democrat added. "We must tax the rich."

According to a June survey released by Americans for Tax Fairness, 72% of U.S. voters support closing "loopholes that let the wealthy avoid paying taxes on the profits from assets they transfer to heirs." The poll also found that 62% of voters support raising the corporate tax rate from 21% to 28%.

The House Ways and Means Committee proposal would only raise the corporate rate to 26.5%.

As Chuck Collins and Sarah Anderson of the Institute for Policy Studies argued in a blog post on Monday, "The public has a tremendous appetite to do much more to address the grotesque concentrations of democracy-distorting wealth and power--and to shut down the ways that billionaires and a few hundred global corporations manipulate our tax system."

"House Democratic tax writers do not go far enough to raise revenue or reduce extreme wealth inequality," Collins and Anderson wrote. "The tax reforms would generate an estimated $2.2 trillion--just barely more than the revenue lost due to the 2017 Republican tax cuts."

Sen. Ron Wyden, chair of the Senate Finance Committee, warned Tuesday that House Democrats' newly released tax plan would let U.S. billionaires off the hook by omitting key reforms that progressive lawmakers, advocacy organizations, and President Joe Biden have embraced.

"The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

--Sen. Ron Wyden

"It would be a monumental mistake for Congress to pass a bill that really exempts billionaires," Wyden (D-Ore.) told the New York Times in response to the House Ways and Means Committee's proposal, which was spearheaded by Rep. Richard Neal (D-Mass.).

While the House plan (pdf) would hike taxes on large corporations and the top 1% of earners in the U.S., analysts and Democratic lawmakers have voiced concerns that it doesn't go nearly as far as it should to raise revenue for policy priorities and tackle the nation's runaway income inequality, which the coronavirus crisis has made even worse. According to one recent analysis, the collective wealth of U.S. billionaires has risen by $1.8 trillion--62%--during the pandemic.

Wyden's committee is in the process of crafting a tax plan of its own as Democrats race to compile their sprawling budget reconciliation package, which is expected to include major investments in green energy, healthcare, housing, and other key areas.

Specifically, Wyden and progressive organizations criticized the House Ways and Means Committee for failing to tackle a loophole that allows the ultra-wealthy to pass on massive fortunes to their heirs tax-free. Earlier this year, Biden released a tax plan that would close the loophole.

"It's important to address the fact that billionaire heirs may never pay tax on billions in stock gains," Wyden told HuffPost on Monday. "The nurses, firefighters, and teachers who pay their taxes with every paycheck know the system is broken when billionaire heirs never pay tax on billions in stock gains."

Steve Wamhoff, director of federal tax policy at the Institute for Taxation and Economic Policy (ITEP), echoed Wyden's concern, noting in an interview with the Washington Post that "if the Ways and Means plan was enacted as is, Jeff Bezos and Elon Musk would still pay an effective rate of $0 on most of their income if they pass their assets on to their heirs."

"It's obviously a big improvement over the tax code we have now," Wamhoff said of the House plan, "but there are a lot of things Biden suggested that would go a lot further."

On Tuesday, the progressive advocacy group Patriotic Millionaires made the House plan's shortcomings the focus of a new mobile billboard campaign that features an image of Bezos--the richest man in the world--accompanied by the caption, "Oops! Missed me! (Thanks, Richie Neal!)"

"Richard Neal and the House Ways and Means Committee failed the president, failed the country, and failed history. It's that simple," Morris Pearl, chair of the Patriotic Millionaires, said in a statement. "This is not what the American people voted for when they elected Joe Biden as president."

To remedy the proposal, the Patriotic Millionaires urged the House Democratic leadership to make several changes, including:

Rep. Alexandria Ocasio-Cortez (D-N.Y.), whose "Tax the Rich" dress at the lavish 2021 Met Gala made waves on social media, said Tuesday that "members of both parties have tried to halt taxing the wealthiest in our society" even after billionaires made enormous wealth gains during the pandemic.

"It's unacceptable," the New York Democrat added. "We must tax the rich."

According to a June survey released by Americans for Tax Fairness, 72% of U.S. voters support closing "loopholes that let the wealthy avoid paying taxes on the profits from assets they transfer to heirs." The poll also found that 62% of voters support raising the corporate tax rate from 21% to 28%.

The House Ways and Means Committee proposal would only raise the corporate rate to 26.5%.

As Chuck Collins and Sarah Anderson of the Institute for Policy Studies argued in a blog post on Monday, "The public has a tremendous appetite to do much more to address the grotesque concentrations of democracy-distorting wealth and power--and to shut down the ways that billionaires and a few hundred global corporations manipulate our tax system."

"House Democratic tax writers do not go far enough to raise revenue or reduce extreme wealth inequality," Collins and Anderson wrote. "The tax reforms would generate an estimated $2.2 trillion--just barely more than the revenue lost due to the 2017 Republican tax cuts."