The world's largest banks in 2019 provided more than $2.6 trillion in loans and underwriting to economic sectors linked to the global biodiversity crisis while doing little to monitor, let alone curb, damage to life-sustaining ecosystems.

That's according to Bankrolling Extinction, a new report published Wednesday by Portfolio Earth, an initiative seeking to challenge the financial industry's role in ecological devastation.

"To prevent extinction, banks have to stop funding it."

--Portfolio Earth

The analysis was described as "a frightening statement of the status quo" by Dr. Robert Watson, former chair of both the U.N.'s Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) and Intergovernmental Panel on Climate Change (IPCC).

Mark Campanale, founder and executive chair of the Carbon Tracker Initiative, said in a statement released Wednesday that this report "reminds us that there is no time to lose for governments and financial regulators to create an appropriate rules-based system to oversee and ensure that banks cannot continue to finance this corporate planetary plunder, unconstrained and unnoticed."

"Environmental destruction," the report authors wrote, "can no longer be seen as an unfortunate byproduct of economic development." Rather, the Covid-19 pandemic has demonstrated that healthy, biodiverse environments "underpin the functioning of our health, societies, and economies."

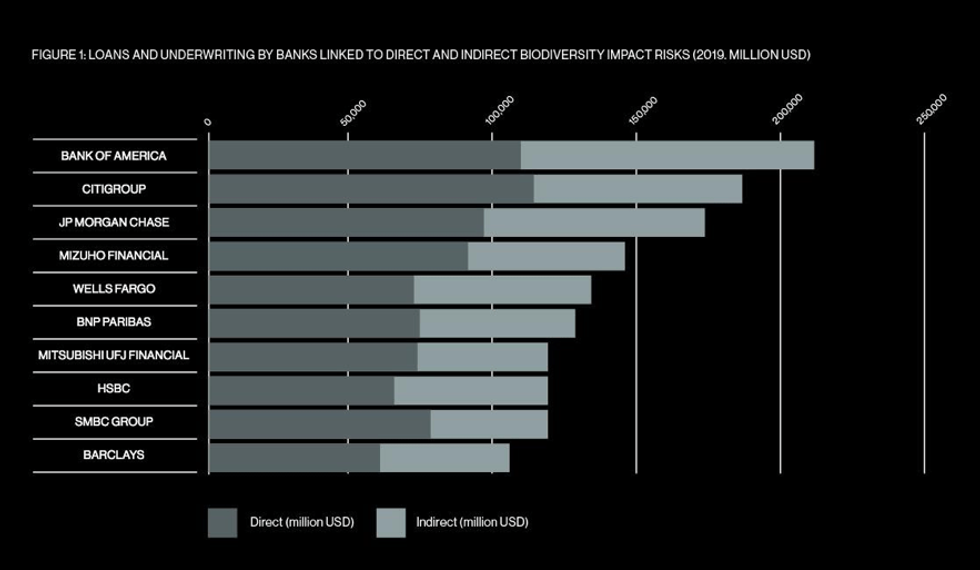

Researchers found that 50 global banks invested more than the entire GDP of Canada in the food, forestry, mining, fossil fuels, infrastructure, tourism, transport, and logistics sectors--activities that IPBES has identified as the major drivers of biodiversity loss.

The top ten offenders were Bank of America, Citigroup, JPMorgan Chase, Mizuho Financial, Wells Fargo, BNP Paribas, Mitsubishi UFJ Financial, HSBC, SMBC Group, and Barclays.

Moreover, the report notes that "none of the banks assessed had... sufficient systems in place to monitor or measure the impact of their loans on biodiversity loss, nor do they have comprehensive policies to halt it."

According to the authors, private financial institutions on Wall Street and elsewhere are unwilling and ill-prepared to promote biodiversity, despite its significance to human life and survival, thanks in part to the fact that "the regulators and rules which govern banks currently protect them from any consequences."

Instead of heeding scientists' warnings about "biological annihilation" and its consequences, "the financial sector is bankrolling the mass extinction crisis, while undermining human rights and indigenous sovereignty."

"While governments and companies have been the focus of attention on this issue," they continued, "actors in the finance sector have largely evaded scrutiny until recently," even though it is their investment decisions that shape the transformation of ecosystems.

The report argues that "to prevent extinction, banks have to stop funding it." To this end, the researchers call for:

- Banks to disclose and radically reduce their impact on nature and stop finance for new fossil fuels, deforestation, overfishing, and ecosystem destruction;

- Governments to stop protecting the role of banks in biodiversity destruction and rewrite the rules of finance to hold banks liable for the damage caused by their lending; and

- People everywhere to have a say in how their money is invested, and a right to stop banks from causing serious harm to people and planet.

Moira Birss, Climate and Finance director of Amazon Watch, said that "if the Amazon rainforest is going to survive, and if we are to have a future on this planet, financial institutions must stop funneling trillions of dollars into the very industries unabashedly driving biodiversity loss."

"The current legal system protects banks from responsibility and liability, and therefore reduces their business incentive to help address damaging activities. Removing these legal protections would force banks to more systematically address the biodiversity impacts of their financing, and transform activities across major supply chains."

--Robin Smale, Vivid Economics

"By maintaining a global system fundamentally based on eternal economic growth and never-ending exploitation of natural elements," said Hana Begovic of Earth Advocacy Youth, "we allow for life on Earth to be considered human-owned property whose point of existence is to be exploited and commodified for human benefit and economic profit."

Kai Chan, a professor at the University of British Columbia and a leading author of the IPBES Global Assessment report, noted that "a global sustainable economy sits at the center of humanity's much-needed transformation to meet the climate and ecological crises."

"And at the center of that," Chan added, "sit the banks and the finance institutions whose investments power development around the globe."

According to Todd Paglia, executive director at Stand.earth, "Today's visionary financial institutions are those that invest in projects that regenerate our oceans, forests, and climate."

"We need to reverse the damage of several centuries of banks investing in the destruction of the heart, lungs, and limbs of our planet," he added, "and do so in short order."

Robin Smale, director of Vivid Economics, pointed out that "the current legal system protects banks from responsibility and liability, and therefore reduces their business incentive to help address damaging activities."

Smale argued that "removing these legal protections would force banks to more systematically address the biodiversity impacts of their financing, and transform activities across major supply chains."

"Imagine a world," said Chan, "in which projects can only raise capital when they have demonstrated that they will contribute meaningfully and positively to restoring the planet's bounty and a safe climate for all."

"That's the future this report envisions and builds toward," he concluded.