SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A demonstrator holds a "Tax the Rich" sign during a protest in New York on June 27, 2020. (Photo: Erik McGregor/LightRocket via Getty Images)

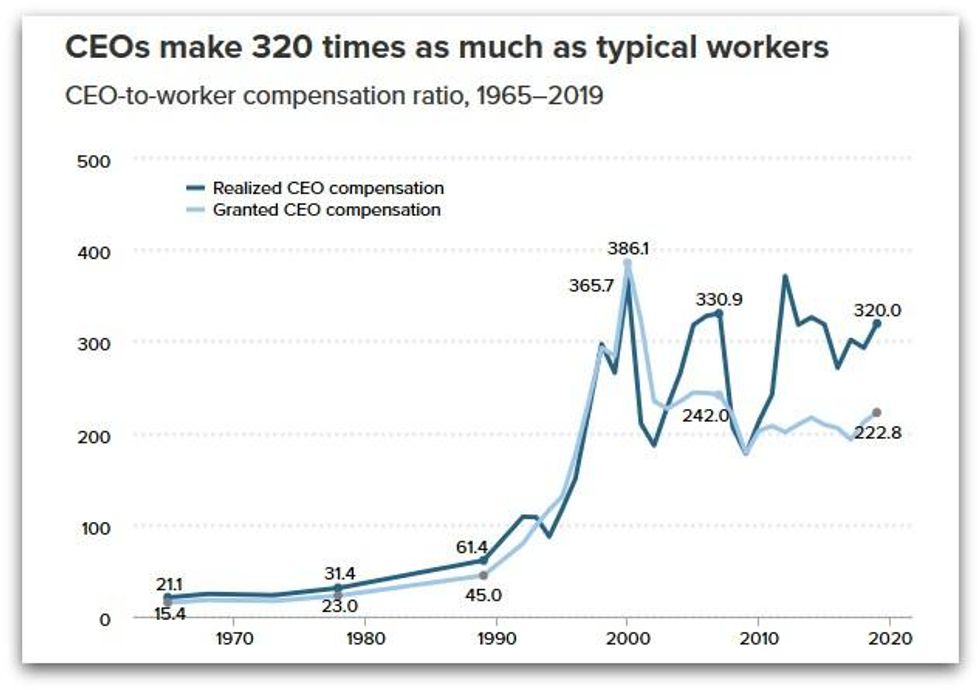

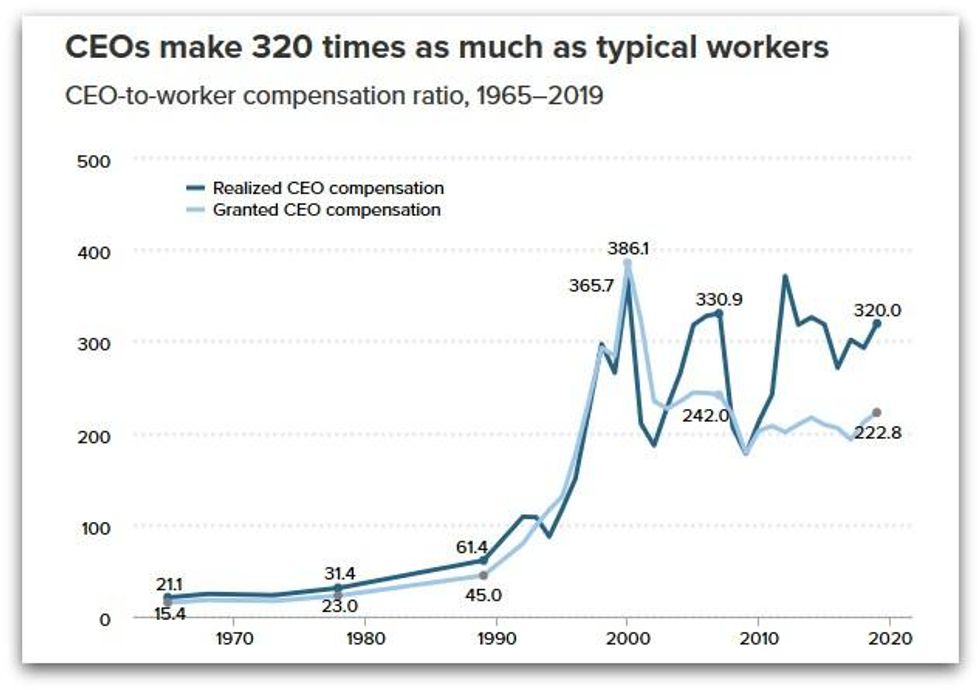

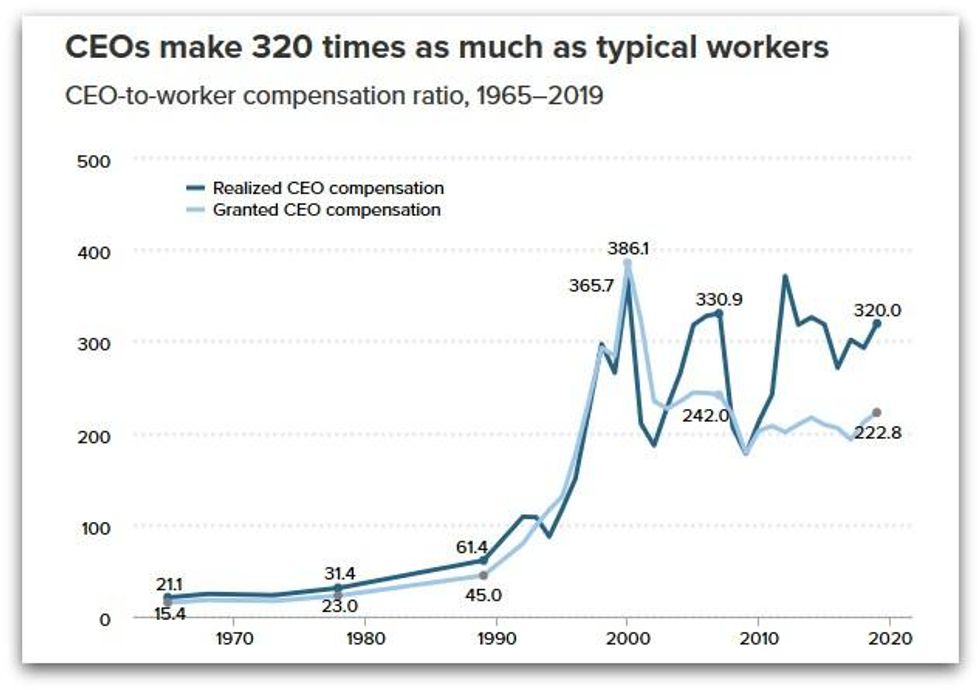

New research published Tuesday by the Economic Policy Institute shows that the top executives at the largest corporations in the United States now make 320 times more than what their typical employees earn in wages and benefits.

"CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."

--Jori Kandra, Economic Policy Institute

EPI's latest annual analysis of executive compensation finds that the CEOs of the top 350 firms in the U.S. raked in an average of $21.3 million in 2019, a 14% increase from 2018. The 320-1 ratio of CEO-to-worker pay in 2019 is more than five times higher than the 61-1 ratio reported in 1989.

The think tank's research comes amid a global pandemic that is likely to exacerbate the decades-long trend of surging income and wealth inequality in the U.S.--a trend that, according to EPI, won't be reversed by CEOs opting to take salary cuts during a public health crisis that has left tens of millions of Americans jobless.

EPI's new report shows that CEO compensation grew by 1,167% from 1978 to 2019, "far outstripping" the growth of the stock market.

"CEOs who volunteer to take salary cuts aren't giving up a lot given how much of their pay comes from stock awards and options," EPI said.

Lawrence Mishel, a distinguished fellow at EPI and co-author of the new report, said in a statement that "while wage growth for the majority of Americans has remained relatively stagnant for decades, CEO compensation continues to balloon."

"This has fueled the spectacular income growth of the top 0.1% and 1.0% and the growth of income inequality overall," said Mishel, who told the Washington Post that CEO pay could rise again in 2020 despite the nationwide economic collapse caused by the Covid-19 crisis.

"CEOs offering salary cuts during the coronavirus pandemic yield press releases," Mishel added, "but no real progress toward reducing inequality and raising workers' wages."

As a substantive alternative to CEO public relations stunts, EPI proposed several policy changes that would significantly reduce the yawning gap between CEO compensation and typical worker pay:

Jori Kandra, research assistant at EPI and co-author of the new report, said the "huge growth in CEO pay" over the past four decades "is not a reflection of the market for talent."

"We know this because CEO compensation has grown more than three times faster than the growth of earnings for the top 0.1% of earners, which was 337% over the same period," said Kandra. "This means that CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

New research published Tuesday by the Economic Policy Institute shows that the top executives at the largest corporations in the United States now make 320 times more than what their typical employees earn in wages and benefits.

"CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."

--Jori Kandra, Economic Policy Institute

EPI's latest annual analysis of executive compensation finds that the CEOs of the top 350 firms in the U.S. raked in an average of $21.3 million in 2019, a 14% increase from 2018. The 320-1 ratio of CEO-to-worker pay in 2019 is more than five times higher than the 61-1 ratio reported in 1989.

The think tank's research comes amid a global pandemic that is likely to exacerbate the decades-long trend of surging income and wealth inequality in the U.S.--a trend that, according to EPI, won't be reversed by CEOs opting to take salary cuts during a public health crisis that has left tens of millions of Americans jobless.

EPI's new report shows that CEO compensation grew by 1,167% from 1978 to 2019, "far outstripping" the growth of the stock market.

"CEOs who volunteer to take salary cuts aren't giving up a lot given how much of their pay comes from stock awards and options," EPI said.

Lawrence Mishel, a distinguished fellow at EPI and co-author of the new report, said in a statement that "while wage growth for the majority of Americans has remained relatively stagnant for decades, CEO compensation continues to balloon."

"This has fueled the spectacular income growth of the top 0.1% and 1.0% and the growth of income inequality overall," said Mishel, who told the Washington Post that CEO pay could rise again in 2020 despite the nationwide economic collapse caused by the Covid-19 crisis.

"CEOs offering salary cuts during the coronavirus pandemic yield press releases," Mishel added, "but no real progress toward reducing inequality and raising workers' wages."

As a substantive alternative to CEO public relations stunts, EPI proposed several policy changes that would significantly reduce the yawning gap between CEO compensation and typical worker pay:

Jori Kandra, research assistant at EPI and co-author of the new report, said the "huge growth in CEO pay" over the past four decades "is not a reflection of the market for talent."

"We know this because CEO compensation has grown more than three times faster than the growth of earnings for the top 0.1% of earners, which was 337% over the same period," said Kandra. "This means that CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."

New research published Tuesday by the Economic Policy Institute shows that the top executives at the largest corporations in the United States now make 320 times more than what their typical employees earn in wages and benefits.

"CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."

--Jori Kandra, Economic Policy Institute

EPI's latest annual analysis of executive compensation finds that the CEOs of the top 350 firms in the U.S. raked in an average of $21.3 million in 2019, a 14% increase from 2018. The 320-1 ratio of CEO-to-worker pay in 2019 is more than five times higher than the 61-1 ratio reported in 1989.

The think tank's research comes amid a global pandemic that is likely to exacerbate the decades-long trend of surging income and wealth inequality in the U.S.--a trend that, according to EPI, won't be reversed by CEOs opting to take salary cuts during a public health crisis that has left tens of millions of Americans jobless.

EPI's new report shows that CEO compensation grew by 1,167% from 1978 to 2019, "far outstripping" the growth of the stock market.

"CEOs who volunteer to take salary cuts aren't giving up a lot given how much of their pay comes from stock awards and options," EPI said.

Lawrence Mishel, a distinguished fellow at EPI and co-author of the new report, said in a statement that "while wage growth for the majority of Americans has remained relatively stagnant for decades, CEO compensation continues to balloon."

"This has fueled the spectacular income growth of the top 0.1% and 1.0% and the growth of income inequality overall," said Mishel, who told the Washington Post that CEO pay could rise again in 2020 despite the nationwide economic collapse caused by the Covid-19 crisis.

"CEOs offering salary cuts during the coronavirus pandemic yield press releases," Mishel added, "but no real progress toward reducing inequality and raising workers' wages."

As a substantive alternative to CEO public relations stunts, EPI proposed several policy changes that would significantly reduce the yawning gap between CEO compensation and typical worker pay:

Jori Kandra, research assistant at EPI and co-author of the new report, said the "huge growth in CEO pay" over the past four decades "is not a reflection of the market for talent."

"We know this because CEO compensation has grown more than three times faster than the growth of earnings for the top 0.1% of earners, which was 337% over the same period," said Kandra. "This means that CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance."