SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

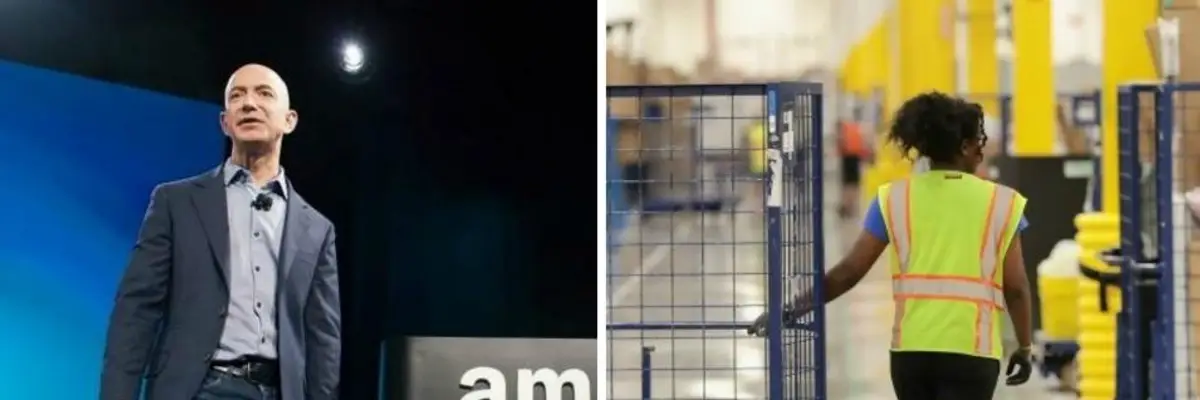

CEOs of the top companies in the U.S., like Amazon executive Jeff Bezos, took home salaries that were 278 times the size of their employees' compensation last year. (Photo: David Ryder/Scott Olson/Getty Images)

As even some of the wealthiest Americans have begun to call for major reforms to the U.S. economic system to narrow the wealth gap, a new study released Wednesday revealed that over the past four decades, salaries for the top executives in the U.S. have gone up by more than 1,000 percent.

CEOs at the 350 largest companies now take home salaries that are 278 times higher than those of the average worker, according to the new Economic Policy Institute (EPI) analysis.

With an average compensation of $17.2 million per year, report co-author Lawrence Mishel said Wednesday, today's CEOs would barely notice a change in their quality of life if their salaries were slashed.

"You could cut CEO pay in half and the economy would not be any different," Mishel, a distinguished fellow at EPI, told The Guardian.

EPI's findings about CEO compensation were denounced as "obscene" by critics of the current economic system, under which 40 percent of American workers struggle to find $400 in their budget to cover an emergency expense while the heads of powerful companies are given huge tax breaks on top of their salaries.

Chief executives earned an average of $17.2m each last year and their pay grew more than 1000 % since 1978, survey finds."

This is an obscene concentration of profit at the top levels of companies. Workers should be able to share in the value.

-- Heidi N. Moore (@moorehn) August 14, 2019

The study represents "an obscene concentration of profit at the top levels of companies," tweeted journalist Heidi Moore. "Workers should be able to share in the value."

"Corporate greed is eviscerating the working class," tweeted the consumer advocacy watchdog Public Citizen.

While CEO pay has gone up exponentially since 1978, the average worker makes only about 11 percent more than they would have in the same job 40 years ago, when adjusting for inflation.

EPI pointed out that CEOs frequently attempt to justify their exorbitant salaries and bonuses by pointing to their companies' growing stock market performance. The country's biggest firms saw their stock prices going up by more than 700 percent in the last four decades--but workers who are responsible for the day-to-day operations of those same companies see little benefit from the growth that they contribute to each day.

"The generally tight link between stock prices and CEO compensation indicates that CEO pay is not being established by a 'market for talent,' as pay surged with the overall rise in profits and stocks, not with the better performance of a CEO's particular firm relative to that firm's competitors," wrote Mishel and co-author Julia Wolfe. "As profits and stock market prices have reached record highs, the wages of most workers have grown very little."

CEO pay did not slow down after the recession of 2009, with executives' salaries growing by more than 52 percent during the recovery from the economic crash brought on largely by powerful, unregulated banks. But workers' salaries have gone up by just 5.3 percent over the same period, with average wages sometimes falling from year to year.

Mishel and Wolfe note in their study that concern over the high salaries of CEOs is rooted in the knowledge of how the rest of the country is struggling to pay for medical care, housing, and falling deep into debt while the wealthiest Americans reap the rewards of workers' labor.

"Some observers argue that exorbitant CEO compensation is merely a symbolic issue, with no consequences for the vast majority of workers," the report reads. "However, the escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0 percent and top 0.1 percent incomes, generating widespread inequality."

To narrow the wealth gap, EPI recommends implementing far higher income tax rates for the richest Americans and greater representation for workers on company boards.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As even some of the wealthiest Americans have begun to call for major reforms to the U.S. economic system to narrow the wealth gap, a new study released Wednesday revealed that over the past four decades, salaries for the top executives in the U.S. have gone up by more than 1,000 percent.

CEOs at the 350 largest companies now take home salaries that are 278 times higher than those of the average worker, according to the new Economic Policy Institute (EPI) analysis.

With an average compensation of $17.2 million per year, report co-author Lawrence Mishel said Wednesday, today's CEOs would barely notice a change in their quality of life if their salaries were slashed.

"You could cut CEO pay in half and the economy would not be any different," Mishel, a distinguished fellow at EPI, told The Guardian.

EPI's findings about CEO compensation were denounced as "obscene" by critics of the current economic system, under which 40 percent of American workers struggle to find $400 in their budget to cover an emergency expense while the heads of powerful companies are given huge tax breaks on top of their salaries.

Chief executives earned an average of $17.2m each last year and their pay grew more than 1000 % since 1978, survey finds."

This is an obscene concentration of profit at the top levels of companies. Workers should be able to share in the value.

-- Heidi N. Moore (@moorehn) August 14, 2019

The study represents "an obscene concentration of profit at the top levels of companies," tweeted journalist Heidi Moore. "Workers should be able to share in the value."

"Corporate greed is eviscerating the working class," tweeted the consumer advocacy watchdog Public Citizen.

While CEO pay has gone up exponentially since 1978, the average worker makes only about 11 percent more than they would have in the same job 40 years ago, when adjusting for inflation.

EPI pointed out that CEOs frequently attempt to justify their exorbitant salaries and bonuses by pointing to their companies' growing stock market performance. The country's biggest firms saw their stock prices going up by more than 700 percent in the last four decades--but workers who are responsible for the day-to-day operations of those same companies see little benefit from the growth that they contribute to each day.

"The generally tight link between stock prices and CEO compensation indicates that CEO pay is not being established by a 'market for talent,' as pay surged with the overall rise in profits and stocks, not with the better performance of a CEO's particular firm relative to that firm's competitors," wrote Mishel and co-author Julia Wolfe. "As profits and stock market prices have reached record highs, the wages of most workers have grown very little."

CEO pay did not slow down after the recession of 2009, with executives' salaries growing by more than 52 percent during the recovery from the economic crash brought on largely by powerful, unregulated banks. But workers' salaries have gone up by just 5.3 percent over the same period, with average wages sometimes falling from year to year.

Mishel and Wolfe note in their study that concern over the high salaries of CEOs is rooted in the knowledge of how the rest of the country is struggling to pay for medical care, housing, and falling deep into debt while the wealthiest Americans reap the rewards of workers' labor.

"Some observers argue that exorbitant CEO compensation is merely a symbolic issue, with no consequences for the vast majority of workers," the report reads. "However, the escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0 percent and top 0.1 percent incomes, generating widespread inequality."

To narrow the wealth gap, EPI recommends implementing far higher income tax rates for the richest Americans and greater representation for workers on company boards.

As even some of the wealthiest Americans have begun to call for major reforms to the U.S. economic system to narrow the wealth gap, a new study released Wednesday revealed that over the past four decades, salaries for the top executives in the U.S. have gone up by more than 1,000 percent.

CEOs at the 350 largest companies now take home salaries that are 278 times higher than those of the average worker, according to the new Economic Policy Institute (EPI) analysis.

With an average compensation of $17.2 million per year, report co-author Lawrence Mishel said Wednesday, today's CEOs would barely notice a change in their quality of life if their salaries were slashed.

"You could cut CEO pay in half and the economy would not be any different," Mishel, a distinguished fellow at EPI, told The Guardian.

EPI's findings about CEO compensation were denounced as "obscene" by critics of the current economic system, under which 40 percent of American workers struggle to find $400 in their budget to cover an emergency expense while the heads of powerful companies are given huge tax breaks on top of their salaries.

Chief executives earned an average of $17.2m each last year and their pay grew more than 1000 % since 1978, survey finds."

This is an obscene concentration of profit at the top levels of companies. Workers should be able to share in the value.

-- Heidi N. Moore (@moorehn) August 14, 2019

The study represents "an obscene concentration of profit at the top levels of companies," tweeted journalist Heidi Moore. "Workers should be able to share in the value."

"Corporate greed is eviscerating the working class," tweeted the consumer advocacy watchdog Public Citizen.

While CEO pay has gone up exponentially since 1978, the average worker makes only about 11 percent more than they would have in the same job 40 years ago, when adjusting for inflation.

EPI pointed out that CEOs frequently attempt to justify their exorbitant salaries and bonuses by pointing to their companies' growing stock market performance. The country's biggest firms saw their stock prices going up by more than 700 percent in the last four decades--but workers who are responsible for the day-to-day operations of those same companies see little benefit from the growth that they contribute to each day.

"The generally tight link between stock prices and CEO compensation indicates that CEO pay is not being established by a 'market for talent,' as pay surged with the overall rise in profits and stocks, not with the better performance of a CEO's particular firm relative to that firm's competitors," wrote Mishel and co-author Julia Wolfe. "As profits and stock market prices have reached record highs, the wages of most workers have grown very little."

CEO pay did not slow down after the recession of 2009, with executives' salaries growing by more than 52 percent during the recovery from the economic crash brought on largely by powerful, unregulated banks. But workers' salaries have gone up by just 5.3 percent over the same period, with average wages sometimes falling from year to year.

Mishel and Wolfe note in their study that concern over the high salaries of CEOs is rooted in the knowledge of how the rest of the country is struggling to pay for medical care, housing, and falling deep into debt while the wealthiest Americans reap the rewards of workers' labor.

"Some observers argue that exorbitant CEO compensation is merely a symbolic issue, with no consequences for the vast majority of workers," the report reads. "However, the escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0 percent and top 0.1 percent incomes, generating widespread inequality."

To narrow the wealth gap, EPI recommends implementing far higher income tax rates for the richest Americans and greater representation for workers on company boards.