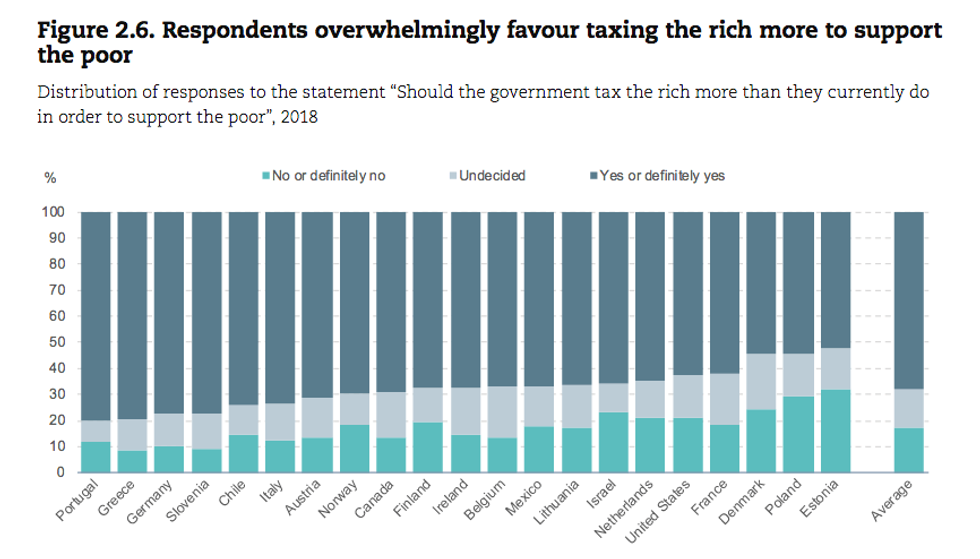

A large majority of residents in the world's leading capitalist nations responded with a resounding "yes" to a survey asking whether they support hiking taxes on the rich to fund social programs for the poor.

Most residents in all 21 countries included in the Organization for Economic Co-operation and Development (OECD) survey published Tuesday said their governments should "tax the rich more than they currently do in order to support the poor."

In the United States, over 50 percent of those polled said they support hiking taxes on the wealthy to help the poor. Average support for the idea among all 22,000 people surveyed was at 68 percent.

The OECD also found that most residents of the nations surveyed "lack confidence in the government's ability to provide adequate income support in case of unemployment, illness or disability, becoming a parent, or old age."

"This is a wake-up call for policymakers," Angel Gurria, secretary-general of the OECD, said in a statement. "Too many people feel they cannot count fully on their government when they need help."

The OECD survey comes as U.S. members of Congress and presidential candidates are advocating a variety of proposals to increase taxes on the rich--including a wealth tax and a 70 percent top marginal tax rate on Americans making over $10 million per year.

As Common Dreams reported in February, these proposals have polled extremely well among the American public.

Sen. Elizabeth Warren (D-Mass.)--a presidential contender who introduced legislation that would impose an annual tax of two percent on assets over $50 million--explained in a town hall Monday that even a modest tax hike on the rich would go a long way toward funding social programs that disprorportionately benefit low-income Americans.

"We get a two percent tax on the 75,000 richest families in this country," Warren said, "we would have enough money to provide universal child care, universal pre-K, universal pre-pre-K for every child in America, and still have two trillion dollars left over."