As President Donald Trump kicked off his aggressive, Koch brothers-backed tax "reform" push with a speech in Missouri on Wednesday, progressive advocacy groups and policy analysts argued that the president's tax agenda is nothing more than a "scam" that would take money from low-income families and hand it to the rich.

"Working families will be the big losers under Trump's tax plan."

--Americans for Tax Fairness"Make no mistake, what Trump and Republican leaders in Congress are proposing is not tax reform," Frank Clemente, executive director of Americans for Tax Fairness (AFT), said in a statement on Tuesday. "They simply want massive tax cuts for millionaires, billionaires, and big corporations, at the expense of everyone else. And those tax giveaways will be paid for by cuts to Social Security, healthcare, education, and other programs that maintain living standards for working families."

In a Twitter thread on Wednesday, Chad Bolt, policy manager for Indivisible, echoed Clemente and urged Americans not to fall for Trump's "scam tactics."

"This is a classic Trump move," Bolt concluded. "He's selling a scam light on details that won't deliver on promises he's making to the people he's selling to."

Ahead of Trump's Missouri speech on Wednesday, AFT released a point-by-point rebuttal of the key claims and assumptions behind the president's--and the GOP's--tax agenda.

Trump has claimed, for instance, that a huge corporate tax cut would result in an "explosion of new business and new jobs."

This couldn't be further from the truth, AFT argues. "And Trump's proposed deep budget cuts to infrastructure, healthcare, medical research, and education won't help create jobs, either."

Pointing to a recent report (pdf) that analyzed 92 publicly held, profitable corporations that already benefit from a low effective tax rate, Sarah Anderson of the Institute for Policy Studies affirmed AFT's position, calling the notion that corporate tax cuts bolster job growth a "myth."

"True tax reform would close loopholes and make the system fairer for everyone."

--Americans for Tax Fairness"If claims about the job-creation benefits of lower tax rates had any validity, these 92 consistently profitable firms would be among the nation's strongest job creators. Instead, we found just the opposite," Anderson wrote in an op-ed for the New York Times. "The companies we reviewed had a median job-growth rate over the past nine years of nearly negative 1 percent, compared with 6 percent for the private sector as a whole. Of those 92 companies, 48 got rid of a combined total of 483,000 jobs."

In an appearance on Bernie TV, Anderson argued that corporate tax cuts do little more than put money in the pockets of CEOs:

The president has also frequently parroted a familiar GOP assertion that conservative "tax reform" is primarily geared toward helping the middle class.

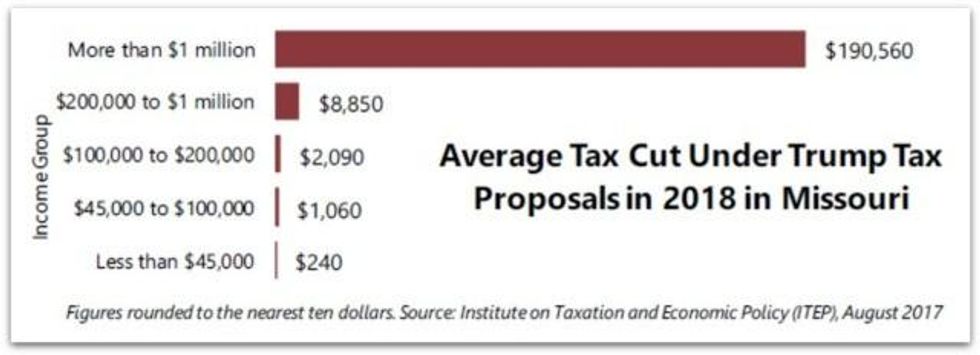

In reality, AFT notes, "working families will be the big losers under Trump's tax plan. In fact, a quarter of middle-class families would actually pay higher taxes under his plan."

As an alternative to Trump's regressive, billionaire-friendly plan, AFT described what "real" tax reform would look like.

"True tax reform would close loopholes and make the system fairer for everyone," AFT noted. "Big corporations don't need a tax cut--what they need is to start paying their fair share of taxes."

Alan Essig, executive director of the Institute on Taxation and Economic Policy, characterized Trump's and the Republican Party's tax proposals as "old hat and disproven" reiterations of trickle-down economics in a statement on Wednesday.

"If lawmakers truly wanted to create good jobs and look out for the middle class," Essig concluded, "they would not peddle policies that would redistribute wealth upward via the tax code."