That figure, the report emphasizes, "does not even begin to cover costs Americans could have been scammed out of due to a sidelined CFPB."

“Donald Trump promised to lower costs for Americans ‘On Day One.’ Instead, he is trying to shut down an agency that protects Americans from getting scammed out of their money by big banks and giant corporations,” Warren said in a statement. “As a result, Trump’s attempt to sideline the CFPB has cost families billions of dollars over the last year alone. We're going to keep fighting for the CFPB and against the billionaires who want to get rid of it.”

The report was released to mark one year since Russell Vought, the White House budget chief and acting CFPB director, ordered the bureau to effectively shut down its operations, including rulemaking and investigations into corporate wrongdoing.

Lawmakers have not confirmed Vought—a Project 2025 architect who has been explicit about his desire to kill the CFPB—as bureau chief, but he has remained in the acting director role thanks to White House legal maneuvers. In recent months, Vought has tried to starve the CFPB of funding—an effort that, for now, has been stymied in court.

"We want to put it out," Vought said in an interview late last year, boasting about mass firings that have left the consumer agency skeletal. "We will be successful probably within the next two or three months."

Prior to the start of President Donald Trump's second White House term, the CFPB had returned around $21 billion to US consumers scammed by banks and other corporations since the bureau's creation in the wake of the Great Recession.

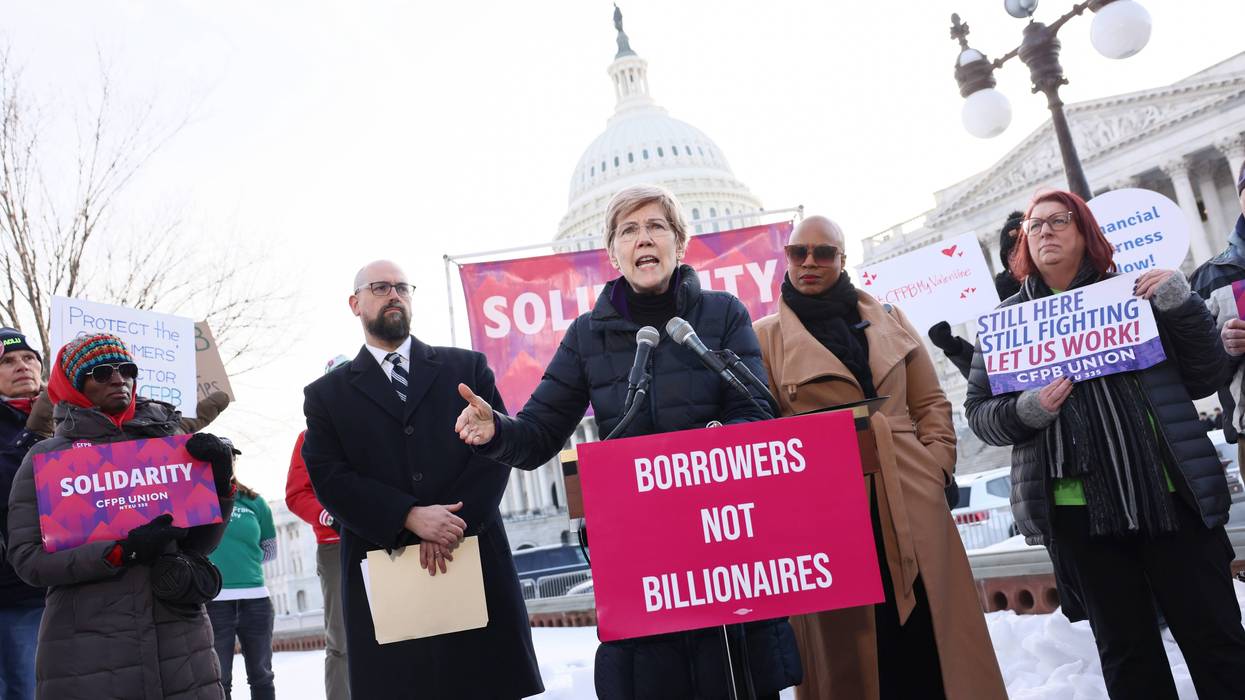

"When you're counting the way that costs have gone up for American families over the last year, be sure to include the cost of getting cheated, because Donald Trump has driven that cost through the roof," Warren said during a rally with fellow Democratic lawmakers and advocates in Washington, DC on Monday.

"We are here today to remind Donald Trump and to remind all those Republicans who support him and enable him, to remind every one of them that they can kick this agency, they can try to hold this agency down, they can try to starve this agency, they can try to tie up the people who work at this agency, but at the end of the day, they will not kill this agency," said Warren. "We will stay in this fight, and we will win."