Are the baby boomers going bust?

A new report by the Government Accountability Office released Tuesday shows that the savings and overall financial stability of Americans older than 55 has dropped dramatically in recent decades, leaving a worrisome situation as the ranks of the elderly are set to increase even more in the years ahead.

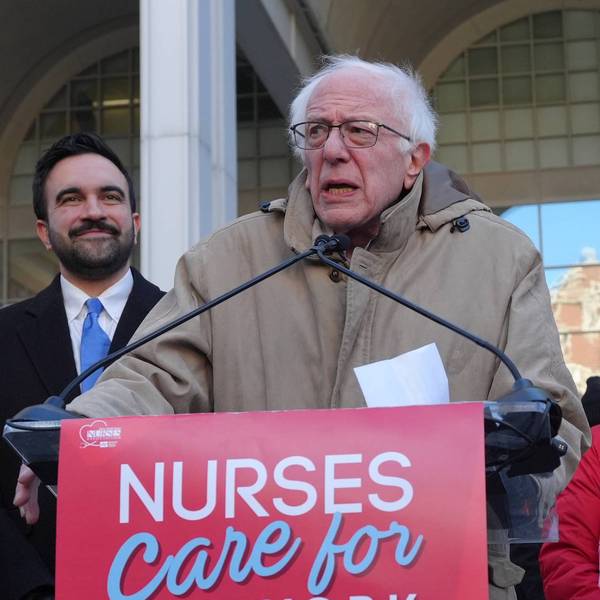

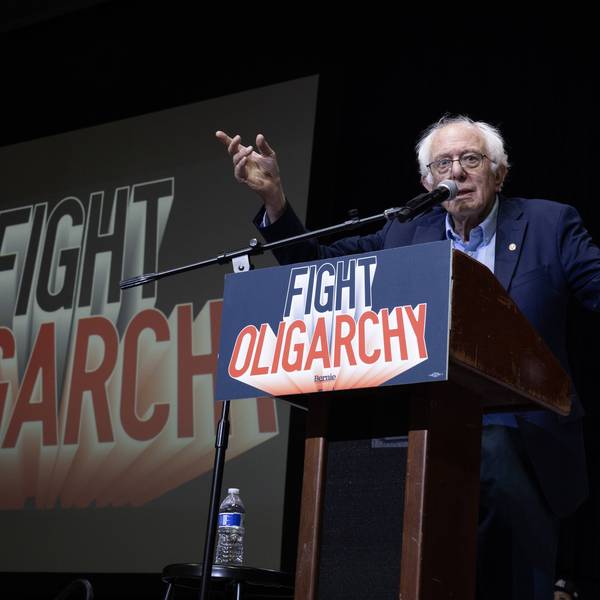

" Social Security is the most successful program in our nation's history. At a time of massive wealth and income inequality, we have got to demand that the richest people in this country pay their fair share."

--Sen. Bernie Sanders According to the report, more than half of this age group have no retirement savings whatsoever and most of these also have no pension (sometimes referred to has a defined benefit (DB) plan) or other spare savings to rely on once they stop working. The GAO says that Social Security currently provides most of the income for about half of households age 65 and older.

But with Social Security payments not keeping pace with the cost of living, experts worry that without finding ways to increase Social Security's reach the current crisis could turn into a full-blown disaster.

We Interrupt This Article with an Urgent Message! Common Dreams is a not-for-profit organization. We fund our news team by pooling together many small contributions from our readers. No advertising. No selling our readers' information. No reliance on big donations from the 1%. This allows us to maintain the editorial independence that our readers rely on. But this media model only works if enough readers pitch in.

We urgently need your help today.

If you support Common Dreams and you want us to survive, your gift today is critical.

Please give now to our Mid-Year Fundraiser! |

As the Huffington Post notes, "In 1975, most workers with employer-sponsored retirement plans had pensions that provided a lifetime 'defined benefit.' As of 2012, such plans had 40 million participants, while 91 million workers had retirement savings plans such as 401(k)s, which are based on workers' own contributions and offer no guarantee of lifetime income."

The GAO study was requested by Sen. Sanders, now a presidential candidate for the Democratic nomination, who earlier this year was the lead sponsor of legislation designed to increase Social Security benefits for recipients.

"This report makes it clear that there is a retirement crisis in America today," Sanders said in response to the GAO findings. "At a time when half of all older workers have no retirement savings, we need to expand, not cut, Social Security benefits so that every American can retire with dignity."

While Republicans and many austerity-friendly Democrats have openly discussed making cuts to Social Security, Sanders has been among those lawmakers who joined progressive-minded economists and social justice advocates to instead demand that Social Security be bolstered by increasing the cap on what high income earners pay into the program's trust fund. Currently that cap is set at just $110,000 which means that people who earn more than that pay a much lower share of their income into the fund annually.

According to Sanders' office, the Social Security Expansion Act he put forth "would make the wealthiest Americans pay the same share of their income into the retirement program as other wage earners." That change, Sanders argues, would extend the solvency of Social Security through 2065 while allowing monthly payments to Social Security recipients go up. Under his proposal, Sanders says the average benefit would increase by $65 a month, cost-of-living adjustments would more accurately measure inflation, and an increase to the minimum benefit could lift millions of vulnerable seniors out of poverty in their final years.

"Social Security is the most successful program in our nation's history," Sanders said. "At a time of massive wealth and income inequality, we have got to demand that the richest people in this country pay their fair share."