SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

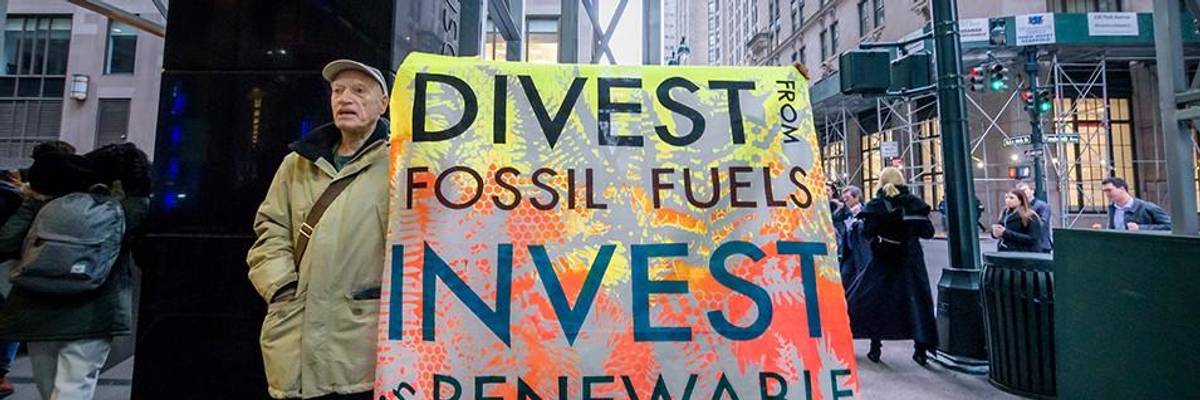

A protester holds a banner at the rally outside JP Morgan Headquarters in Manhattan, New York. (Photo: Erik McGregor/LightRocket via Getty Images)

First the good news: The technology needed for a carbon-free economy in every country in the world already exists. It is affordable, most of it will make our lives better, and making that transition rapidly would cost less than cleaning up the disasters anticipated by inaction on climate.

Now the not so good news: To achieve the very ambitious goals scientists have put forth to keep the planet habitable, such as reducing emissions and carbon capture, we need to act quickly; because the human and social costs to those living in the path of destruction, a disproportionate number of whom are low-income people of color, is incalculable.

Who is slowing the transition to a just and sustainable society?

There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners.

Fossil fuel companies, like all corporations, are designed for generating profit. As society changes to require sustainable practices, many companies will be able to shift their business models to achieve the triple bottom line of profit, people, and planet. But for fossil fuel companies, what drives their profit is ownership of carbon in the ground. That's why they have spent billions of dollars stoking the climate denial industry and fighting regulations.

We are not all on the same side in the fight for a sustainable future. There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners. A company like Enbridge's core business is building fossil fuel infrastructure. They are not going to shift to a green business model.

While the fossil fuel companies themselves cannot be counted on to become champions of the transition to a sustainable economy, the world of finance can change and remain profitable. And it is this group of actors that we need to pressure. Stop the Money Pipeline shares information on those funders and fights to expose their work. The key funders of Enbridge's Line 3--a 1,097-mile crude oil pipeline extending from Alberta to Superior, Wisconsin--are Liberty Mutual, Blackrock, Wells Fargo, and JP Morgan chase. They are direct funders and insurers of the pipeline. If they withdrew their support the project would be stopped.

Less direct, but equally important in propping up the fossil fuel industry are the pension funds, such as California's CalPERS and CalSTRS. They are among the largest investment funds in the world, and as public entities they should be acting in the public interest. These investors give companies like Enbridge a social license by investing in them.

Institutional investors and banks are not likely to stop funding the fossil fuel industry until we pressure them to do so. Earlier this year activists succeeded in getting the $246 billion New York State Common Retirement Fund to begin divesting from fossil fuels. Fossil Free California has been working for seven years to get CalPERS and CalSTRS to divest. It has been a strange fight, since the funds have already lost billions of dollars in value by staying in what is clearly a dying sector of the economy and Governor Newsome has asked them to use their investment strategies to speed the transition to a sustainable economy.

As the major fossil fuel companies are beginning to lose value, some investors are moving away from them. But passive funds still include them in their indexes. And fossil fuel companies are seen as legitimate businesses operating according to community norms. Big pension funds such as CalPERS and CalSTRS are holding onto passive funds arguing that they can help the fossil fuel industry to become better social actors. Enbridge and Exxon-Mobil might be heading for the precipice, but the banks and pension funds are the ones who fill their gas tanks.

Our role in the fight

For years the climate fight was seen by many as a matter of consumers voting with their dollars to shift how society functions. The concept of the personal carbon footprint was popularized in a 2005 British Petroleum campaign and encouraged people to look at individual consumers as the cause of the climate crisis. We need to come out of the fog of individualistic thinking and get clear about who is slowing us from making the transition from fossil fuels as quickly as we need to. And we need to take away the social license of the fossil fuel companies as quickly as we can. The way to do that is by focusing on their funders.

Scientists predict we have until 2030 for human society to make massive shifts in how we use energy that would allow the world can remain habitable. The present fight against the expansion of Enbridge's Line 3 gas pipeline and the Dakota Access Pipeline is a test of grassroots mobilization. Right now, indigenous leaders, water protectors, youth climate activists, and people who live in the vast areas likely to be destroyed by spills and leaks from the pipelines, are engaged in a big fight to stop the expansion.

For those of us living in the rest of the country, we can support those activists by taking away the social license of the funders and insurers of those projects to make it impossible for them to go forward. By moving investments to climate-safe pension funds, pressuring J.P. Morgan Chase, the largest funder of the fossil fuel industry and Blackrock, the world's largest investor in the fossil fuel industry to divest, we can help stop the pipeline of money that is fueling the climate crisis before it's too late.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Cynthia Kaufman is a writer and educator. She is the author of five books on social change: Consumerism, Sustainability, and Happiness: How to Build a World Where Everyone Has Enough (Routledge 2023), The Sea is Rising and So Are We: A Climate Justice Handbook (PM Press 2021), Challenging Power: Democracy and Accountability in a Fractured World (Bloomsbury 2020), Getting Past Capitalism: History, Vision, Hope (Lexington Books 2012), and Ideas for Action: Relevant Theory for Radical Change (2nd Edition PM Press 2016). She is the director of the Vasconcellos Institute for Democracy in Action at De Anza College. Visit her website.

First the good news: The technology needed for a carbon-free economy in every country in the world already exists. It is affordable, most of it will make our lives better, and making that transition rapidly would cost less than cleaning up the disasters anticipated by inaction on climate.

Now the not so good news: To achieve the very ambitious goals scientists have put forth to keep the planet habitable, such as reducing emissions and carbon capture, we need to act quickly; because the human and social costs to those living in the path of destruction, a disproportionate number of whom are low-income people of color, is incalculable.

Who is slowing the transition to a just and sustainable society?

There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners.

Fossil fuel companies, like all corporations, are designed for generating profit. As society changes to require sustainable practices, many companies will be able to shift their business models to achieve the triple bottom line of profit, people, and planet. But for fossil fuel companies, what drives their profit is ownership of carbon in the ground. That's why they have spent billions of dollars stoking the climate denial industry and fighting regulations.

We are not all on the same side in the fight for a sustainable future. There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners. A company like Enbridge's core business is building fossil fuel infrastructure. They are not going to shift to a green business model.

While the fossil fuel companies themselves cannot be counted on to become champions of the transition to a sustainable economy, the world of finance can change and remain profitable. And it is this group of actors that we need to pressure. Stop the Money Pipeline shares information on those funders and fights to expose their work. The key funders of Enbridge's Line 3--a 1,097-mile crude oil pipeline extending from Alberta to Superior, Wisconsin--are Liberty Mutual, Blackrock, Wells Fargo, and JP Morgan chase. They are direct funders and insurers of the pipeline. If they withdrew their support the project would be stopped.

Less direct, but equally important in propping up the fossil fuel industry are the pension funds, such as California's CalPERS and CalSTRS. They are among the largest investment funds in the world, and as public entities they should be acting in the public interest. These investors give companies like Enbridge a social license by investing in them.

Institutional investors and banks are not likely to stop funding the fossil fuel industry until we pressure them to do so. Earlier this year activists succeeded in getting the $246 billion New York State Common Retirement Fund to begin divesting from fossil fuels. Fossil Free California has been working for seven years to get CalPERS and CalSTRS to divest. It has been a strange fight, since the funds have already lost billions of dollars in value by staying in what is clearly a dying sector of the economy and Governor Newsome has asked them to use their investment strategies to speed the transition to a sustainable economy.

As the major fossil fuel companies are beginning to lose value, some investors are moving away from them. But passive funds still include them in their indexes. And fossil fuel companies are seen as legitimate businesses operating according to community norms. Big pension funds such as CalPERS and CalSTRS are holding onto passive funds arguing that they can help the fossil fuel industry to become better social actors. Enbridge and Exxon-Mobil might be heading for the precipice, but the banks and pension funds are the ones who fill their gas tanks.

Our role in the fight

For years the climate fight was seen by many as a matter of consumers voting with their dollars to shift how society functions. The concept of the personal carbon footprint was popularized in a 2005 British Petroleum campaign and encouraged people to look at individual consumers as the cause of the climate crisis. We need to come out of the fog of individualistic thinking and get clear about who is slowing us from making the transition from fossil fuels as quickly as we need to. And we need to take away the social license of the fossil fuel companies as quickly as we can. The way to do that is by focusing on their funders.

Scientists predict we have until 2030 for human society to make massive shifts in how we use energy that would allow the world can remain habitable. The present fight against the expansion of Enbridge's Line 3 gas pipeline and the Dakota Access Pipeline is a test of grassroots mobilization. Right now, indigenous leaders, water protectors, youth climate activists, and people who live in the vast areas likely to be destroyed by spills and leaks from the pipelines, are engaged in a big fight to stop the expansion.

For those of us living in the rest of the country, we can support those activists by taking away the social license of the funders and insurers of those projects to make it impossible for them to go forward. By moving investments to climate-safe pension funds, pressuring J.P. Morgan Chase, the largest funder of the fossil fuel industry and Blackrock, the world's largest investor in the fossil fuel industry to divest, we can help stop the pipeline of money that is fueling the climate crisis before it's too late.

Cynthia Kaufman is a writer and educator. She is the author of five books on social change: Consumerism, Sustainability, and Happiness: How to Build a World Where Everyone Has Enough (Routledge 2023), The Sea is Rising and So Are We: A Climate Justice Handbook (PM Press 2021), Challenging Power: Democracy and Accountability in a Fractured World (Bloomsbury 2020), Getting Past Capitalism: History, Vision, Hope (Lexington Books 2012), and Ideas for Action: Relevant Theory for Radical Change (2nd Edition PM Press 2016). She is the director of the Vasconcellos Institute for Democracy in Action at De Anza College. Visit her website.

First the good news: The technology needed for a carbon-free economy in every country in the world already exists. It is affordable, most of it will make our lives better, and making that transition rapidly would cost less than cleaning up the disasters anticipated by inaction on climate.

Now the not so good news: To achieve the very ambitious goals scientists have put forth to keep the planet habitable, such as reducing emissions and carbon capture, we need to act quickly; because the human and social costs to those living in the path of destruction, a disproportionate number of whom are low-income people of color, is incalculable.

Who is slowing the transition to a just and sustainable society?

There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners.

Fossil fuel companies, like all corporations, are designed for generating profit. As society changes to require sustainable practices, many companies will be able to shift their business models to achieve the triple bottom line of profit, people, and planet. But for fossil fuel companies, what drives their profit is ownership of carbon in the ground. That's why they have spent billions of dollars stoking the climate denial industry and fighting regulations.

We are not all on the same side in the fight for a sustainable future. There are many businesses still profiting off antiquated and destructive technology; many politicians who are still funded by them; and many in the world of finance who still see them as business partners. A company like Enbridge's core business is building fossil fuel infrastructure. They are not going to shift to a green business model.

While the fossil fuel companies themselves cannot be counted on to become champions of the transition to a sustainable economy, the world of finance can change and remain profitable. And it is this group of actors that we need to pressure. Stop the Money Pipeline shares information on those funders and fights to expose their work. The key funders of Enbridge's Line 3--a 1,097-mile crude oil pipeline extending from Alberta to Superior, Wisconsin--are Liberty Mutual, Blackrock, Wells Fargo, and JP Morgan chase. They are direct funders and insurers of the pipeline. If they withdrew their support the project would be stopped.

Less direct, but equally important in propping up the fossil fuel industry are the pension funds, such as California's CalPERS and CalSTRS. They are among the largest investment funds in the world, and as public entities they should be acting in the public interest. These investors give companies like Enbridge a social license by investing in them.

Institutional investors and banks are not likely to stop funding the fossil fuel industry until we pressure them to do so. Earlier this year activists succeeded in getting the $246 billion New York State Common Retirement Fund to begin divesting from fossil fuels. Fossil Free California has been working for seven years to get CalPERS and CalSTRS to divest. It has been a strange fight, since the funds have already lost billions of dollars in value by staying in what is clearly a dying sector of the economy and Governor Newsome has asked them to use their investment strategies to speed the transition to a sustainable economy.

As the major fossil fuel companies are beginning to lose value, some investors are moving away from them. But passive funds still include them in their indexes. And fossil fuel companies are seen as legitimate businesses operating according to community norms. Big pension funds such as CalPERS and CalSTRS are holding onto passive funds arguing that they can help the fossil fuel industry to become better social actors. Enbridge and Exxon-Mobil might be heading for the precipice, but the banks and pension funds are the ones who fill their gas tanks.

Our role in the fight

For years the climate fight was seen by many as a matter of consumers voting with their dollars to shift how society functions. The concept of the personal carbon footprint was popularized in a 2005 British Petroleum campaign and encouraged people to look at individual consumers as the cause of the climate crisis. We need to come out of the fog of individualistic thinking and get clear about who is slowing us from making the transition from fossil fuels as quickly as we need to. And we need to take away the social license of the fossil fuel companies as quickly as we can. The way to do that is by focusing on their funders.

Scientists predict we have until 2030 for human society to make massive shifts in how we use energy that would allow the world can remain habitable. The present fight against the expansion of Enbridge's Line 3 gas pipeline and the Dakota Access Pipeline is a test of grassroots mobilization. Right now, indigenous leaders, water protectors, youth climate activists, and people who live in the vast areas likely to be destroyed by spills and leaks from the pipelines, are engaged in a big fight to stop the expansion.

For those of us living in the rest of the country, we can support those activists by taking away the social license of the funders and insurers of those projects to make it impossible for them to go forward. By moving investments to climate-safe pension funds, pressuring J.P. Morgan Chase, the largest funder of the fossil fuel industry and Blackrock, the world's largest investor in the fossil fuel industry to divest, we can help stop the pipeline of money that is fueling the climate crisis before it's too late.