RECOMMENDED...

Germany Profits from Greeks' Hardships

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis. This is a conclusion of research carried out by the Halle Institute for Economic Research (IWH). The study shows that the Greek debt crisis resulted in a reduction in German bund rates of about 300 basis points (BP). This led to interest savings of more than EUR 100 billion (equivalent to more than 3 percent of gross domestic product (GDP) during the period 2010 to 2015.

Aug 15, 2015

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis. This is a conclusion of research carried out by the Halle Institute for Economic Research (IWH). The study shows that the Greek debt crisis resulted in a reduction in German bund rates of about 300 basis points (BP). This led to interest savings of more than EUR 100 billion (equivalent to more than 3 percent of gross domestic product (GDP) during the period 2010 to 2015.

According to the study, Germany would still benefit if Greece defaults on all its debt. The savings would still be substantial if Greece does pay or pays at least in part. This is the result of investors' increased demand for German bonds because of the greater safety they provide. Many investors would lend money to the German government at extremely low rates rather than risk losses on higher return enterprises.

Greece missed two key payments to the International Monetary Fund (IMF) in June and July, and the terms for a third bailout need to be reached by August 20. On that date, Greece next debt repayment to the European Central Bank is due. Although Greek officials were optimistic about the results of the negotiations, German officials were more cautious. Steffen Seibert, Chancellor Angela Merkel's spokesman, said that "thoroughness comes before speed".

Greece asked for its first bailout in 2010, and Germany provided the funds for the following five years either directly or through the IMF or the European Stability Mechanism.

While German officials want Greece to implement credible pension reforms and privatization plans, the Athens government is desperately trying to find funds to recapitalize the country's ailing banks. However, any deal will have to be ratified by Germans MPs, many of whom oppose further concessions to the Syriza government.

Unlike other European countries, the German economy is still expected to grow in 2015.

In the meantime, the bailout money Greece has received so far hasn't made its way into the economy but rather it has gone to pay off the country's international loans. The government cannot begin to pay down its enormous debt load unless a recovery takes hold. In practical terms, something has to give and the indications are that unless most of Greece's debt is written off, we will see the same scenario repeated in a short time.

So far, the Greeks have paid dearly for the country's troubles (a mixture of its own leader's corruption and inefficiency and international corruption and inefficiency). Unemployment figures are above 25 percent (25.4 percent in August of 2012 and probably much higher now) and there is a significant deterioration of social and health services.

A great number of small size enterprises have suffered the consequences of declining consumption, lack of liquidity and emergency taxes. It is estimated that more than 65,000 of them have closed since 2010, leading to the unemployment of thousands of people. A new generation of "neo-homeless" now exists, some of whom are people of high educational background who are unable to cope with the crisis.

It is not surprising that suicides have increased dramatically, while many psychiatric clinics have had to close down at the time when they are most needed. A similar situation has risen as a result of increasing number of HIV infected people, probably the result of increased drug addiction and use contaminated needles, while drug prevention centers continue to close down.

There is something incongruous where one of the richest countries in the world continues to profit from the miseries of a poor country like Greece. To pretend that Greece will be revived by a new influx of predatory loans is to pretend that a terminally sick patient will be cured by a blood transfusion.

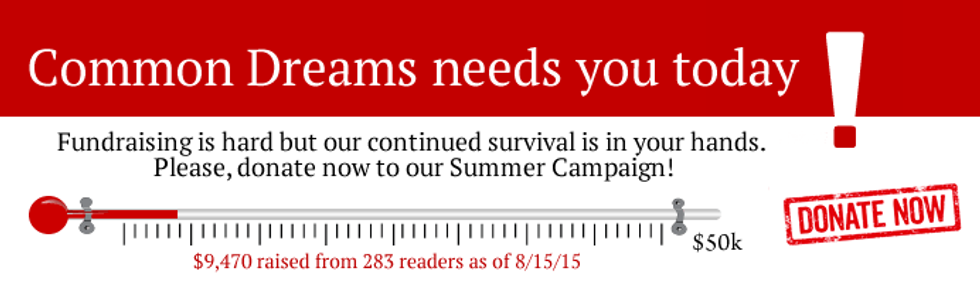

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

Cesar Chelala

Dr. Cesar Chelala is an international public health consultant, co-winner of an Overseas Press Club of America award and two national journalism awards from Argentina.

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis. This is a conclusion of research carried out by the Halle Institute for Economic Research (IWH). The study shows that the Greek debt crisis resulted in a reduction in German bund rates of about 300 basis points (BP). This led to interest savings of more than EUR 100 billion (equivalent to more than 3 percent of gross domestic product (GDP) during the period 2010 to 2015.

According to the study, Germany would still benefit if Greece defaults on all its debt. The savings would still be substantial if Greece does pay or pays at least in part. This is the result of investors' increased demand for German bonds because of the greater safety they provide. Many investors would lend money to the German government at extremely low rates rather than risk losses on higher return enterprises.

Greece missed two key payments to the International Monetary Fund (IMF) in June and July, and the terms for a third bailout need to be reached by August 20. On that date, Greece next debt repayment to the European Central Bank is due. Although Greek officials were optimistic about the results of the negotiations, German officials were more cautious. Steffen Seibert, Chancellor Angela Merkel's spokesman, said that "thoroughness comes before speed".

Greece asked for its first bailout in 2010, and Germany provided the funds for the following five years either directly or through the IMF or the European Stability Mechanism.

While German officials want Greece to implement credible pension reforms and privatization plans, the Athens government is desperately trying to find funds to recapitalize the country's ailing banks. However, any deal will have to be ratified by Germans MPs, many of whom oppose further concessions to the Syriza government.

Unlike other European countries, the German economy is still expected to grow in 2015.

In the meantime, the bailout money Greece has received so far hasn't made its way into the economy but rather it has gone to pay off the country's international loans. The government cannot begin to pay down its enormous debt load unless a recovery takes hold. In practical terms, something has to give and the indications are that unless most of Greece's debt is written off, we will see the same scenario repeated in a short time.

So far, the Greeks have paid dearly for the country's troubles (a mixture of its own leader's corruption and inefficiency and international corruption and inefficiency). Unemployment figures are above 25 percent (25.4 percent in August of 2012 and probably much higher now) and there is a significant deterioration of social and health services.

A great number of small size enterprises have suffered the consequences of declining consumption, lack of liquidity and emergency taxes. It is estimated that more than 65,000 of them have closed since 2010, leading to the unemployment of thousands of people. A new generation of "neo-homeless" now exists, some of whom are people of high educational background who are unable to cope with the crisis.

It is not surprising that suicides have increased dramatically, while many psychiatric clinics have had to close down at the time when they are most needed. A similar situation has risen as a result of increasing number of HIV infected people, probably the result of increased drug addiction and use contaminated needles, while drug prevention centers continue to close down.

There is something incongruous where one of the richest countries in the world continues to profit from the miseries of a poor country like Greece. To pretend that Greece will be revived by a new influx of predatory loans is to pretend that a terminally sick patient will be cured by a blood transfusion.

Cesar Chelala

Dr. Cesar Chelala is an international public health consultant, co-winner of an Overseas Press Club of America award and two national journalism awards from Argentina.

As Greeks suffer in multiple ways the effects of the economic crisis their country is going through, Germany has profited handsomely from the Greek crisis. This is a conclusion of research carried out by the Halle Institute for Economic Research (IWH). The study shows that the Greek debt crisis resulted in a reduction in German bund rates of about 300 basis points (BP). This led to interest savings of more than EUR 100 billion (equivalent to more than 3 percent of gross domestic product (GDP) during the period 2010 to 2015.

According to the study, Germany would still benefit if Greece defaults on all its debt. The savings would still be substantial if Greece does pay or pays at least in part. This is the result of investors' increased demand for German bonds because of the greater safety they provide. Many investors would lend money to the German government at extremely low rates rather than risk losses on higher return enterprises.

Greece missed two key payments to the International Monetary Fund (IMF) in June and July, and the terms for a third bailout need to be reached by August 20. On that date, Greece next debt repayment to the European Central Bank is due. Although Greek officials were optimistic about the results of the negotiations, German officials were more cautious. Steffen Seibert, Chancellor Angela Merkel's spokesman, said that "thoroughness comes before speed".

Greece asked for its first bailout in 2010, and Germany provided the funds for the following five years either directly or through the IMF or the European Stability Mechanism.

While German officials want Greece to implement credible pension reforms and privatization plans, the Athens government is desperately trying to find funds to recapitalize the country's ailing banks. However, any deal will have to be ratified by Germans MPs, many of whom oppose further concessions to the Syriza government.

Unlike other European countries, the German economy is still expected to grow in 2015.

In the meantime, the bailout money Greece has received so far hasn't made its way into the economy but rather it has gone to pay off the country's international loans. The government cannot begin to pay down its enormous debt load unless a recovery takes hold. In practical terms, something has to give and the indications are that unless most of Greece's debt is written off, we will see the same scenario repeated in a short time.

So far, the Greeks have paid dearly for the country's troubles (a mixture of its own leader's corruption and inefficiency and international corruption and inefficiency). Unemployment figures are above 25 percent (25.4 percent in August of 2012 and probably much higher now) and there is a significant deterioration of social and health services.

A great number of small size enterprises have suffered the consequences of declining consumption, lack of liquidity and emergency taxes. It is estimated that more than 65,000 of them have closed since 2010, leading to the unemployment of thousands of people. A new generation of "neo-homeless" now exists, some of whom are people of high educational background who are unable to cope with the crisis.

It is not surprising that suicides have increased dramatically, while many psychiatric clinics have had to close down at the time when they are most needed. A similar situation has risen as a result of increasing number of HIV infected people, probably the result of increased drug addiction and use contaminated needles, while drug prevention centers continue to close down.

There is something incongruous where one of the richest countries in the world continues to profit from the miseries of a poor country like Greece. To pretend that Greece will be revived by a new influx of predatory loans is to pretend that a terminally sick patient will be cured by a blood transfusion.

We've had enough. The 1% own and operate the corporate media. They are doing everything they can to defend the status quo, squash dissent and protect the wealthy and the powerful. The Common Dreams media model is different. We cover the news that matters to the 99%. Our mission? To inform. To inspire. To ignite change for the common good. How? Nonprofit. Independent. Reader-supported. Free to read. Free to republish. Free to share. With no advertising. No paywalls. No selling of your data. Thousands of small donations fund our newsroom and allow us to continue publishing. Can you chip in? We can't do it without you. Thank you.