SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

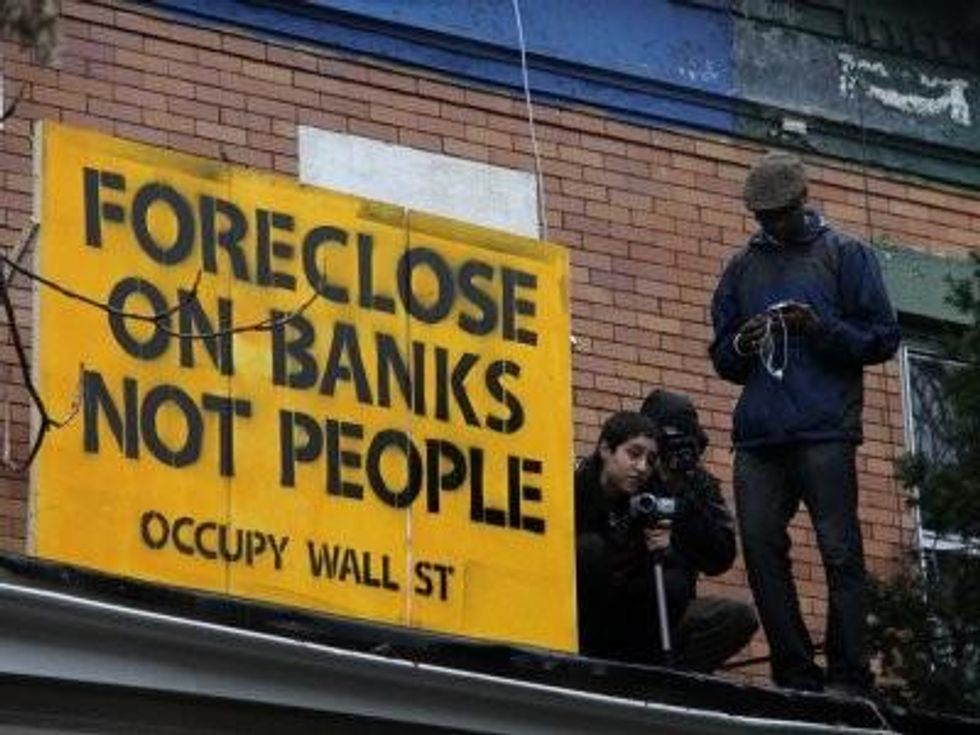

Rumor has it that as early as today, after months of negotiation with big banks, the White House may announce a settlement that would let the banks off the hook for their role in the foreclosure crisis -- paying a tiny fraction of what's needed in exchange for blanket immunity from future lawsuits.

We hope these rumors are untrue.

President Obama has the ability to stop and change the direction of this sweetheart deal. He should reject any deal that benefits the one percent and lets the big banks get away with their crimes. Instead, the president should stand with the 99 percent and push for real accountability and a solution that will help millions of people in this country.

Here are the hard facts about the housing crisis we face:

Default and foreclosure rates are now several times higher than at any time since the Great Depression.

If President Obama is serious about solving this crisis, he must ensure three things:

First: The banks must pay a minimum $300 billion in principal reduction for homeowners with underwater mortgages and/or restitution for foreclosed-on families. This is essential. Every effort to date to reboot the housing market has failed because it has not done the most essential thing -- actually reduce the massive debt load carried by homeowners.

As it stands, the deal likely to be announced Monday would have the banks pay only $20 billion, an astonishingly small fraction of what's needed. Add up all the underwater homes in America, and there's an estimated $700 billion in negative equity in the country, according to a recent study. If banks fix what they broke and write down principals for all underwater mortgages, this would free up millions of people to pump billions of dollars back into local economies, create jobs, and ultimately generate revenue to help invest in things that will help our economy grow.

Second: There must be a full-fledged, full-blown investigation into Wall Street financial fraud by the Department of Justice. There should be a task force with the staff resources, the authority, and the explicit mission of seriously investigating fraudulent behavior in the way home mortgages were securitized.

Reports of the current deal suggest banks could walk away without any actual investigation into their role in the housing crisis.

Third: There should be no civil or criminal immunity for the banks from future lawsuits. That means there should be no broad release of claims in any current or future negotiation or settlement.

The banks must pay to help solve the crisis they played such a big role in creating. They can afford it.

U.S. banks raked in $35 billion in profits last summer alone and are currently sitting on a historically high level of cash reserves of $1.64 trillion. The six biggest banks -- Bank of America, Wells Fargo, Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley -- hold assets totaling $9.5 trillion; and together paid an income tax rate of only 11% in 2009 and 2010, far below the federally mandated 35% corporate tax rate.

And that's not all. Despite their bleak performance this year, the nation's top six banks paid out $144 billion in bonuses and compensation for 2011, second only to the record $147 billion they paid out in 2007 at the height of the economic boom.

While banks enjoy record profits and the prospect of total immunity, millions of Americans are drowning in underwater mortgages.

Everyday people are already out front, fighting against the malfeasance of the banks; the White House should stand with them. Our national leaders need look no farther than Atlanta, GA, for an instructive profile in courage. Earlier this month, a community church in Dr. Martin Luther King's old neighborhood refused to be ignored. In 2008, a tornado devastated the historic, 108-year-old Higher Ground Empowerment Center church, and they were forced to take out a loan to cover repairs. The loan went underwater and became harder and harder to pay back. For nearly four years, the church asked the bank to modify their loan, but BB&T bank ignored them. Instead, last week, the bank started to evict the church. Sound familiar? Anyone with an underwater mortgage can tell you: banks these days just can't seem to treat their own customers with decency and manners.

However, after Occupy Atlanta staged a high-profile press conference, and 65,000 people signed a national petition by Rebuild the Dream, the church got BB&T bank to agree to modify their loan to something affordable and reasonable.

This happy ending is, unfortunately, the rare exception. BB&T, after being shaken to their senses (and shamed in the media), came to the table and did the right thing. But millions of homeowners have no way to stage protests and press conferences. Abuse, fraud, conflicts of interest, and lawlessness have been endemic at every stage of the mortgage origination and foreclosure process. This chain of misconduct by many of the nation's largest financial companies is at the root of the foreclosure avalanche and it's time to demand a course of action that will resolve the current crisis and create jobs in the future.

If these folks in Atlanta can show this level of courage in standing up to a big bank, then certainly Obama and state attorneys general can show the same courage.

The banks got their bailout. Now we need a strong and fair settlement to help Americans drowning in underwater mortgages.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

George Goehl is a long-time community organizer and the host of To See Each Other, which this season follows seniors in rural Wisconsin fighting to save beloved public nursing homes.

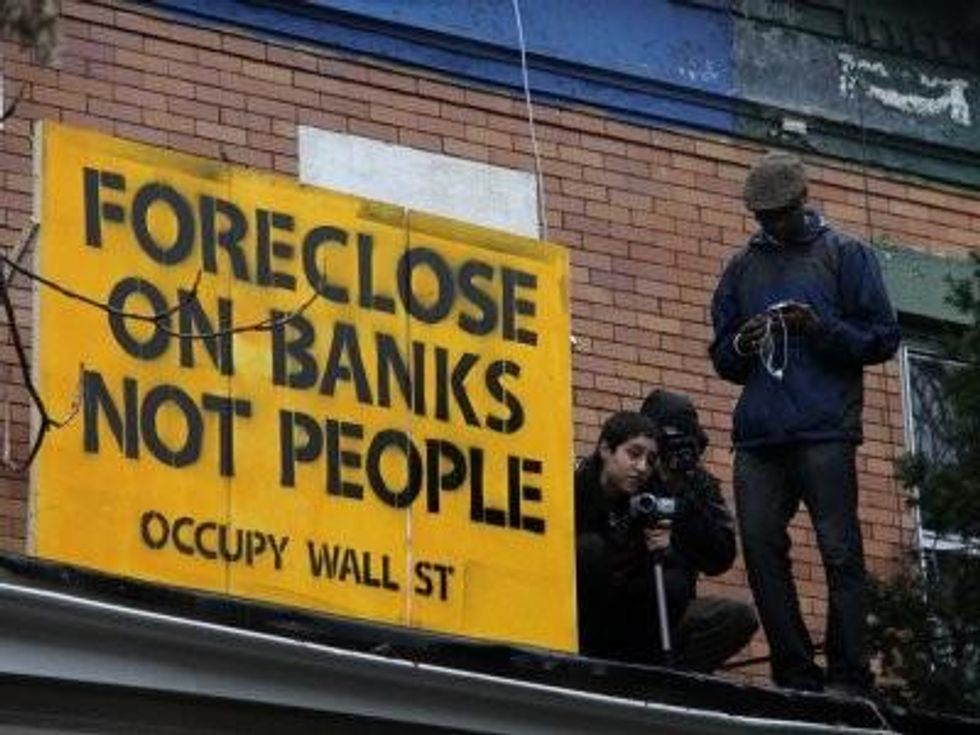

Rumor has it that as early as today, after months of negotiation with big banks, the White House may announce a settlement that would let the banks off the hook for their role in the foreclosure crisis -- paying a tiny fraction of what's needed in exchange for blanket immunity from future lawsuits.

We hope these rumors are untrue.

President Obama has the ability to stop and change the direction of this sweetheart deal. He should reject any deal that benefits the one percent and lets the big banks get away with their crimes. Instead, the president should stand with the 99 percent and push for real accountability and a solution that will help millions of people in this country.

Here are the hard facts about the housing crisis we face:

Default and foreclosure rates are now several times higher than at any time since the Great Depression.

If President Obama is serious about solving this crisis, he must ensure three things:

First: The banks must pay a minimum $300 billion in principal reduction for homeowners with underwater mortgages and/or restitution for foreclosed-on families. This is essential. Every effort to date to reboot the housing market has failed because it has not done the most essential thing -- actually reduce the massive debt load carried by homeowners.

As it stands, the deal likely to be announced Monday would have the banks pay only $20 billion, an astonishingly small fraction of what's needed. Add up all the underwater homes in America, and there's an estimated $700 billion in negative equity in the country, according to a recent study. If banks fix what they broke and write down principals for all underwater mortgages, this would free up millions of people to pump billions of dollars back into local economies, create jobs, and ultimately generate revenue to help invest in things that will help our economy grow.

Second: There must be a full-fledged, full-blown investigation into Wall Street financial fraud by the Department of Justice. There should be a task force with the staff resources, the authority, and the explicit mission of seriously investigating fraudulent behavior in the way home mortgages were securitized.

Reports of the current deal suggest banks could walk away without any actual investigation into their role in the housing crisis.

Third: There should be no civil or criminal immunity for the banks from future lawsuits. That means there should be no broad release of claims in any current or future negotiation or settlement.

The banks must pay to help solve the crisis they played such a big role in creating. They can afford it.

U.S. banks raked in $35 billion in profits last summer alone and are currently sitting on a historically high level of cash reserves of $1.64 trillion. The six biggest banks -- Bank of America, Wells Fargo, Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley -- hold assets totaling $9.5 trillion; and together paid an income tax rate of only 11% in 2009 and 2010, far below the federally mandated 35% corporate tax rate.

And that's not all. Despite their bleak performance this year, the nation's top six banks paid out $144 billion in bonuses and compensation for 2011, second only to the record $147 billion they paid out in 2007 at the height of the economic boom.

While banks enjoy record profits and the prospect of total immunity, millions of Americans are drowning in underwater mortgages.

Everyday people are already out front, fighting against the malfeasance of the banks; the White House should stand with them. Our national leaders need look no farther than Atlanta, GA, for an instructive profile in courage. Earlier this month, a community church in Dr. Martin Luther King's old neighborhood refused to be ignored. In 2008, a tornado devastated the historic, 108-year-old Higher Ground Empowerment Center church, and they were forced to take out a loan to cover repairs. The loan went underwater and became harder and harder to pay back. For nearly four years, the church asked the bank to modify their loan, but BB&T bank ignored them. Instead, last week, the bank started to evict the church. Sound familiar? Anyone with an underwater mortgage can tell you: banks these days just can't seem to treat their own customers with decency and manners.

However, after Occupy Atlanta staged a high-profile press conference, and 65,000 people signed a national petition by Rebuild the Dream, the church got BB&T bank to agree to modify their loan to something affordable and reasonable.

This happy ending is, unfortunately, the rare exception. BB&T, after being shaken to their senses (and shamed in the media), came to the table and did the right thing. But millions of homeowners have no way to stage protests and press conferences. Abuse, fraud, conflicts of interest, and lawlessness have been endemic at every stage of the mortgage origination and foreclosure process. This chain of misconduct by many of the nation's largest financial companies is at the root of the foreclosure avalanche and it's time to demand a course of action that will resolve the current crisis and create jobs in the future.

If these folks in Atlanta can show this level of courage in standing up to a big bank, then certainly Obama and state attorneys general can show the same courage.

The banks got their bailout. Now we need a strong and fair settlement to help Americans drowning in underwater mortgages.

George Goehl is a long-time community organizer and the host of To See Each Other, which this season follows seniors in rural Wisconsin fighting to save beloved public nursing homes.

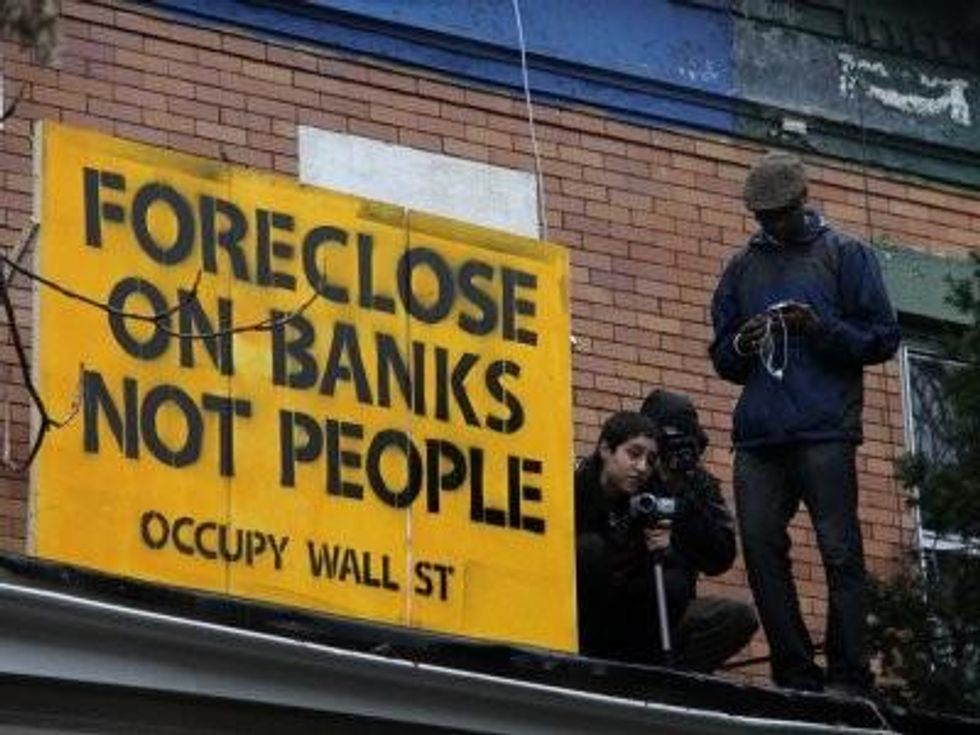

Rumor has it that as early as today, after months of negotiation with big banks, the White House may announce a settlement that would let the banks off the hook for their role in the foreclosure crisis -- paying a tiny fraction of what's needed in exchange for blanket immunity from future lawsuits.

We hope these rumors are untrue.

President Obama has the ability to stop and change the direction of this sweetheart deal. He should reject any deal that benefits the one percent and lets the big banks get away with their crimes. Instead, the president should stand with the 99 percent and push for real accountability and a solution that will help millions of people in this country.

Here are the hard facts about the housing crisis we face:

Default and foreclosure rates are now several times higher than at any time since the Great Depression.

If President Obama is serious about solving this crisis, he must ensure three things:

First: The banks must pay a minimum $300 billion in principal reduction for homeowners with underwater mortgages and/or restitution for foreclosed-on families. This is essential. Every effort to date to reboot the housing market has failed because it has not done the most essential thing -- actually reduce the massive debt load carried by homeowners.

As it stands, the deal likely to be announced Monday would have the banks pay only $20 billion, an astonishingly small fraction of what's needed. Add up all the underwater homes in America, and there's an estimated $700 billion in negative equity in the country, according to a recent study. If banks fix what they broke and write down principals for all underwater mortgages, this would free up millions of people to pump billions of dollars back into local economies, create jobs, and ultimately generate revenue to help invest in things that will help our economy grow.

Second: There must be a full-fledged, full-blown investigation into Wall Street financial fraud by the Department of Justice. There should be a task force with the staff resources, the authority, and the explicit mission of seriously investigating fraudulent behavior in the way home mortgages were securitized.

Reports of the current deal suggest banks could walk away without any actual investigation into their role in the housing crisis.

Third: There should be no civil or criminal immunity for the banks from future lawsuits. That means there should be no broad release of claims in any current or future negotiation or settlement.

The banks must pay to help solve the crisis they played such a big role in creating. They can afford it.

U.S. banks raked in $35 billion in profits last summer alone and are currently sitting on a historically high level of cash reserves of $1.64 trillion. The six biggest banks -- Bank of America, Wells Fargo, Citigroup, JP Morgan Chase, Goldman Sachs, and Morgan Stanley -- hold assets totaling $9.5 trillion; and together paid an income tax rate of only 11% in 2009 and 2010, far below the federally mandated 35% corporate tax rate.

And that's not all. Despite their bleak performance this year, the nation's top six banks paid out $144 billion in bonuses and compensation for 2011, second only to the record $147 billion they paid out in 2007 at the height of the economic boom.

While banks enjoy record profits and the prospect of total immunity, millions of Americans are drowning in underwater mortgages.

Everyday people are already out front, fighting against the malfeasance of the banks; the White House should stand with them. Our national leaders need look no farther than Atlanta, GA, for an instructive profile in courage. Earlier this month, a community church in Dr. Martin Luther King's old neighborhood refused to be ignored. In 2008, a tornado devastated the historic, 108-year-old Higher Ground Empowerment Center church, and they were forced to take out a loan to cover repairs. The loan went underwater and became harder and harder to pay back. For nearly four years, the church asked the bank to modify their loan, but BB&T bank ignored them. Instead, last week, the bank started to evict the church. Sound familiar? Anyone with an underwater mortgage can tell you: banks these days just can't seem to treat their own customers with decency and manners.

However, after Occupy Atlanta staged a high-profile press conference, and 65,000 people signed a national petition by Rebuild the Dream, the church got BB&T bank to agree to modify their loan to something affordable and reasonable.

This happy ending is, unfortunately, the rare exception. BB&T, after being shaken to their senses (and shamed in the media), came to the table and did the right thing. But millions of homeowners have no way to stage protests and press conferences. Abuse, fraud, conflicts of interest, and lawlessness have been endemic at every stage of the mortgage origination and foreclosure process. This chain of misconduct by many of the nation's largest financial companies is at the root of the foreclosure avalanche and it's time to demand a course of action that will resolve the current crisis and create jobs in the future.

If these folks in Atlanta can show this level of courage in standing up to a big bank, then certainly Obama and state attorneys general can show the same courage.

The banks got their bailout. Now we need a strong and fair settlement to help Americans drowning in underwater mortgages.